This version of the form is not currently in use and is provided for reference only. Download this version of

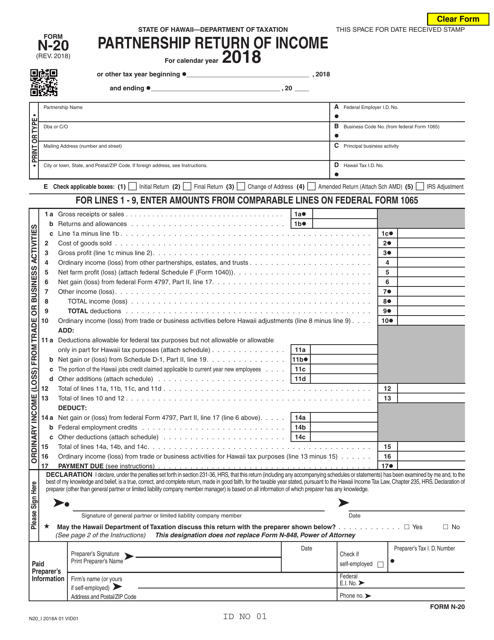

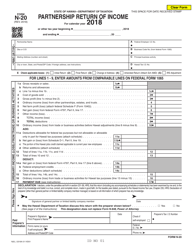

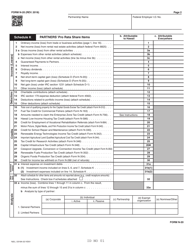

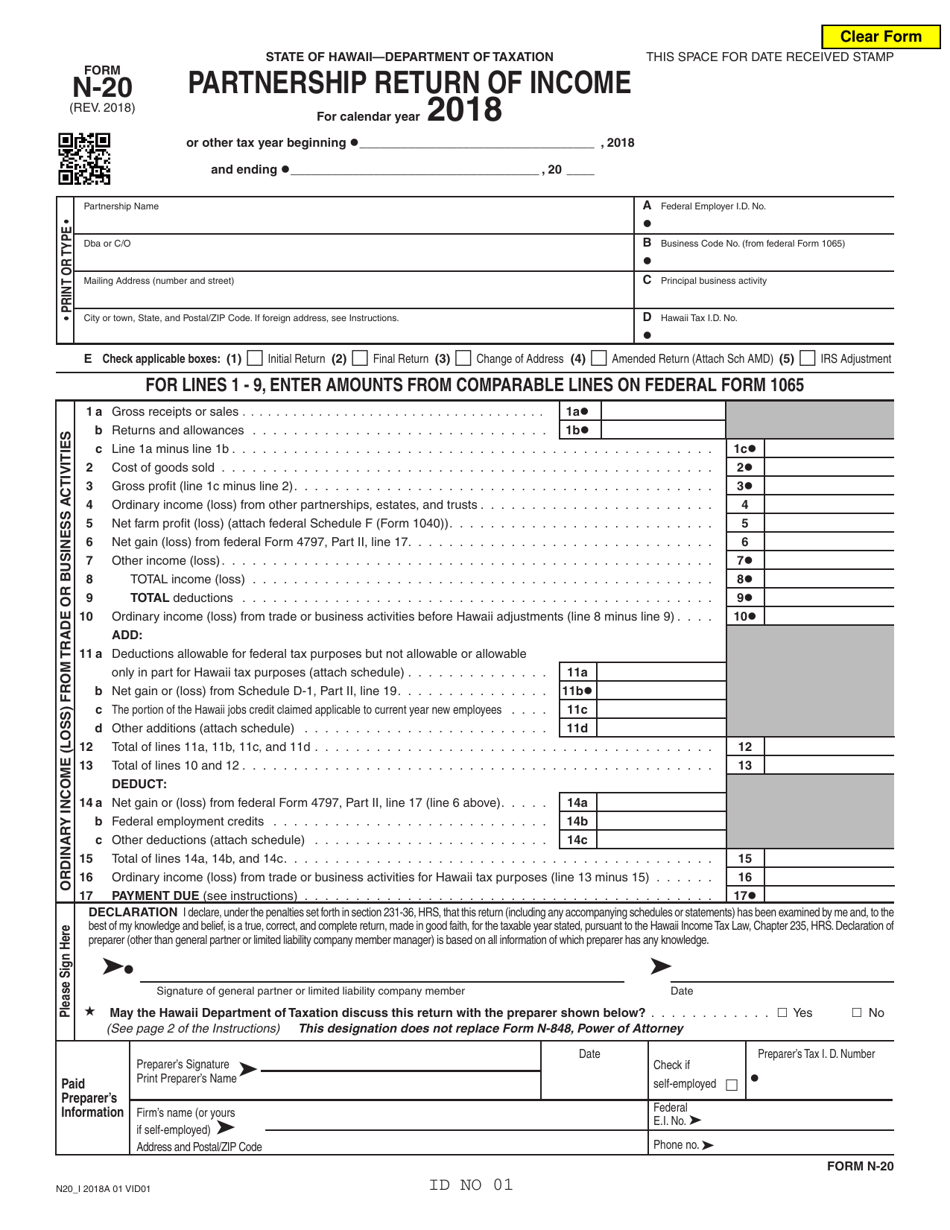

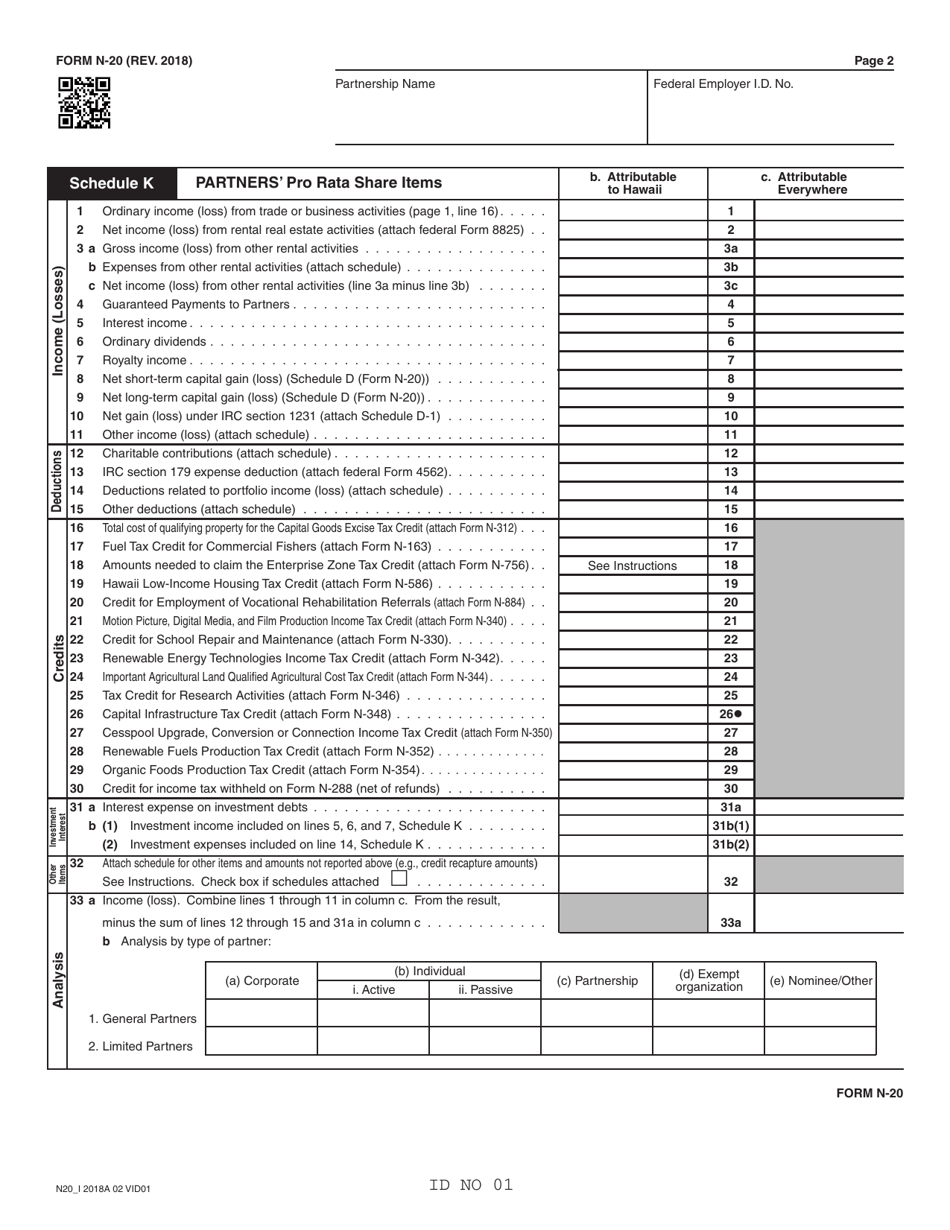

Form N-20

for the current year.

Form N-20 Partnership Return of Income - Hawaii

What Is Form N-20?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-20?

A: Form N-20 is the Partnership Return of Income form for the state of Hawaii.

Q: Who needs to file Form N-20?

A: Partnerships that are doing business in Hawaii or have income from Hawaii sources generally need to file Form N-20.

Q: When is the due date for Form N-20?

A: The due date for filing Form N-20 is on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any extensions available for filing Form N-20?

A: Yes, extensions may be available upon request. However, any tax due must still be paid by the original due date to avoid penalties and interest.

Q: Is Form N-20 required for every partnership?

A: Generally, yes. However, partnerships with no business income or activity in Hawaii may be exempt from filing Form N-20. It is recommended to consult a tax professional for specific guidance.

Q: What information do I need to complete Form N-20?

A: You will need information about the partnership's income, deductions, credits, and other relevant financial details for the taxable year.

Q: Can Form N-20 be filed electronically?

A: Yes, the Hawaii Department of Taxation allows electronic filing of Form N-20.

Q: Are there any penalties for not filing Form N-20 on time?

A: Yes, penalties may apply for late or non-filing of Form N-20. It is important to file on or before the due date to avoid these penalties.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-20 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.