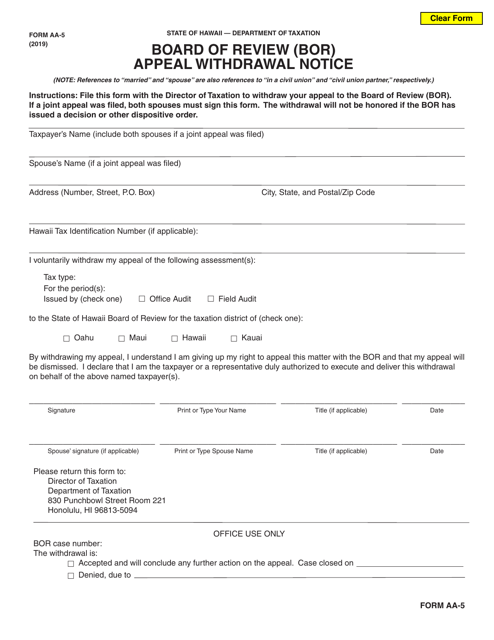

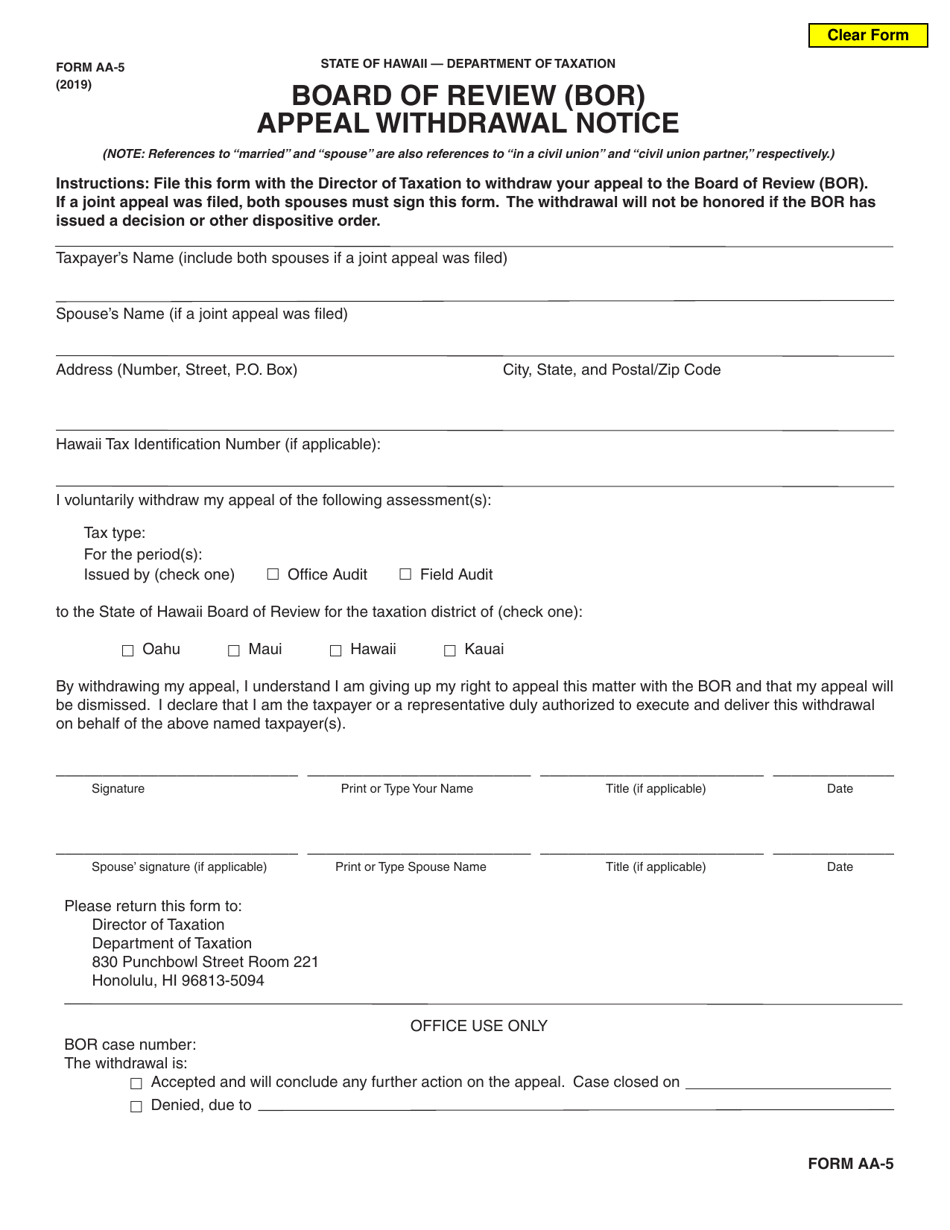

Form AA-5 Board of Review (Bor) Appeal Withdrawal Notice - Hawaii

What Is Form AA-5?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AA-5?

A: Form AA-5 is the Board of Review (BOR) Appeal Withdrawal Notice.

Q: What is the purpose of Form AA-5?

A: The purpose of Form AA-5 is to withdraw an appeal that was filed with the Board of Review (BOR).

Q: Who can use Form AA-5?

A: Anyone who has filed an appeal with the Board of Review (BOR) in Hawaii can use Form AA-5 to withdraw their appeal.

Q: Is there a fee for filing Form AA-5?

A: No, there is no fee for filing Form AA-5.

Q: What information do I need to provide on Form AA-5?

A: You will need to provide your name, contact information, the case number, and the reason for withdrawing your appeal.

Q: How do I submit Form AA-5?

A: You can submit Form AA-5 by mail, fax, or in person to the Board of Review (BOR) office in Hawaii.

Q: What happens after I submit Form AA-5?

A: After you submit Form AA-5 to withdraw your appeal, the BOR will update their records and close the case.

Q: Can I change my mind after withdrawing my appeal?

A: No, once you have submitted Form AA-5 to withdraw your appeal, the decision is final and cannot be reversed.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AA-5 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.