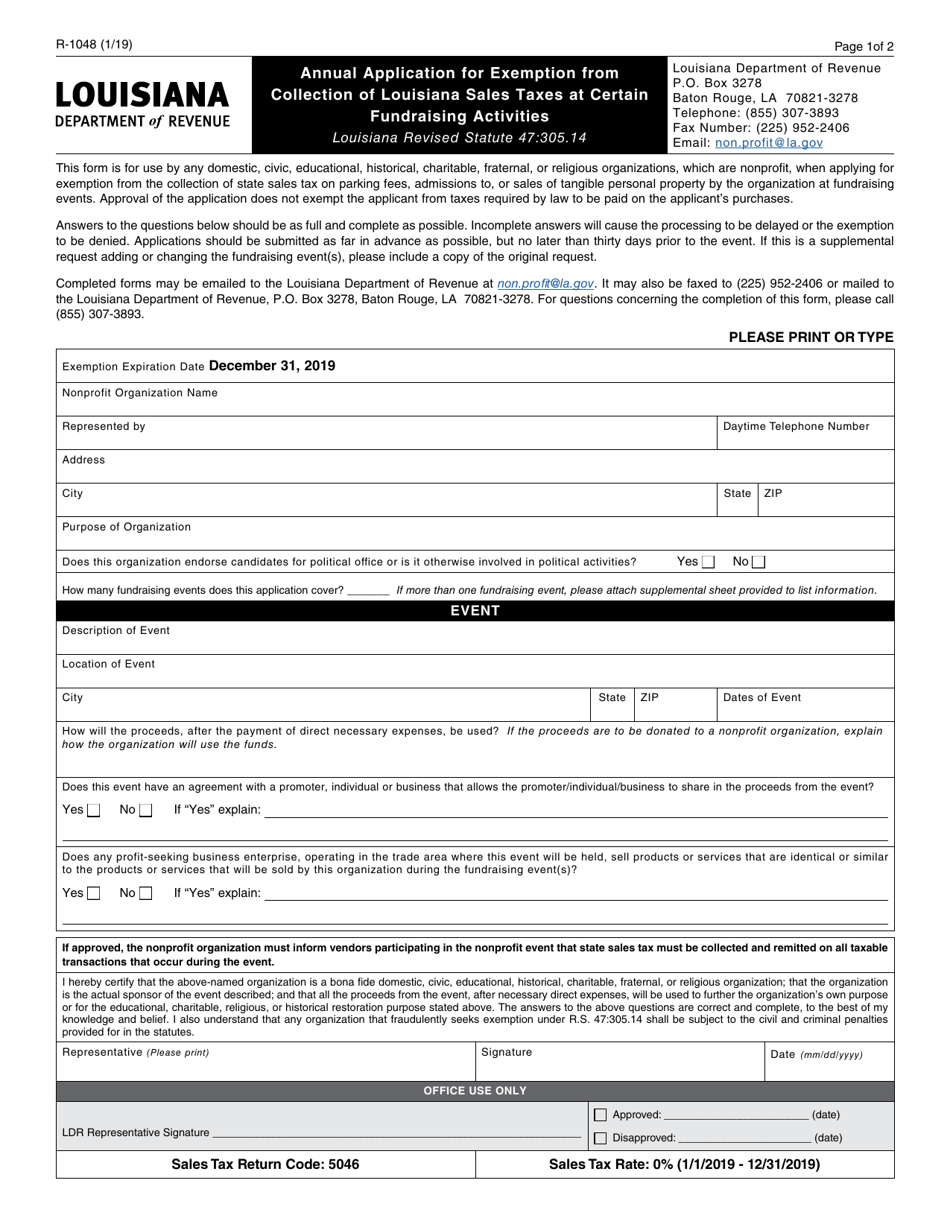

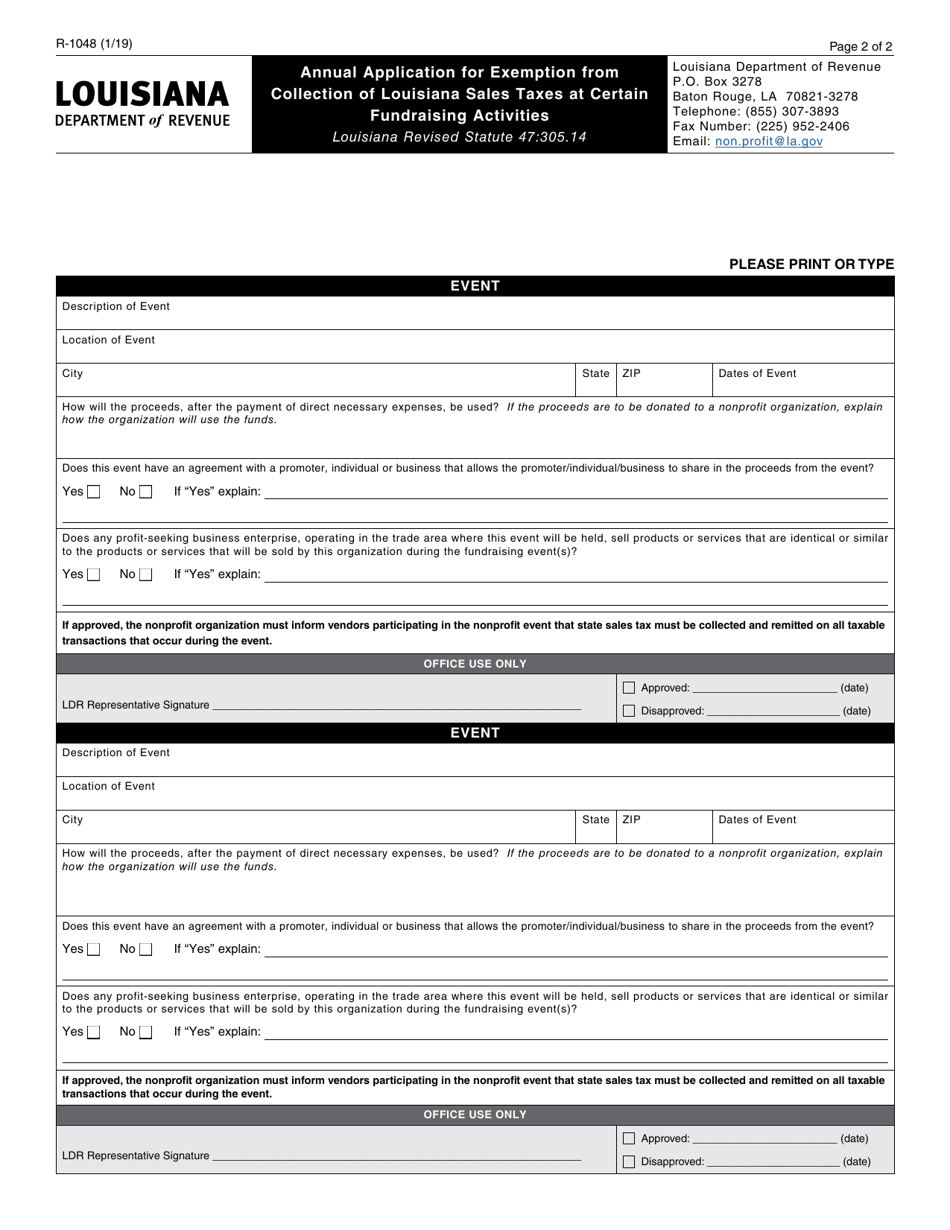

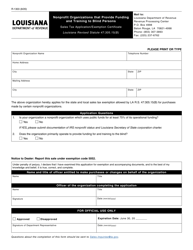

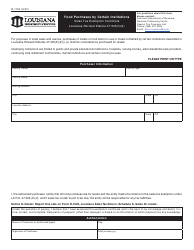

This version of the form is not currently in use and is provided for reference only. Download this version of

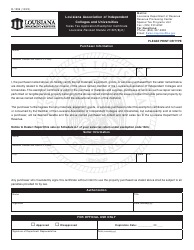

Form R-1048

for the current year.

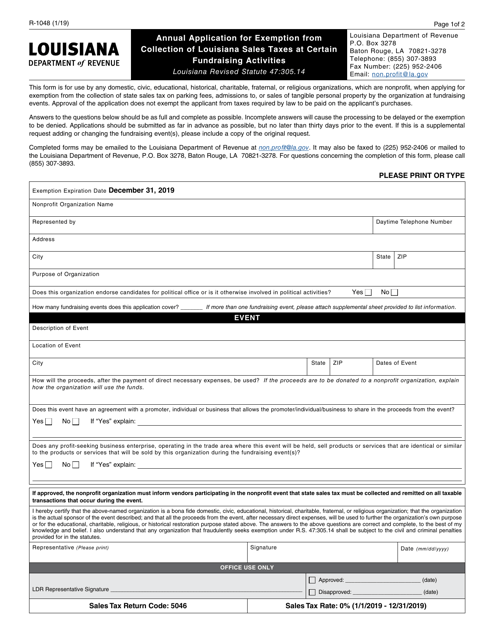

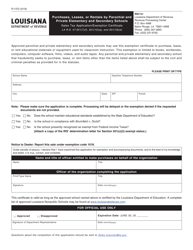

Form R-1048 Annual Application for Exemption From Collection of Louisiana Sales Taxes at Certain Fundraising Activities - Louisiana

What Is Form R-1048?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1048?

A: Form R-1048 is the Annual Application for Exemption From Collection of Louisiana Sales Taxes at Certain Fundraising Activities in Louisiana.

Q: Who needs to file Form R-1048?

A: Non-profit organizations engaged in fundraising activities in Louisiana need to file Form R-1048.

Q: What is the purpose of Form R-1048?

A: The purpose of Form R-1048 is to apply for exemption from collecting sales taxes for fundraising activities in Louisiana.

Q: How often does Form R-1048 need to be filed?

A: Form R-1048 needs to be filed annually.

Q: Is there a fee to file Form R-1048?

A: No, there is no fee to file Form R-1048.

Q: What are some examples of fundraising activities covered by Form R-1048?

A: Examples of fundraising activities covered by Form R-1048 include bake sales, car washes, and charity auctions.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1048 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.