This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-30 Schedule P

for the current year.

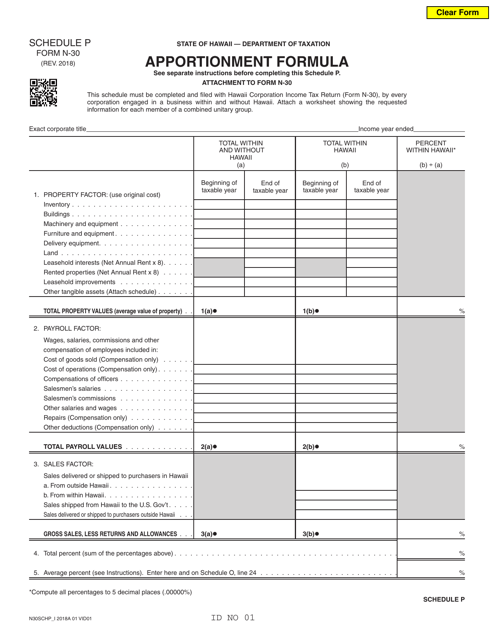

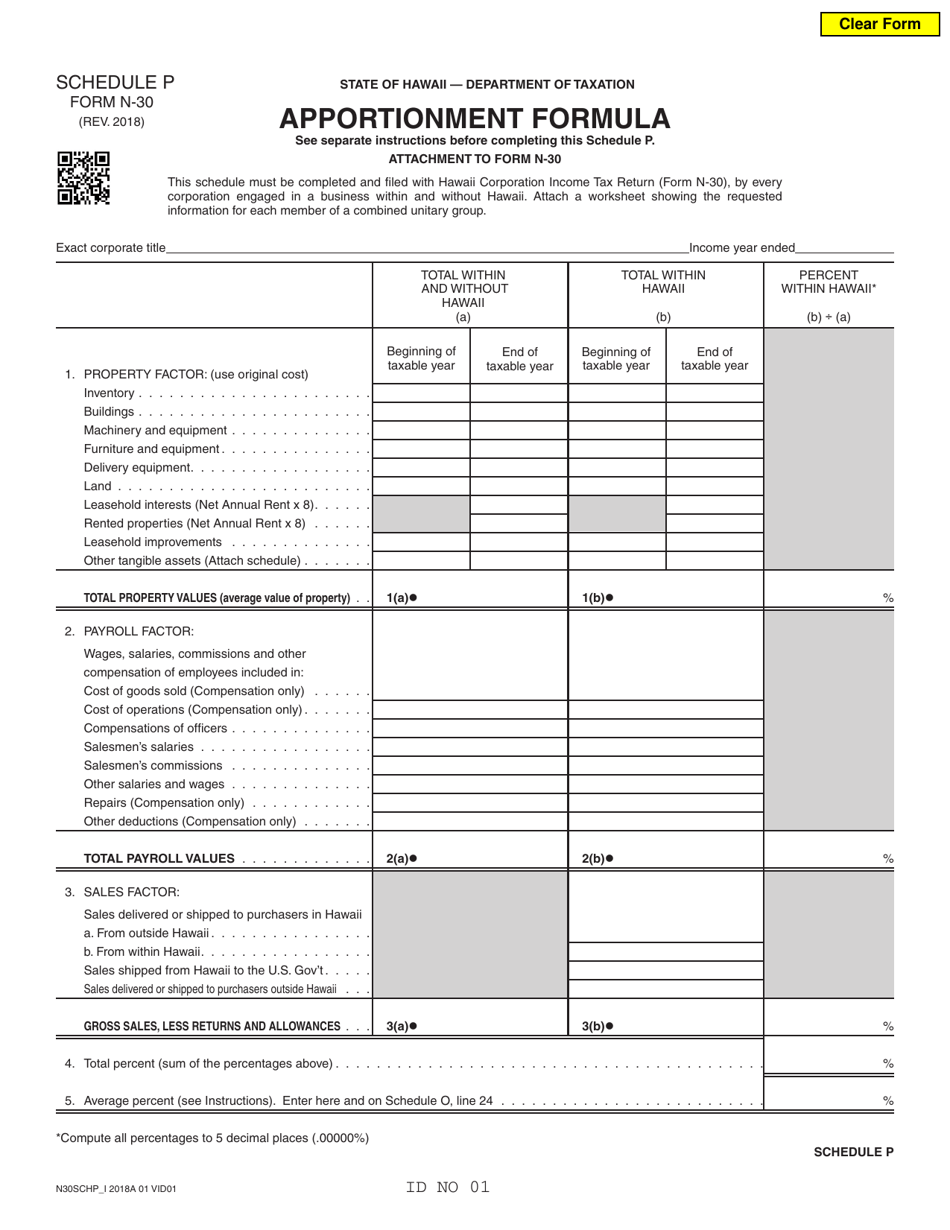

Form N-30 Schedule P Apportionment Formula - Hawaii

What Is Form N-30 Schedule P?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-30 Schedule P?

A: Form N-30 Schedule P is a tax form used in Hawaii to calculate the apportionment of income for multi-state corporations.

Q: What is the apportionment formula?

A: The apportionment formula is used to determine the portion of a corporation's income that is taxable in Hawaii based on its business activities in the state.

Q: What is the purpose of the apportionment formula?

A: The purpose of the apportionment formula is to ensure that corporations are only taxed on the portion of their income that is attributable to their activities in Hawaii.

Q: How is the apportionment formula calculated?

A: The apportionment formula is calculated by using a three-factor formula that takes into account the corporation's sales, property, and payroll in Hawaii compared to its total sales, property, and payroll everywhere.

Q: Why is the apportionment formula important?

A: The apportionment formula is important because it helps determine the amount of income that a corporation owes in taxes to Hawaii, based on its level of business activity in the state.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-30 Schedule P by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.