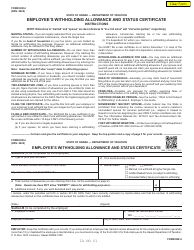

This version of the form is not currently in use and is provided for reference only. Download this version of

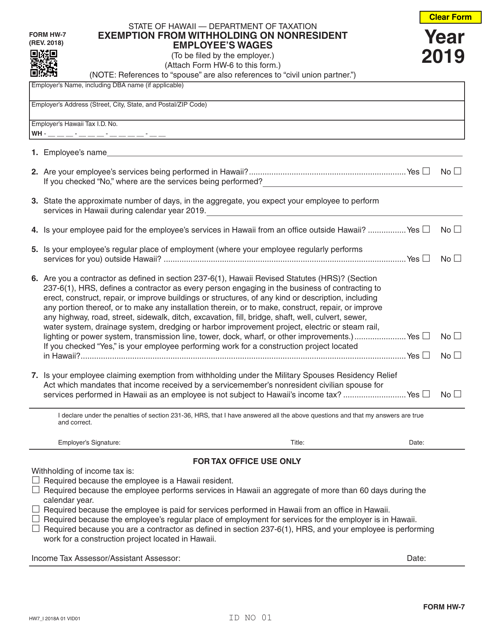

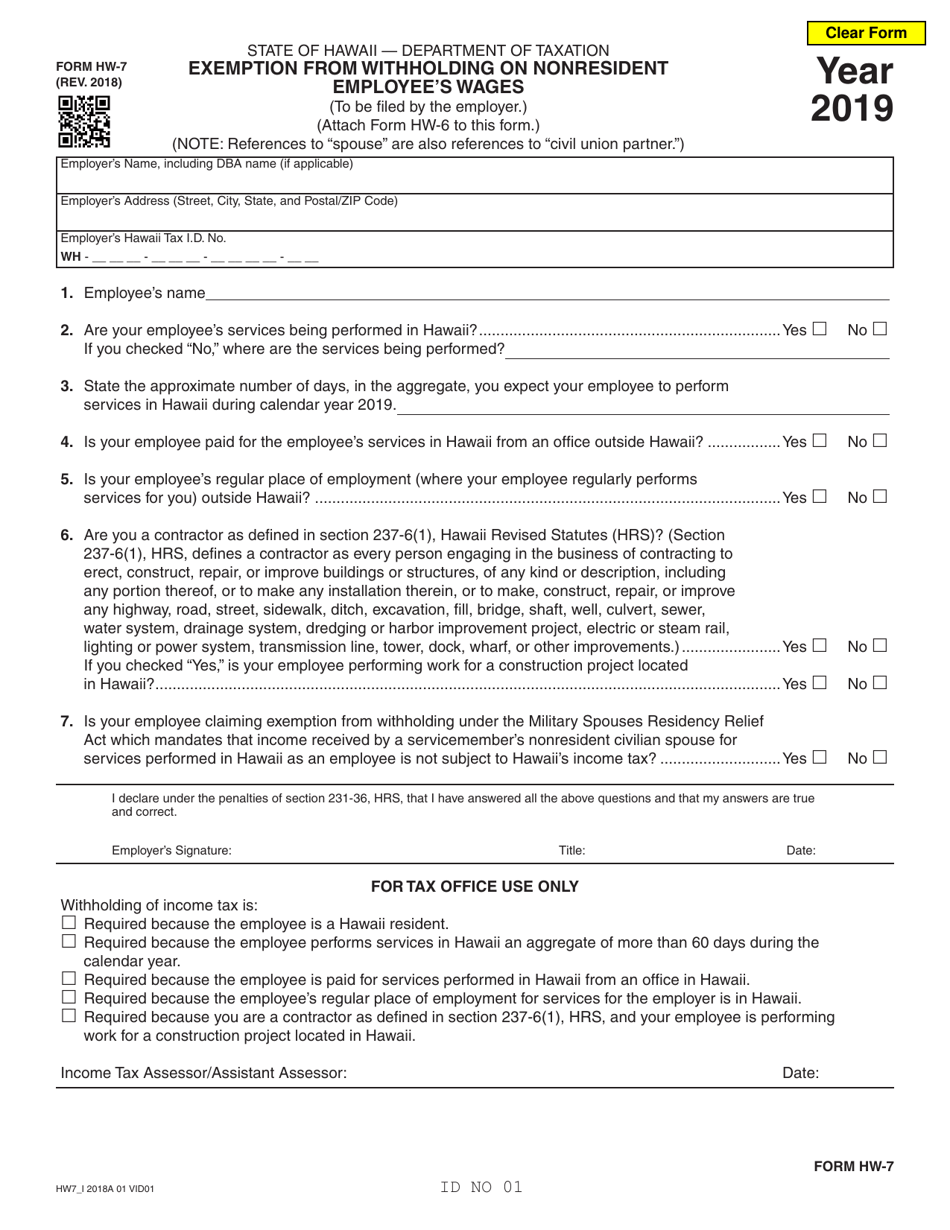

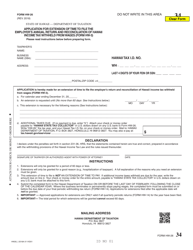

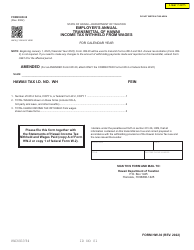

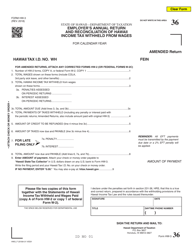

Form HW-7

for the current year.

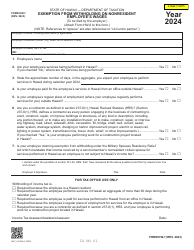

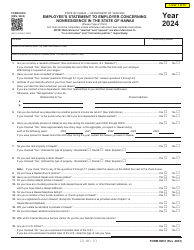

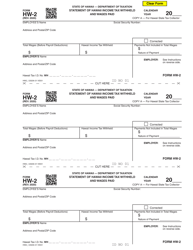

Form HW-7 Exemption From Withholding on Nonresident Employee's Wages - Hawaii

What Is Form HW-7?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is HW-7?

A: HW-7 is a form used to claim exemption from withholding on a nonresident employee's wages in Hawaii.

Q: Who can use HW-7?

A: Nonresident employees who meet certain conditions can use HW-7 to claim exemption from withholding in Hawaii.

Q: What does it mean to claim exemption from withholding?

A: Claiming exemption from withholding means that no income tax will be deducted from your wages.

Q: What are the eligibility criteria for claiming exemption on HW-7?

A: To be eligible, you must have had no income tax liability in Hawaii for the previous tax year and expect to have no liability for the current year.

Q: When should I submit HW-7?

A: You should submit the HW-7 form to your employer before the first payment of wages subject to withholding.

Q: Do I need to submit HW-7 every year?

A: Yes, you need to submit the HW-7 form every year if you want to continue claiming exemption from withholding in Hawaii.

Q: Is HW-7 applicable only to nonresident employees?

A: Yes, HW-7 is specifically for nonresident employees who meet the eligibility criteria.

Q: What happens if I do not submit HW-7?

A: If you do not submit the HW-7 form, your employer will withhold income tax from your wages as required by law.

Q: Can I claim exemption from withholding in other states using HW-7?

A: No, HW-7 is specific to claiming exemption from withholding in Hawaii only.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW-7 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.