This version of the form is not currently in use and is provided for reference only. Download this version of

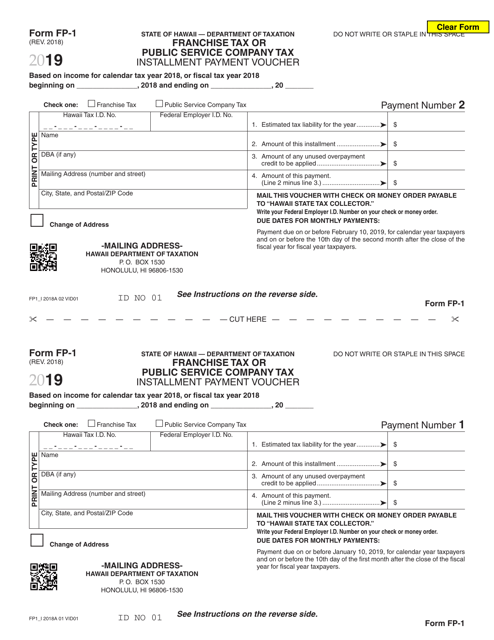

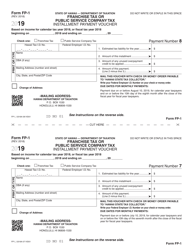

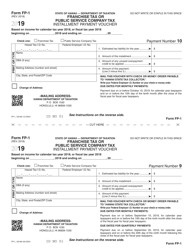

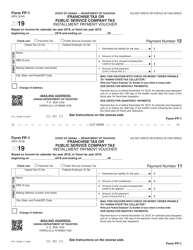

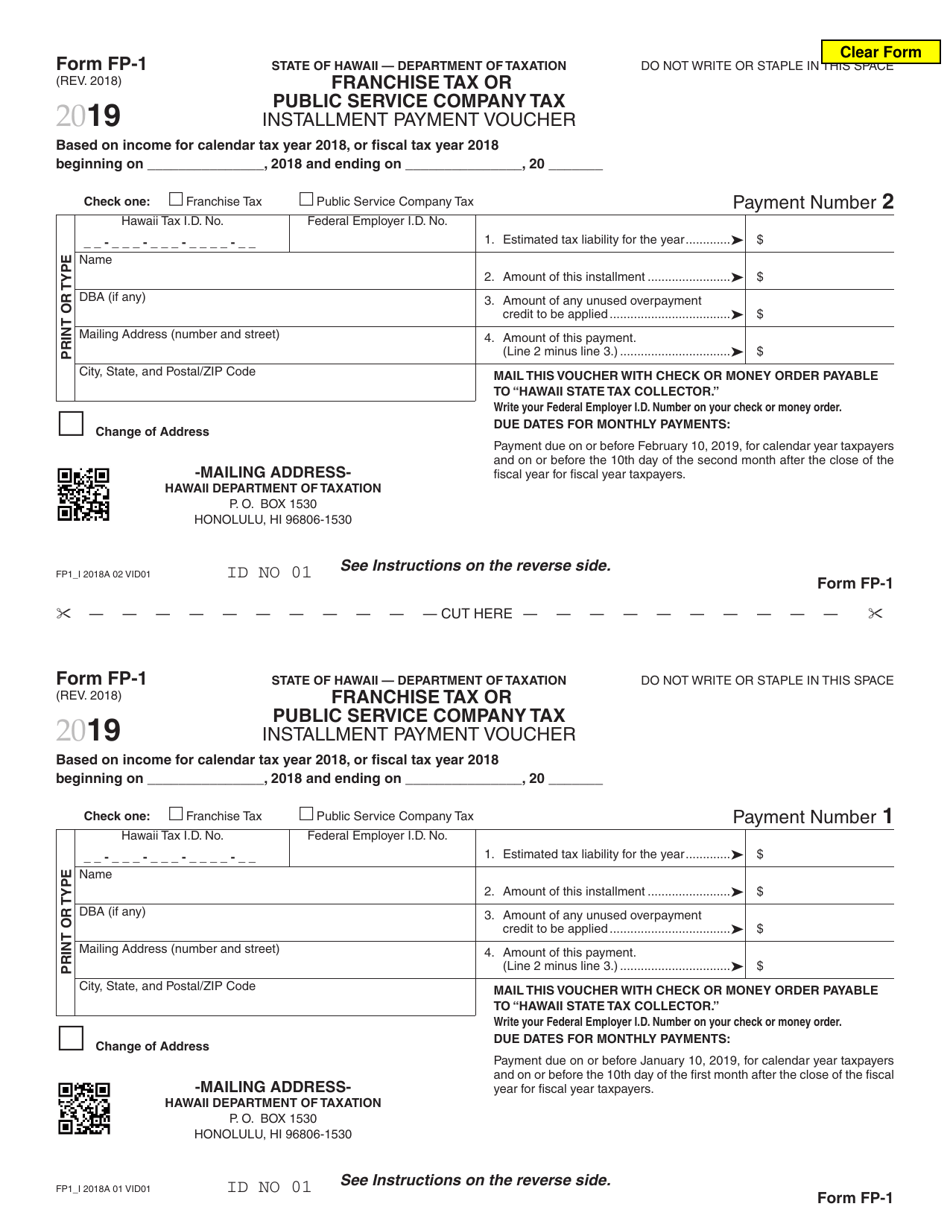

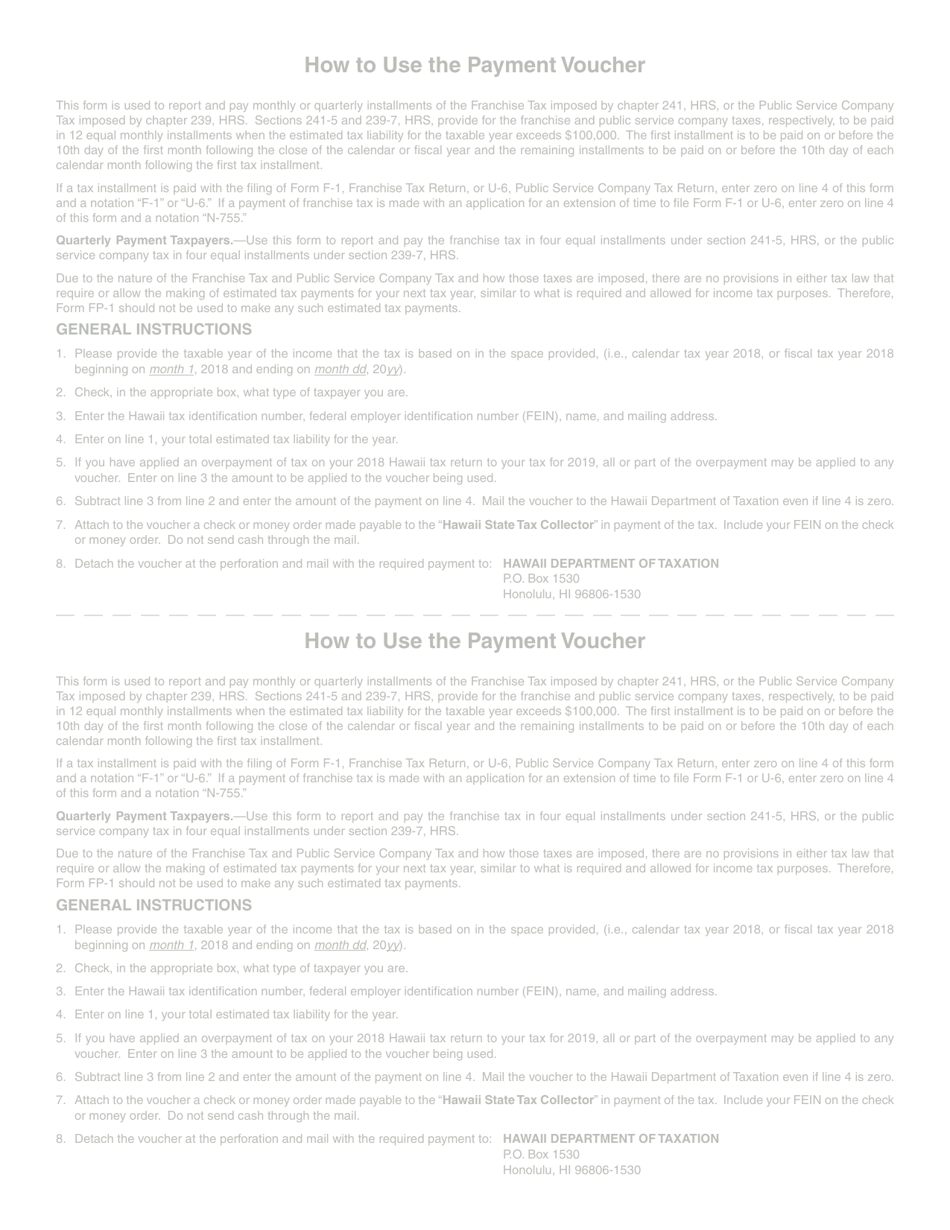

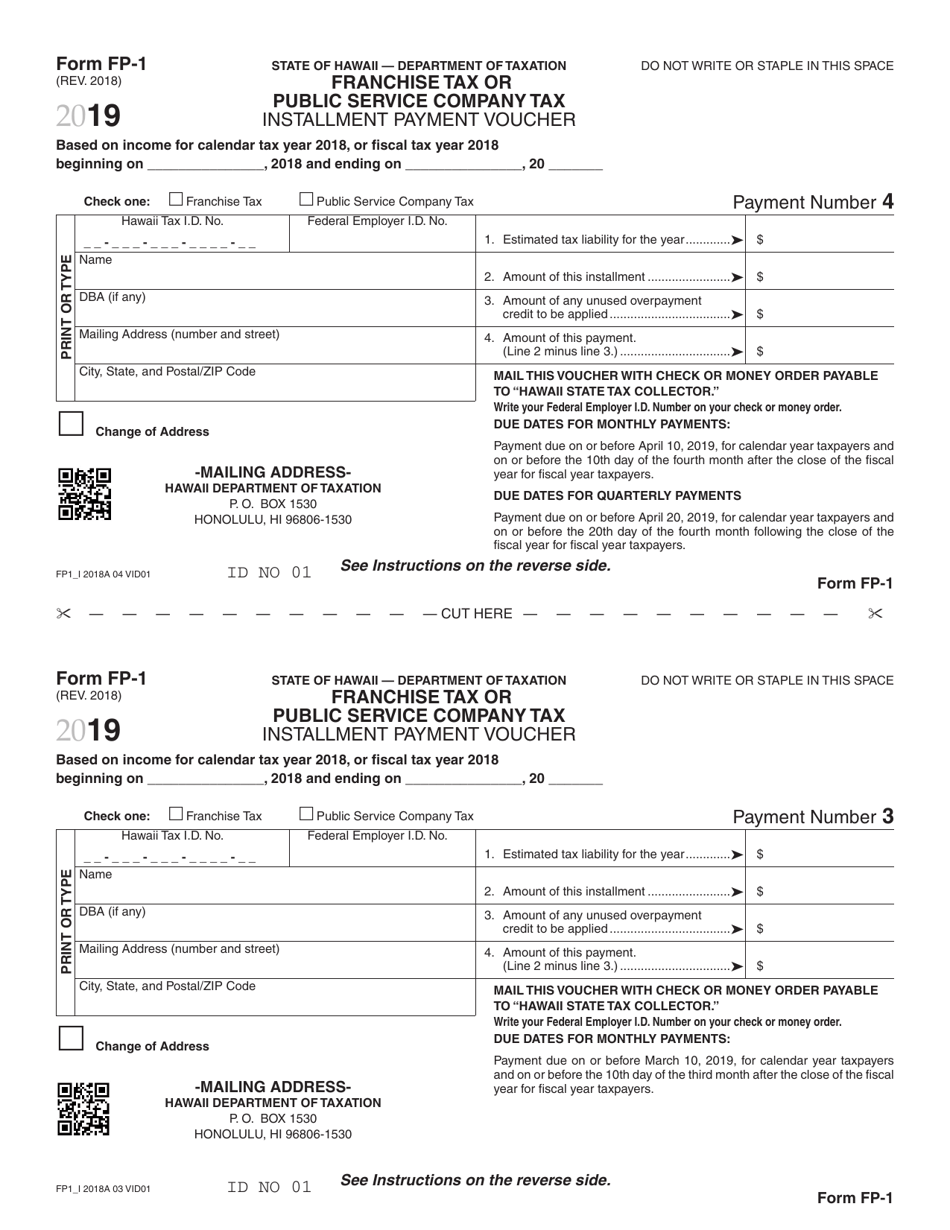

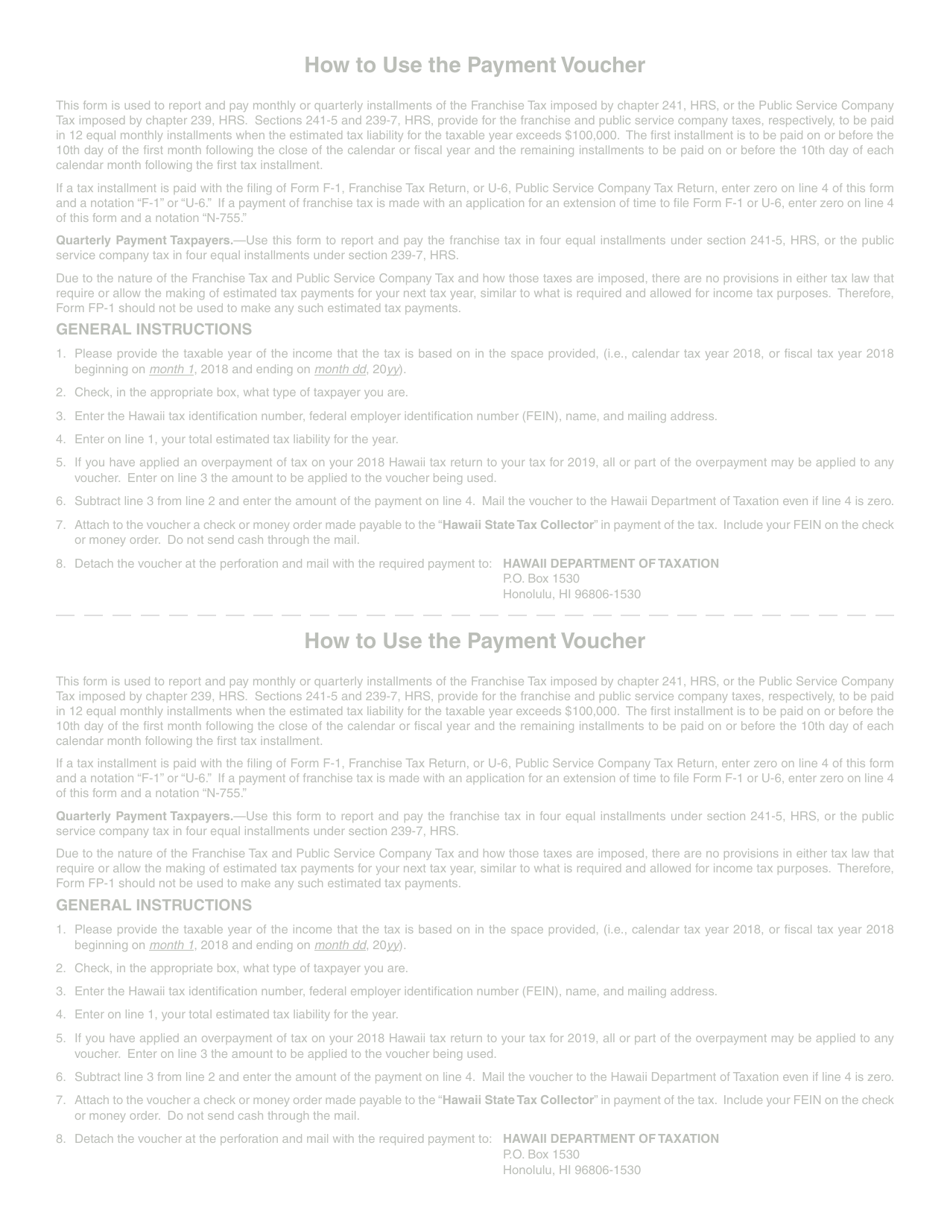

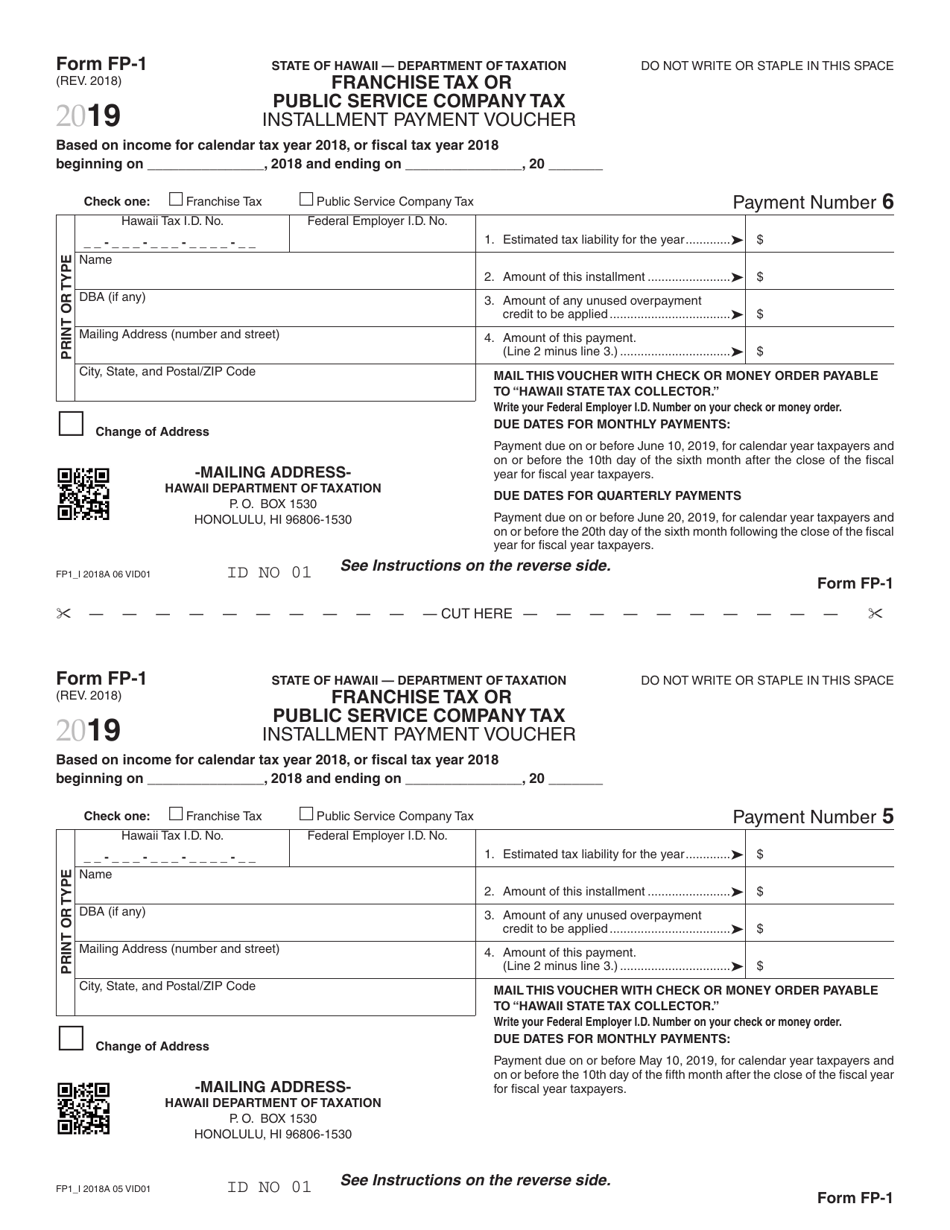

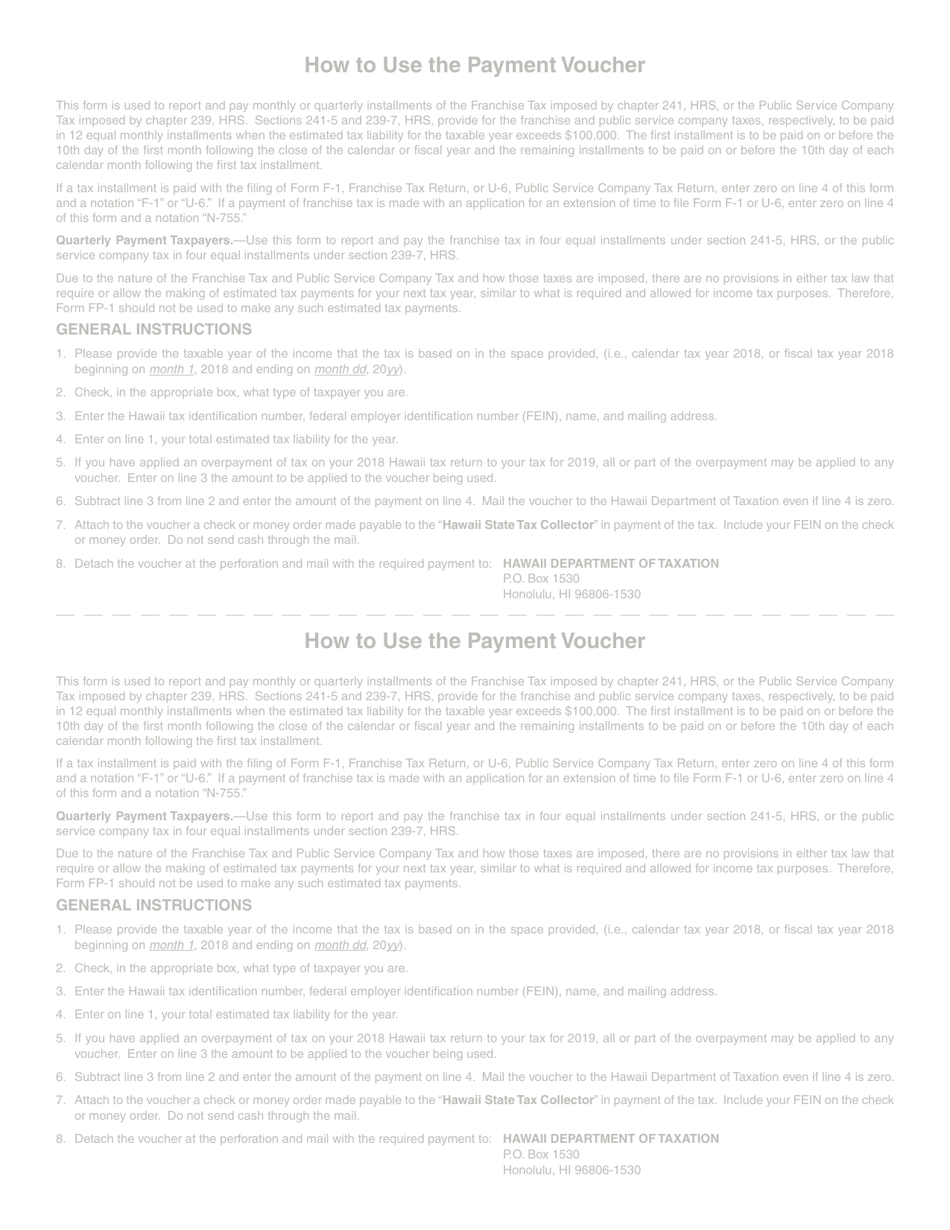

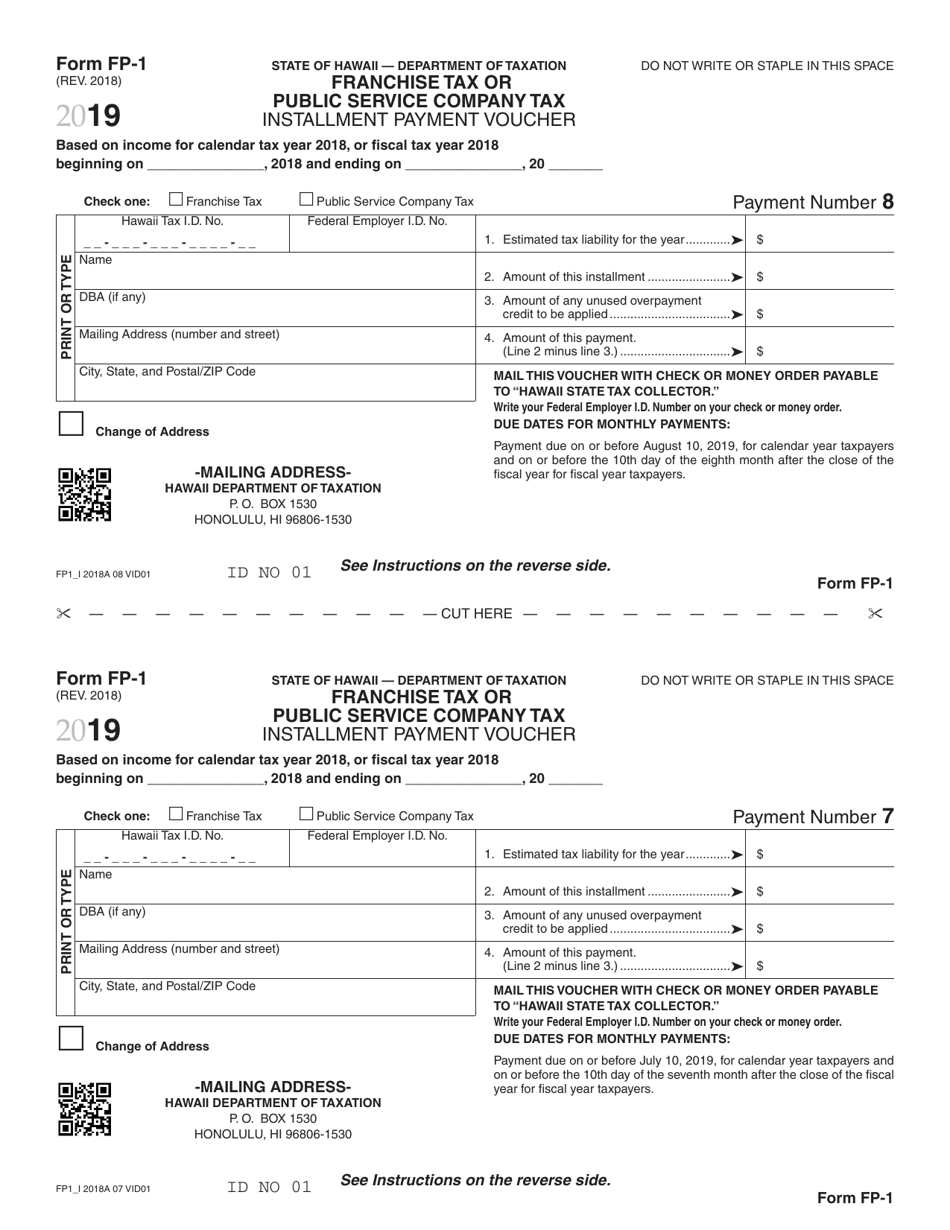

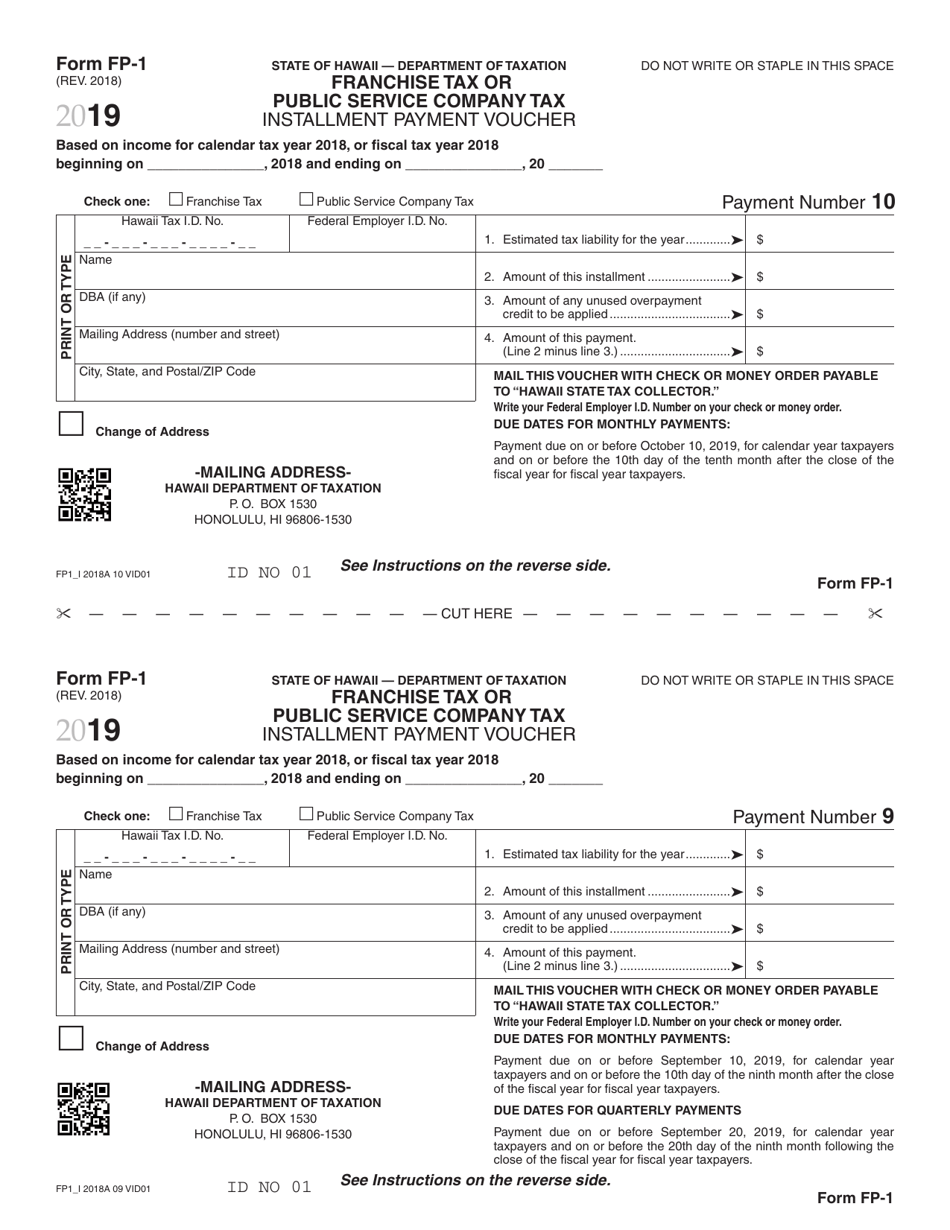

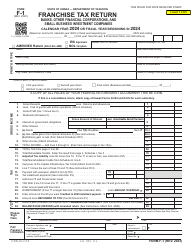

Form FP-1

for the current year.

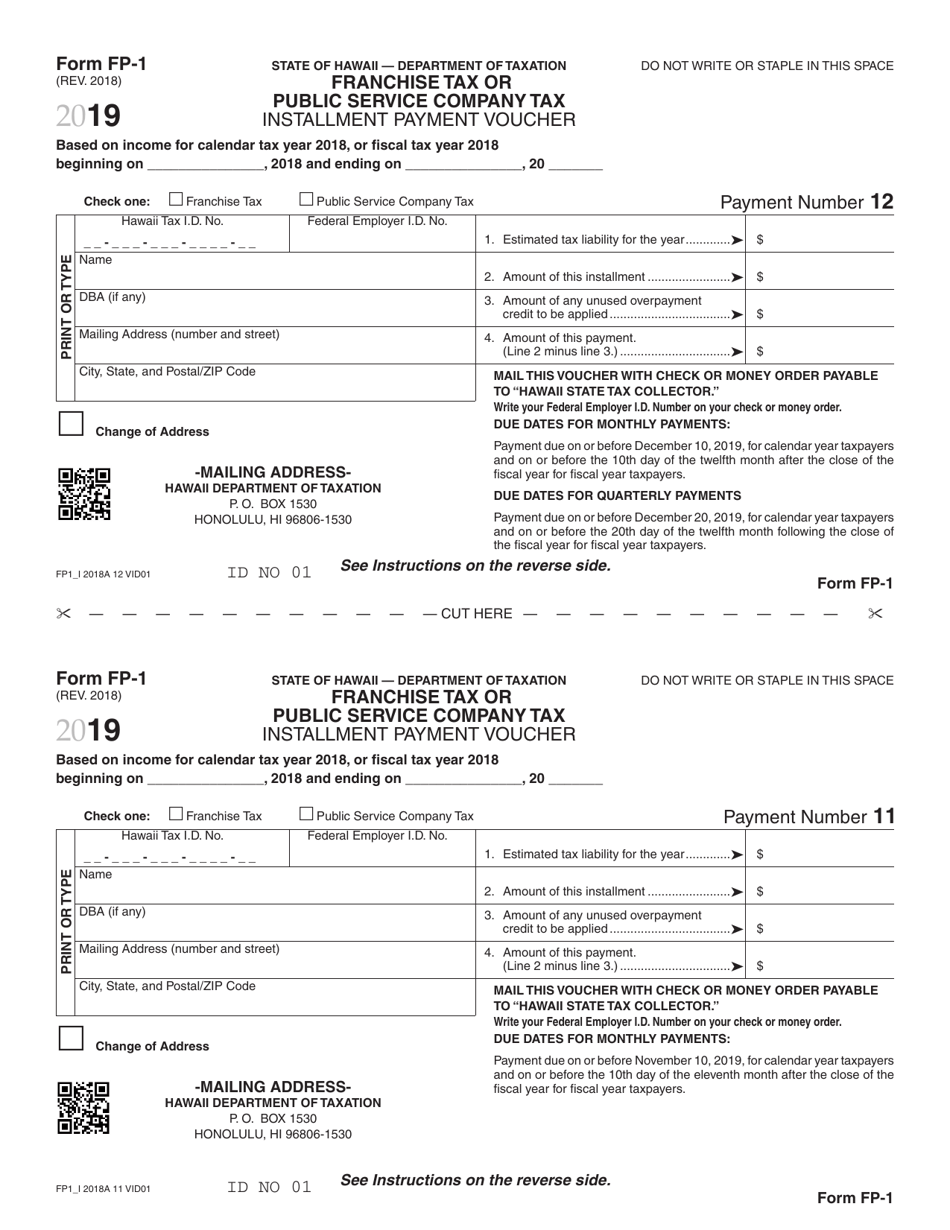

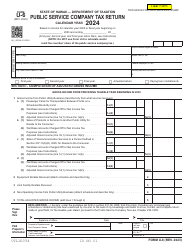

Form FP-1 Franchise Tax or Public Service Company Tax Installment Payment Voucher - Hawaii

What Is Form FP-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FP-1?

A: Form FP-1 is the Franchise Tax or Public Service CompanyTax Installment Payment Voucher in Hawaii.

Q: What is the purpose of Form FP-1?

A: The purpose of Form FP-1 is to make installment payments for franchise tax or public service company tax in Hawaii.

Q: Who needs to file Form FP-1?

A: Individuals or entities required to pay franchise tax or public service company tax in Hawaii need to file Form FP-1.

Q: How often do I need to file Form FP-1?

A: Form FP-1 needs to be filed quarterly.

Q: What information do I need to provide on Form FP-1?

A: You need to provide your name or business name, tax year, tax type, and payment information on Form FP-1.

Q: Are there any penalties for not filing Form FP-1?

A: Yes, there are penalties for not filing Form FP-1 or not making the required installment payments.

Q: Can I make partial payments using Form FP-1?

A: Yes, Form FP-1 allows for partial payments of the franchise tax or public service company tax.

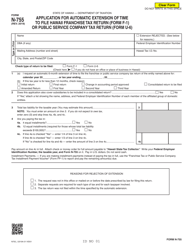

Q: Can I request an extension to file Form FP-1?

A: No, there are no extensions allowed for filing Form FP-1.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FP-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.