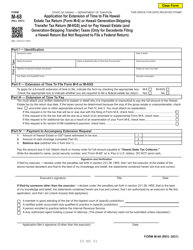

This version of the form is not currently in use and is provided for reference only. Download this version of

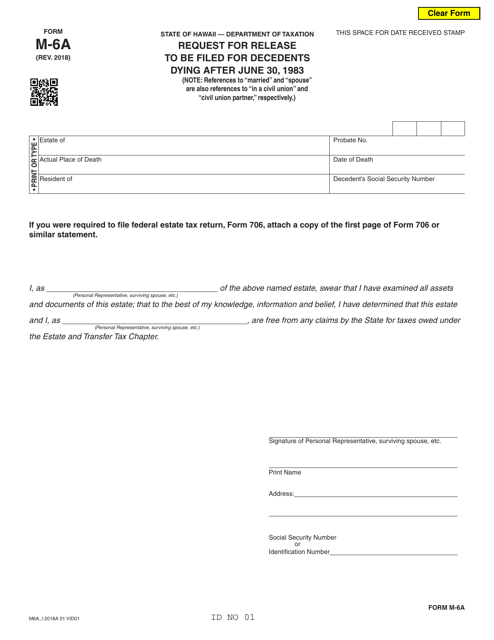

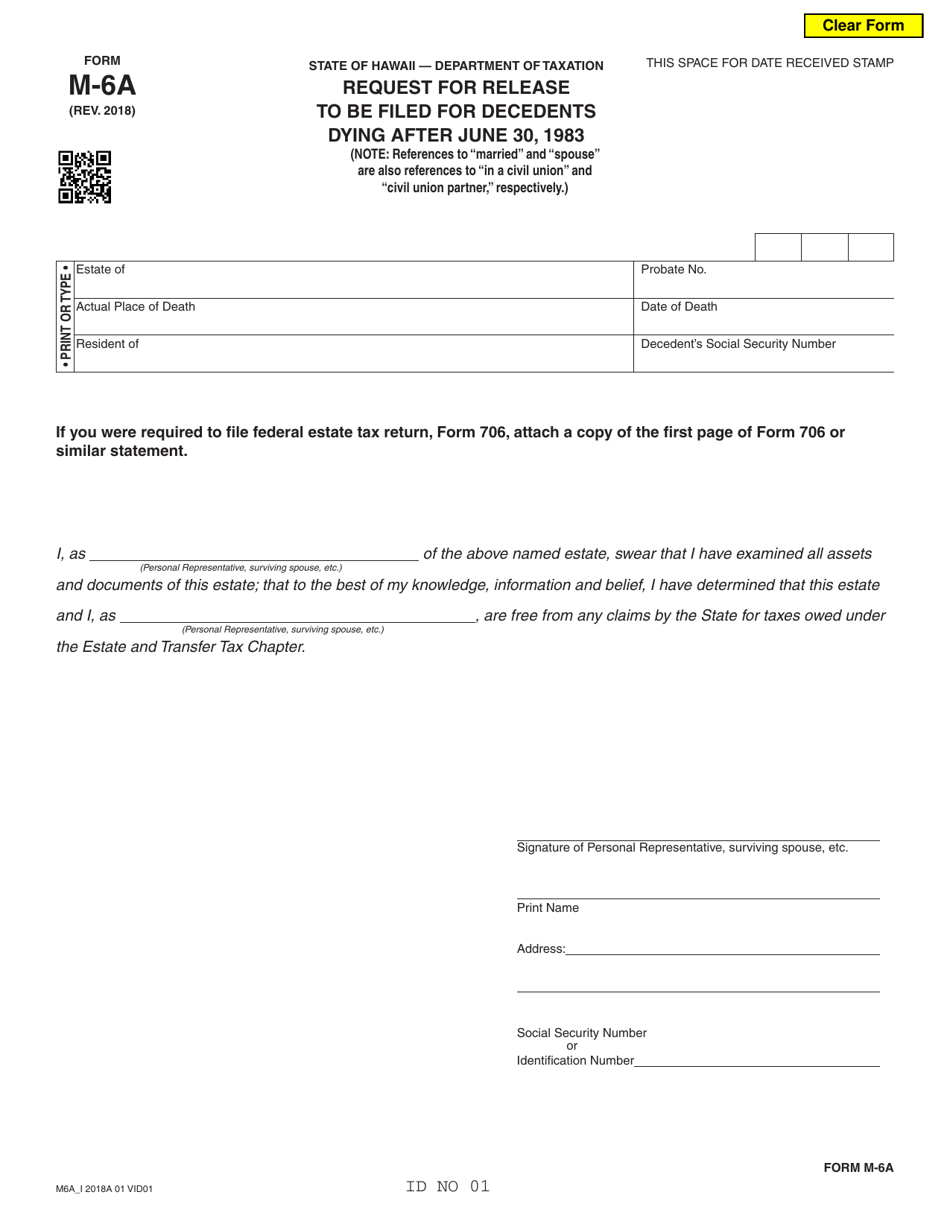

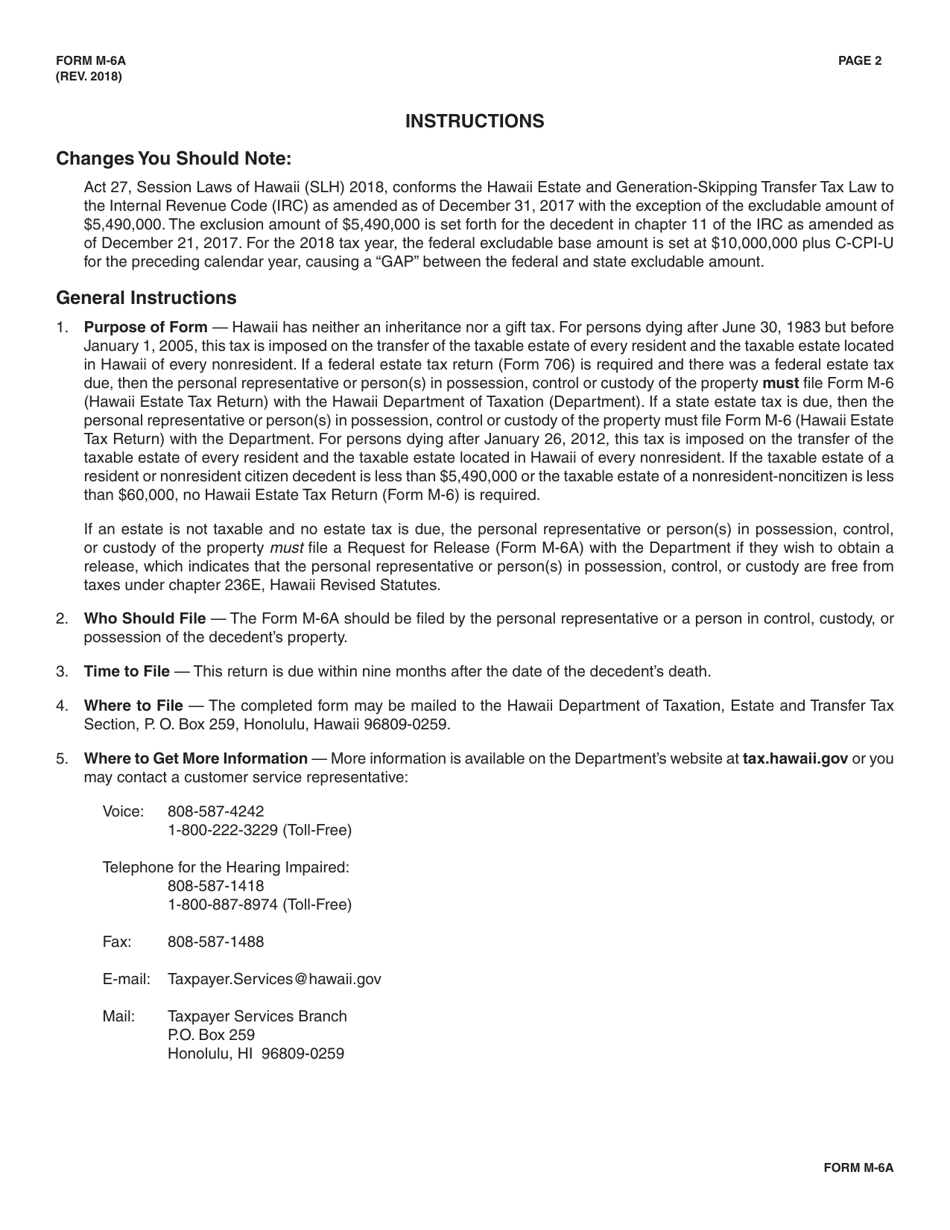

Form M-6A

for the current year.

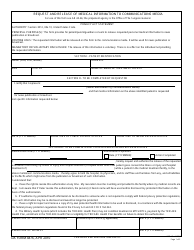

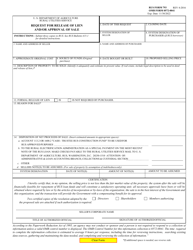

Form M-6A Request for Release to Be Filed for Decedents Dying After June 30, 1983 - Hawaii

What Is Form M-6A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-6A?

A: Form M-6A is a document used in Hawaii for requesting release of assets for decedents who died after June 30, 1983.

Q: Who is required to file Form M-6A?

A: Form M-6A is filed by individuals who need to release assets of a decedent who died after June 30, 1983 in Hawaii.

Q: What is the purpose of Form M-6A?

A: The purpose of Form M-6A is to request the release of assets for decedents who passed away after June 30, 1983 in Hawaii.

Q: When should Form M-6A be filed?

A: Form M-6A should be filed when you need to release assets of a decedent who died after June 30, 1983 in Hawaii.

Q: Is there a fee for filing Form M-6A?

A: No, there is no fee for filing Form M-6A in Hawaii.

Q: Are there any additional documents required to file Form M-6A?

A: Yes, supporting documents such as death certificates and proof of relationship may be required along with Form M-6A.

Q: What happens after filing Form M-6A?

A: After filing Form M-6A, the Hawaii Department of Taxation will review the request and process it accordingly.

Q: Is there a time limit for filing Form M-6A?

A: There is no specific time limit mentioned for filing Form M-6A, but it is recommended to file it as soon as possible after the decedent's death.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-6A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.