This version of the form is not currently in use and is provided for reference only. Download this version of

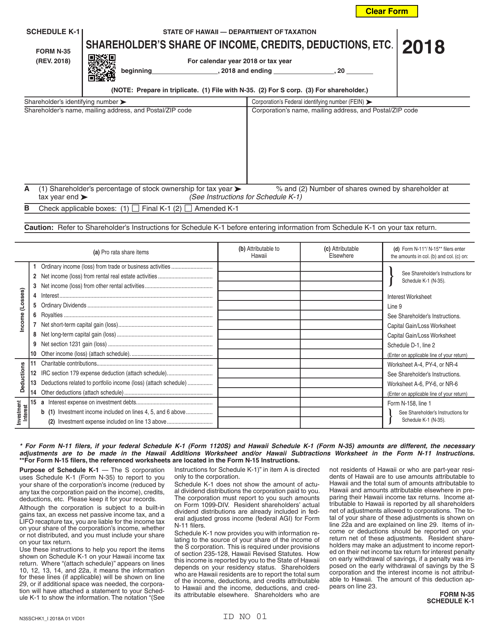

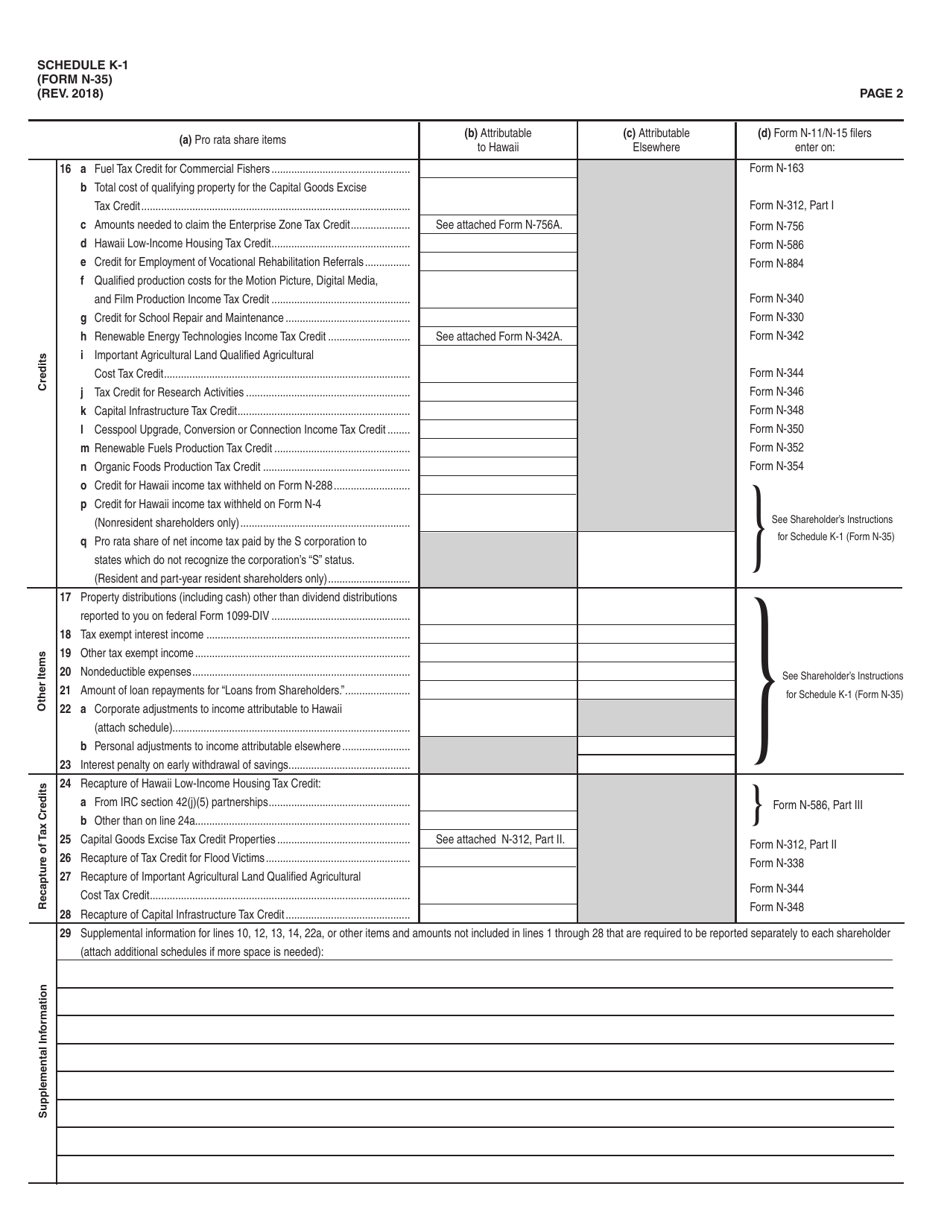

Form N-35 Schedule K-1

for the current year.

Form N-35 Schedule K-1 Shareholder's Share of Income, Credits, Deductions, Etc . - Hawaii

What Is Form N-35 Schedule K-1?

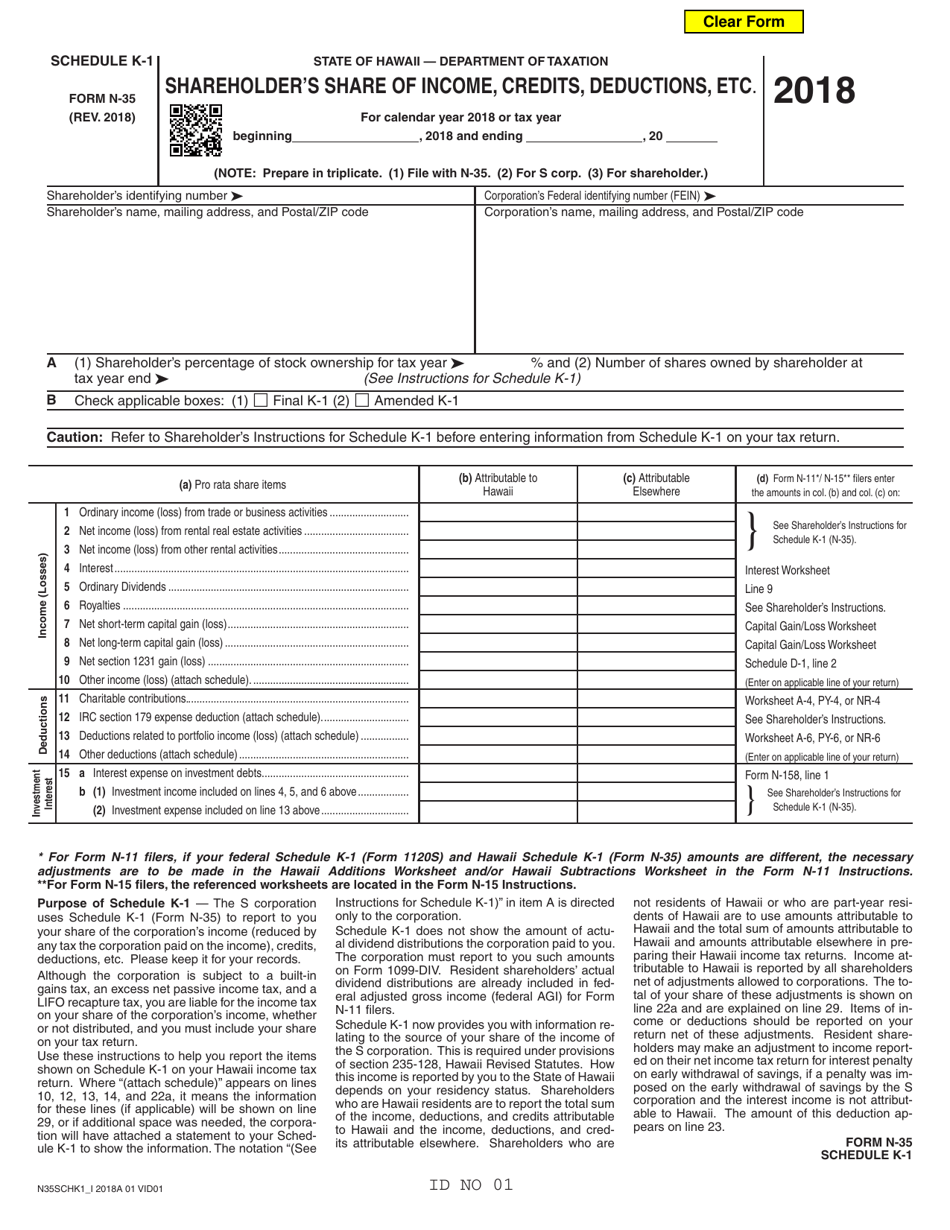

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-35, S Corporation Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-35 Schedule K-1?

A: Form N-35 Schedule K-1 is a form used by shareholders of Hawaii corporations to report their share of income, credits, deductions, etc.

Q: Who needs to file Form N-35 Schedule K-1?

A: Shareholders of Hawaii corporations need to file Form N-35 Schedule K-1.

Q: What information does Form N-35 Schedule K-1 require?

A: Form N-35 Schedule K-1 requires shareholders to report their share of income, credits, deductions, etc. from the Hawaii corporation.

Q: When is the deadline for filing Form N-35 Schedule K-1?

A: The deadline for filing Form N-35 Schedule K-1 is the same as the deadline for filing the Hawaii corporation's tax return, which is generally on or before April 20th.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-35 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.