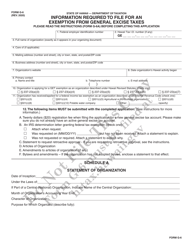

This version of the form is not currently in use and is provided for reference only. Download this version of

Form G-75

for the current year.

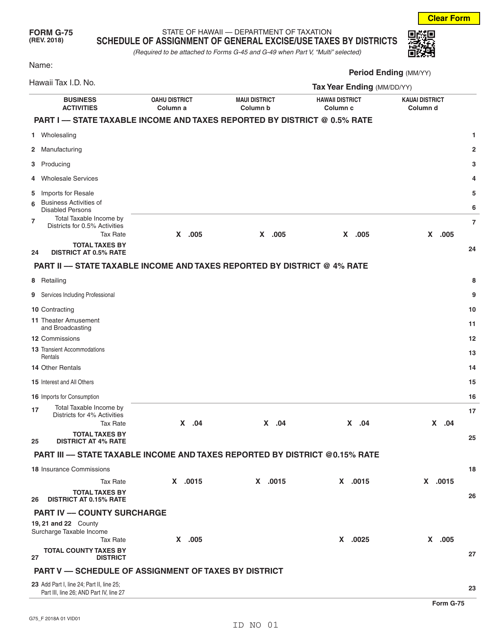

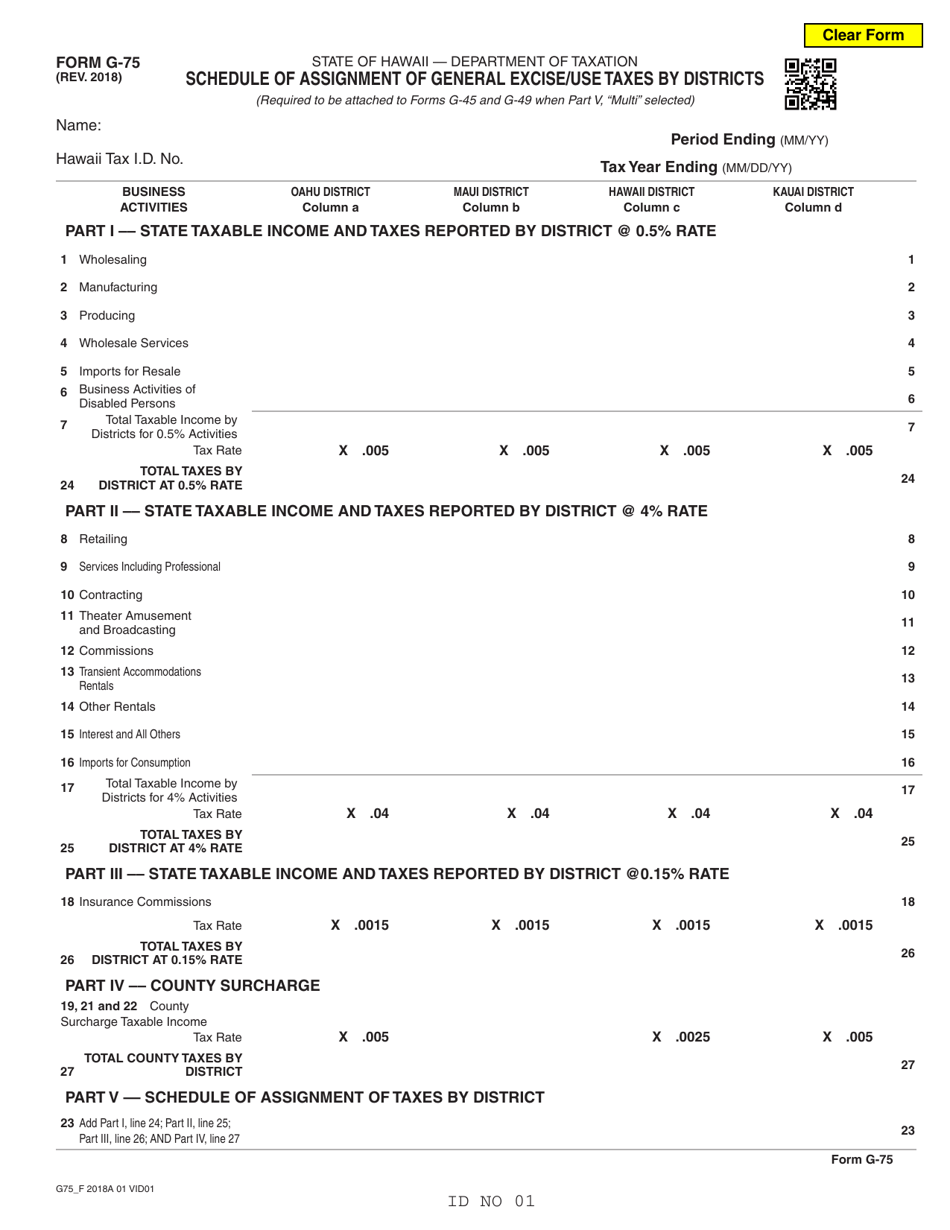

Form G-75 Schedule of Assignment of General Excise / Use Taxes by Districts - Hawaii

What Is Form G-75?

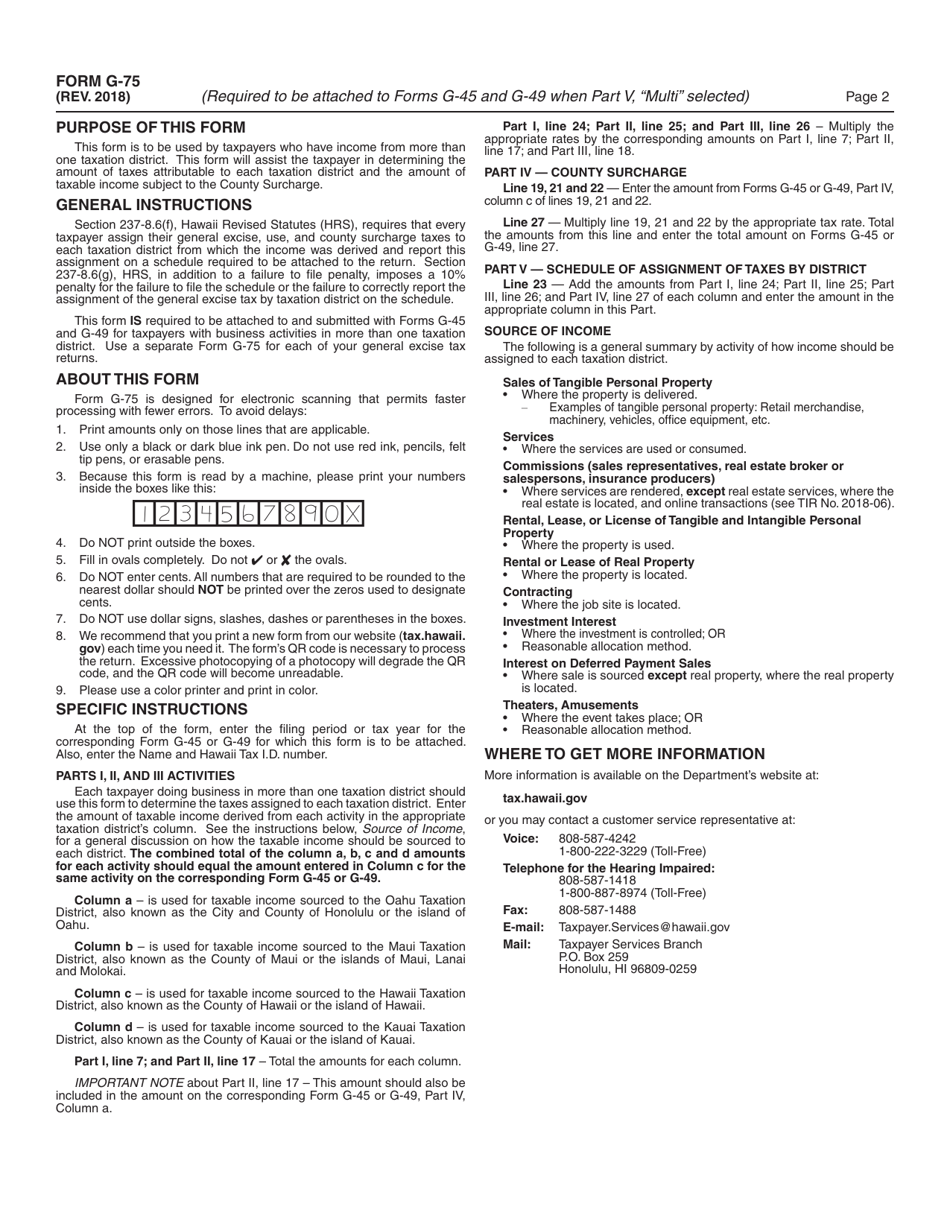

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

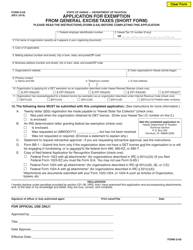

Q: What is Form G-75?

A: Form G-75 is the Schedule of Assignment of General Excise/Use Taxes by Districts in Hawaii.

Q: What is the purpose of Form G-75?

A: Form G-75 is used to determine how much general excise/use tax revenue is allocated to each district in Hawaii.

Q: Who is required to file Form G-75?

A: Anyone who is engaged in business activities subject to general excise/use tax in Hawaii must file Form G-75.

Q: When is Form G-75 due?

A: Form G-75 is due on or before the 20th day of the month following the close of the reporting period.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-75 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.