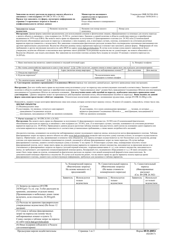

This version of the form is not currently in use and is provided for reference only. Download this version of

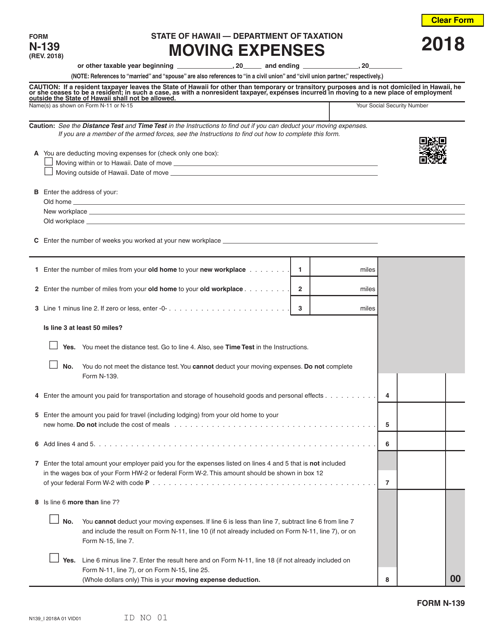

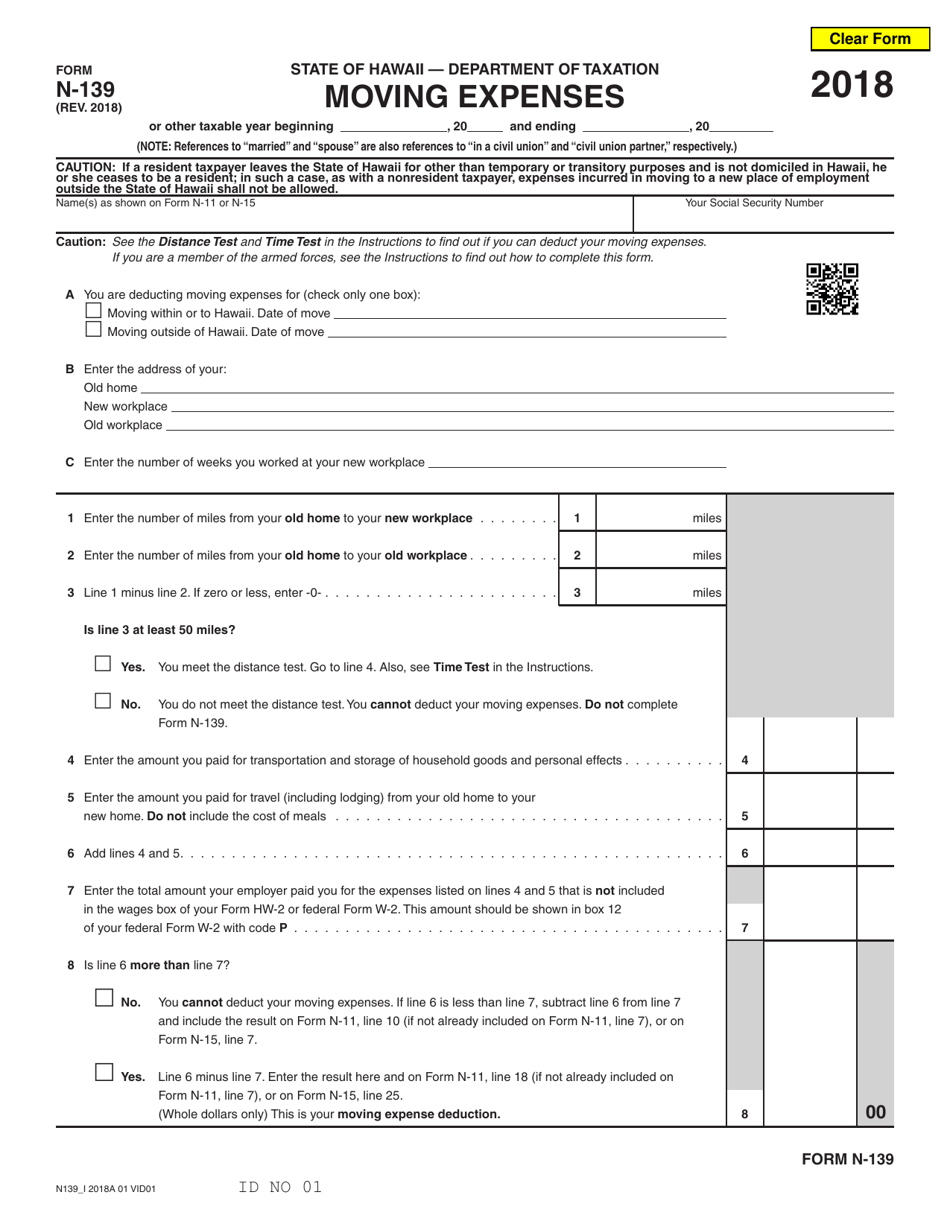

Form N-139

for the current year.

Form N-139 Moving Expenses - Hawaii

What Is Form N-139?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-139?

A: Form N-139 is the form used to report moving expenses for residents of Hawaii.

Q: Who needs to file Form N-139?

A: Residents of Hawaii who have incurred moving expenses and are eligible for the moving expense deduction need to file Form N-139.

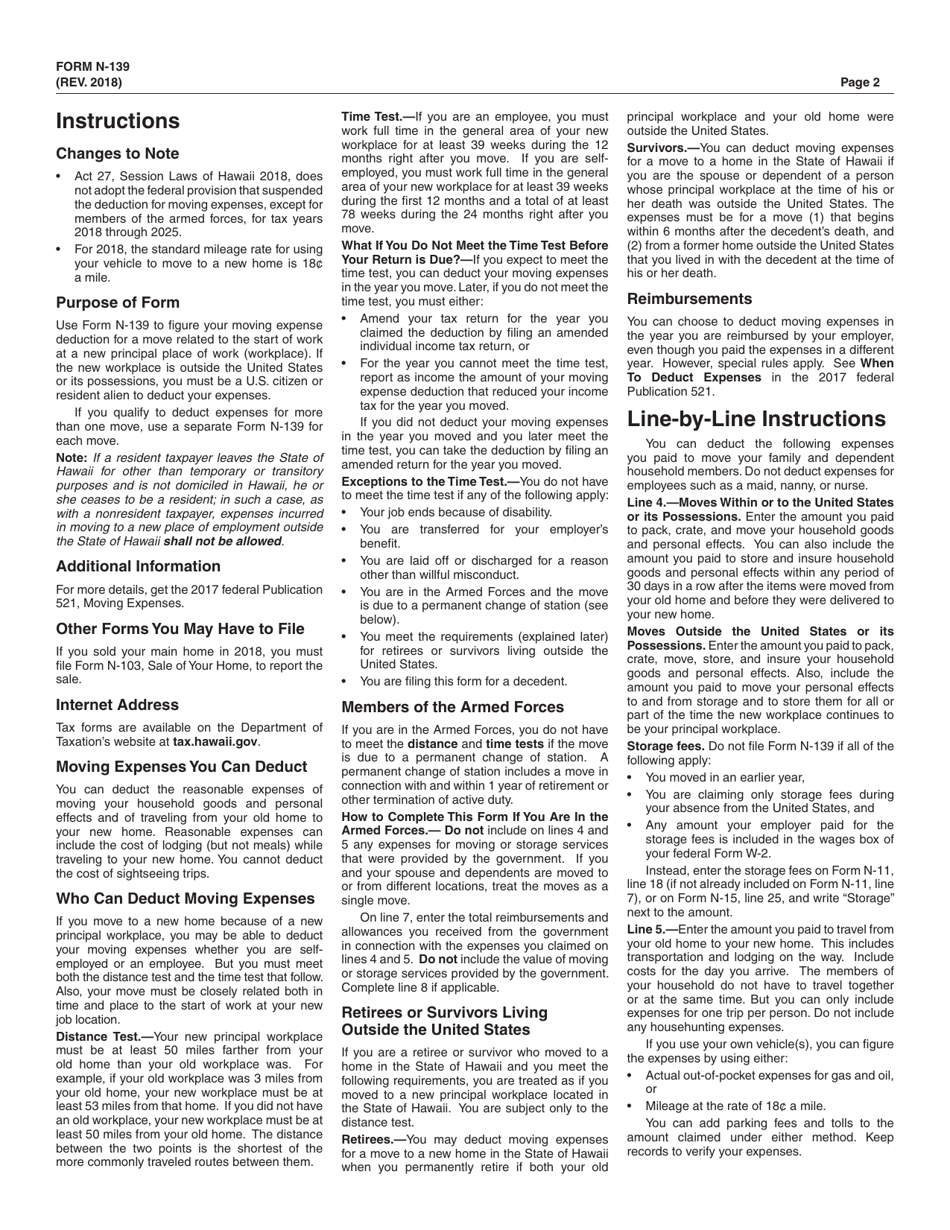

Q: What are moving expenses?

A: Moving expenses refer to the costs incurred when relocating your home due to a change in job location or starting a new job.

Q: Is the moving expense deduction available to everyone?

A: No, the moving expense deduction is only available to those who meet certain criteria, such as distance and time requirements.

Q: When is the deadline to file Form N-139?

A: The deadline to file Form N-139 is typically the same as the deadline for filing your Hawaii state tax return.

Q: Can I e-file Form N-139?

A: Yes, you can e-file Form N-139 if you choose to electronically file your Hawaii state tax return.

Q: Are there any penalties for not filing Form N-139?

A: Yes, failure to file Form N-139 or reporting inaccurate information may result in penalties imposed by the Hawaii Department of Taxation.

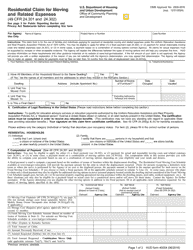

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-139 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.