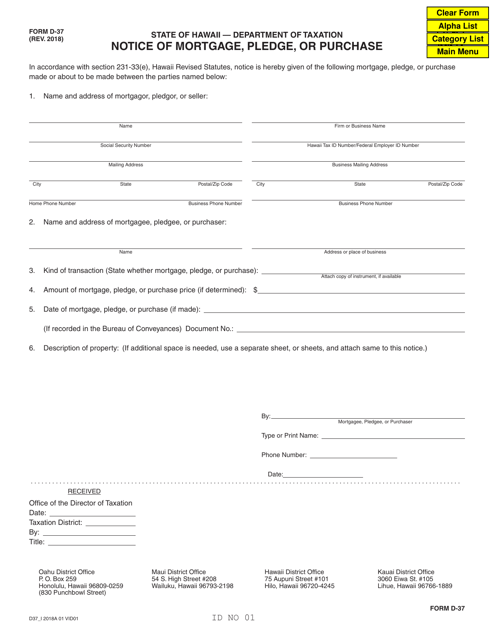

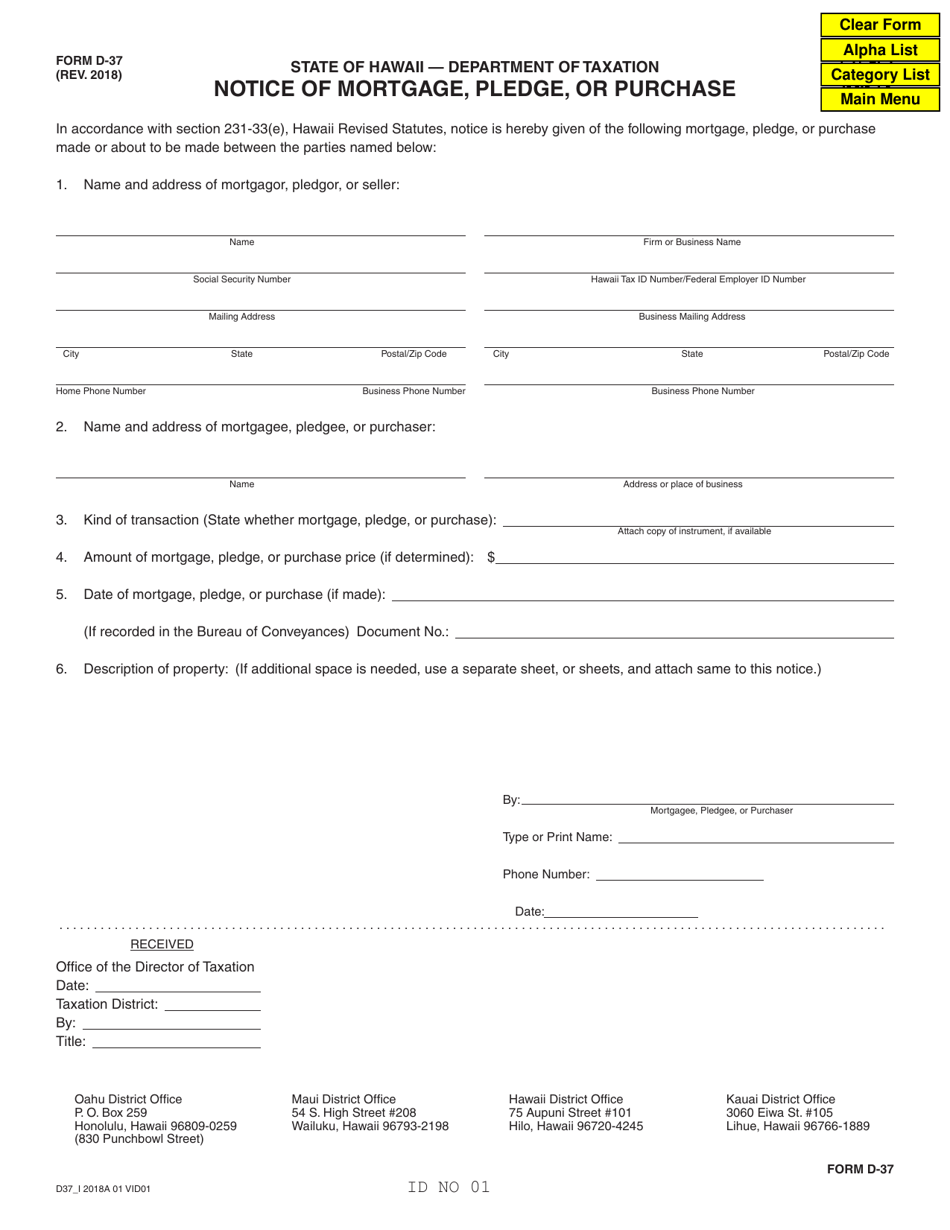

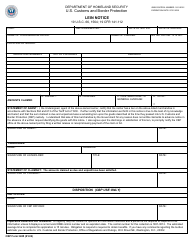

Form D-37 Notice of Mortgage, Pledge, or Purchase - Hawaii

What Is Form D-37?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-37?

A: Form D-37 is a notice of mortgage, pledge, or purchase in Hawaii.

Q: Who is required to fill out Form D-37?

A: Anyone who has a mortgage, pledge, or purchase in Hawaii may be required to fill out this form.

Q: What is the purpose of Form D-37?

A: The purpose of Form D-37 is to provide notice of a mortgage, pledge, or purchase to the appropriate authorities.

Q: Is there a fee for filing Form D-37?

A: There may be a filing fee associated with submitting Form D-37. Check with the relevant agency for more information.

Q: Are there any deadlines for filing Form D-37?

A: It is important to file Form D-37 within the specified timeframes set by the relevant authorities in Hawaii.

Q: What information is required on Form D-37?

A: Form D-37 typically requires information such as the names of the parties involved, description of the property, and details of the mortgage, pledge, or purchase.

Q: Do I need to submit any additional documents with Form D-37?

A: The requirements for additional documents may vary depending on the specific circumstances. Refer to the instructions on Form D-37 or contact the relevant agency for guidance.

Q: What happens after I file Form D-37?

A: After filing Form D-37, it will be processed by the appropriate authorities. You may receive a confirmation or acknowledgment of the filing.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-37 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.