This version of the form is not currently in use and is provided for reference only. Download this version of

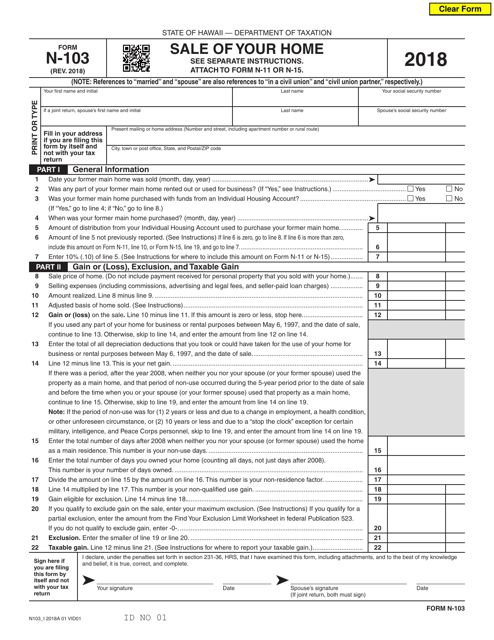

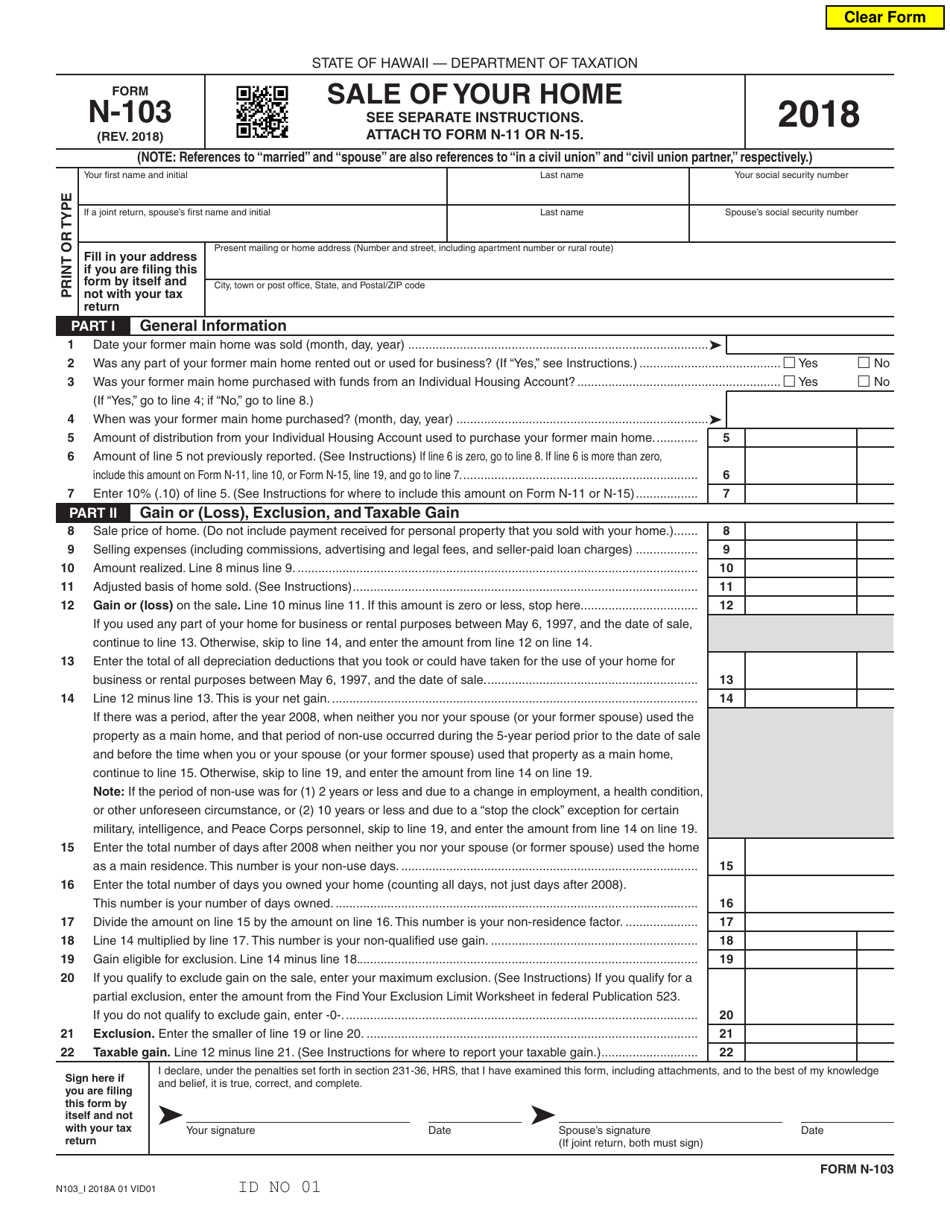

Form N-103

for the current year.

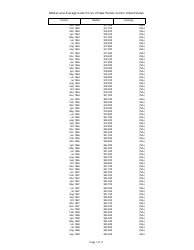

Form N-103 Sale of Your Home - Hawaii

What Is Form N-103?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-103?

A: Form N-103 is a tax form used in Hawaii to report the sale of your home.

Q: Who needs to file Form N-103?

A: You need to file Form N-103 if you sold your home in Hawaii and need to report the transaction for tax purposes.

Q: What information is required on Form N-103?

A: Form N-103 requires details about the sale, such as the date of sale, sale price, and any expenses or deductions.

Q: When is the deadline for filing Form N-103?

A: The deadline for filing Form N-103 is typically April 20th of the year following the sale of your home.

Q: Are there any specific requirements or exemptions for Form N-103?

A: Yes, there are certain requirements and exemptions for Form N-103. It is recommended to consult the official instructions or a tax professional for specific guidance.

Q: What happens if I don't file Form N-103?

A: Failing to file Form N-103 may result in penalties and interest charges from the Hawaii Department of Taxation.

Q: Can I e-file Form N-103?

A: Yes, you can e-file Form N-103 through the Hawaii Department of Taxation's e-filing system.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-103 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.