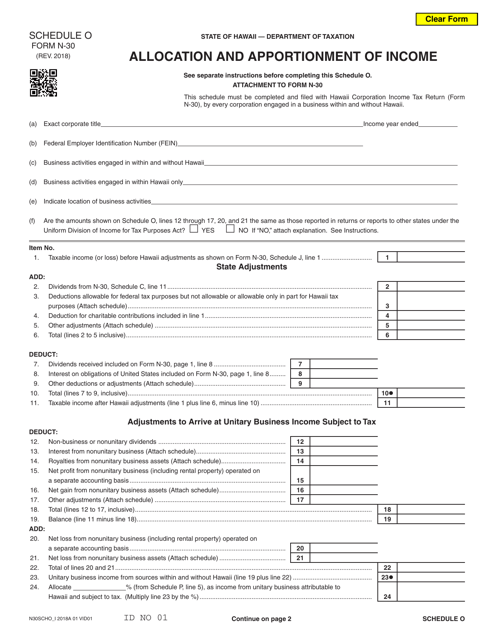

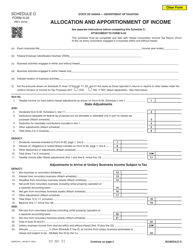

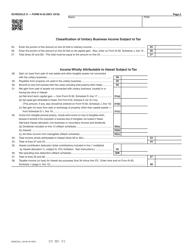

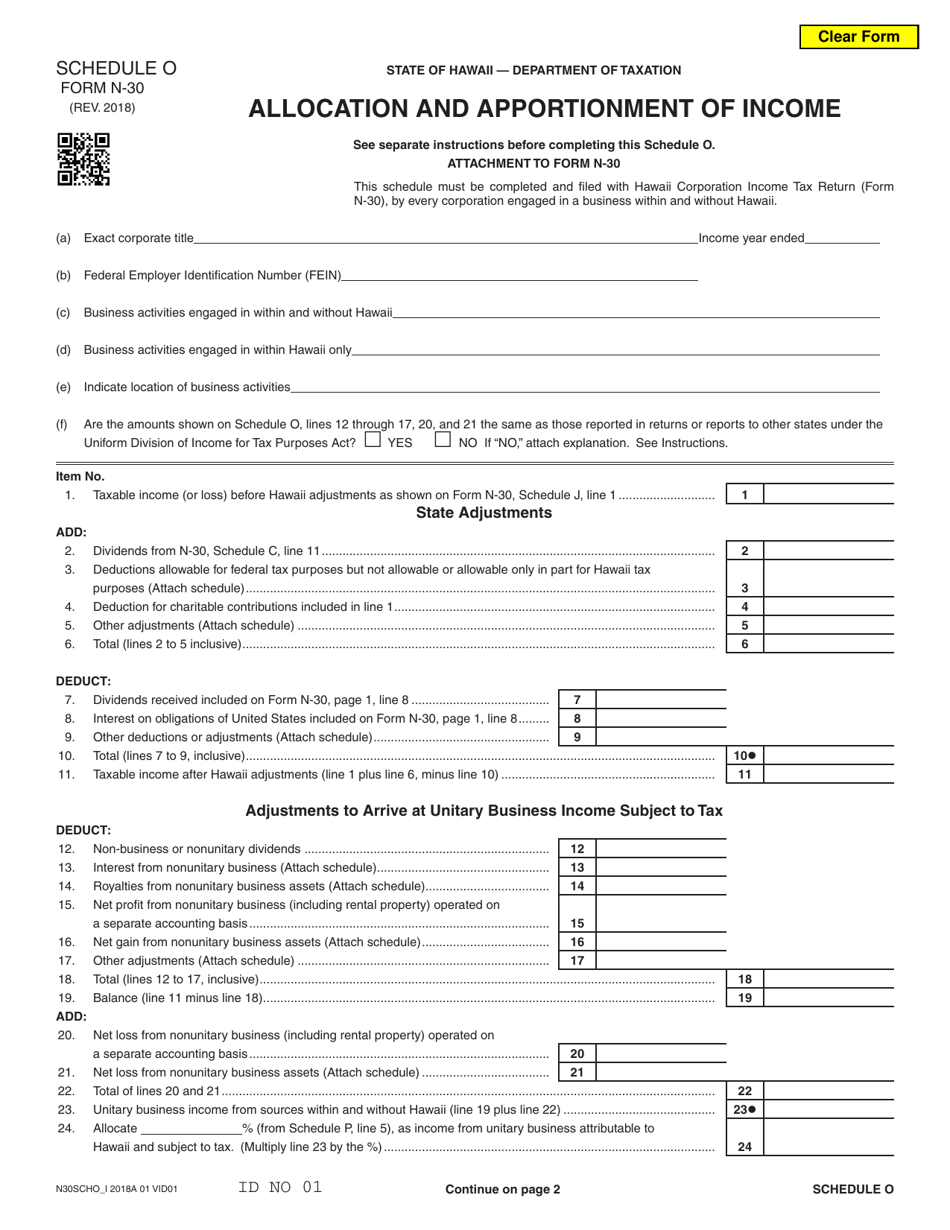

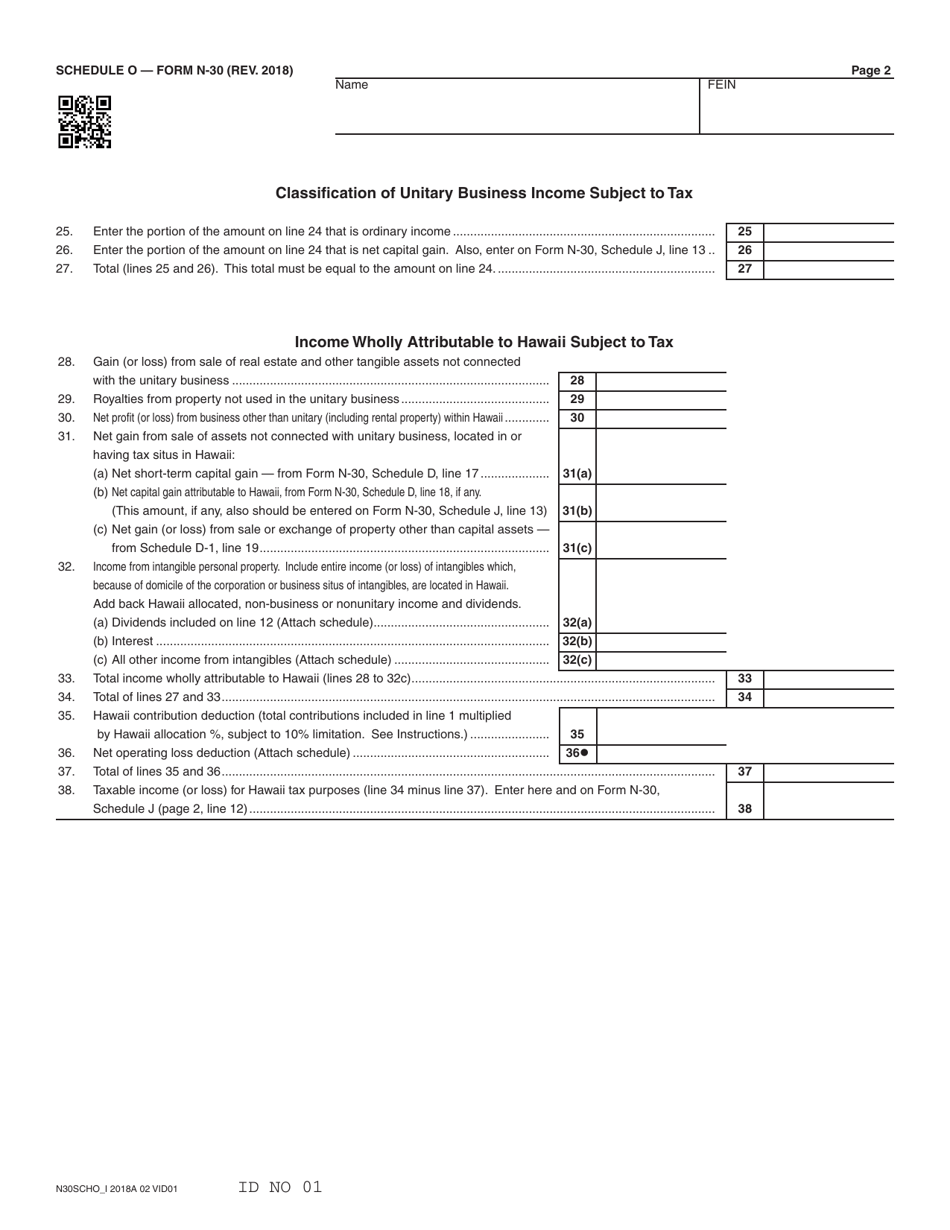

Form N-30 Schedule O Allocation and Apportionment of Income - Hawaii

What Is Form N-30 Schedule O?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-30 Schedule O?

A: Form N-30 Schedule O is a tax form used in Hawaii to allocate and apportion income.

Q: What is the purpose of Form N-30 Schedule O?

A: The purpose of Form N-30 Schedule O is to determine how income is allocated and apportioned for tax purposes.

Q: Who needs to file Form N-30 Schedule O?

A: Taxpayers in Hawaii who need to allocate and apportion their income for tax purposes are required to file Form N-30 Schedule O.

Q: When is Form N-30 Schedule O due?

A: Form N-30 Schedule O is typically due along with the taxpayer's Hawaii tax return, which is usually due on April 20th.

Q: What information is required to complete Form N-30 Schedule O?

A: To complete Form N-30 Schedule O, you will need information about your income and how it should be allocated and apportioned according to Hawaii tax laws.

Q: Is there a fee for filing Form N-30 Schedule O?

A: No, there is no fee for filing Form N-30 Schedule O.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-30 Schedule O by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.