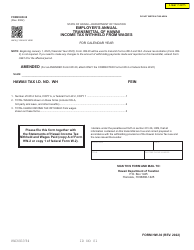

This version of the form is not currently in use and is provided for reference only. Download this version of

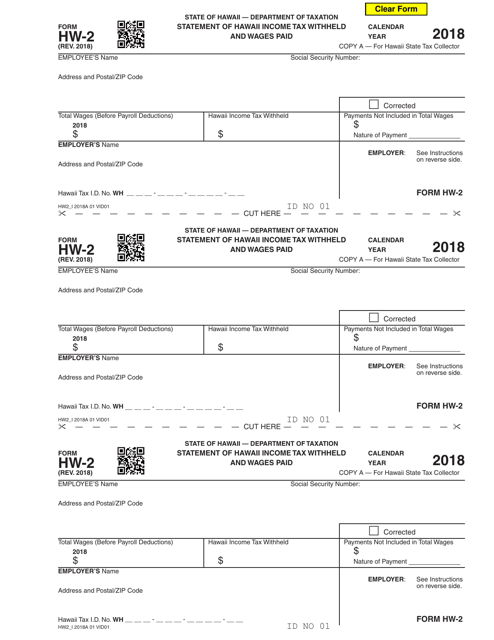

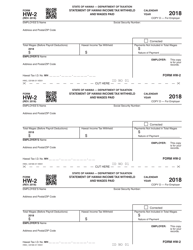

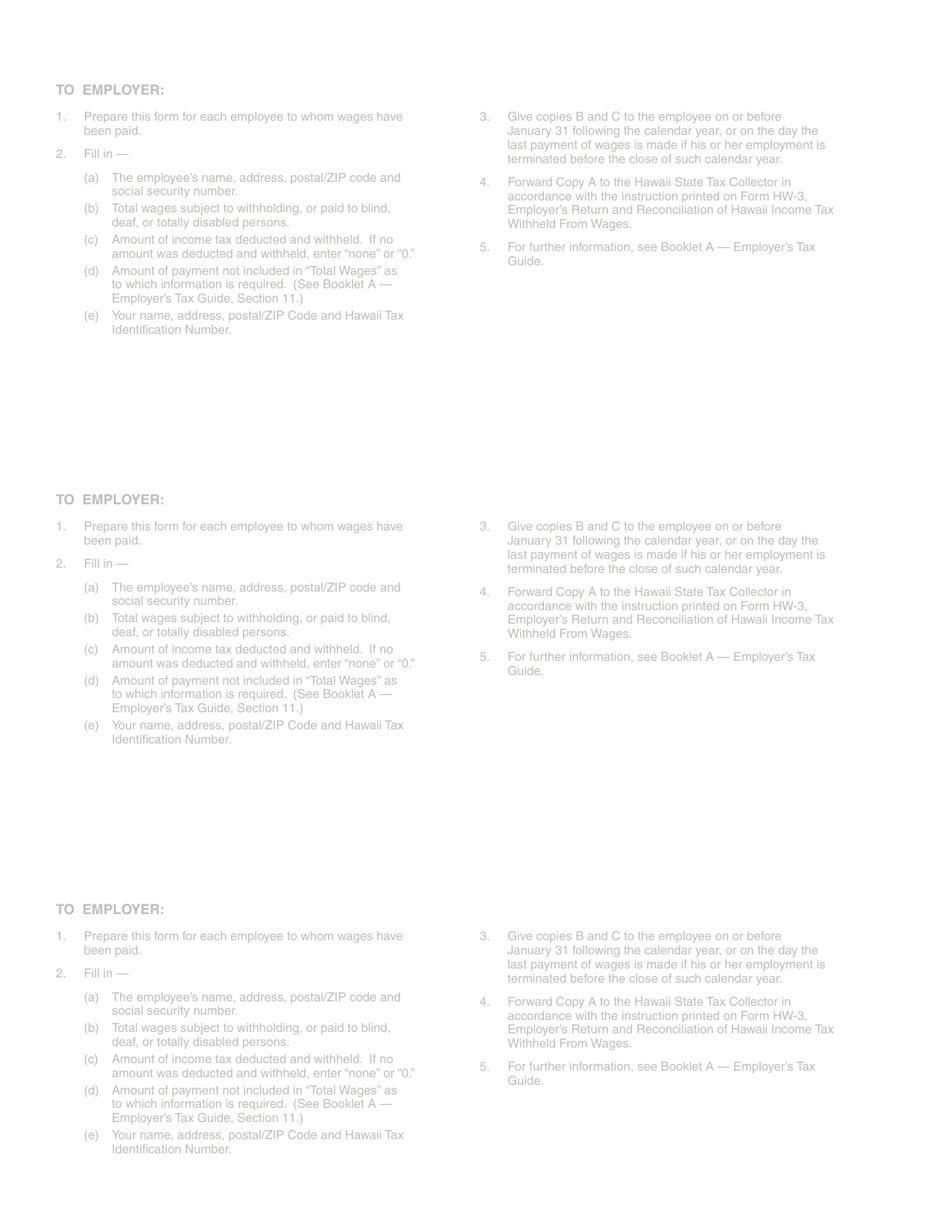

Form HW-2

for the current year.

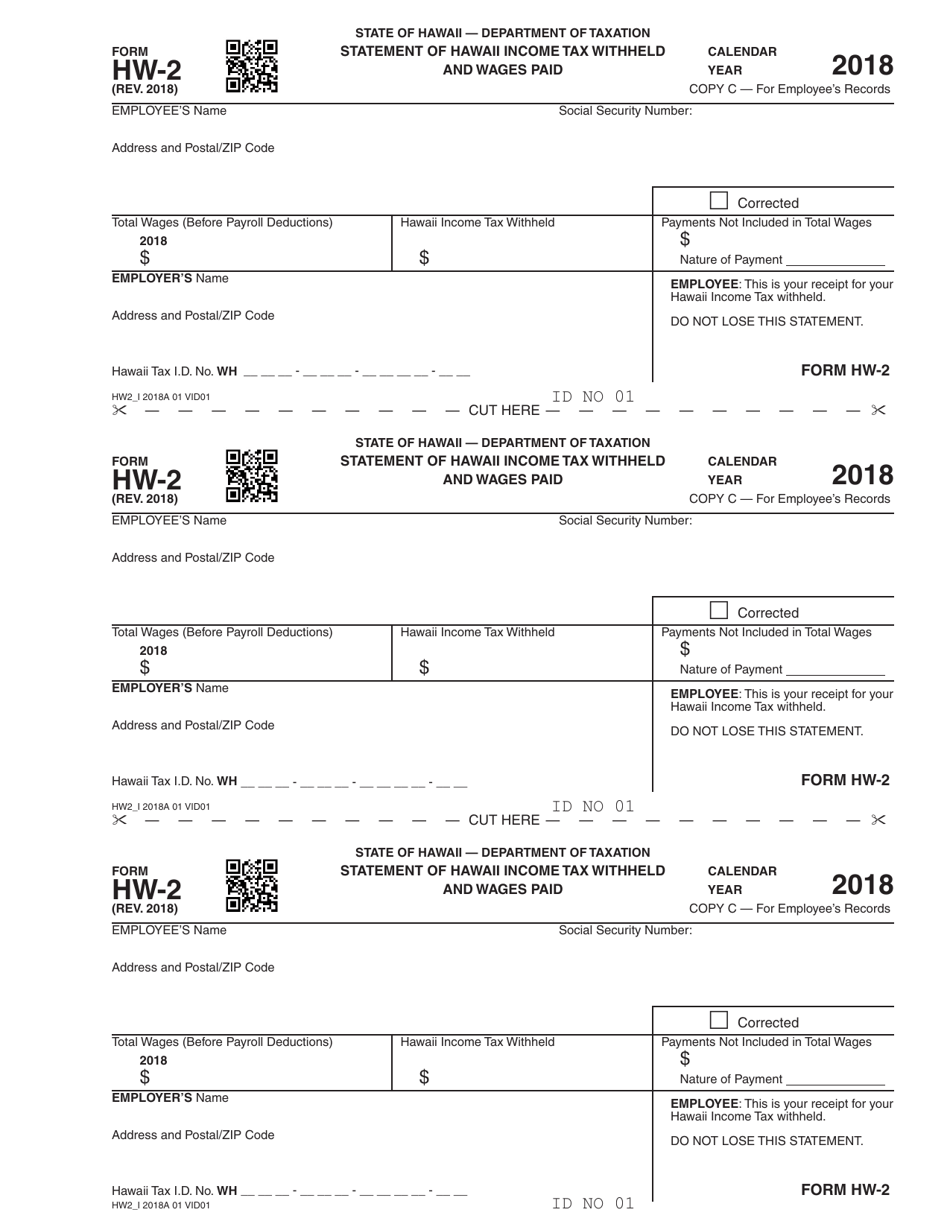

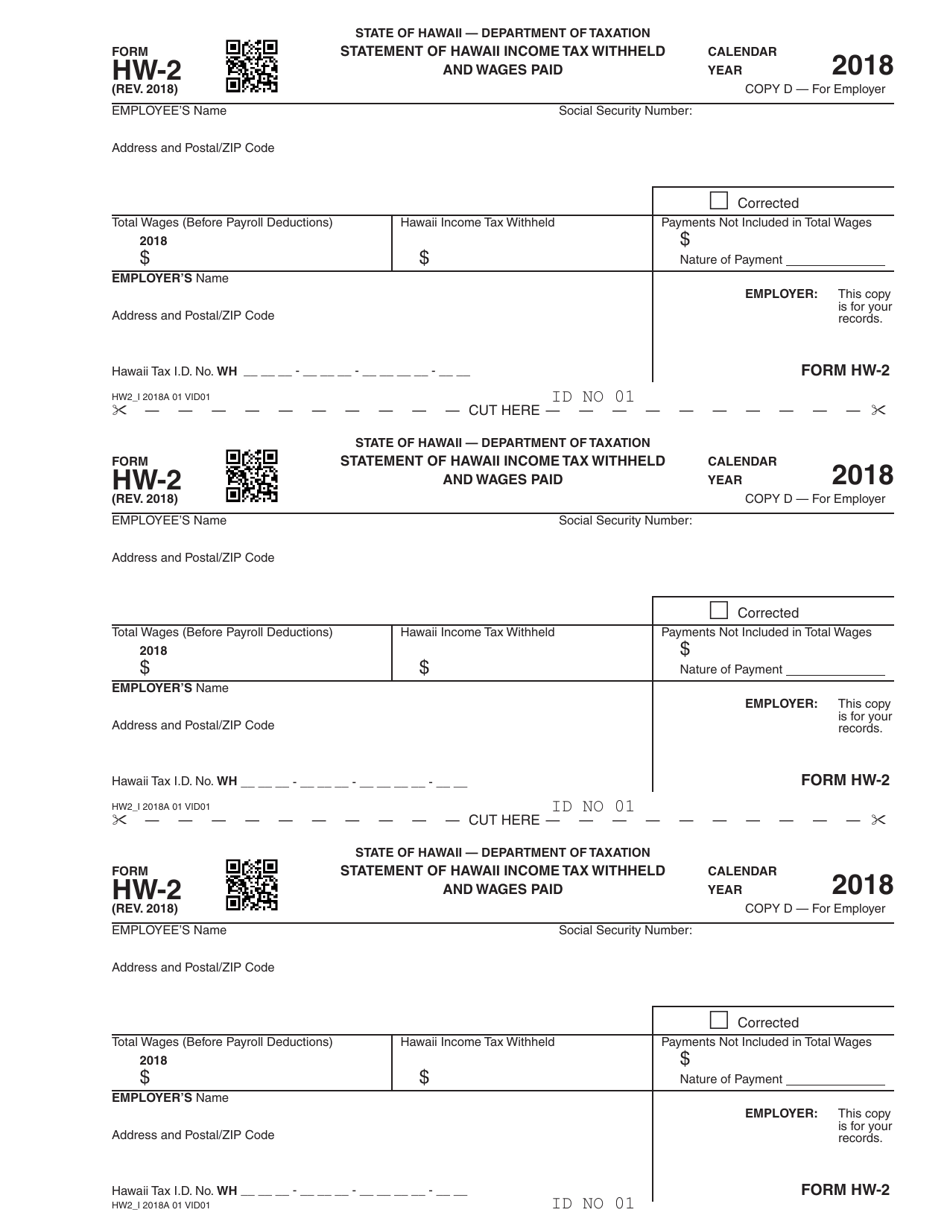

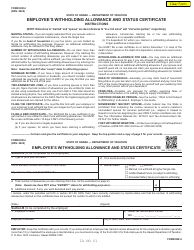

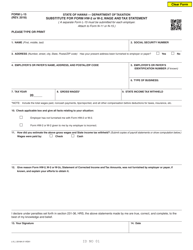

Form HW-2 Statement of Hawaii Income Tax Withheld and Wages Paid - Hawaii

What Is Form HW-2?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is HW-2?

A: HW-2 is a statement of Hawaii income tax withheld and wages paid.

Q: What does HW-2 report?

A: HW-2 reports the amount of Hawaii income tax withheld from an employee's wages and the total wages paid.

Q: Who files the HW-2?

A: Employers file the HW-2 on behalf of their employees.

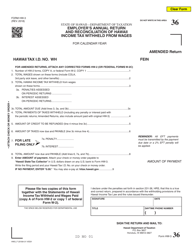

Q: When is the HW-2 due?

A: The HW-2 is due on or before January 31st of the following year.

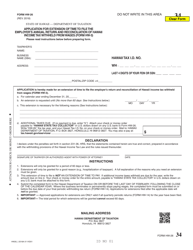

Q: What should I do if I did not receive a HW-2 form?

A: If you did not receive a HW-2 form, you should contact your employer to request a copy.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW-2 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.