This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-163

for the current year.

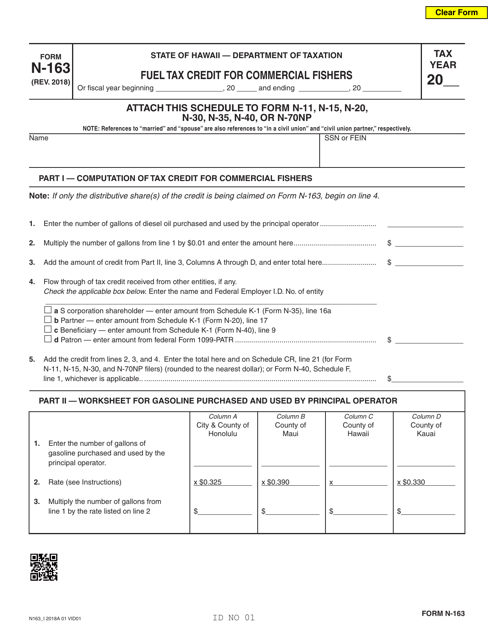

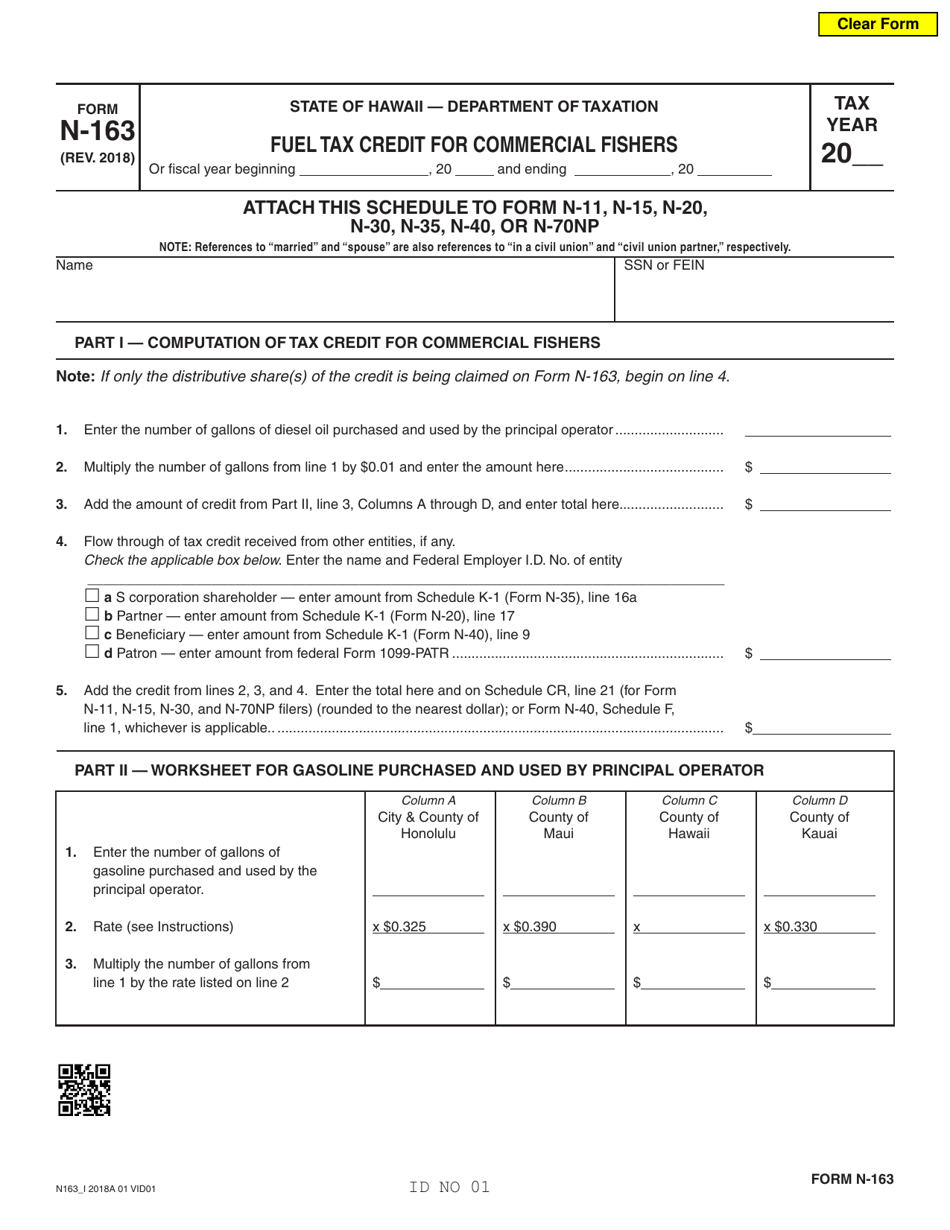

Form N-163 Fuel Tax Credit for Commercial Fishers - Hawaii

What Is Form N-163?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-163?

A: Form N-163 is a document used by commercial fishers in Hawaii to claim a fuel tax credit.

Q: Who can use Form N-163?

A: Form N-163 can be used by commercial fishers in Hawaii.

Q: What is the purpose of Form N-163?

A: The purpose of Form N-163 is to claim a fuel tax credit for commercial fishers in Hawaii.

Q: What is the fuel tax credit for commercial fishers in Hawaii?

A: The fuel tax credit for commercial fishers in Hawaii is a refund of the state and county fuel taxes paid on fuel used in fishing operations.

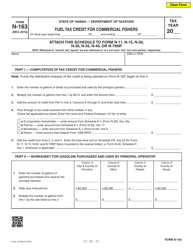

Q: What information is required on Form N-163?

A: Form N-163 requires information on the quantity of fuel used, fuel tax paid, and fishing operations.

Q: How do I file Form N-163?

A: Form N-163 can be filed by mailing it to the Hawaii Department of Taxation.

Q: Is there a deadline for filing Form N-163?

A: Yes, Form N-163 must be filed by December 31 of the year following the calendar year in which the fuel was purchased.

Q: Can I e-file Form N-163?

A: No, Form N-163 cannot be e-filed and must be filed by mail.

Q: What supporting documents should I include with Form N-163?

A: You should include copies of your fuel invoices and any other relevant documents that support your claim.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-163 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.