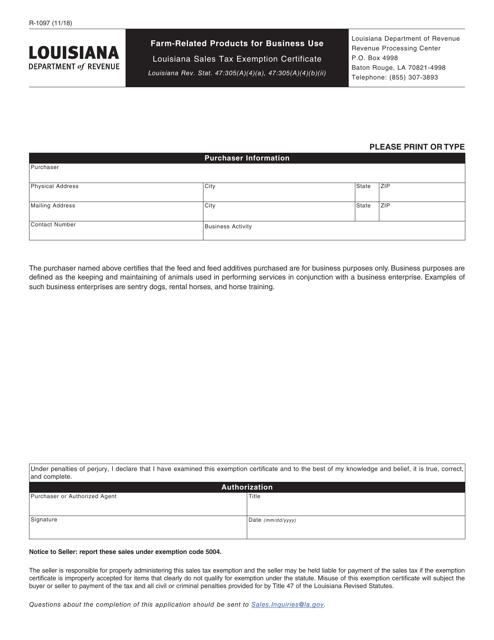

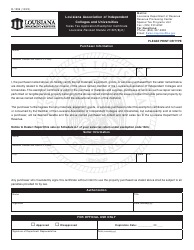

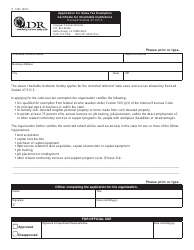

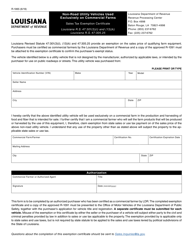

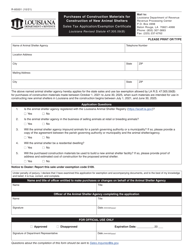

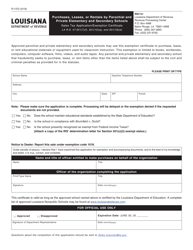

Form R-1097 Farm-Related Products for Business Use - Louisiana Sales Tax Exemption Certificate - Louisiana

What Is Form R-1097?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

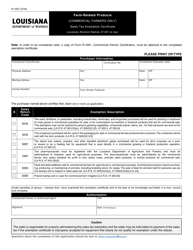

Q: What is Form R-1097?

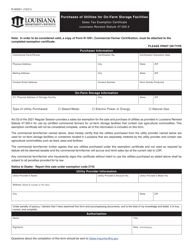

A: Form R-1097 is a Louisiana Sales Tax Exemption Certificate for farm-related products used in business.

Q: What is the purpose of Form R-1097?

A: The purpose of Form R-1097 is to claim a sales tax exemption on farm-related products used in business.

Q: Who can use Form R-1097?

A: Farmers and businesses involved in agricultural activities can use Form R-1097.

Q: What is the sales tax exemption for farm-related products?

A: The sales tax exemption allows farmers and agricultural businesses to purchase certain products without paying sales tax.

Q: Which products are eligible for the sales tax exemption?

A: Farm-related products such as seeds, fertilizers, pesticides, and equipment used for agricultural activities are eligible for the sales tax exemption.

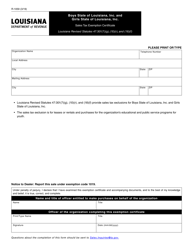

Q: Is there a deadline to submit Form R-1097?

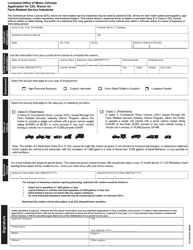

A: No, there is no specific deadline to submit Form R-1097. It can be submitted whenever you make an eligible purchase.

Q: Do I need to renew Form R-1097?

A: No, Form R-1097 does not need to be renewed. Once you obtain it, you can use it for eligible purchases as long as you meet the requirements.

Q: Can individuals use Form R-1097 for personal purchases?

A: No, Form R-1097 is specifically for farm-related products used in business. It cannot be used for personal purchases.

Q: Are there any limitations or restrictions on the sales tax exemption?

A: Yes, there may be limitations or restrictions on the sales tax exemption. It is important to review the instructions and guidelines provided with Form R-1097 for specific details.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

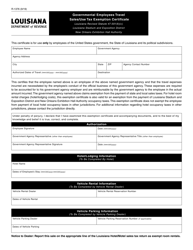

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1097 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.