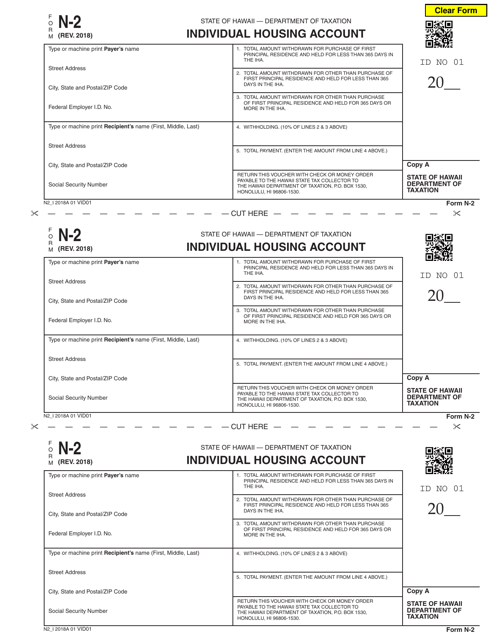

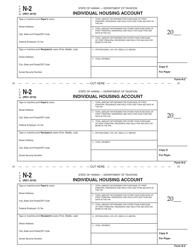

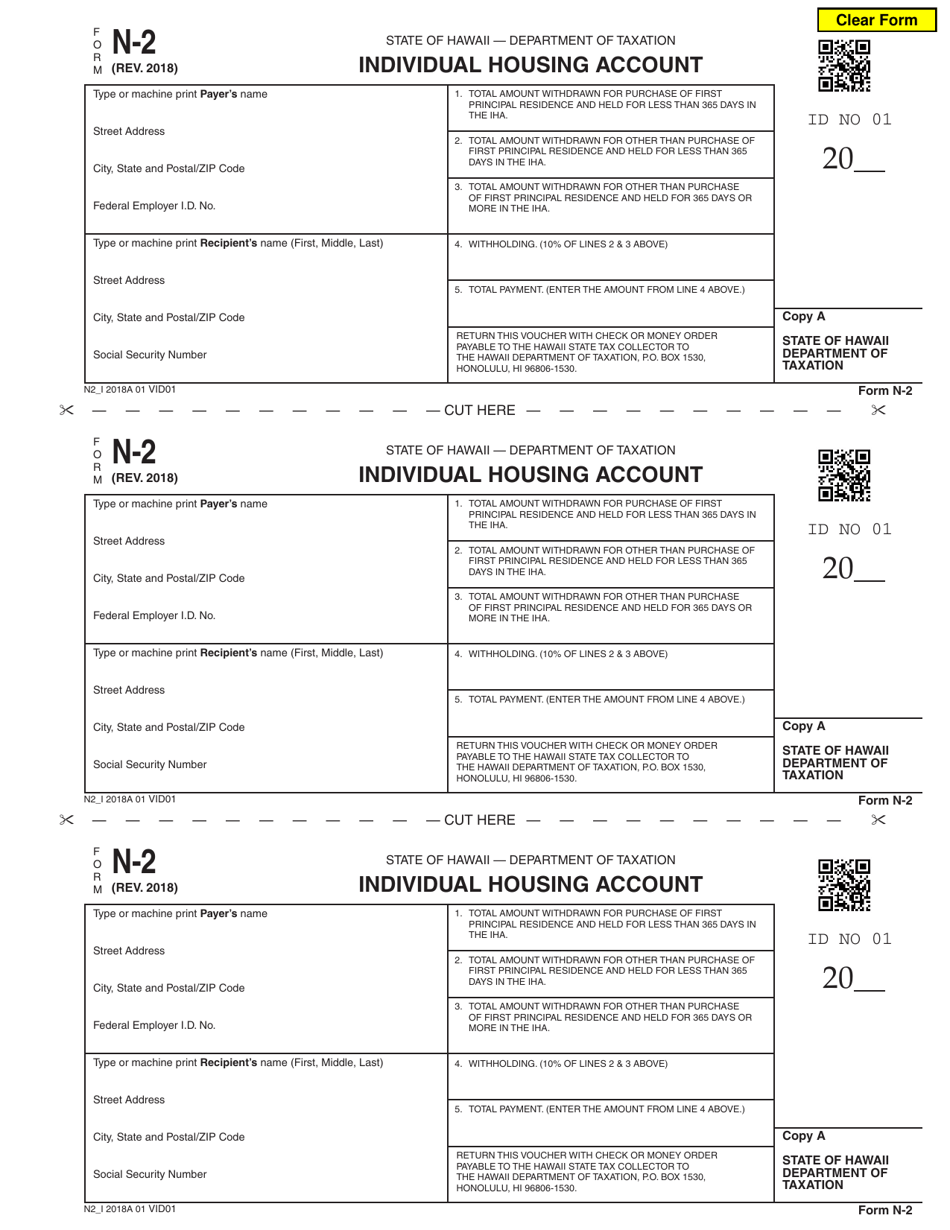

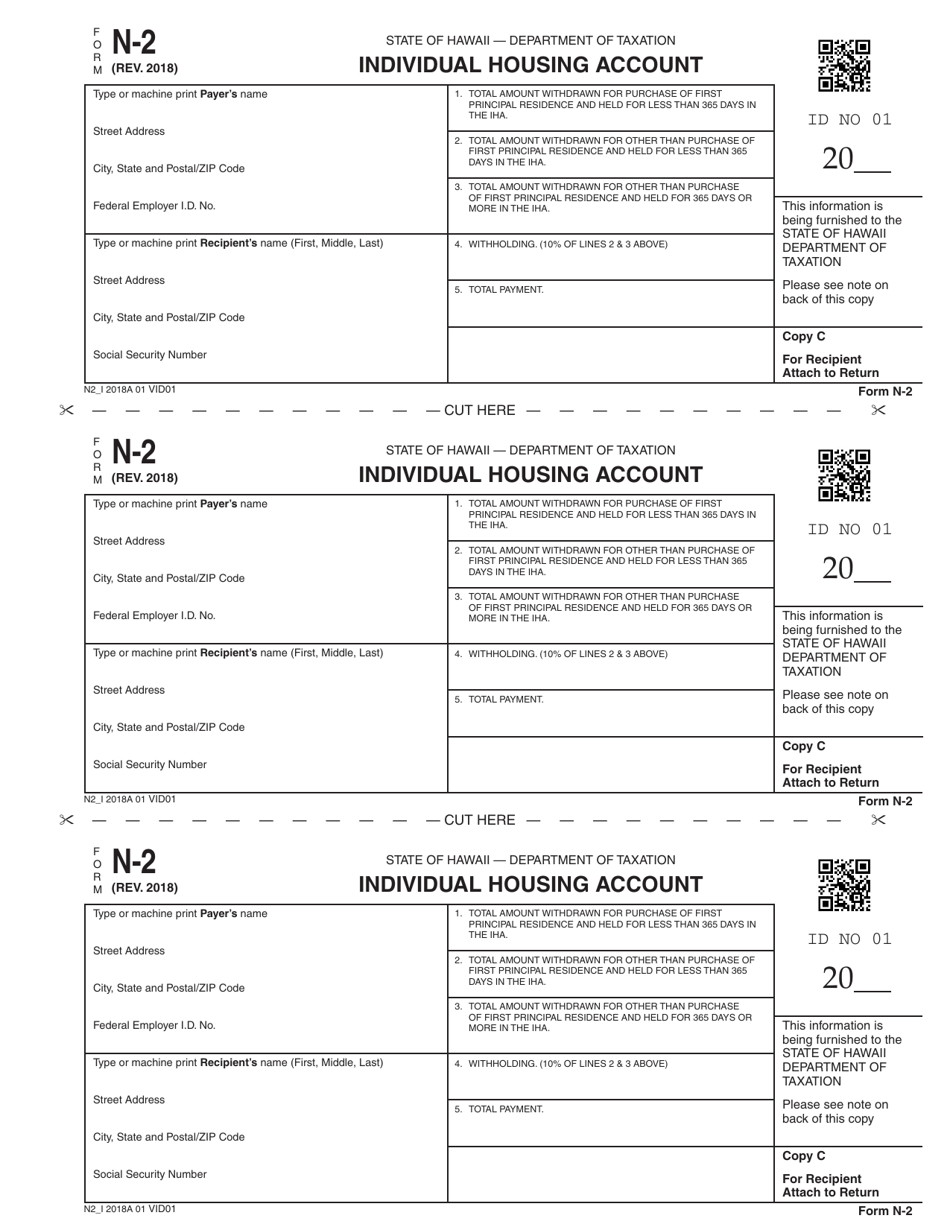

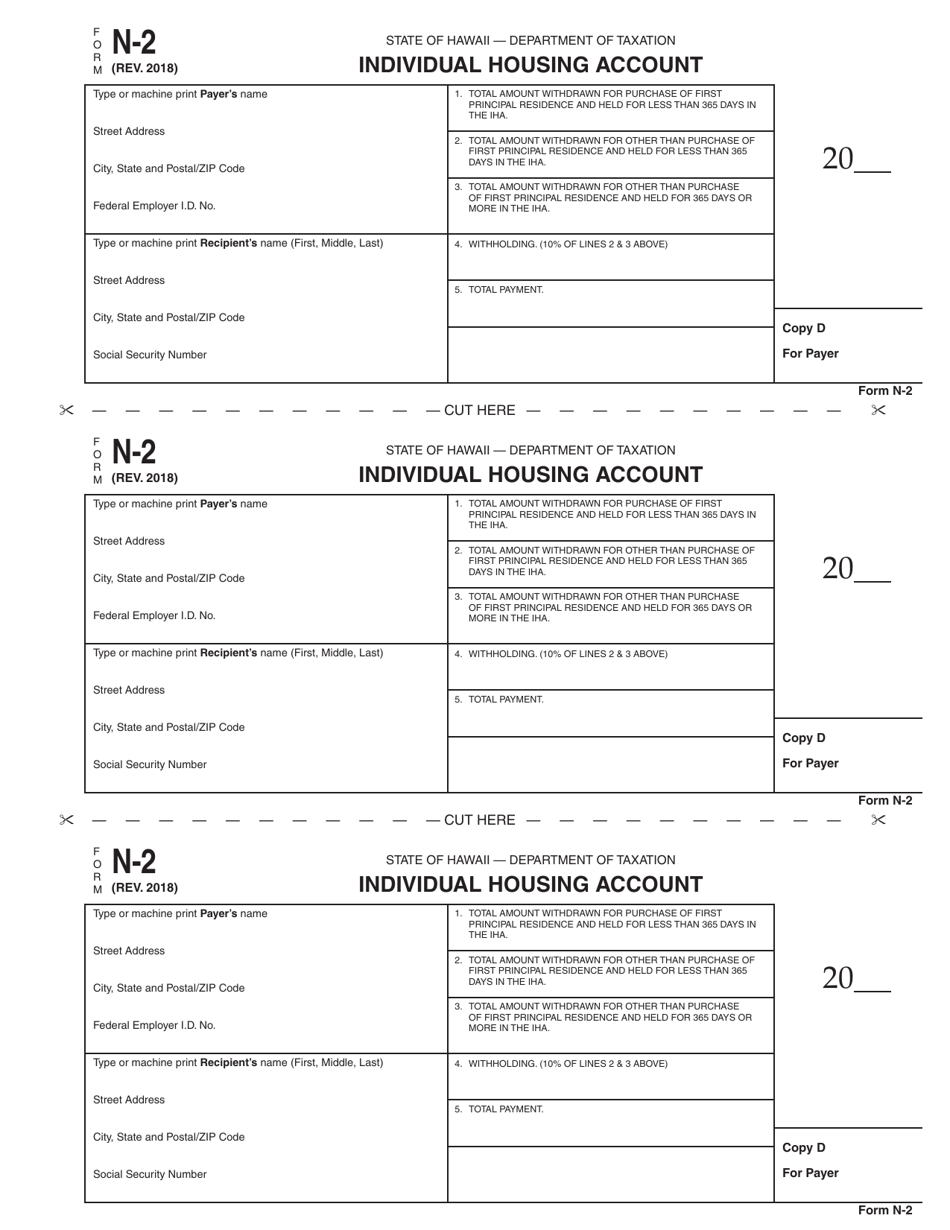

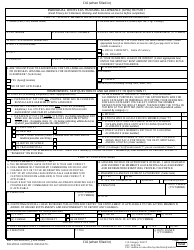

Form N-2 Individual Housing Account - Hawaii

What Is Form N-2?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-2?

A: Form N-2 is the Individual Housing Account form used in Hawaii.

Q: What is an Individual Housing Account?

A: An Individual Housing Account is a savings account that can be used for down payment and closing costs on a home purchase.

Q: Who can open an Individual Housing Account?

A: Individuals who are residents of Hawaii and have a social security number can open an Individual Housing Account.

Q: What are the benefits of opening an Individual Housing Account?

A: Opening an Individual Housing Account allows individuals to save for a down payment and closing costs on a home purchase while earning tax-free interest.

Q: How much can be contributed to an Individual Housing Account?

A: The maximum annual contribution to an Individual Housing Account is $2,000 for individuals and $4,000 for married couples filing jointly.

Q: Are there any income limitations to contribute to an Individual Housing Account?

A: Yes, individuals with an adjusted gross income of over $135,000 and married couples with an adjusted gross income of over $195,000 are not eligible to contribute to an Individual Housing Account.

Q: Can the funds in an Individual Housing Account be used for any home purchase?

A: No, the funds in an Individual Housing Account can only be used for the purchase of a primary residence in Hawaii.

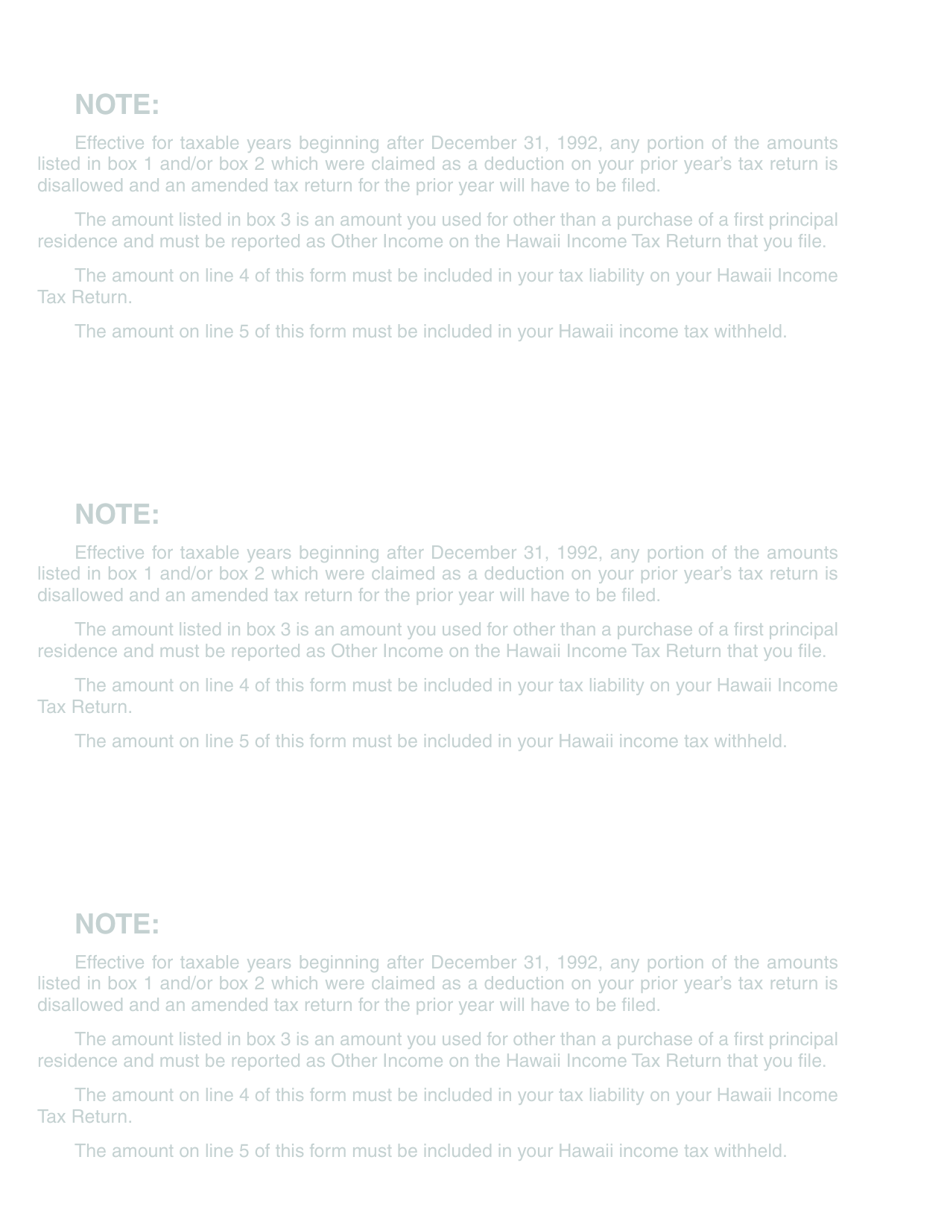

Q: What happens if the funds in an Individual Housing Account are not used for a home purchase?

A: If the funds in an Individual Housing Account are not used for a home purchase within 10 years, they must be withdrawn and taxes and penalties may apply.

Q: What is the deadline for contributing to an Individual Housing Account?

A: Contributions to an Individual Housing Account must be made by the tax return due date, which is usually April 15th.

Q: Are there any other requirements for opening an Individual Housing Account?

A: Yes, individuals must first obtain a Certification of Eligibility from the Hawaii Housing Finance and Development Corporation before opening an Individual Housing Account.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-2 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.