This version of the form is not currently in use and is provided for reference only. Download this version of

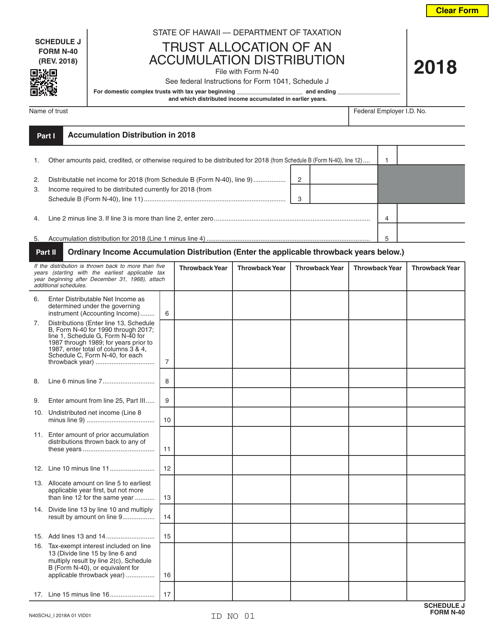

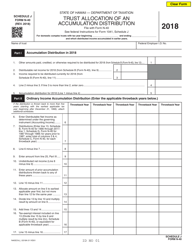

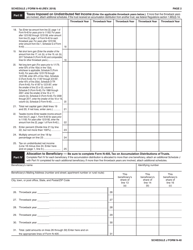

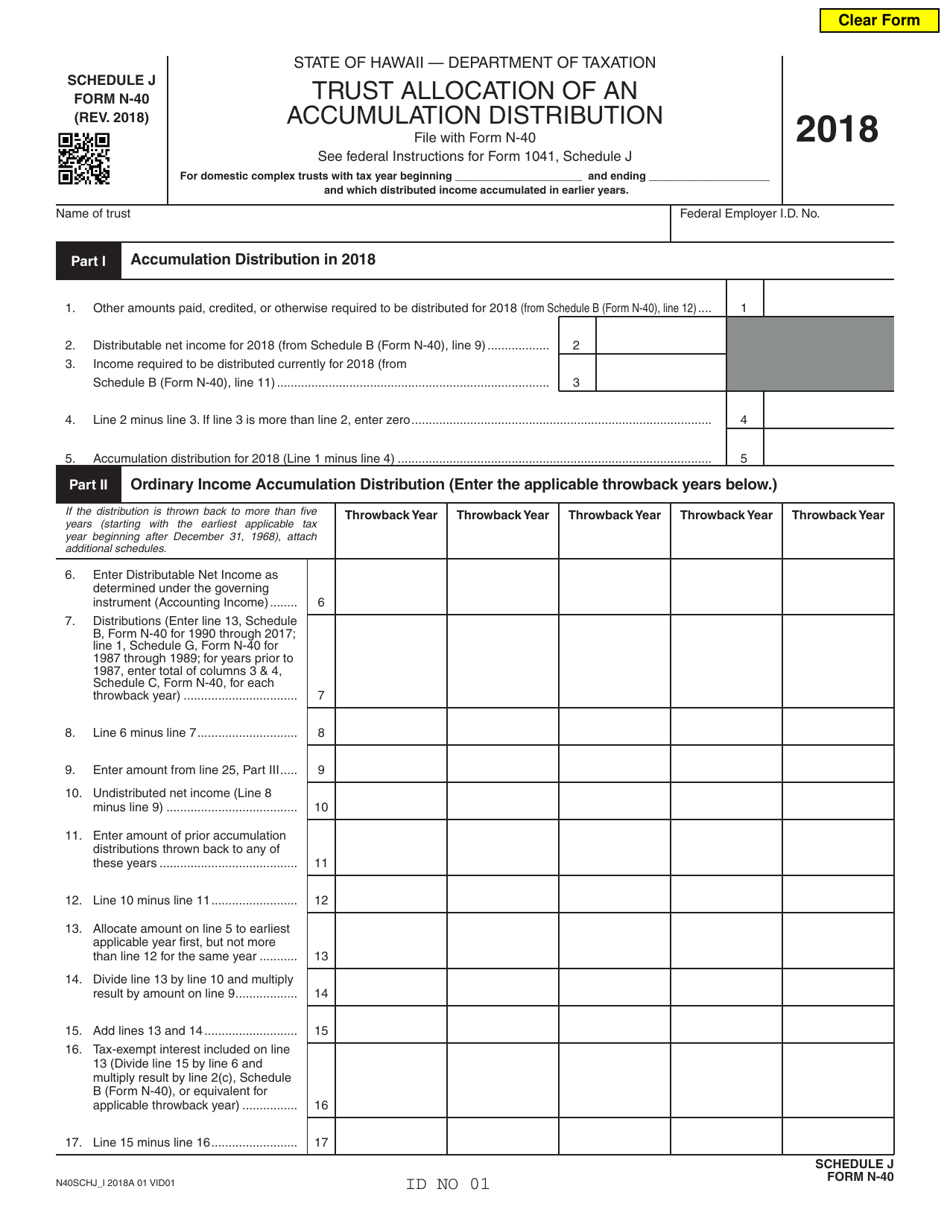

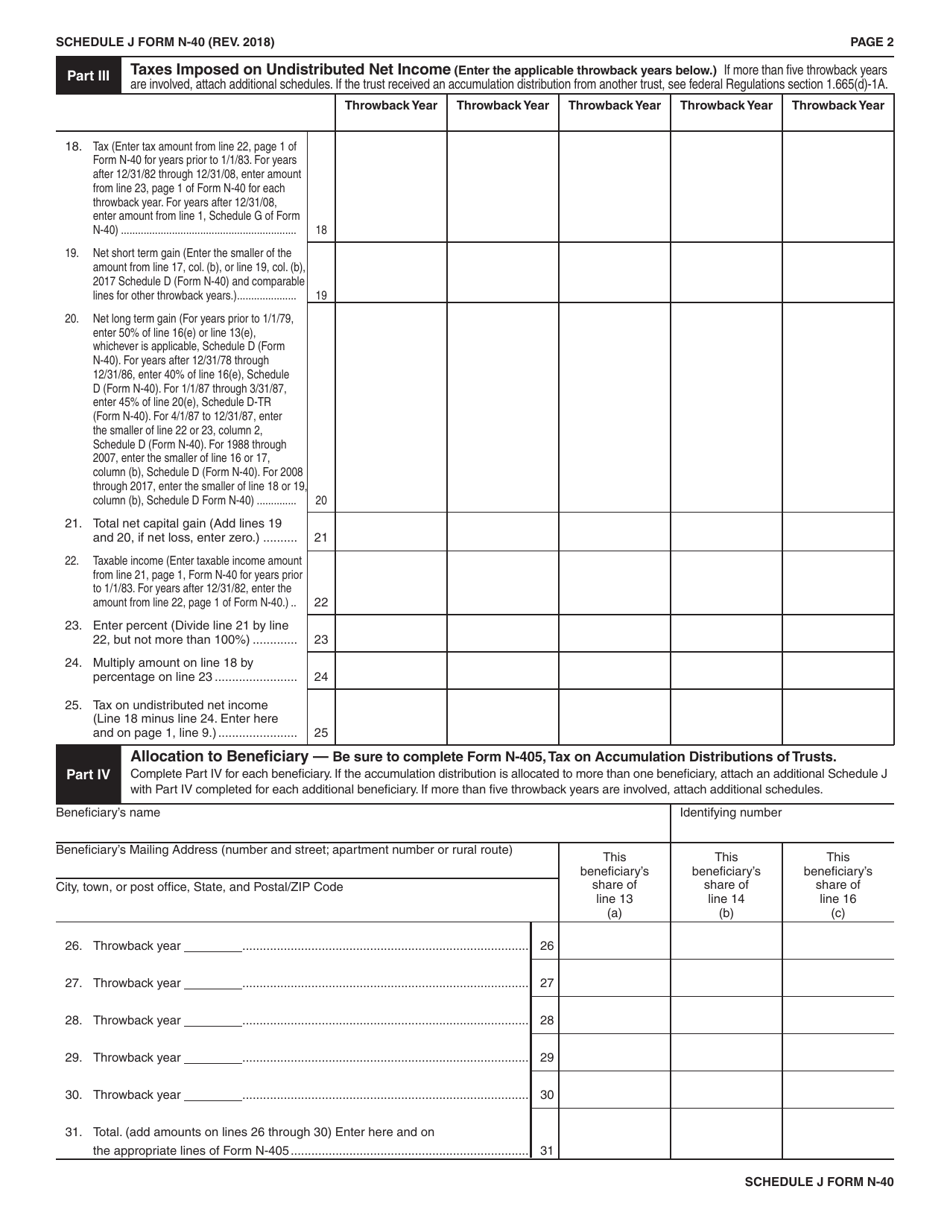

Form N-40 Schedule J

for the current year.

Form N-40 Schedule J Trust Allocation of an Accumulation Distribution - Hawaii

What Is Form N-40 Schedule J?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-40, Fiduciary Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-40 Schedule J?

A: Form N-40 Schedule J is a document used to allocate the accumulation distribution of a trust in Hawaii.

Q: What is an accumulation distribution?

A: An accumulation distribution refers to income or gains that a trust has accumulated over time.

Q: Who needs to file Form N-40 Schedule J?

A: Individuals or entities in Hawaii who have a trust with accumulation distribution need to file Form N-40 Schedule J.

Q: What is the purpose of Form N-40 Schedule J?

A: The purpose of Form N-40 Schedule J is to allocate the accumulation distribution of a trust among its beneficiaries.

Q: What information is required on Form N-40 Schedule J?

A: Form N-40 Schedule J requires you to provide information about the trust and its beneficiaries, as well as the allocation of the accumulation distribution.

Q: When is the deadline to file Form N-40 Schedule J?

A: The deadline to file Form N-40 Schedule J is the same as the deadline to file your Hawaii state tax return.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40 Schedule J by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.