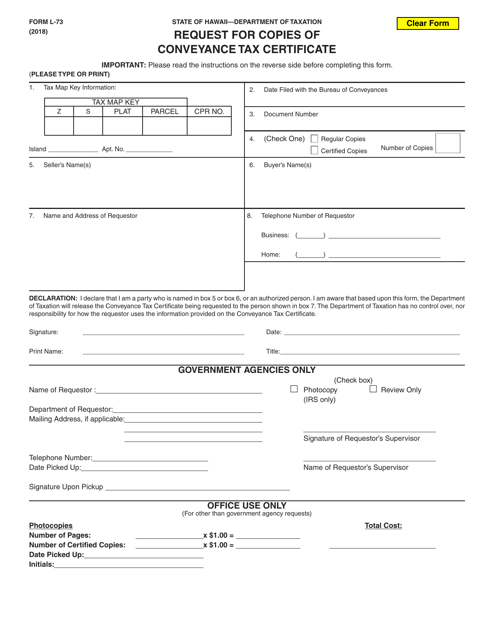

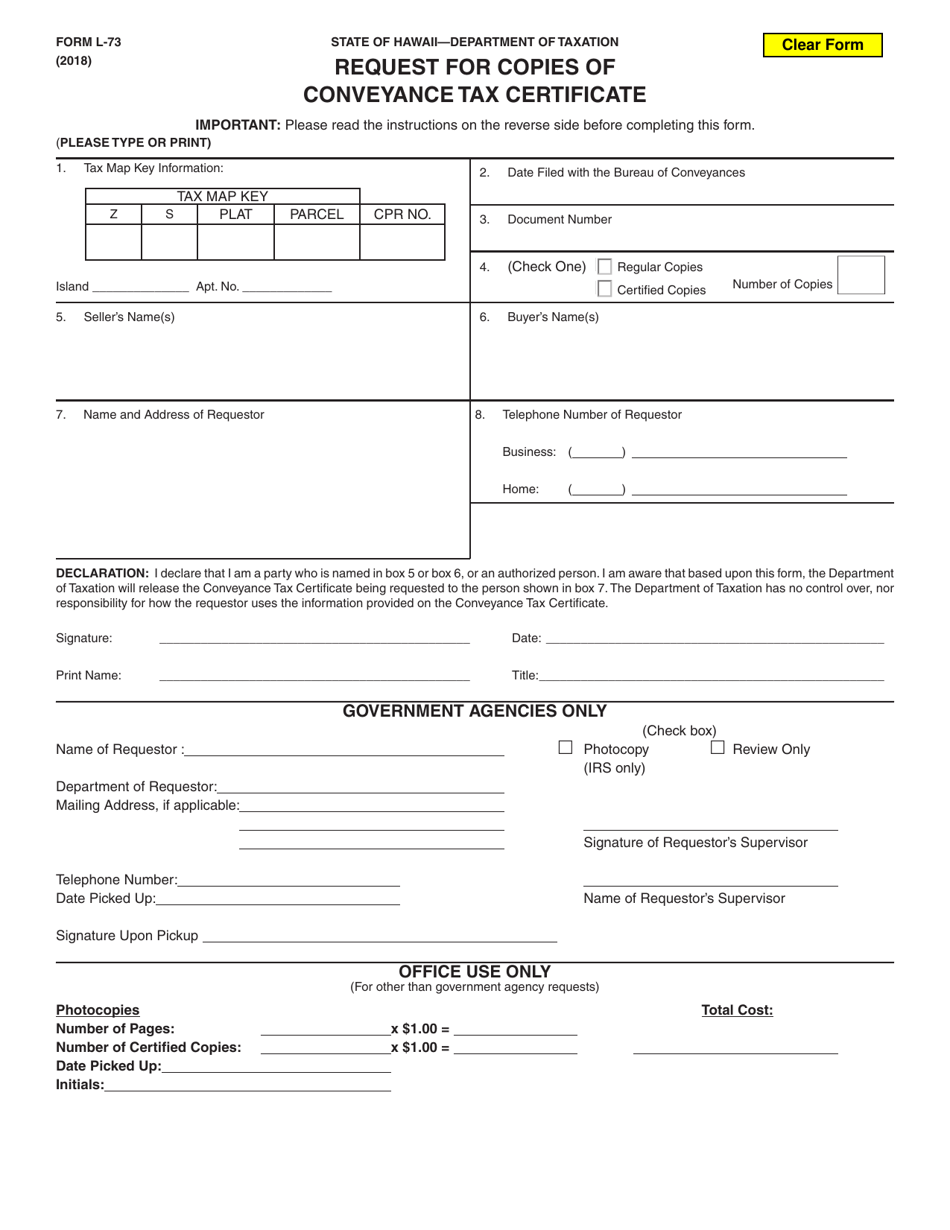

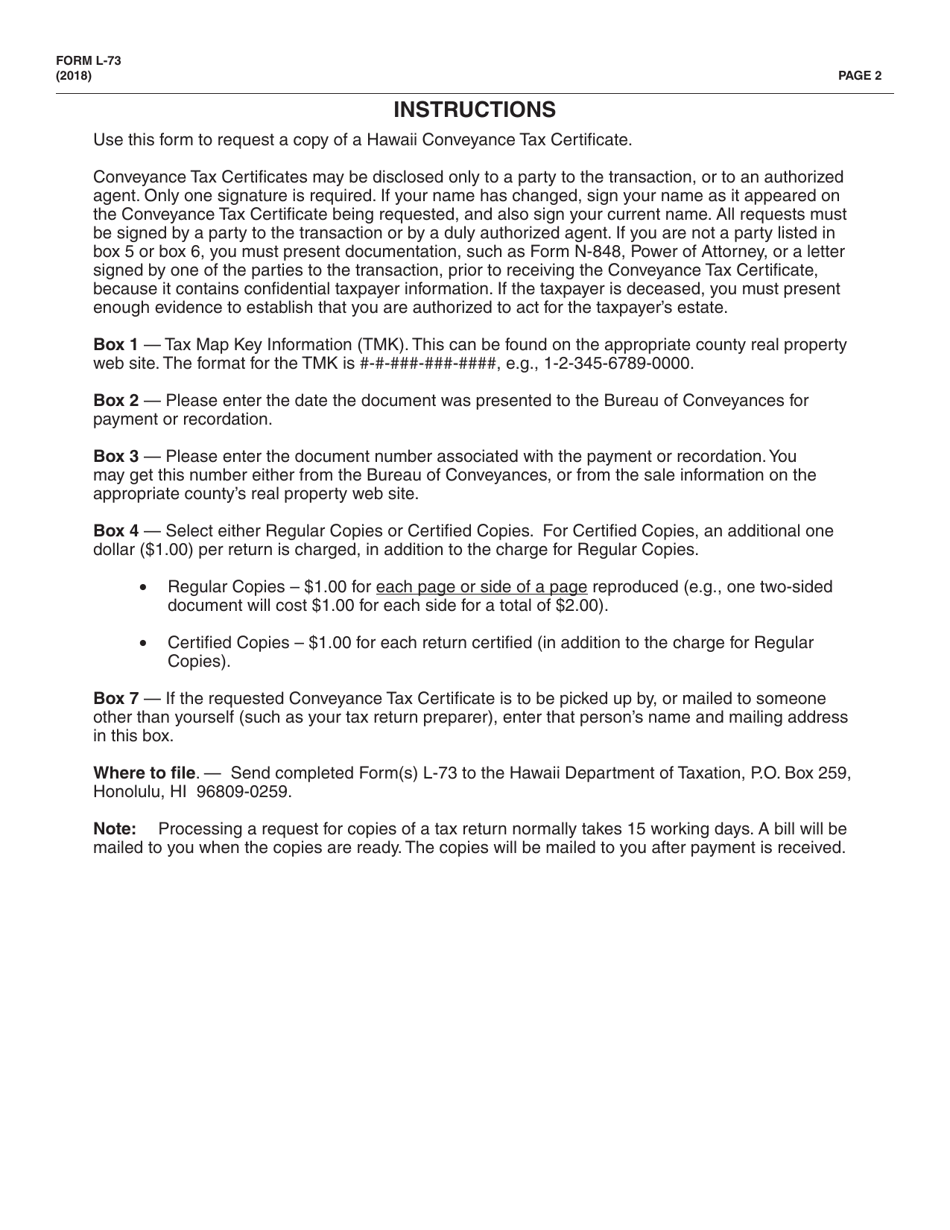

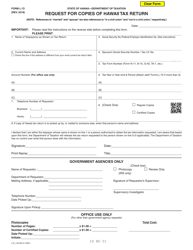

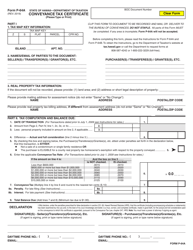

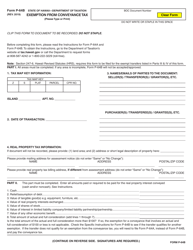

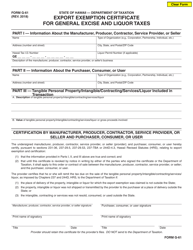

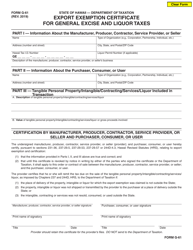

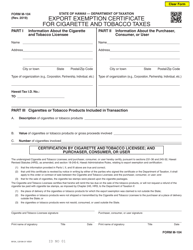

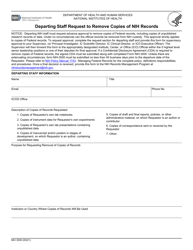

Form L-73 Request for Copies of Conveyance Tax Certificates - Hawaii

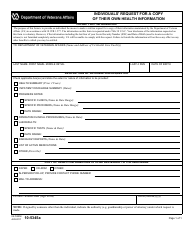

What Is Form L-73?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-73?

A: Form L-73 is a request form used in Hawaii to obtain copies of Conveyance Tax Certificates.

Q: What is a Conveyance Tax Certificate?

A: A Conveyance Tax Certificate is a document that provides proof of the amount of conveyance tax paid on a property transfer in Hawaii.

Q: Why would I need copies of Conveyance Tax Certificates?

A: You may need copies of Conveyance Tax Certificates for various purposes, such as property transactions, legal proceedings, or tax-related matters.

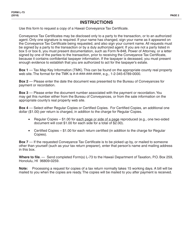

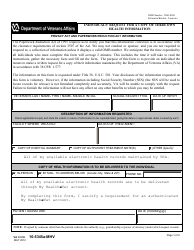

Q: How do I complete Form L-73?

A: To complete Form L-73, you will need to provide information about the property, the parties involved in the transaction, and the reason for requesting the copies of Conveyance Tax Certificates.

Q: How long does it take to process a request for copies of Conveyance Tax Certificates?

A: The processing time for requests may vary, but it typically takes a few weeks to receive the copies of Conveyance Tax Certificates.

Q: Can I request copies of Conveyance Tax Certificates for properties located outside of Hawaii?

A: No, Form L-73 is specifically for properties located in Hawaii. For properties in other states, you will need to contact the respective state's tax authorities.

Q: Who can submit Form L-73?

A: Form L-73 can be submitted by property owners or authorized individuals, such as attorneys or legal representatives.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-73 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.