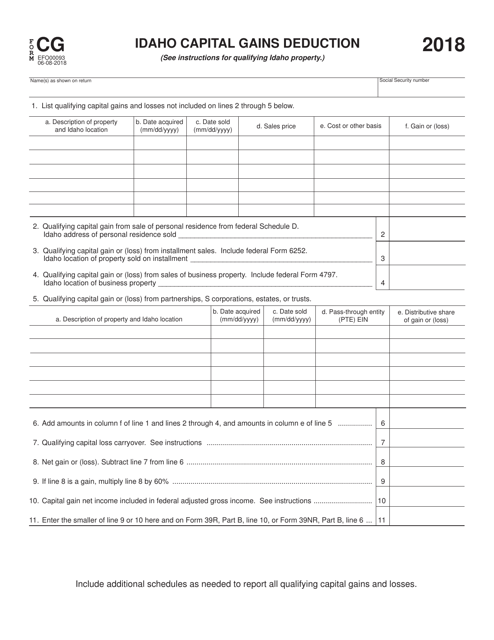

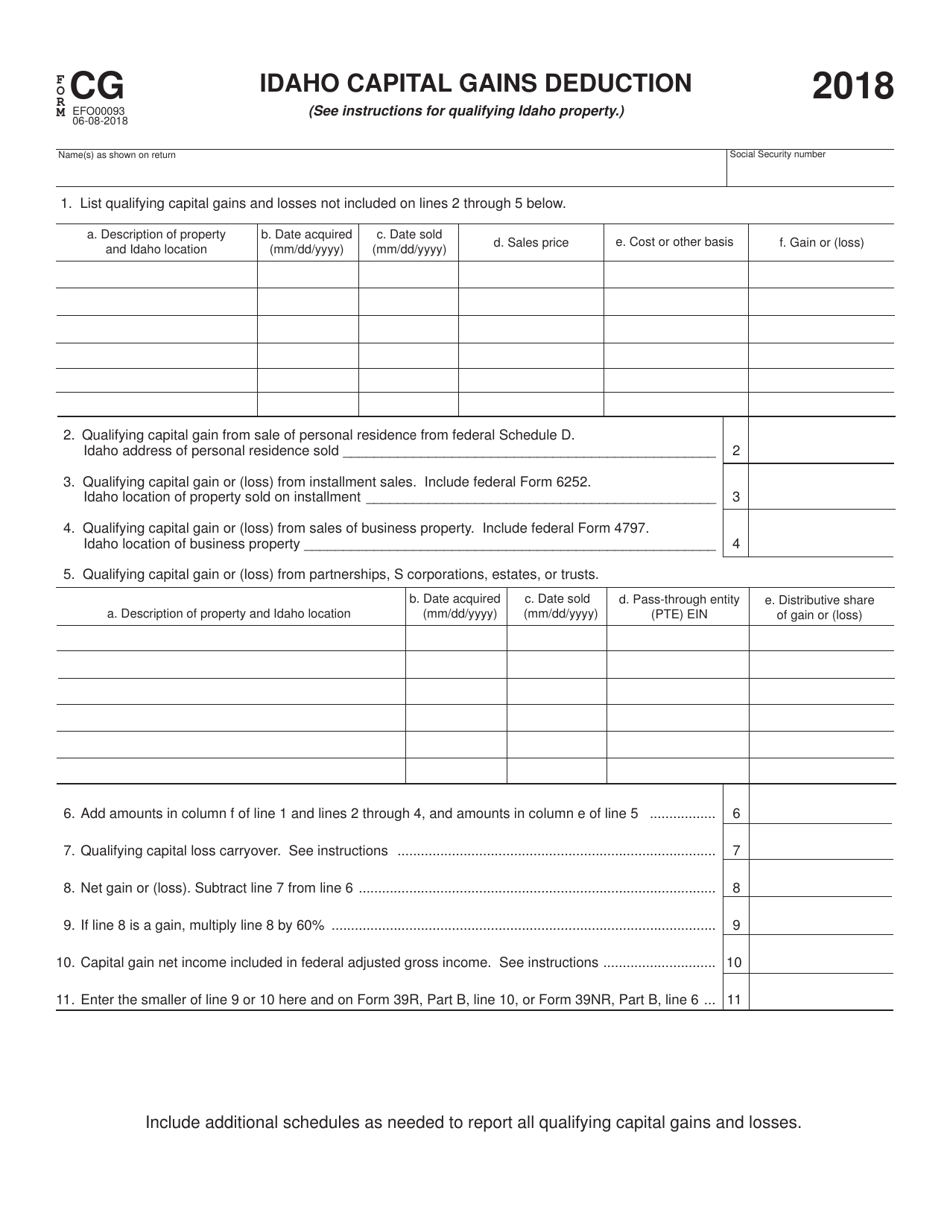

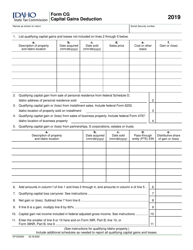

Form EFO00093 (CG) Idaho Capital Gains Deduction - Idaho

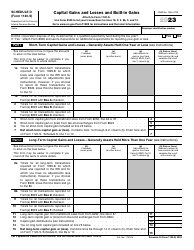

What Is Form EFO00093 (CG)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFO00093 (CG)?

A: Form EFO00093 (CG) is a tax form used in the state of Idaho to claim the Idaho Capital Gains Deduction.

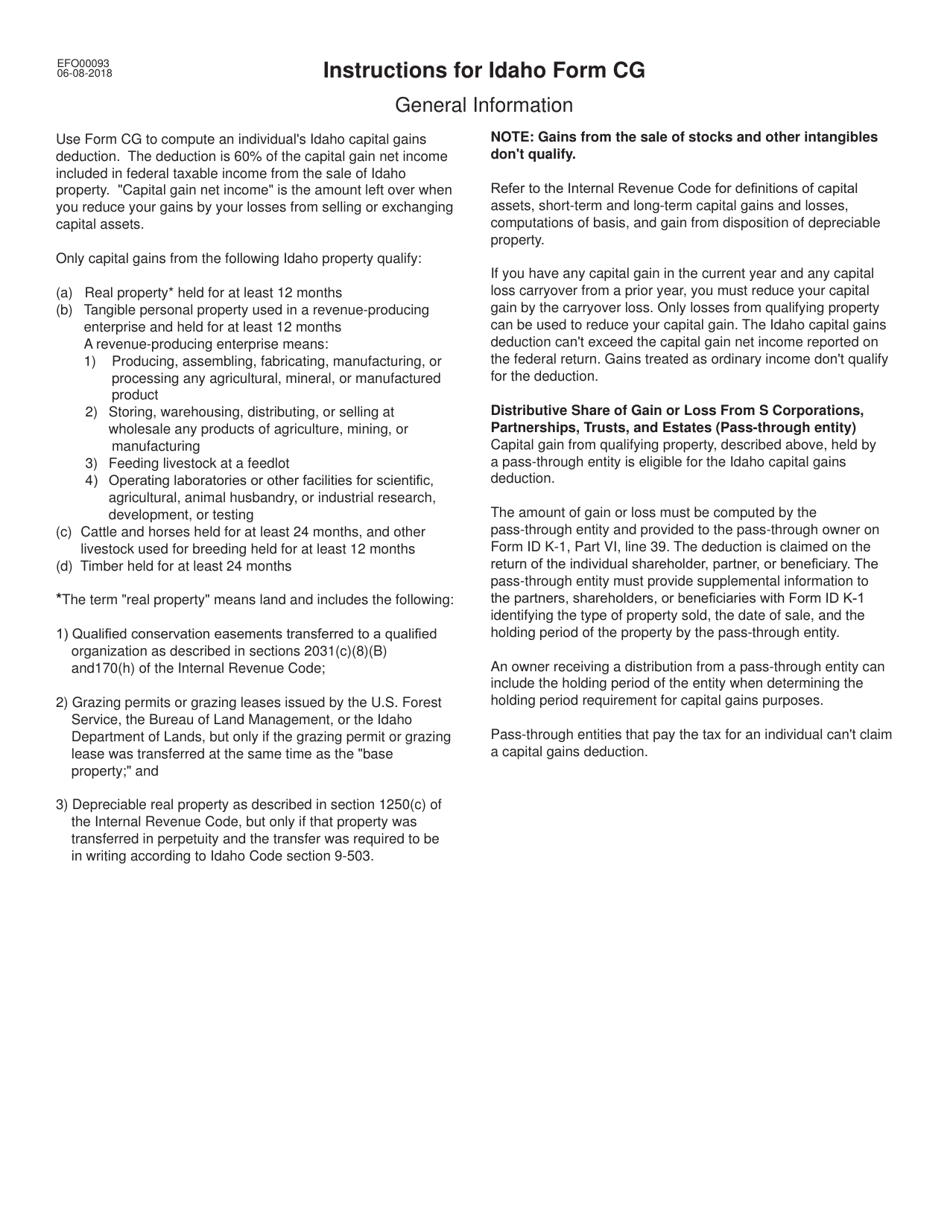

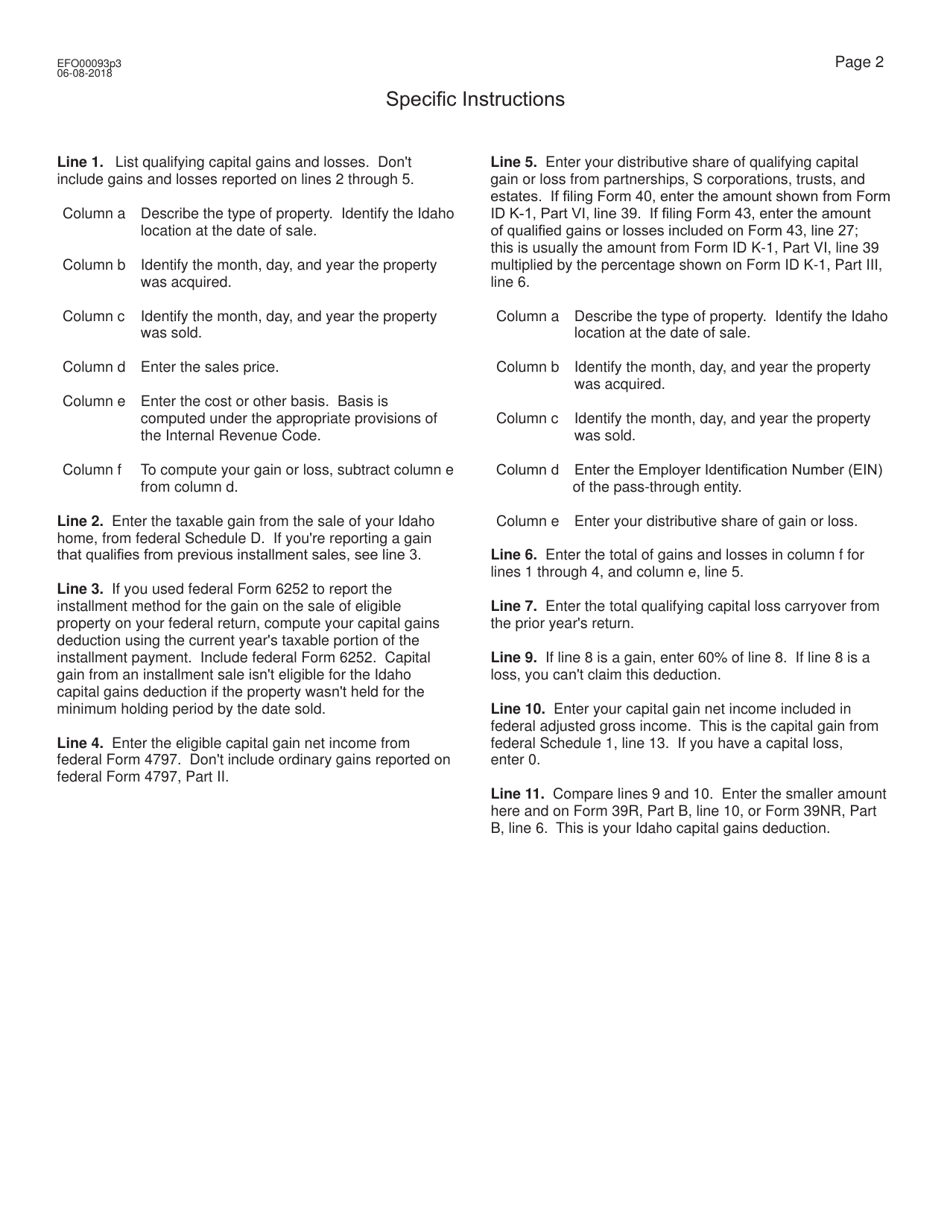

Q: What is the Idaho Capital Gains Deduction?

A: The Idaho Capital Gains Deduction is a tax benefit that allows Idaho residents to deduct a portion of their capital gains from their state income tax.

Q: Who is eligible for the Idaho Capital Gains Deduction?

A: Idaho residents who have realized capital gains from the sale of real or tangible property may be eligible for the deduction.

Q: How much can I deduct with the Idaho Capital Gains Deduction?

A: The amount that can be deducted with the Idaho Capital Gains Deduction depends on the taxpayer's filing status and the length of time they held the property. The deduction is limited to a maximum of $100,000.

Q: What is the purpose of Form EFO00093 (CG)?

A: Form EFO00093 (CG) is used to calculate and claim the Idaho Capital Gains Deduction on the taxpayer's state income tax return.

Q: Are there any other requirements or limitations for claiming the Idaho Capital Gains Deduction?

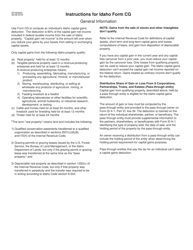

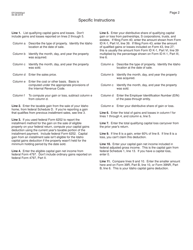

A: Yes, there are additional requirements and limitations for claiming the deduction, including specific criteria for the type of property sold and the length of time it was held. It is recommended to review the instructions for Form EFO00093 (CG) or consult a tax professional for more information.

Q: When is the deadline to file Form EFO00093 (CG)?

A: Form EFO00093 (CG) must be filed along with the taxpayer's state income tax return by the deadline set by the Idaho State Tax Commission, which is usually April 15th.

Q: Can I claim the Idaho Capital Gains Deduction if I am not a resident of Idaho?

A: No, the Idaho Capital Gains Deduction is only available to Idaho residents.

Q: Is the Idaho Capital Gains Deduction the same as the federal capital gains tax rate?

A: No, the Idaho Capital Gains Deduction is a separate deduction from the state income tax and is not linked to the federal capital gains tax rate. The deduction is specific to Idaho and may have different rules and limitations.

Form Details:

- Released on June 8, 2018;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EFO00093 (CG) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.