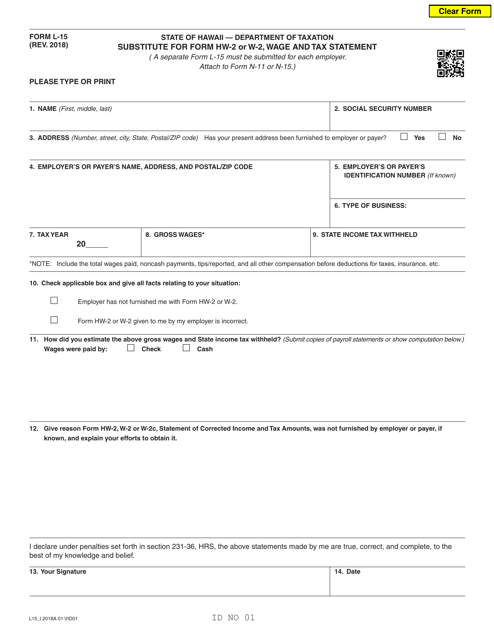

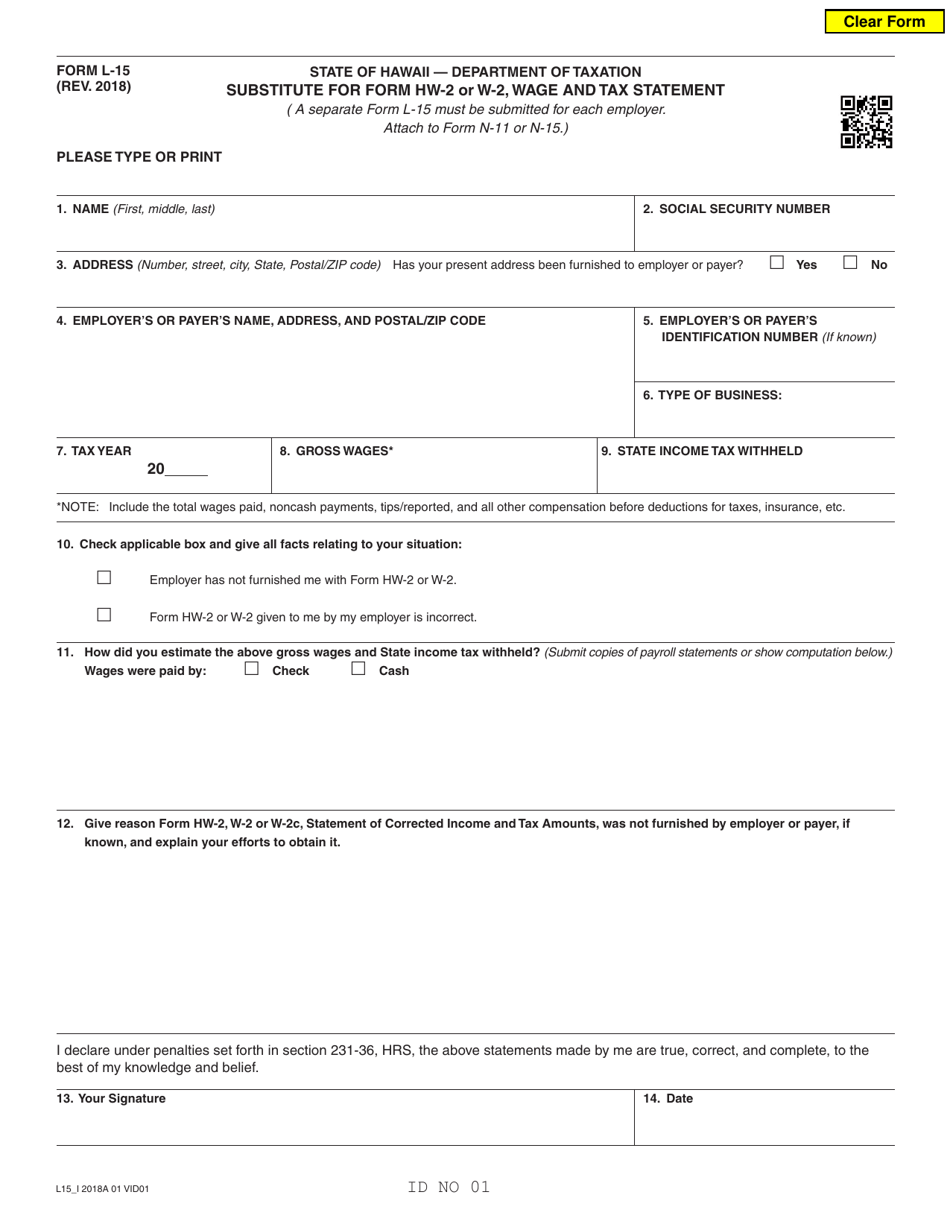

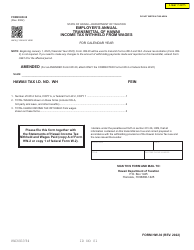

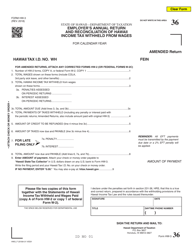

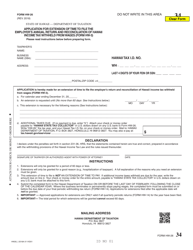

Form L-15 Substitute for Form Hw-2 or W-2, Wage and Tax Statement - Hawaii

What Is Form L-15?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-15?

A: Form L-15 is a substitute for Form HW-2 or W-2, used for reporting wages and taxes in Hawaii.

Q: When is Form L-15 used?

A: Form L-15 is used as a substitute for Form HW-2 or W-2 when reporting wages and taxes in Hawaii.

Q: Why would someone need to use Form L-15?

A: Someone may need to use Form L-15 if they are unable to obtain or lost their original Form HW-2 or W-2.

Q: Who is required to file Form L-15?

A: Anyone who is required to file Form HW-2 or W-2 in Hawaii but is unable to obtain or lost their original forms.

Q: How should Form L-15 be filled out?

A: Form L-15 should be filled out with accurate information regarding wages and taxes, including any necessary attachments or explanations.

Q: When is the deadline for filing Form L-15?

A: The deadline for filing Form L-15 is generally the same as the deadline for filing Form HW-2 or W-2, which is January 31st.

Q: Are there any penalties for not filing Form L-15?

A: Yes, there may be penalties for not filing Form L-15 or for filing it late, including potential fines or interest charges.

Q: Are there any fees associated with filing Form L-15?

A: No, there are no fees for filing Form L-15, but penalties may apply if the form is not filed or filed late.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-15 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.