This version of the form is not currently in use and is provided for reference only. Download this version of

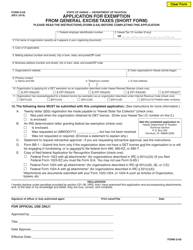

Form G-37

for the current year.

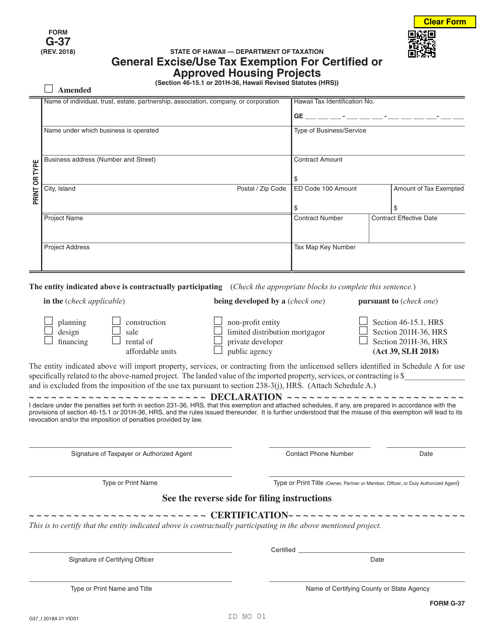

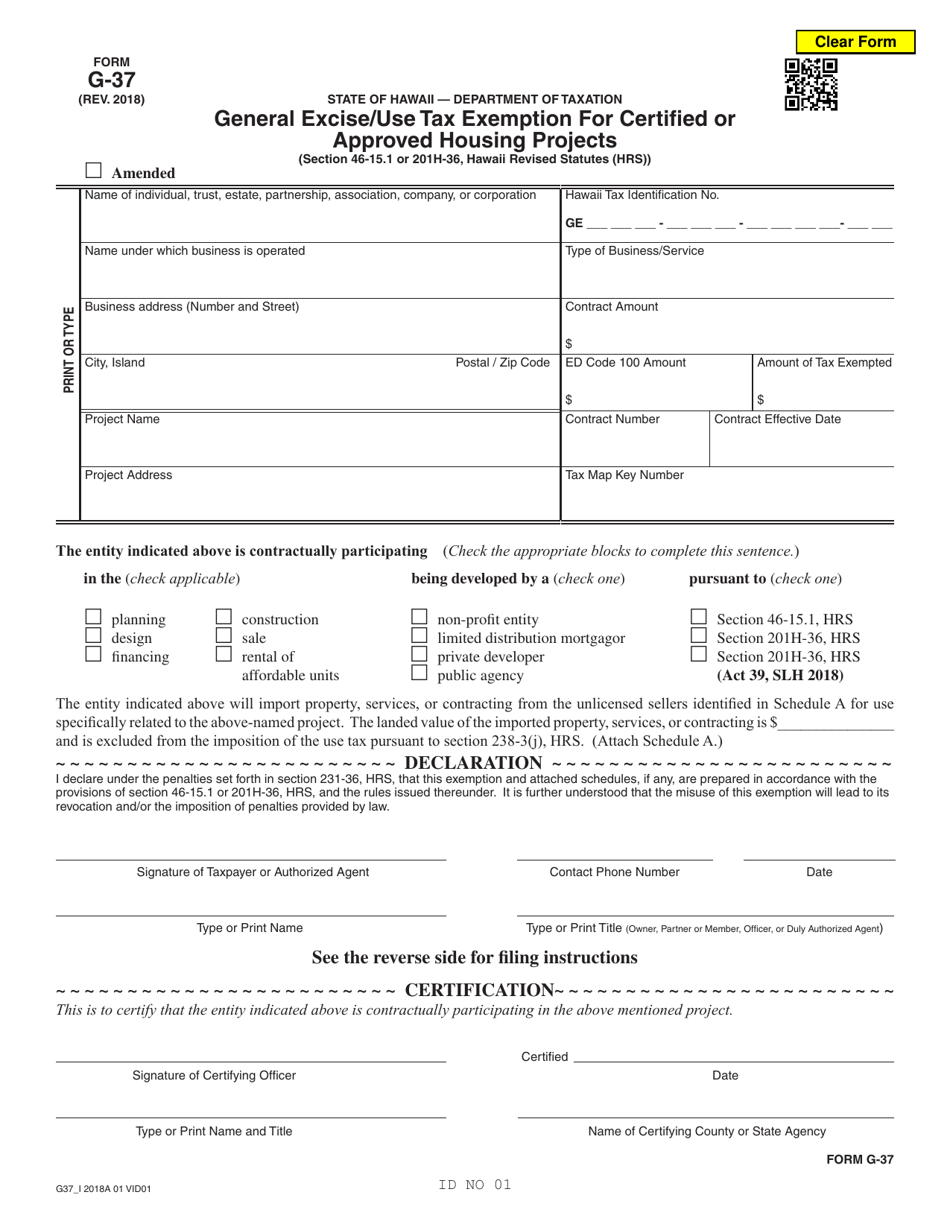

Form G-37 General Excise / Use Tax Exemption for Certified or Approved Housing Projects - Hawaii

What Is Form G-37?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-37?

A: Form G-37 is a form used in Hawaii for claiming general excise/use tax exemption for certified or approved housing projects.

Q: What is the purpose of Form G-37?

A: The purpose of Form G-37 is to claim general excise/use tax exemption for certified or approved housing projects in Hawaii.

Q: What types of housing projects can claim exemption using Form G-37?

A: Certified or approved housing projects in Hawaii can claim general excise/use tax exemption using Form G-37.

Q: What taxes does Form G-37 provide exemption for?

A: Form G-37 provides exemption for general excise/use tax in Hawaii for certified or approved housing projects.

Q: What information is required to complete Form G-37?

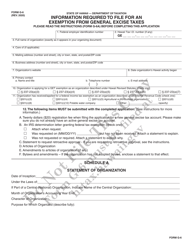

A: To complete Form G-37, you will need to provide information about the housing project, such as project name, location, and certification details.

Q: Are there any fees or costs associated with filing Form G-37?

A: There are no fees or costs associated with filing Form G-37 in Hawaii.

Q: Is there a deadline for filing Form G-37?

A: There is no specific deadline mentioned for filing Form G-37. It should be filed at the time of claiming the tax exemption.

Q: Can Form G-37 be filed electronically?

A: No, Form G-37 cannot be filed electronically. It must be printed, filled out, and submitted by mail or in person.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-37 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.