This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form G-26

for the current year.

Instructions for Form G-26 Use Tax Return - Imports for Consumption - Hawaii

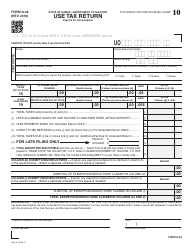

This document contains official instructions for Form G-26 , Use Tax Return - Imports for Consumption - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form G-26 is available for download through this link.

FAQ

Q: What is Form G-26?

A: Form G-26 is a Use Tax Return for Imports for Consumption specific to the state of Hawaii.

Q: What is the purpose of Form G-26?

A: Form G-26 is used to report and pay use tax on imported goods for consumption in Hawaii.

Q: Who needs to file Form G-26?

A: Any individual or business that imports goods for consumption in Hawaii and owes use tax must file Form G-26.

Q: When is Form G-26 due?

A: Form G-26 is due on the 20th day of the month following the end of the reporting period.

Q: Is there a penalty for late filing of Form G-26?

A: Yes, there is a penalty for late filing of Form G-26. The penalty is calculated based on the amount of tax owed and the number of days the return is late.

Q: Are there any exemptions or deductions available on Form G-26?

A: Yes, there are certain exemptions and deductions available on Form G-26. Consult the instructions provided with the form for more information.

Q: What supporting documentation do I need to include with Form G-26?

A: You may be required to provide supporting documentation such as invoices, bills of lading, or proof of payment with Form G-26. Refer to the instructions for a complete list of required documents.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.