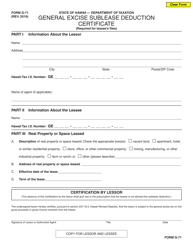

This version of the form is not currently in use and is provided for reference only. Download this version of

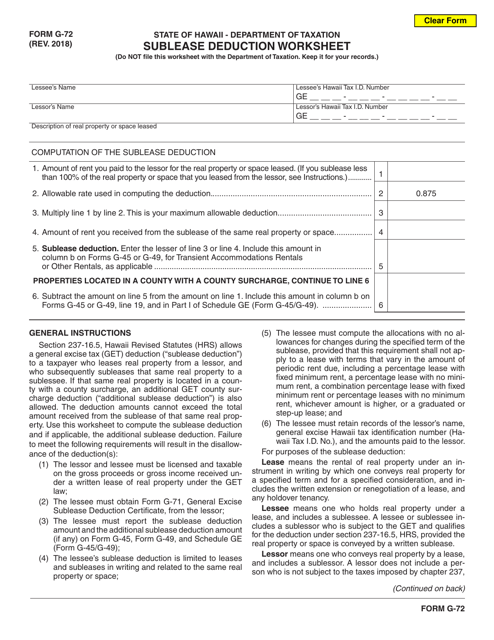

Form G-72

for the current year.

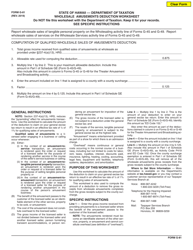

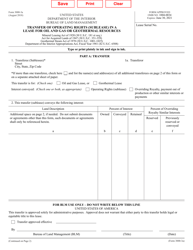

Form G-72 Sublease Deduction Worksheet - Hawaii

What Is Form G-72?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-72?

A: Form G-72 is a Sublease Deduction Worksheet specific to Hawaii.

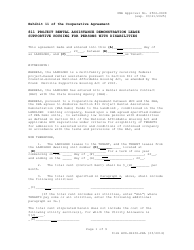

Q: What is a sublease deduction?

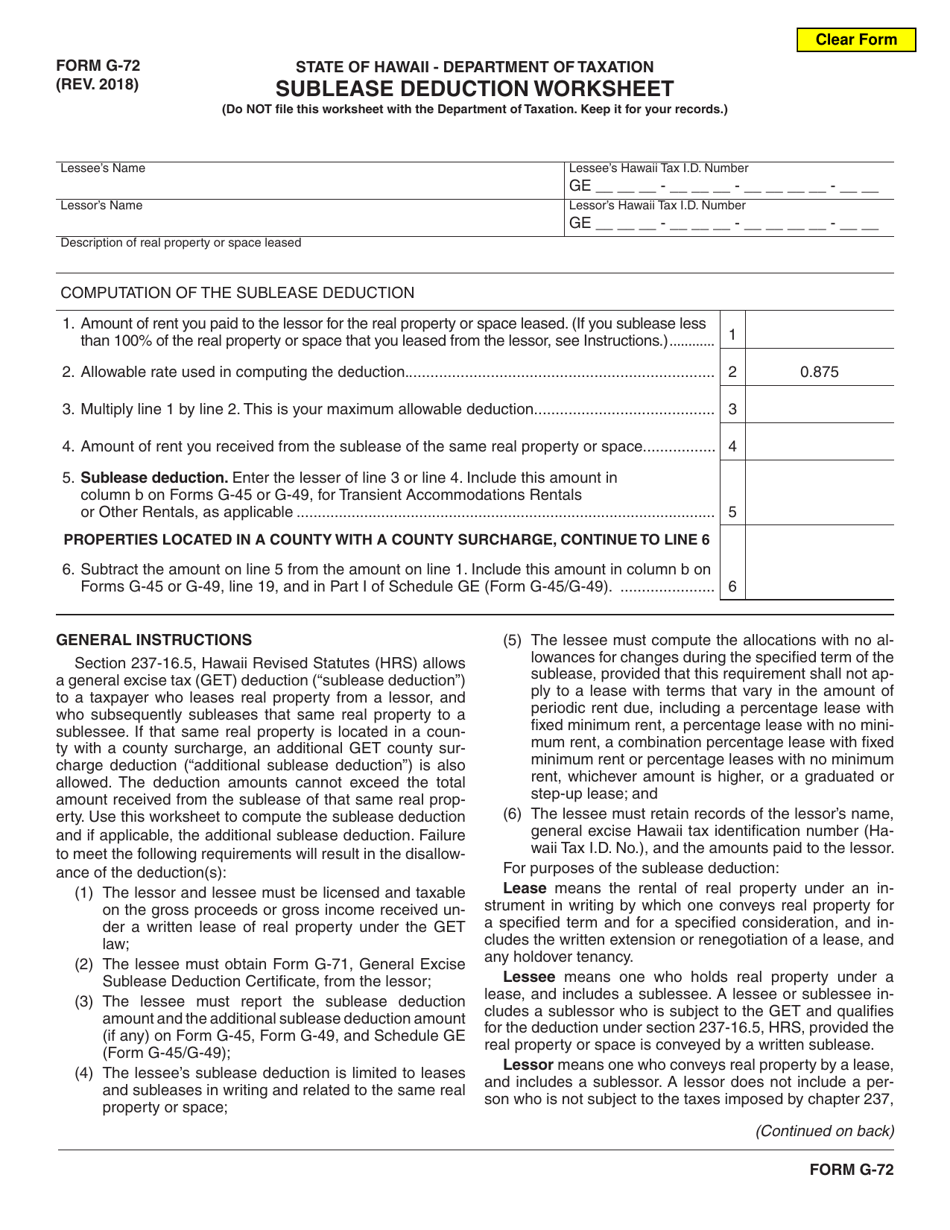

A: A sublease deduction is a deduction claimed by tenants who sublease a portion of their rented property.

Q: Who can use Form G-72?

A: Form G-72 is used by Hawaii residents who sublease a portion of their rented property.

Q: What information is required in Form G-72?

A: Form G-72 requires the tenant's contact information, details of the sublease agreement, and calculation of the sublease deduction.

Q: Is Form G-72 specific to Hawaii?

A: Yes, Form G-72 is specific to Hawaii and is used for state tax purposes in Hawaii.

Q: Can I claim a sublease deduction on my federal taxes?

A: No, the sublease deduction is specific to state taxes and cannot be claimed on federal taxes.

Q: Do I need to include Form G-72 with my tax return?

A: Yes, if you are claiming a sublease deduction in Hawaii, you need to include Form G-72 along with your tax return.

Q: What is the deadline for submitting Form G-72?

A: The deadline for submitting Form G-72 is the same as the deadline for filing your state tax return in Hawaii.

Q: Can I amend Form G-72 if I made an error?

A: Yes, you can amend Form G-72 if you made an error by filing an amended tax return with the corrected information.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-72 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.