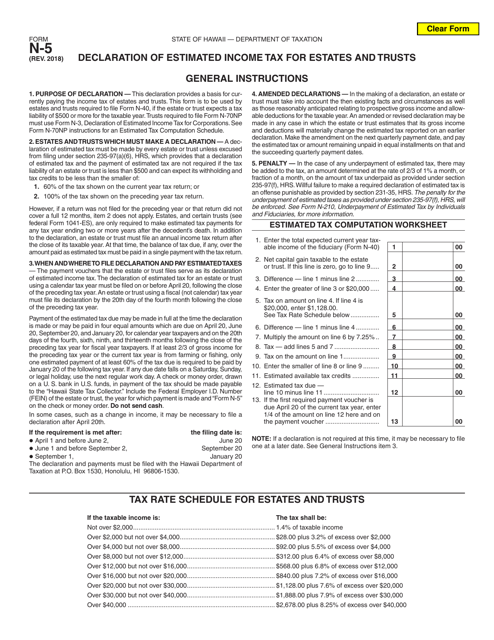

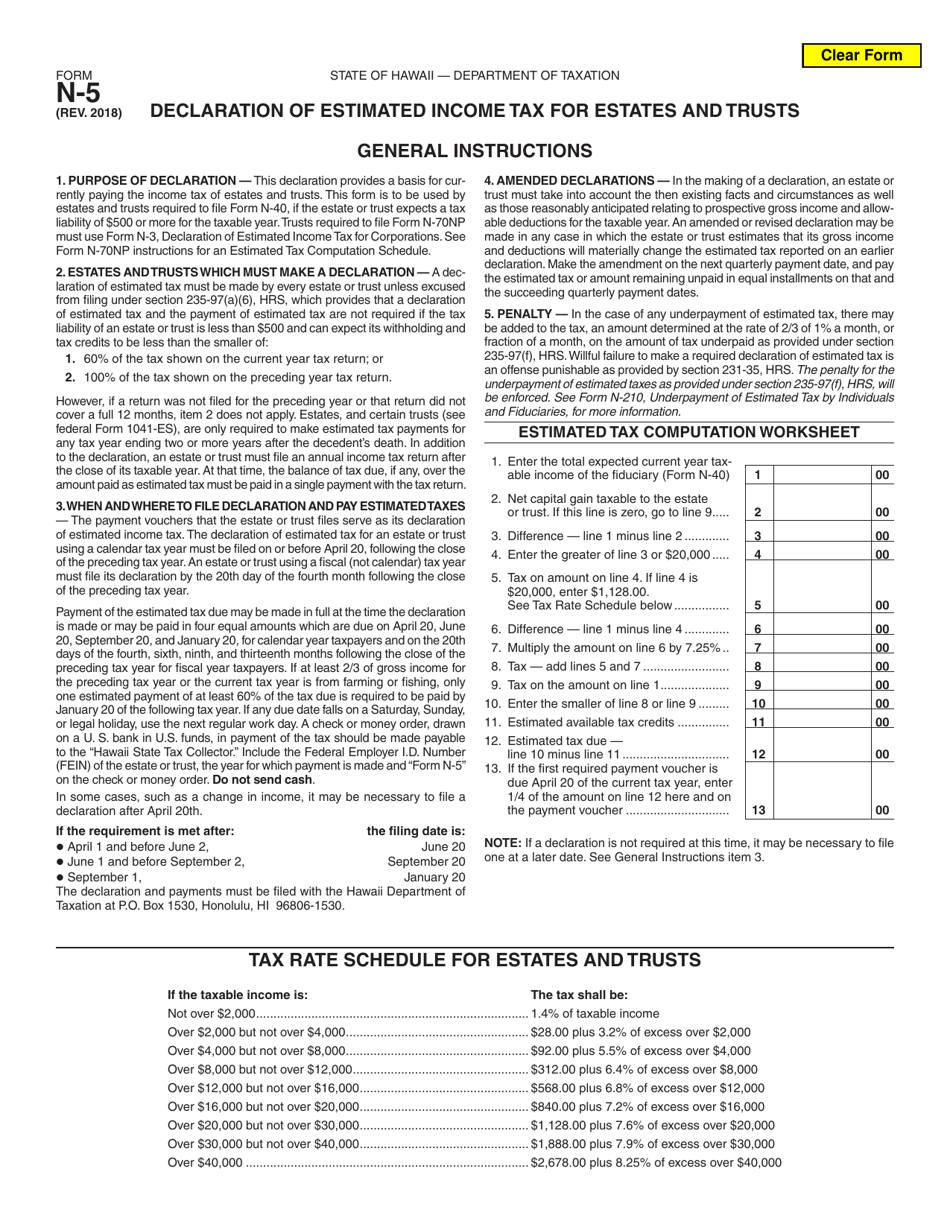

Form N-5 Declaration of Estimated Income Tax for Estates and Trusts - Hawaii

What Is Form N-5?

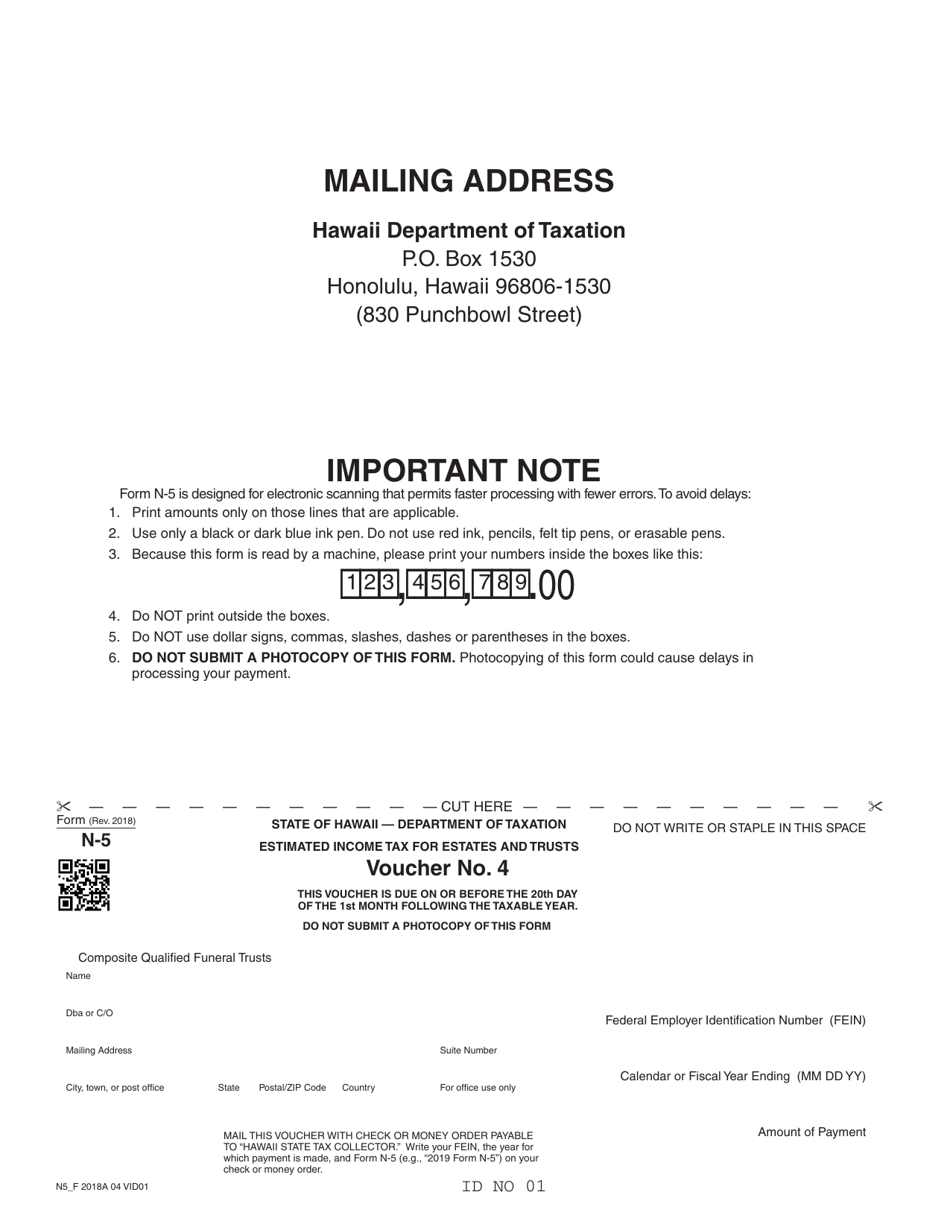

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-5?

A: Form N-5 is the Declaration of Estimated Income Tax for Estates and Trusts - Hawaii.

Q: Who should file Form N-5?

A: Estates and trusts in Hawaii that have income from sources within the state and expect to owe more than $500 in income tax for the current calendar year should file Form N-5.

Q: What is the purpose of Form N-5?

A: The purpose of Form N-5 is to declare and pay estimated income tax for estates and trusts in Hawaii.

Q: When is Form N-5 due?

A: Form N-5 is due on or before the 15th day of the 4th month following the close of the taxable year.

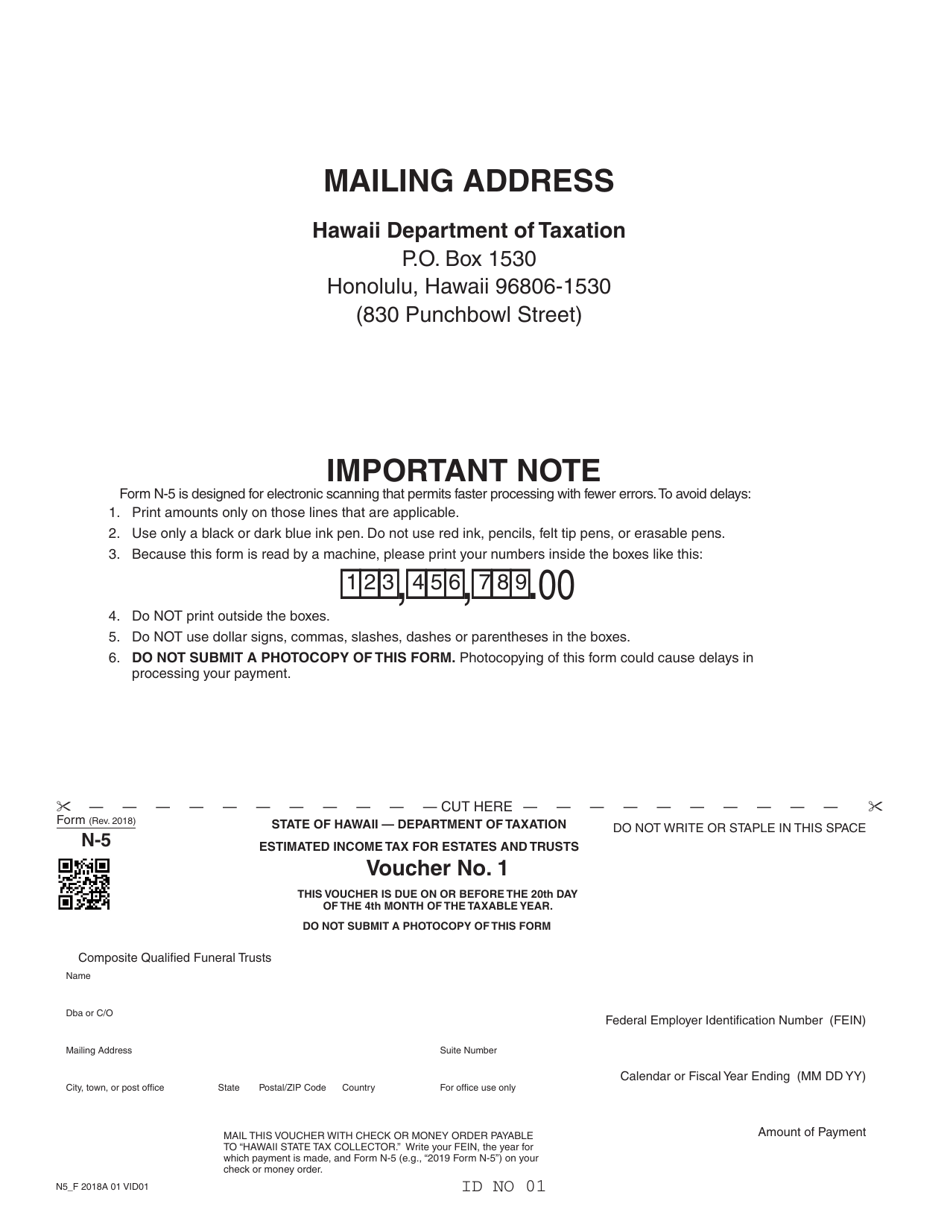

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-5 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.