This version of the form is not currently in use and is provided for reference only. Download this version of

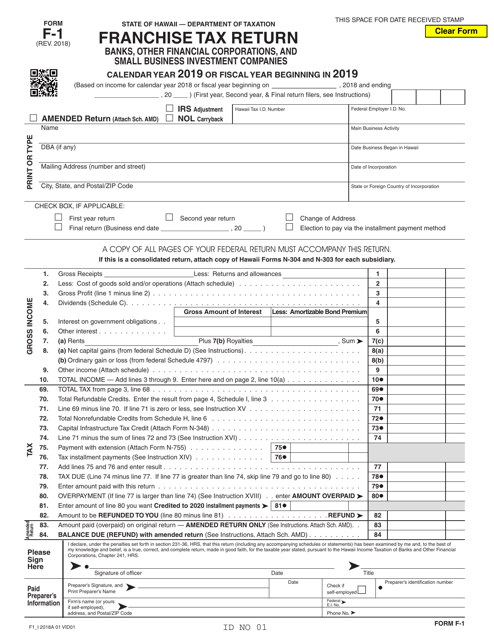

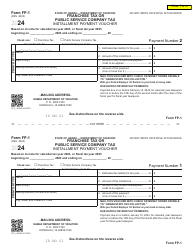

Form F-1

for the current year.

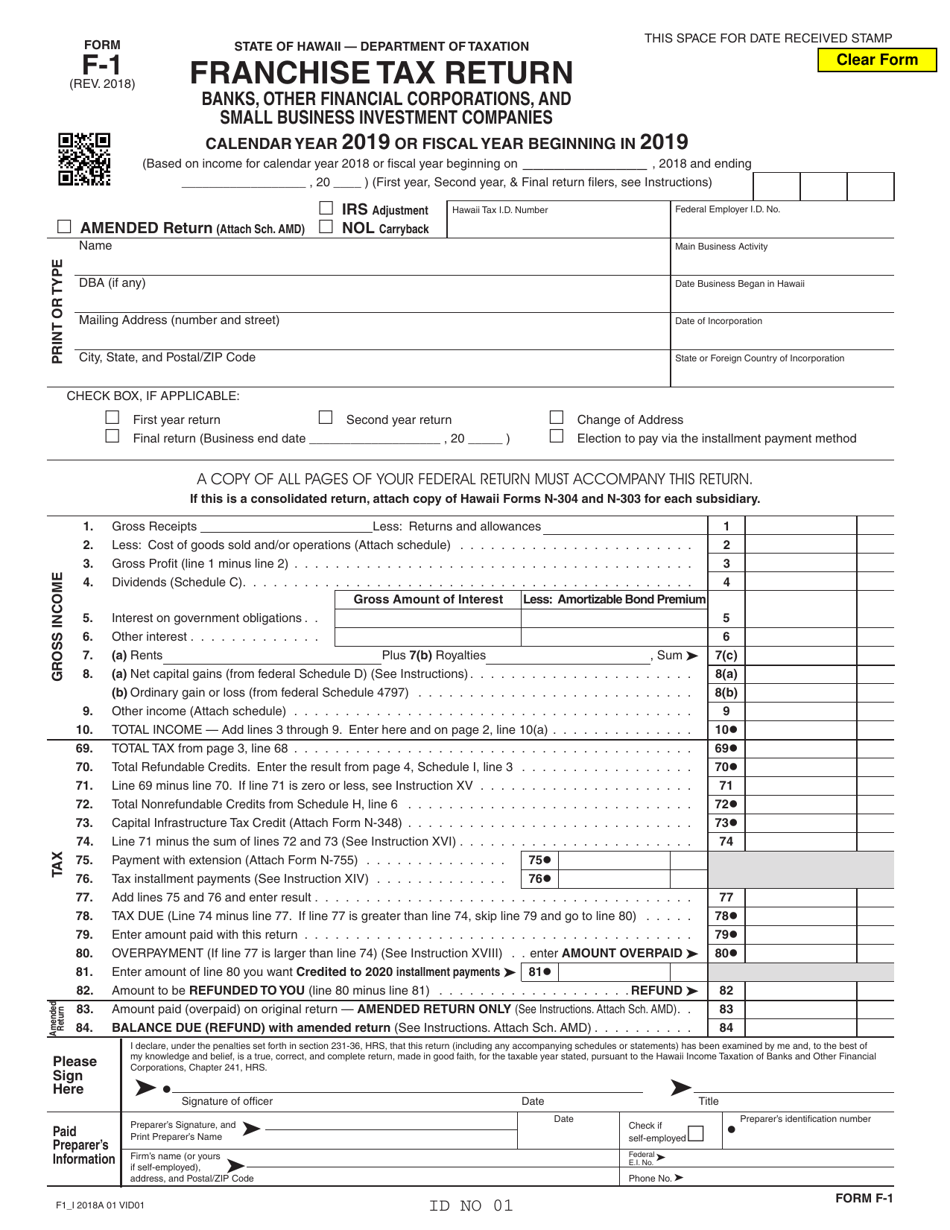

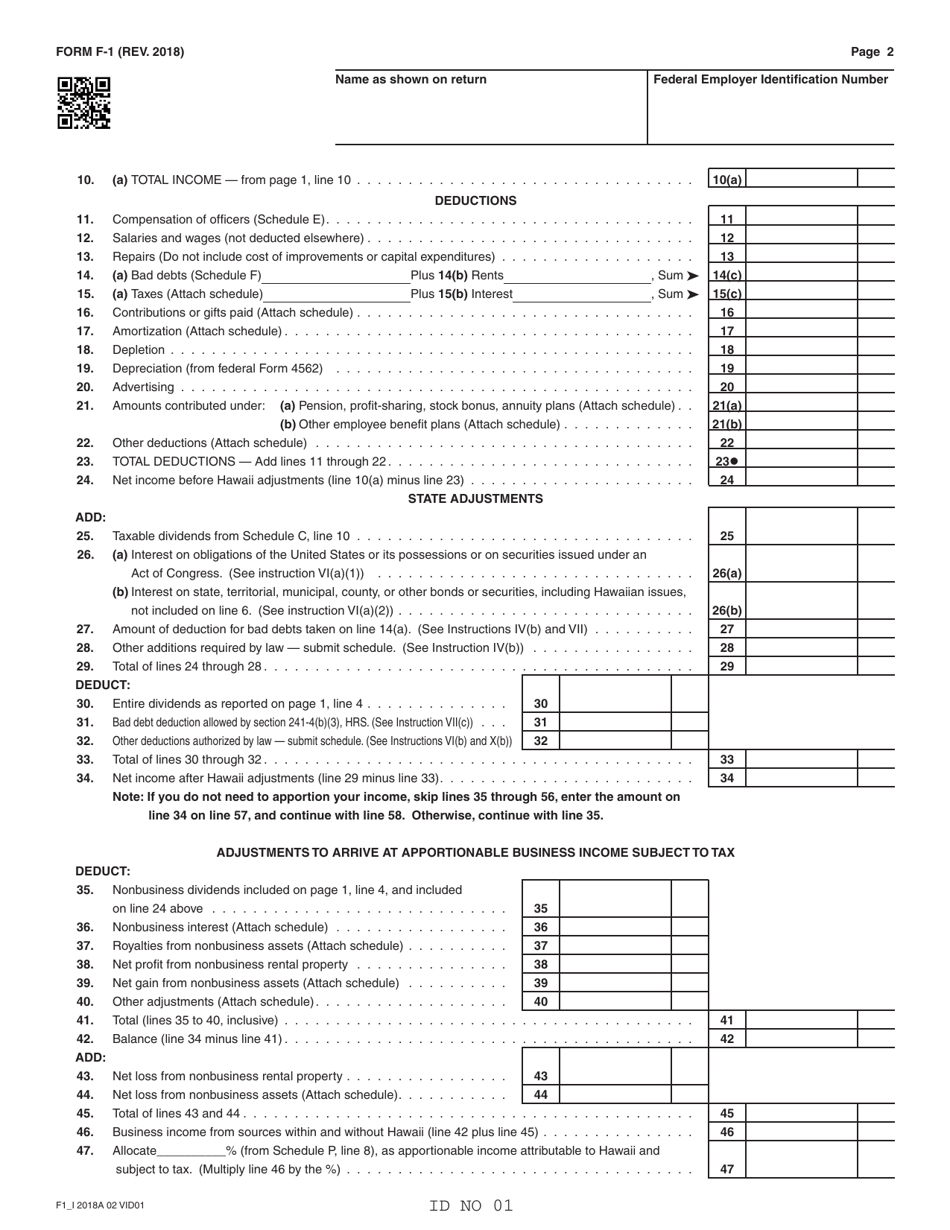

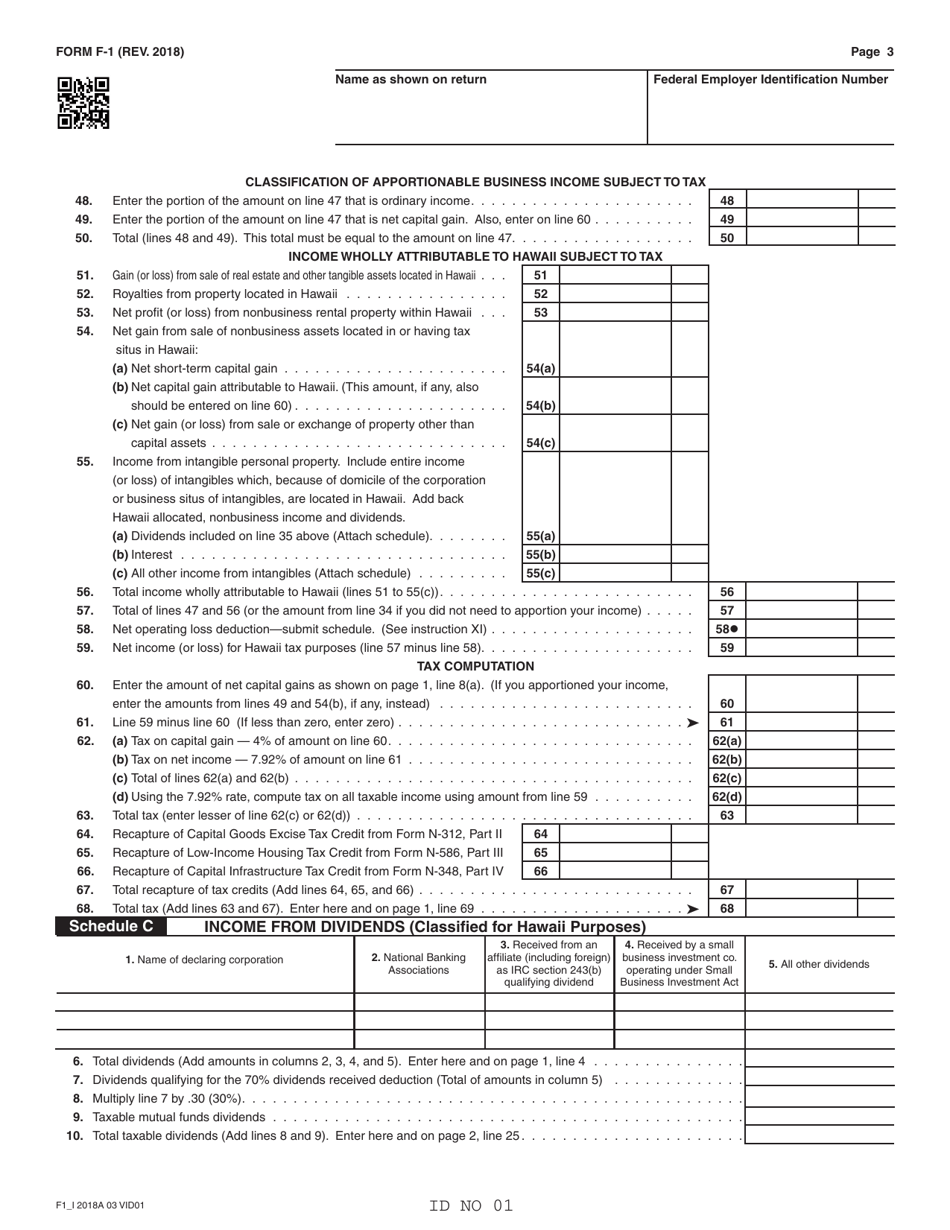

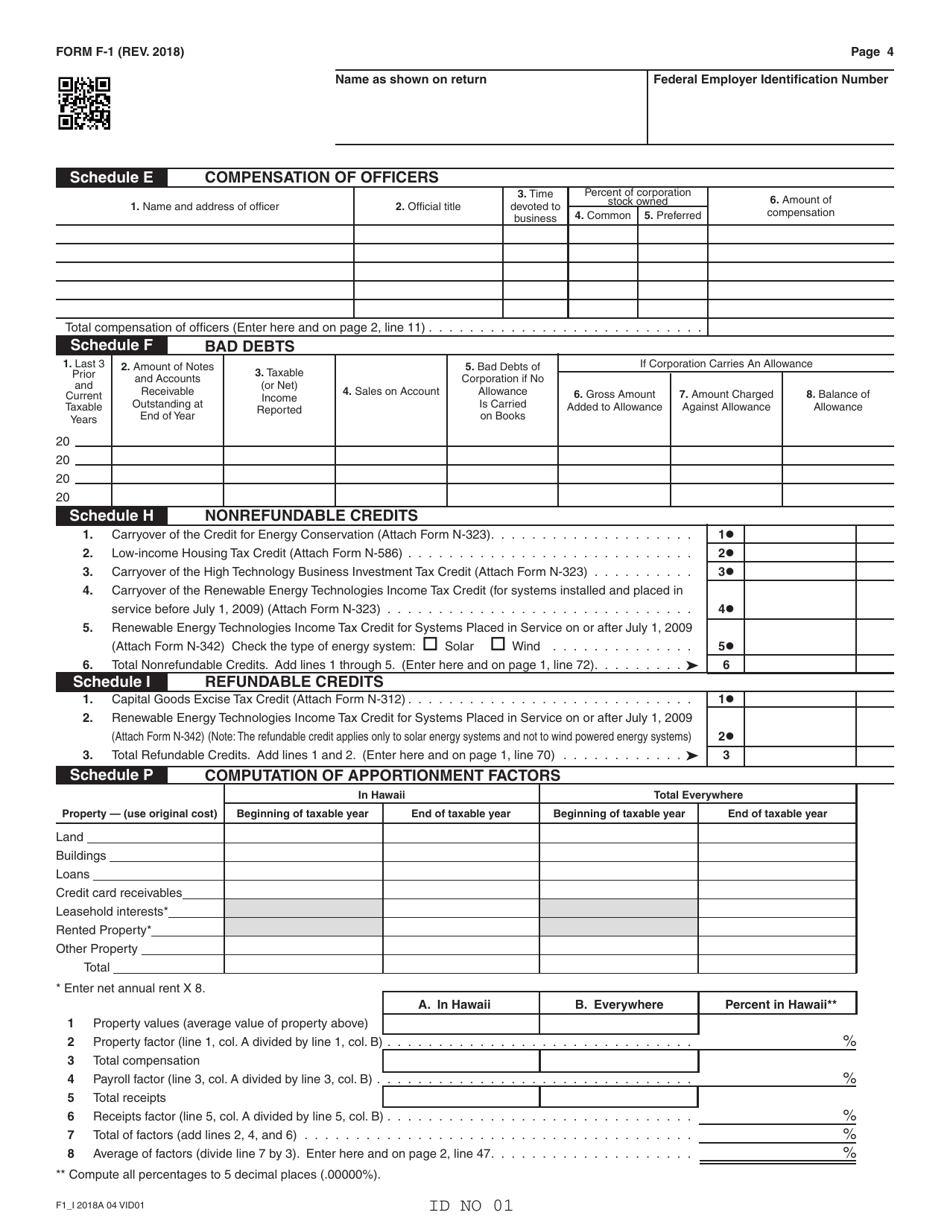

Form F-1 Franchise Tax Return - Banks, Other Financial Corporations, Andsmall Business Investment Companies - Hawaii

What Is Form F-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-1 Franchise Tax Return?

A: Form F-1 Franchise Tax Return is a tax form specific to banks, other financial corporations, and small business investment companies in Hawaii.

Q: Who is required to file Form F-1 Franchise Tax Return?

A: Banks, other financial corporations, and small business investment companies in Hawaii are required to file Form F-1 Franchise Tax Return.

Q: What is the purpose of Form F-1 Franchise Tax Return?

A: The purpose of Form F-1 Franchise Tax Return is to report and pay franchise taxes owed by banks, other financial corporations, and small business investment companies in Hawaii.

Q: How often is Form F-1 Franchise Tax Return filed?

A: Form F-1 Franchise Tax Return is filed annually by banks, other financial corporations, and small business investment companies in Hawaii.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.