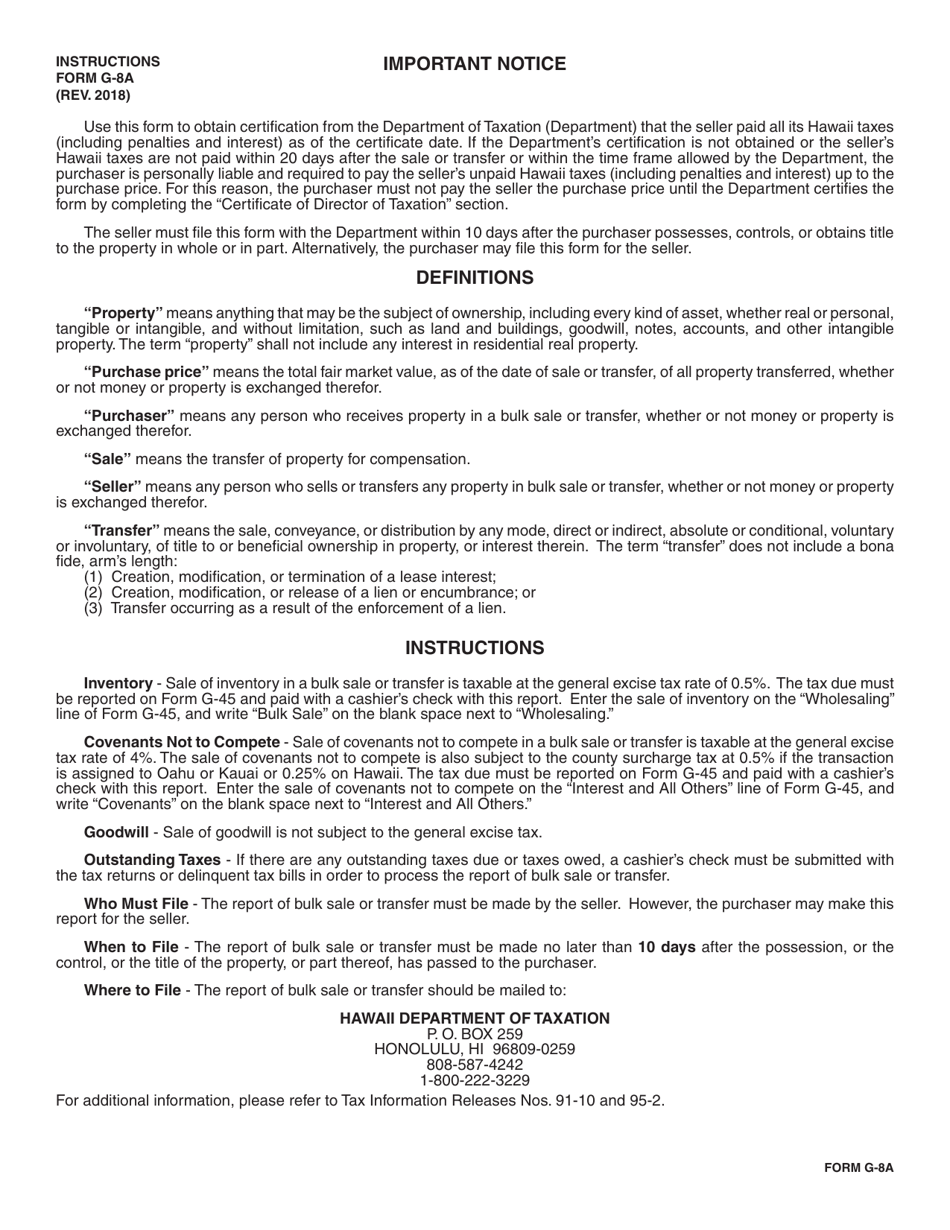

This version of the form is not currently in use and is provided for reference only. Download this version of

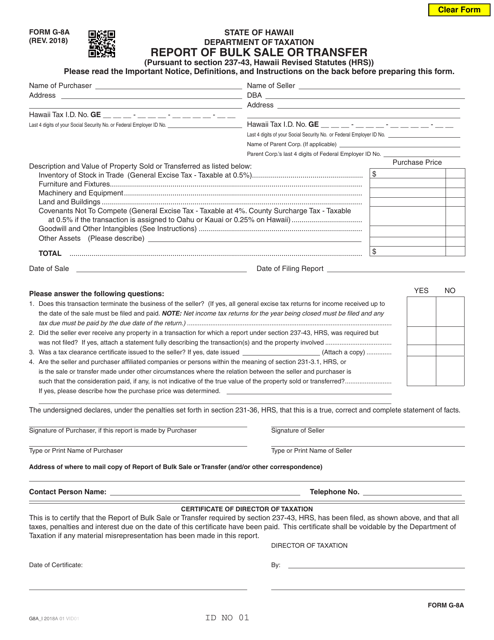

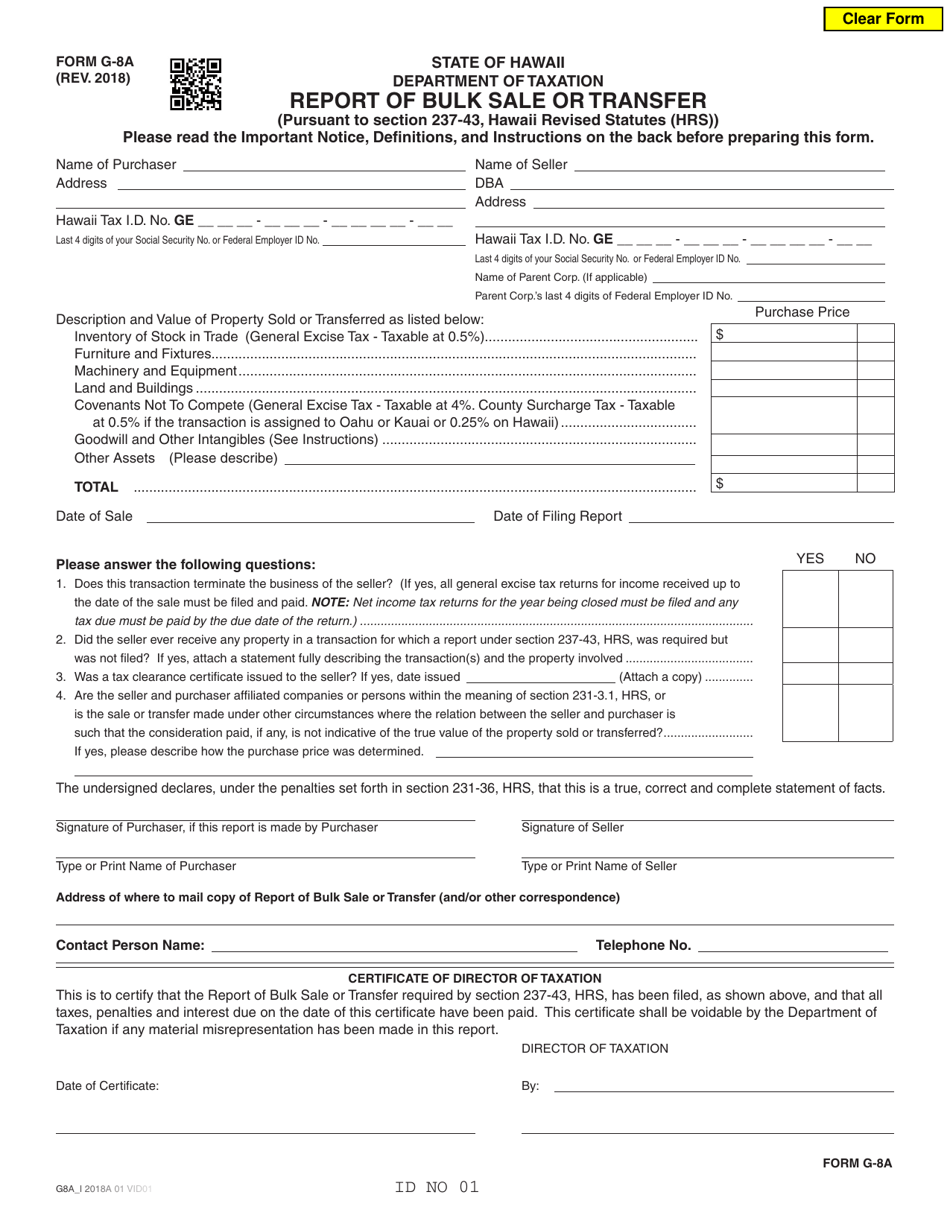

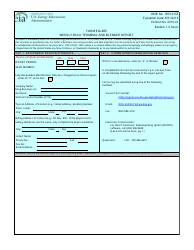

Form G-8A

for the current year.

Form G-8A Report of Bulk Sale or Transfer - Hawaii

What Is Form G-8A?

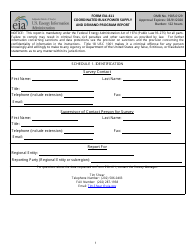

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-8A?

A: Form G-8A is a report of bulk sale or transfer specifically for Hawaii.

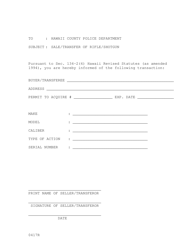

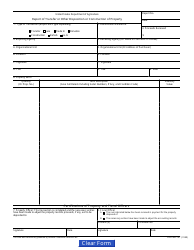

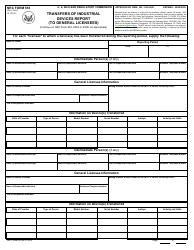

Q: What is a bulk sale or transfer?

A: A bulk sale or transfer refers to a sale of a substantial part or all of a business's inventory, equipment, or other assets.

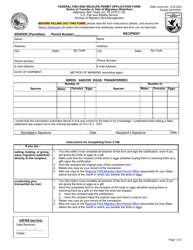

Q: Who needs to file Form G-8A?

A: Both the seller and the buyer are required to file Form G-8A prior to the sale or transfer.

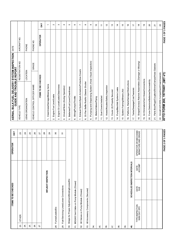

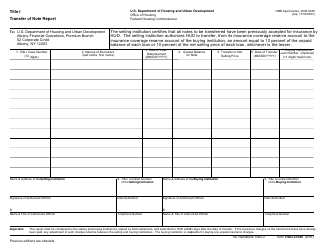

Q: What information is required on Form G-8A?

A: Form G-8A requires detailed information about the seller, the buyer, and the assets involved in the sale or transfer.

Q: When should Form G-8A be filed?

A: Form G-8A should be filed at least ten days before the sale or transfer is planned to take place.

Q: What happens after Form G-8A is filed?

A: Once Form G-8A is filed, the governing agency will review the information provided and may contact the seller or buyer for additional information or clarification.

Q: What are the consequences of not filing Form G-8A?

A: Failure to file Form G-8A or providing false information on the form may result in penalties, fines, and legal consequences. It is important to comply with the reporting requirements to avoid any potential issues.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-8A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.