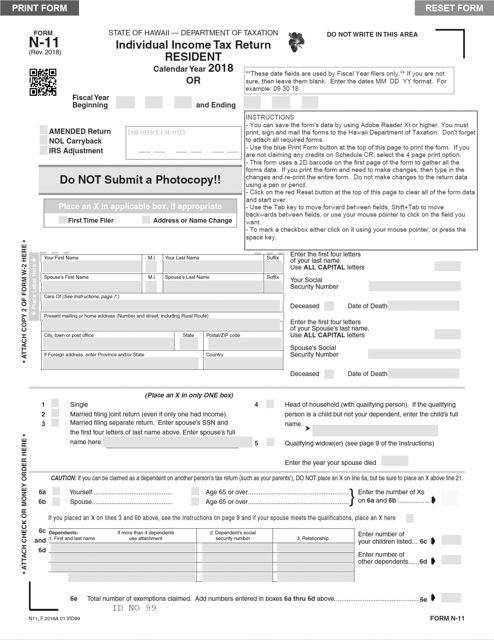

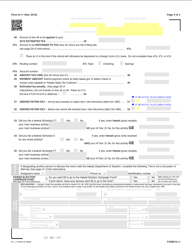

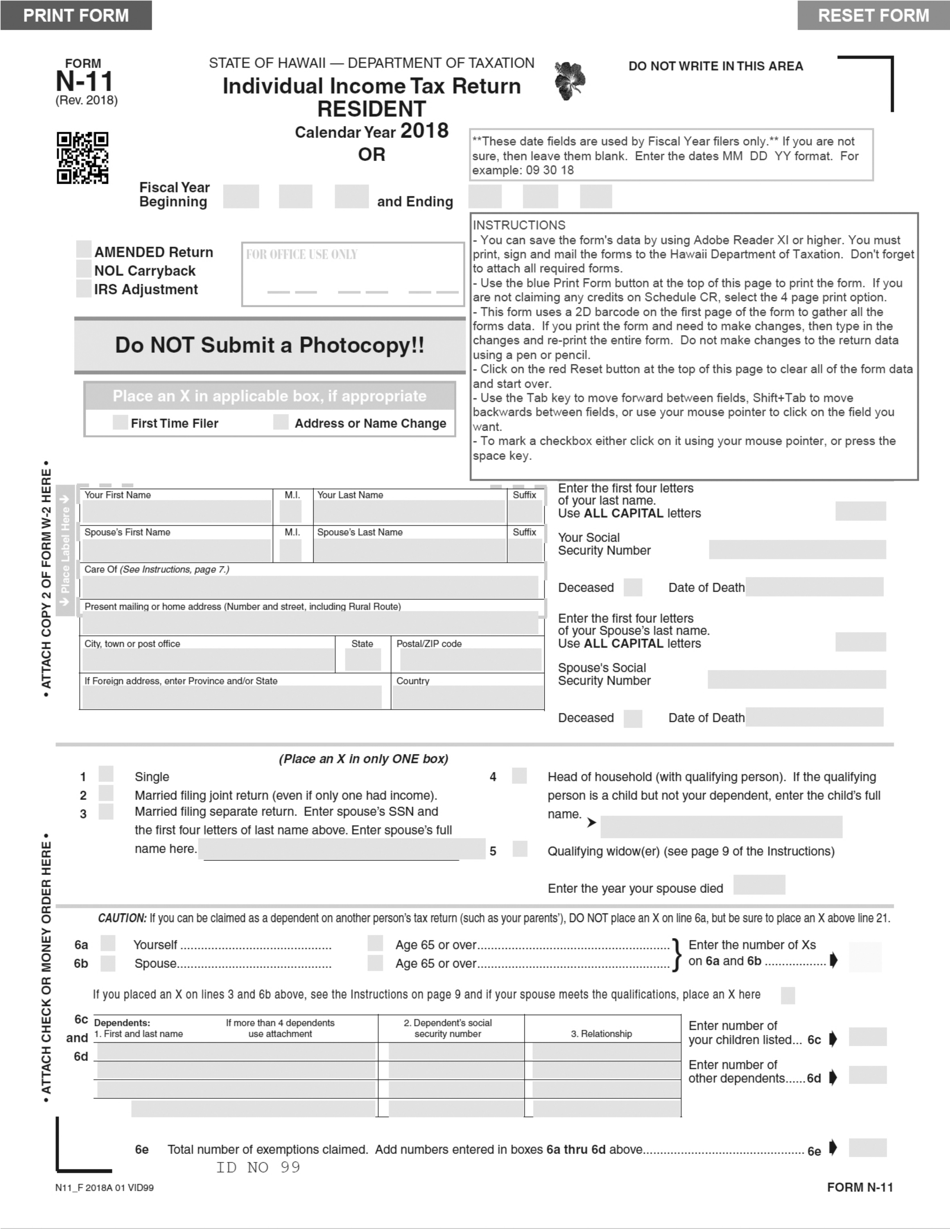

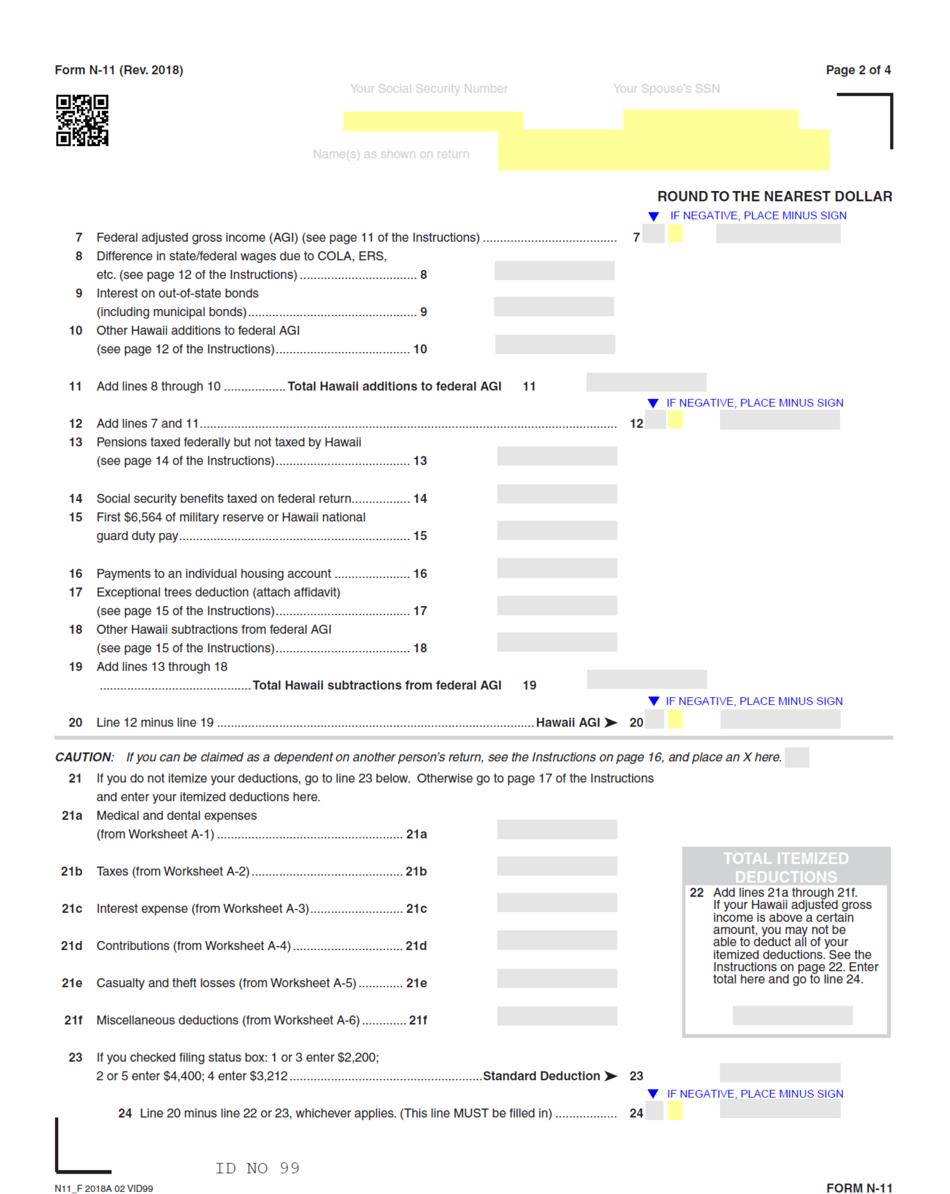

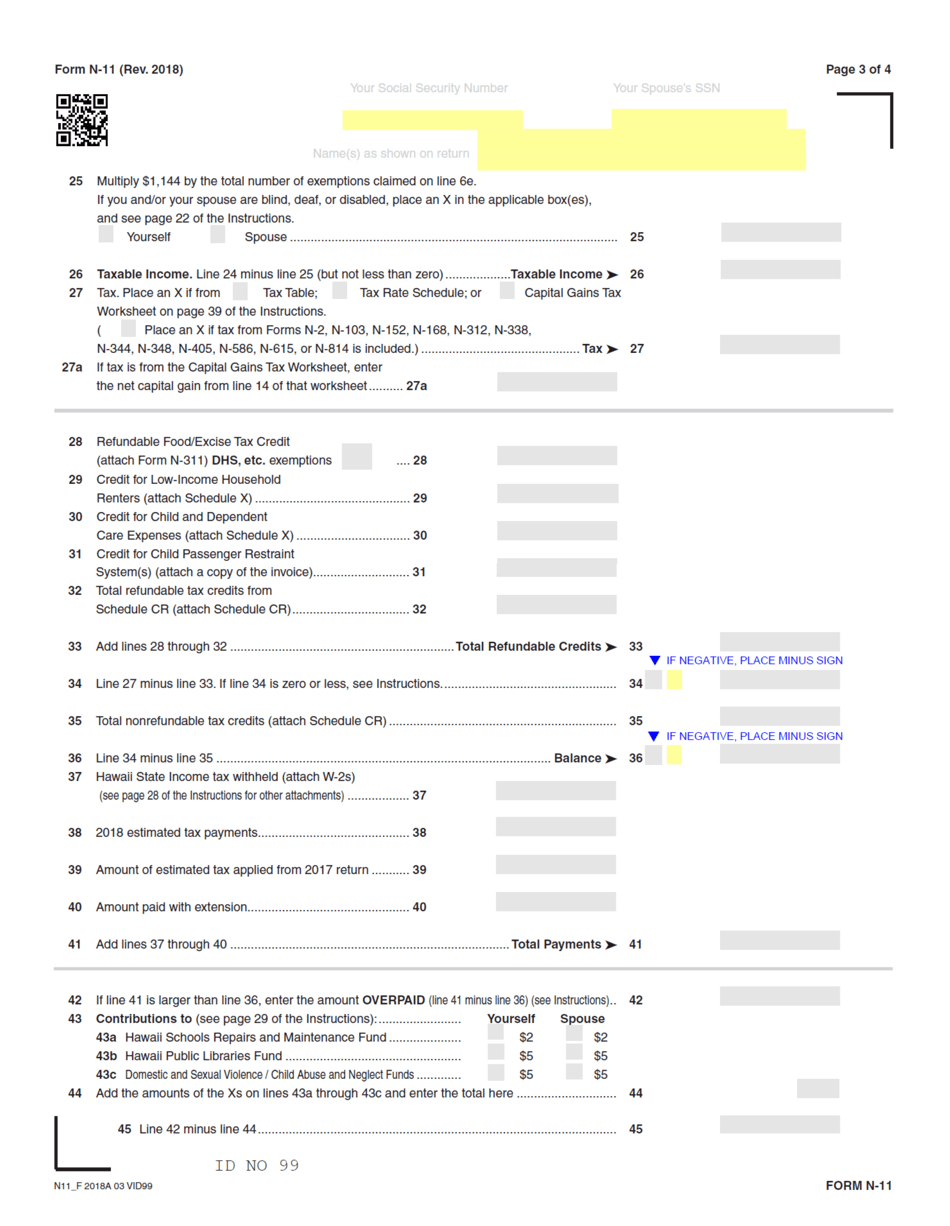

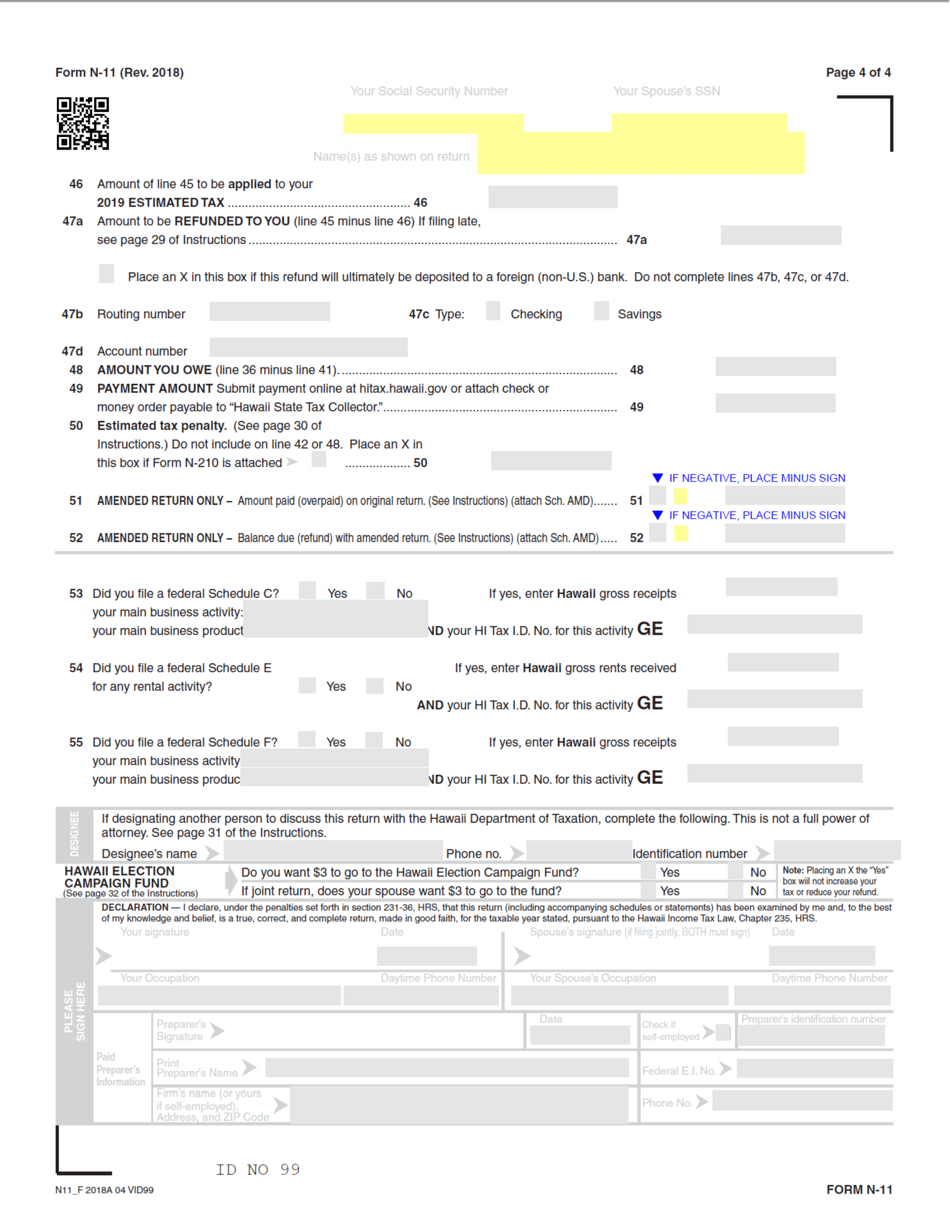

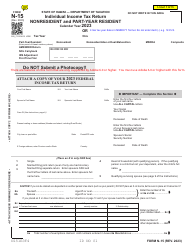

Form N-11 Individual Income Tax Return - Resident - Hawaii

What Is Form N-11?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-11?

A: Form N-11 is the Individual Income Tax Return for Hawaii residents.

Q: Who needs to file Form N-11?

A: Hawaii residents who have earned income during the tax year need to file Form N-11.

Q: What is the deadline for filing Form N-11?

A: The deadline for filing Form N-11 is April 20th.

Q: What documents do I need to file Form N-11?

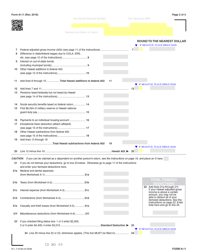

A: You will need your W-2 forms, 1099 forms, and any other documentation of income and deductions.

Q: Can I file Form N-11 electronically?

A: Yes, you can file Form N-11 electronically through Hawaii's e-filing system.

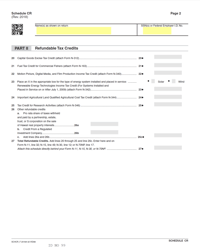

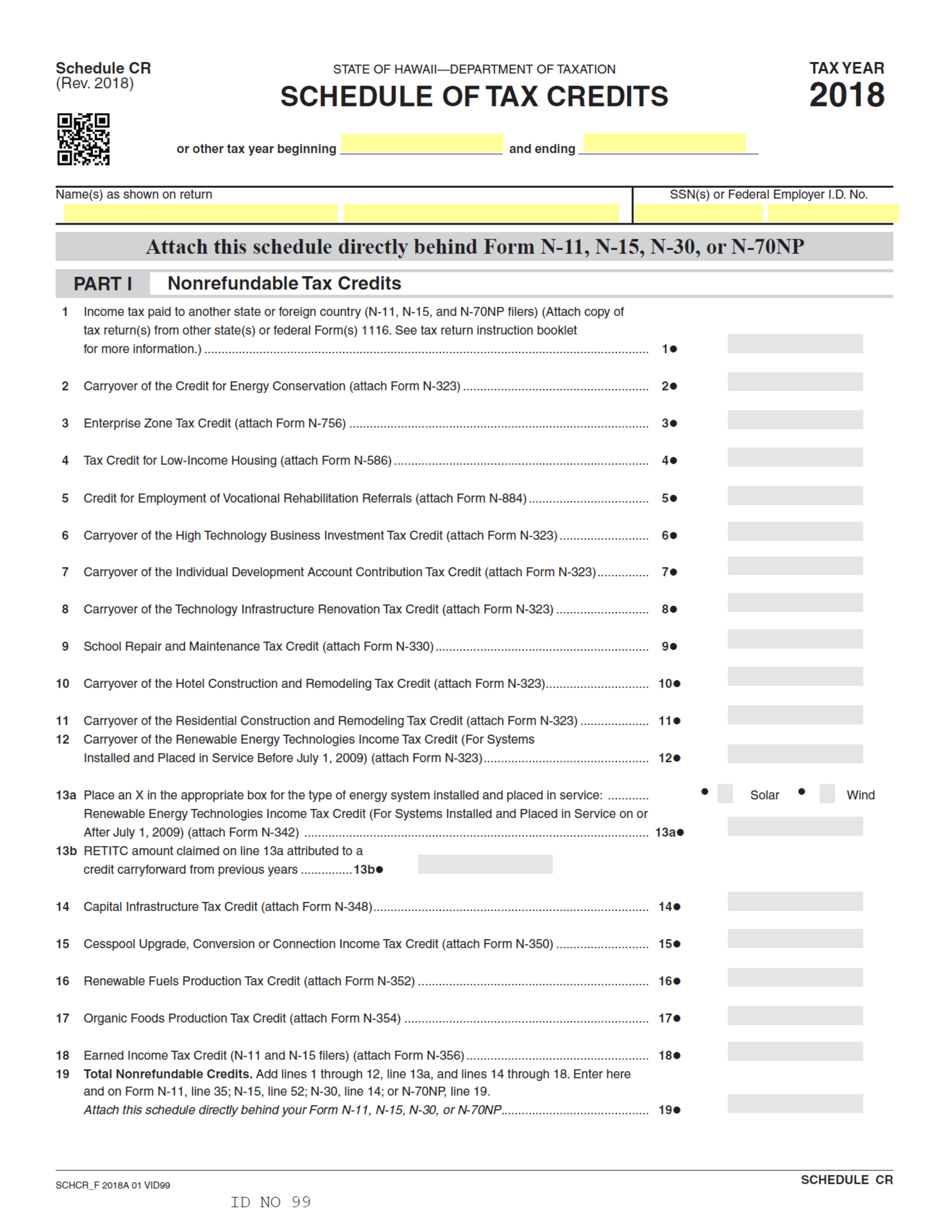

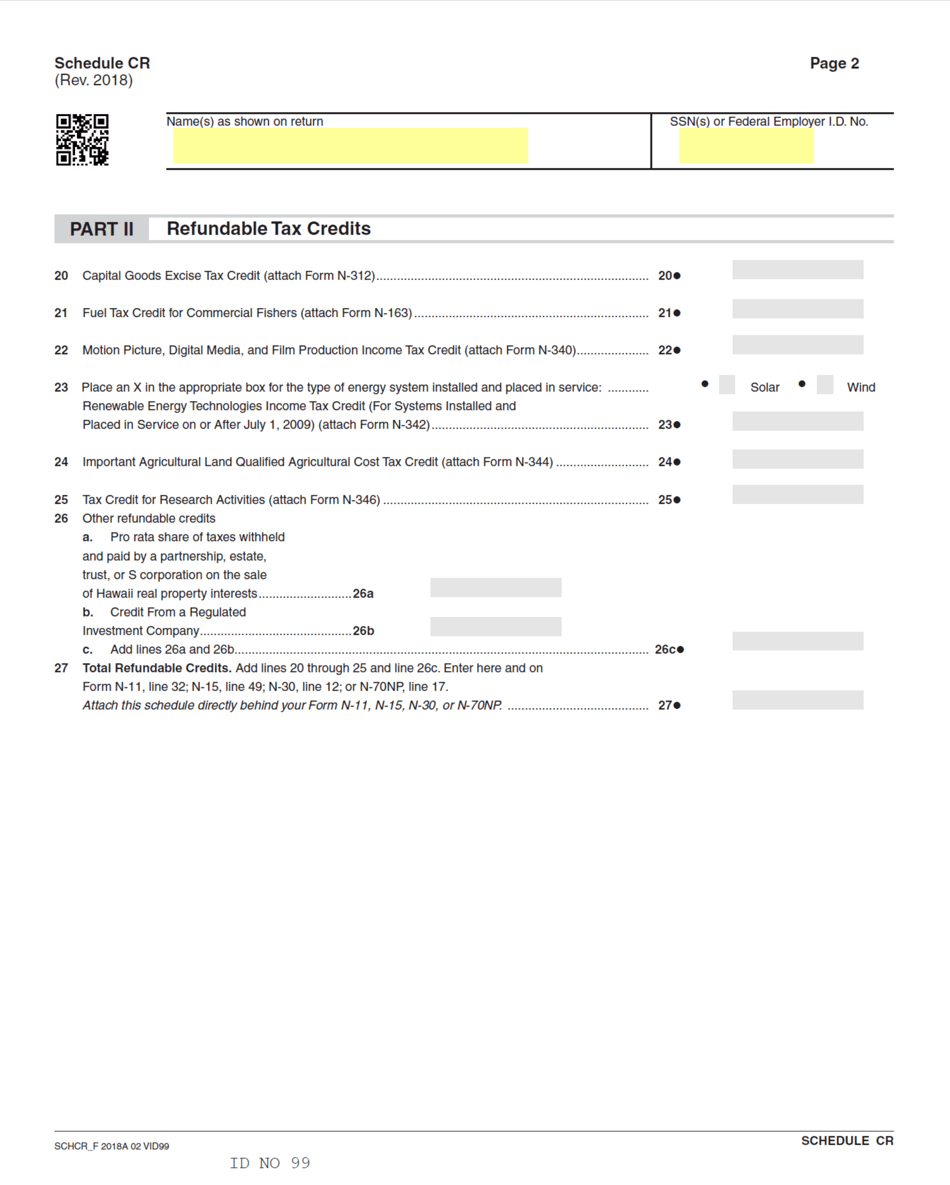

Q: Are there any tax credits available on Form N-11?

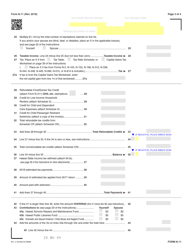

A: Yes, there are several tax credits available on Form N-11, including the Child and Dependent Care Credit, the Earned Income Credit, and the Residential Renewable Energy Technology Credit.

Q: Can I file Form N-11 if I am not a resident of Hawaii?

A: No, Form N-11 is specifically for Hawaii residents. Non-residents should file the appropriate tax form for their state or country.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-11 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.