This version of the form is not currently in use and is provided for reference only. Download this version of

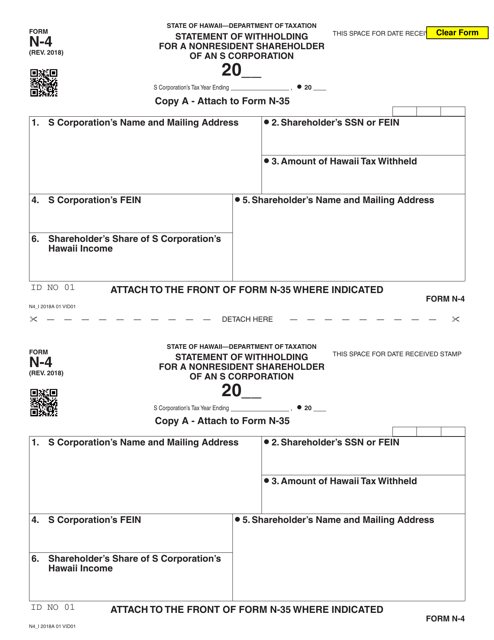

Form N-4

for the current year.

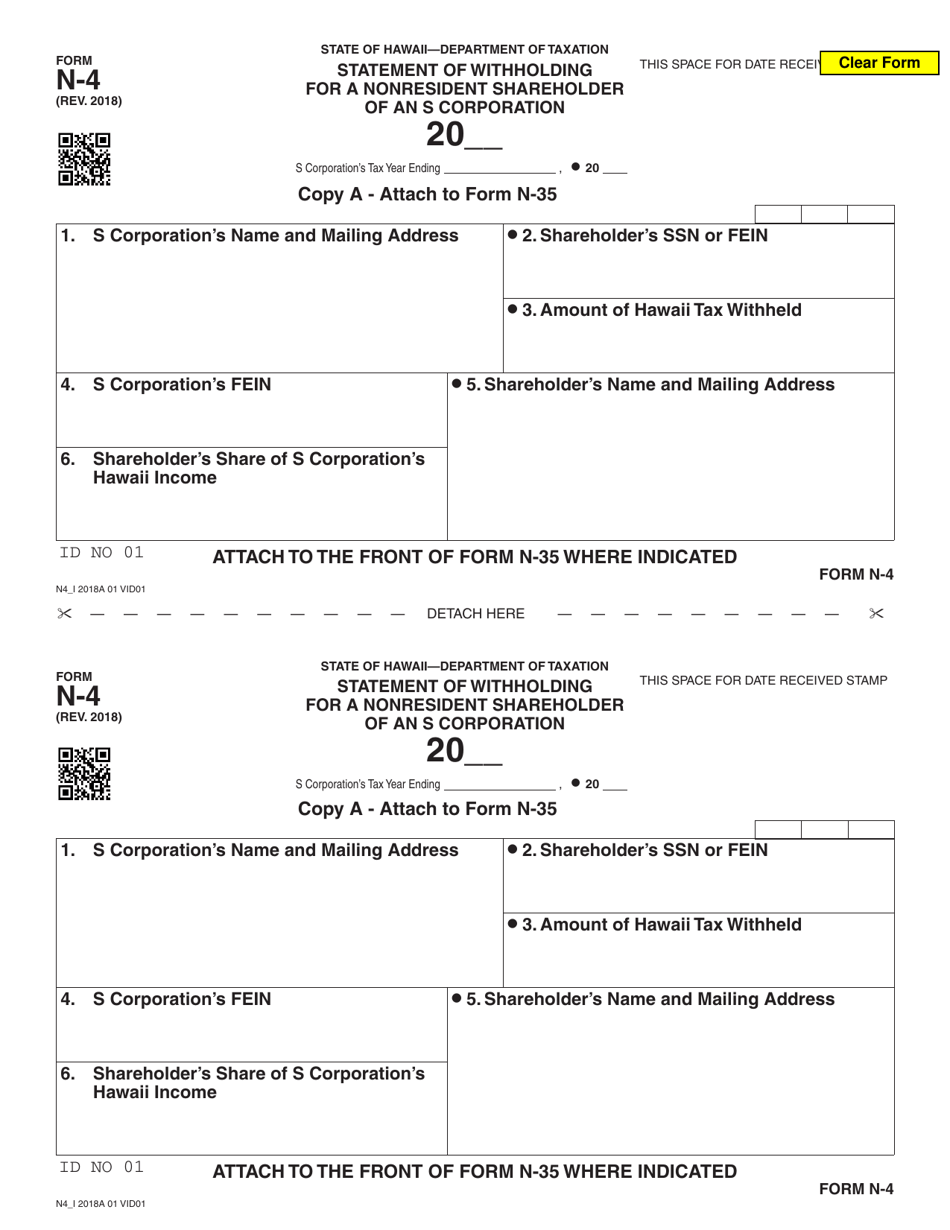

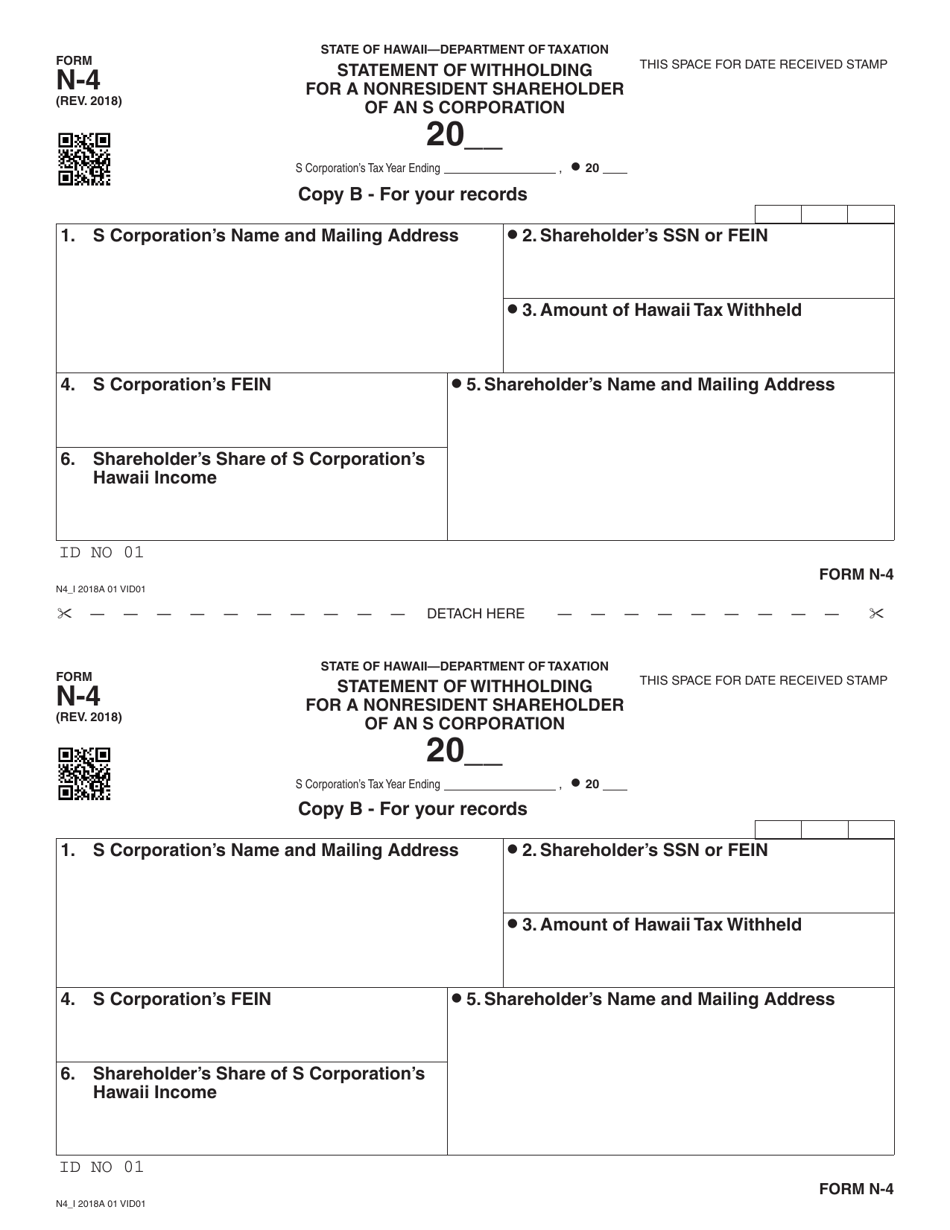

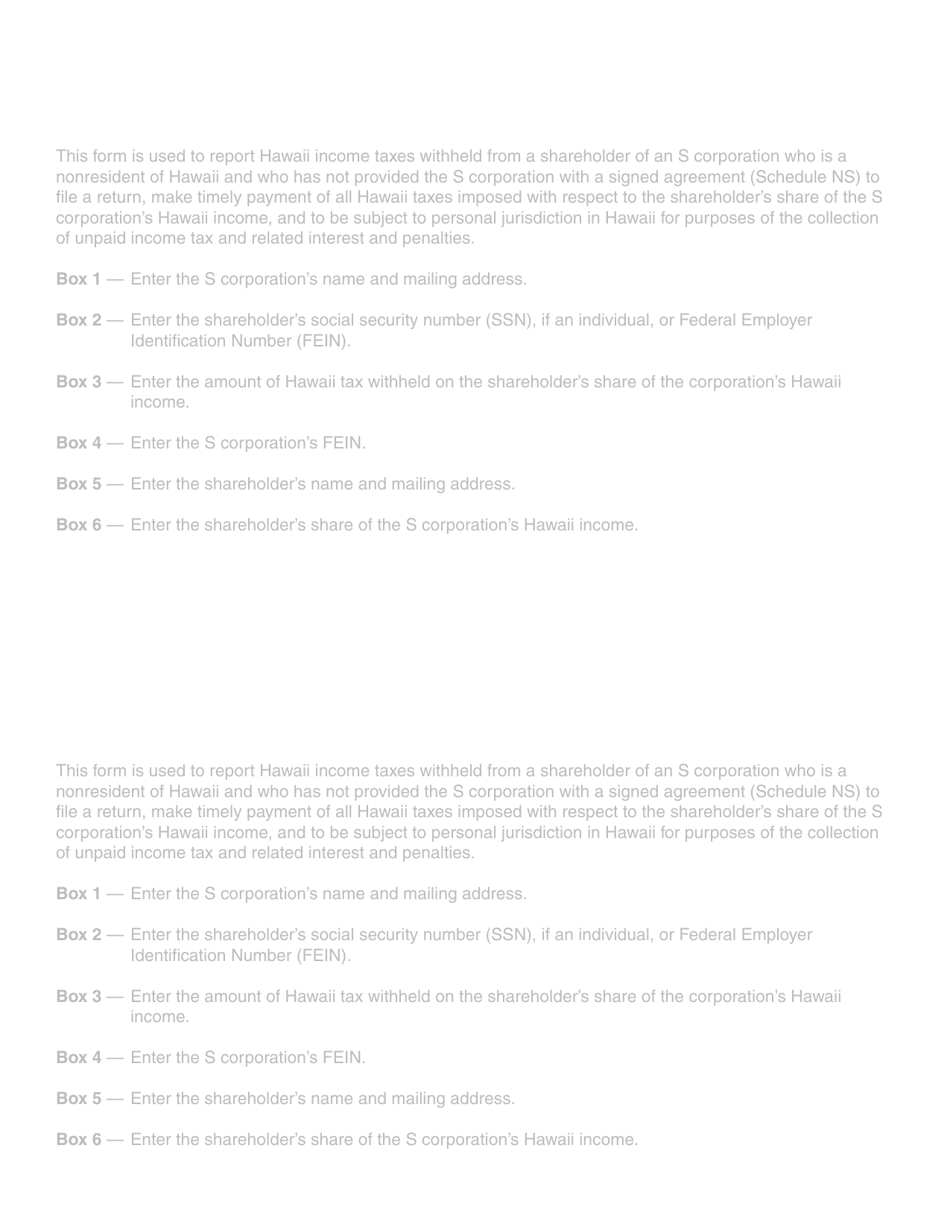

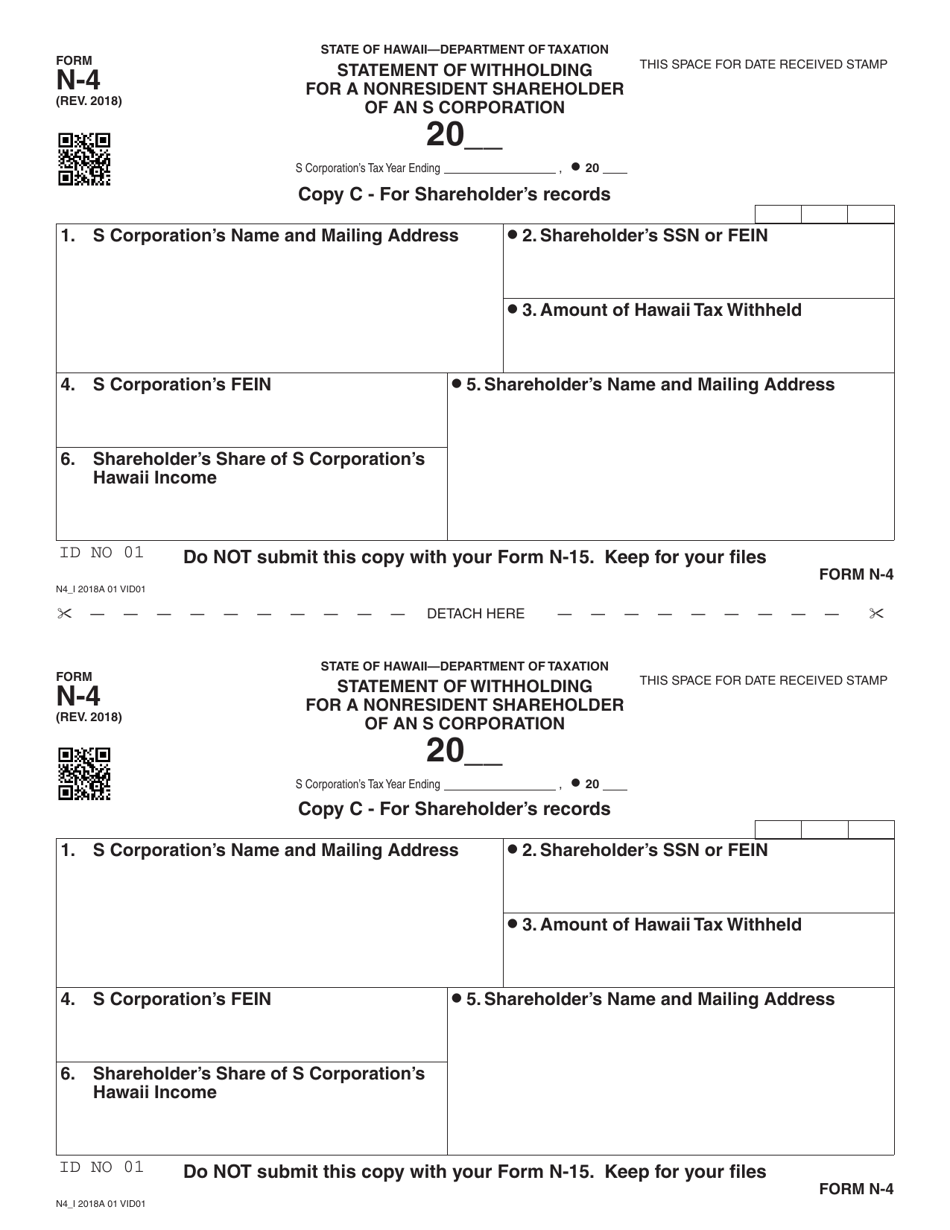

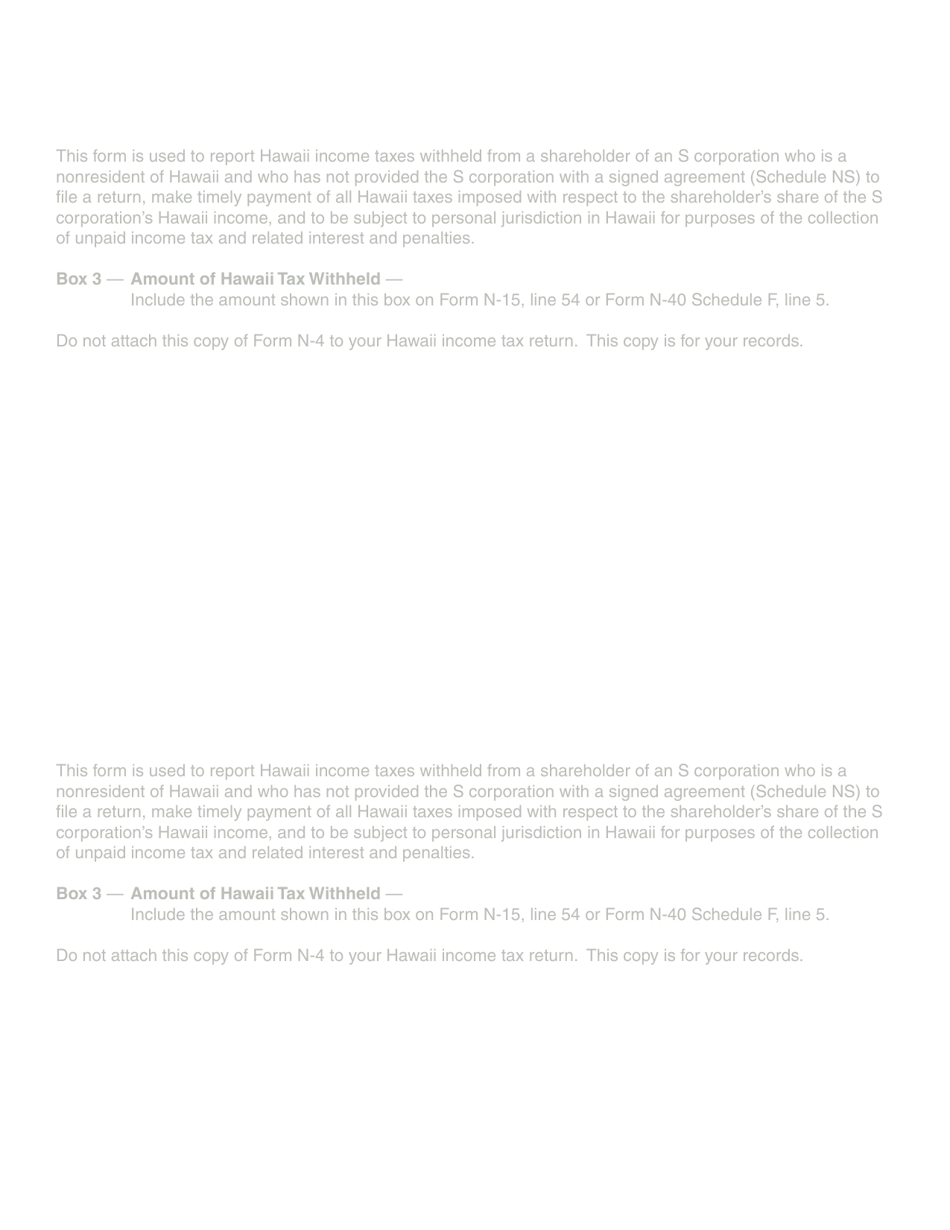

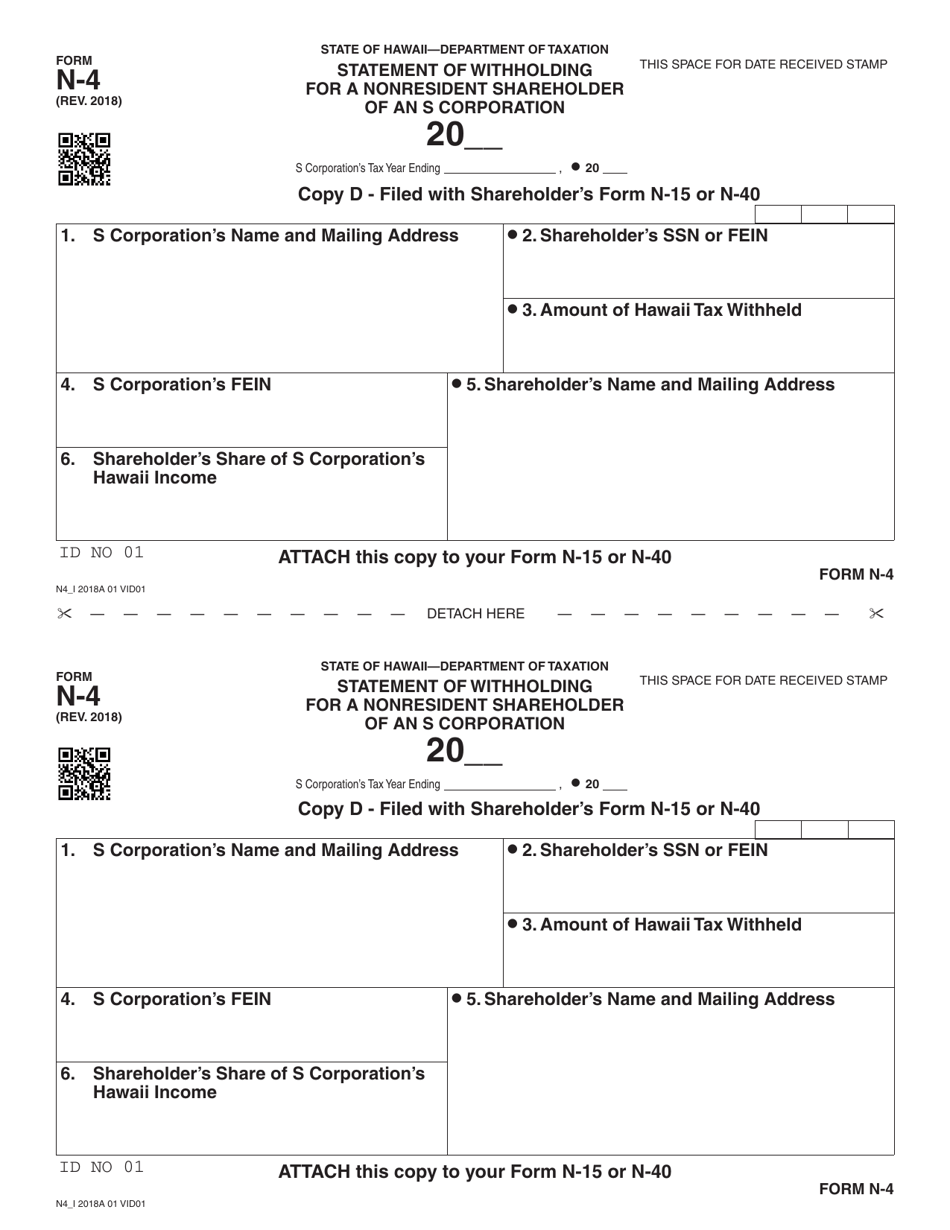

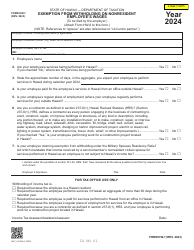

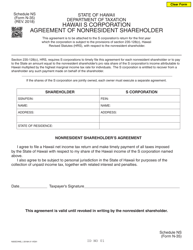

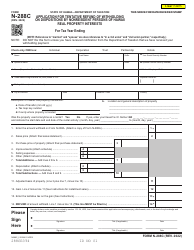

Form N-4 Statement of Withholding for a Nonresident Shareholder of an S Corporation - Hawaii

What Is Form N-4?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-4?

A: Form N-4 is the Statement of Withholding for a Nonresident Shareholder of an S Corporation for Hawaii.

Q: Who should file Form N-4?

A: Nonresident shareholders of an S Corporation in Hawaii should file Form N-4.

Q: What is the purpose of Form N-4?

A: Form N-4 is used to report and remit withholding taxes on income distributed to nonresident shareholders.

Q: How often should Form N-4 be filed?

A: Form N-4 should be filed annually.

Q: Are there any exemptions or exceptions to filing Form N-4?

A: There are certain exemptions and exceptions available, so refer to the instructions provided with the form.

Q: What information is required on Form N-4?

A: Form N-4 requires information about the S Corporation, nonresident shareholders, and the withholding tax calculation.

Q: Is there a deadline for filing Form N-4?

A: Yes, Form N-4 must be filed by the due date for annual tax returns, which is typically April 20th.

Q: What are the consequences of not filing Form N-4?

A: Failure to file Form N-4 or pay the withholding taxes may result in penalties and interest charges.

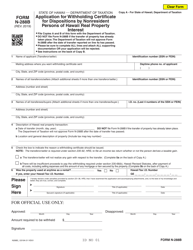

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-4 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.