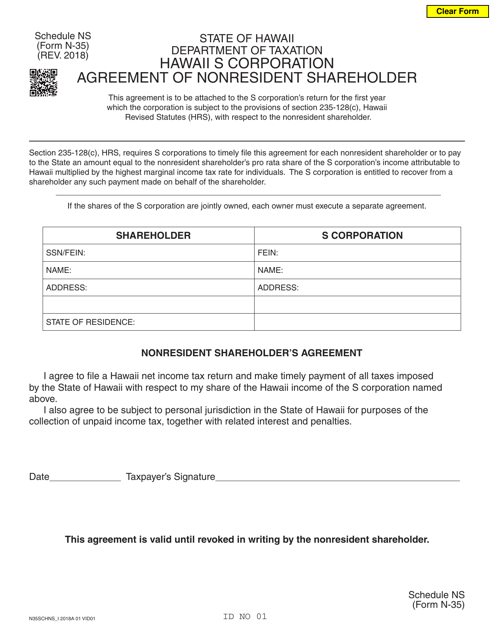

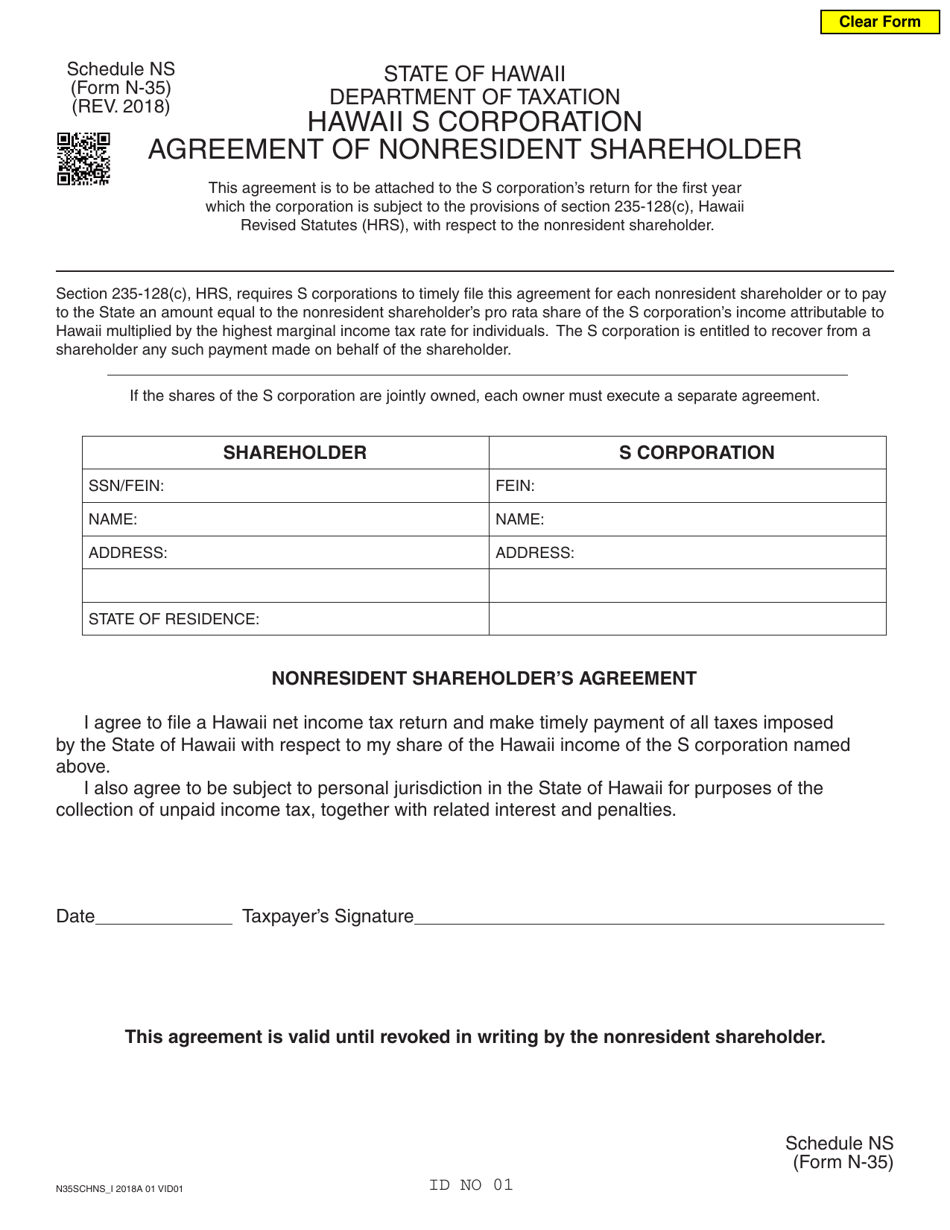

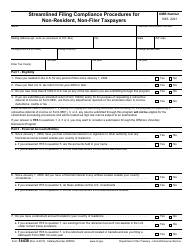

Form N-35 Schedule NS Hawaii S Corporationagreement of Nonresident Shareholder - Hawaii

What Is Form N-35 Schedule NS?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-35 Schedule NS?

A: Form N-35 Schedule NS is an attachment to the Hawaii State tax return form N-35, used by S corporations with nonresident shareholders.

Q: What is a Hawaii S Corporation?

A: A Hawaii S Corporation is a type of corporation that has elected to be taxed under Subchapter S of the Internal Revenue Code and meets specific eligibility requirements.

Q: Who should file Form N-35 Schedule NS?

A: S corporations in Hawaii with nonresident shareholders should file Form N-35 Schedule NS.

Q: What is the purpose of Form N-35 Schedule NS?

A: The purpose of Form N-35 Schedule NS is to report the distributive share of income, deductions, and credits allocated to nonresident shareholders of the S corporation.

Q: Is Form N-35 Schedule NS mandatory?

A: Yes, if you are an S corporation with nonresident shareholders in Hawaii, filing Form N-35 Schedule NS is mandatory.

Q: What information is required on Form N-35 Schedule NS?

A: Form N-35 Schedule NS requires information such as the name, address, and Social Security number of the nonresident shareholder, as well as the amount of income, deductions, and credits allocated to them.

Q: When is the deadline to file Form N-35 Schedule NS?

A: The deadline to file Form N-35 Schedule NS is the same as the deadline for filing the Hawaii State tax return, which is typically April 20th.

Q: Are there any penalties for not filing Form N-35 Schedule NS?

A: Yes, failure to file Form N-35 Schedule NS may result in penalties and interest charges imposed by the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-35 Schedule NS by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.