This version of the form is not currently in use and is provided for reference only. Download this version of

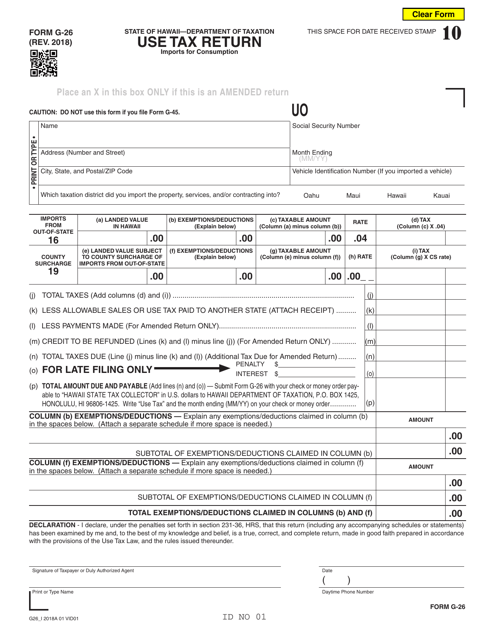

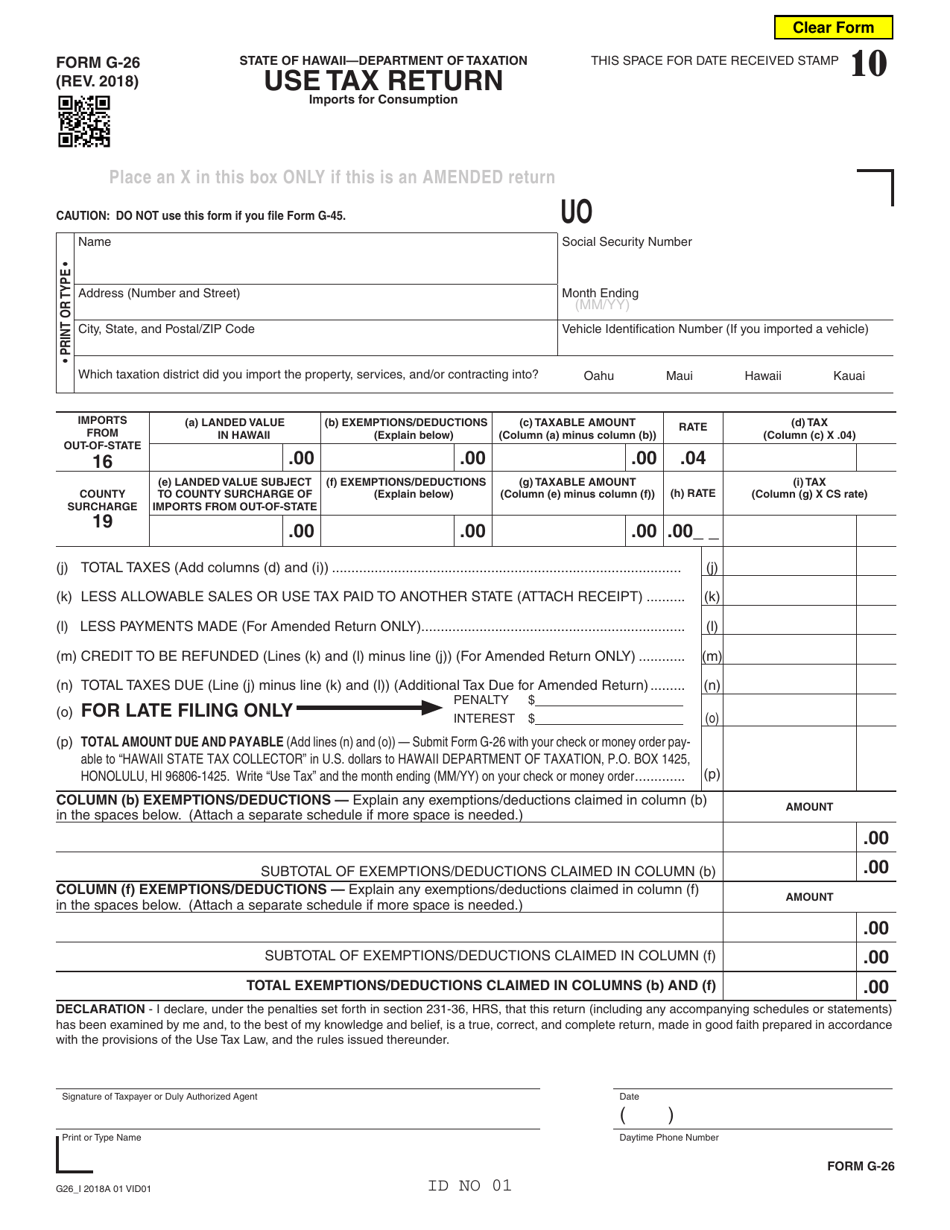

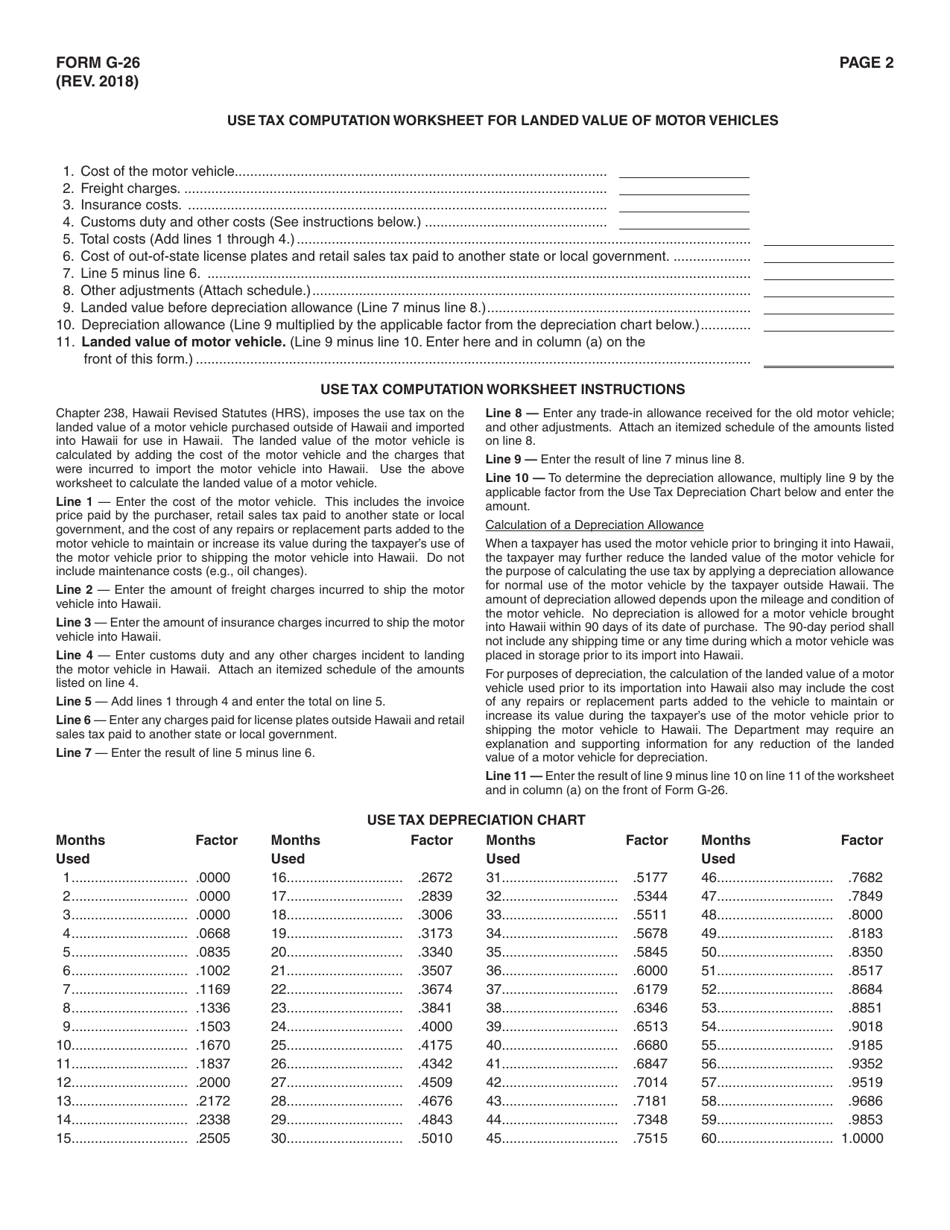

Form G-26

for the current year.

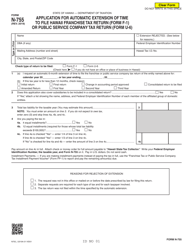

Form G-26 Use Tax Return - Hawaii

What Is Form G-26?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form G-26?

A: Form G-26 is the Use Tax Return form used in Hawaii.

Q: What is use tax?

A: Use tax is a tax on goods purchased outside of Hawaii for use, storage, or consumption in Hawaii.

Q: When should I file Form G-26?

A: Form G-26 should be filed on a monthly basis and must be filed by the 20th day of the following month.

Q: Do I need to file Form G-26 if I don't owe any use tax?

A: Yes, even if you don't owe any use tax, you still need to file a zero-dollar return using Form G-26.

Q: What happens if I don't file Form G-26 or pay the use tax?

A: Failure to file Form G-26 or pay the use tax can result in penalties and interest being assessed by the State of Hawaii.

Q: What records do I need to keep for use tax purposes?

A: You should keep records of all purchases made outside of Hawaii that are subject to use tax, including receipts, invoices, and shipping documents.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-26 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.