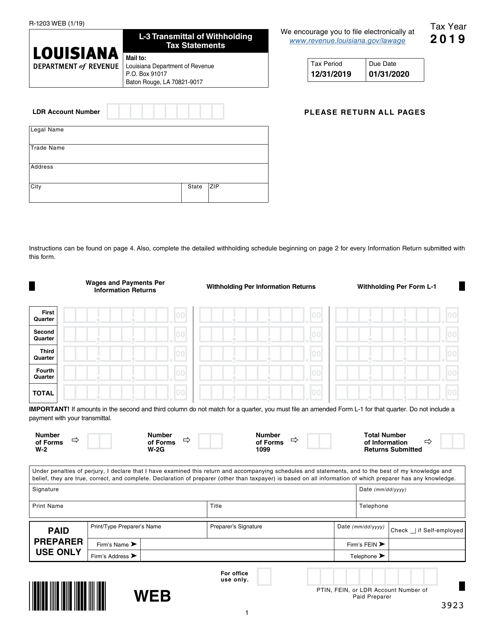

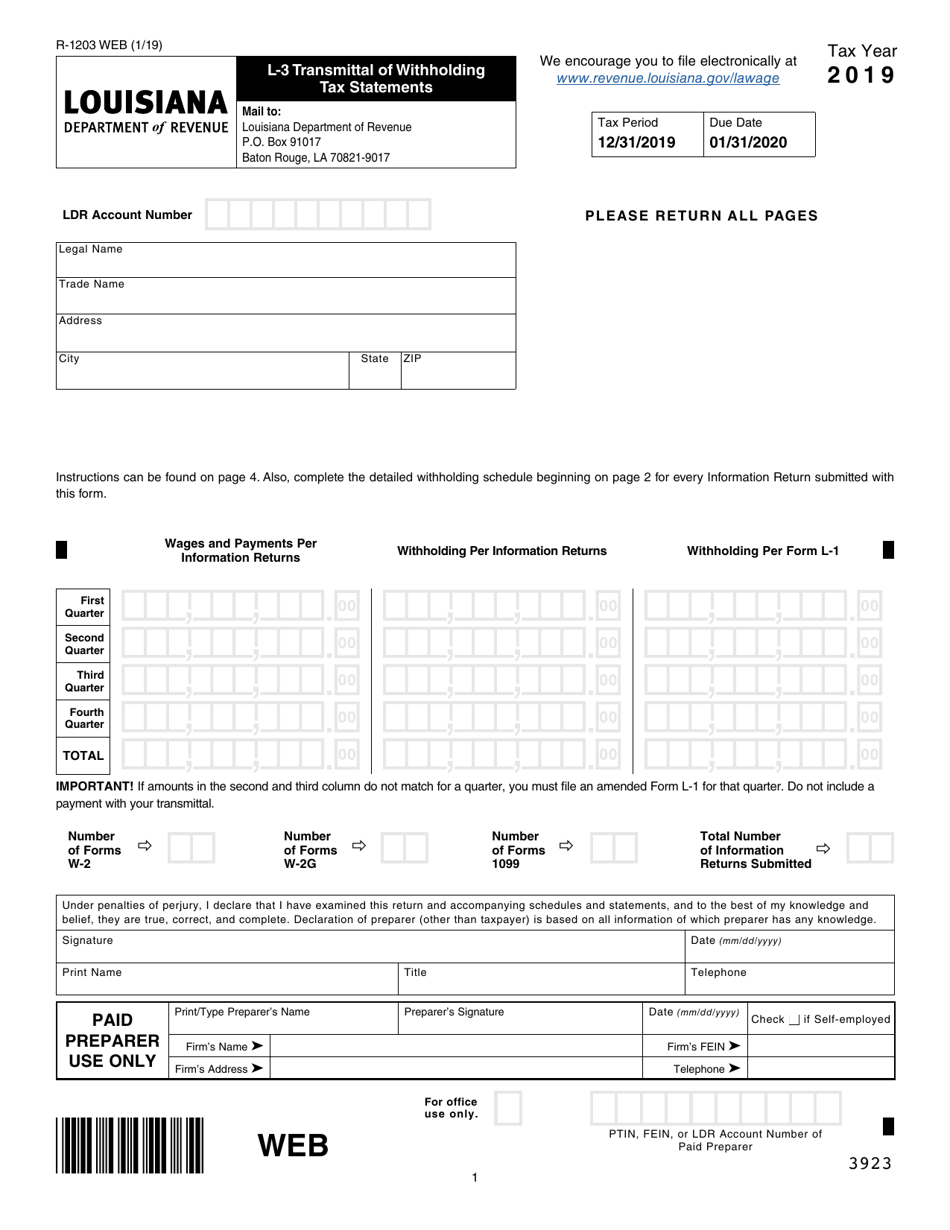

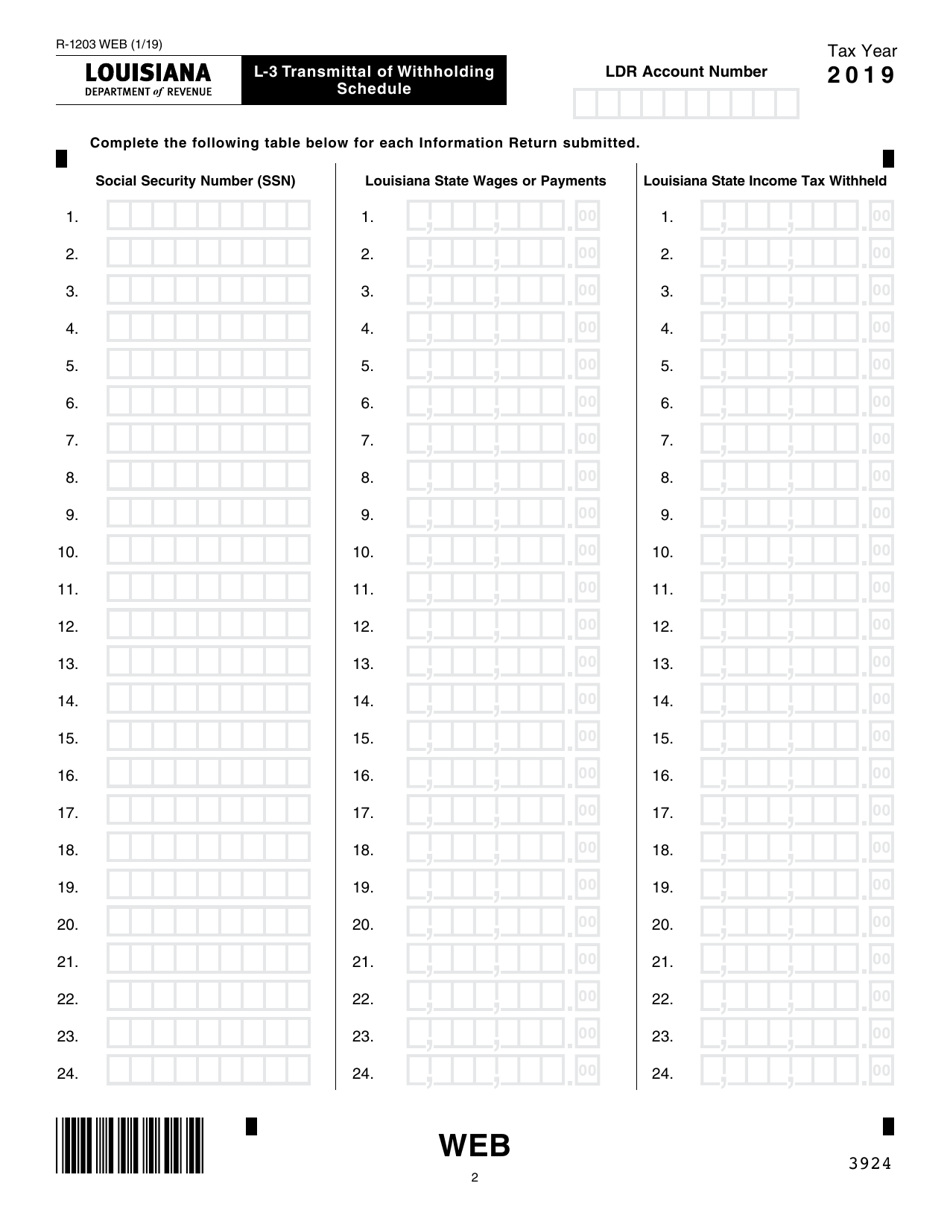

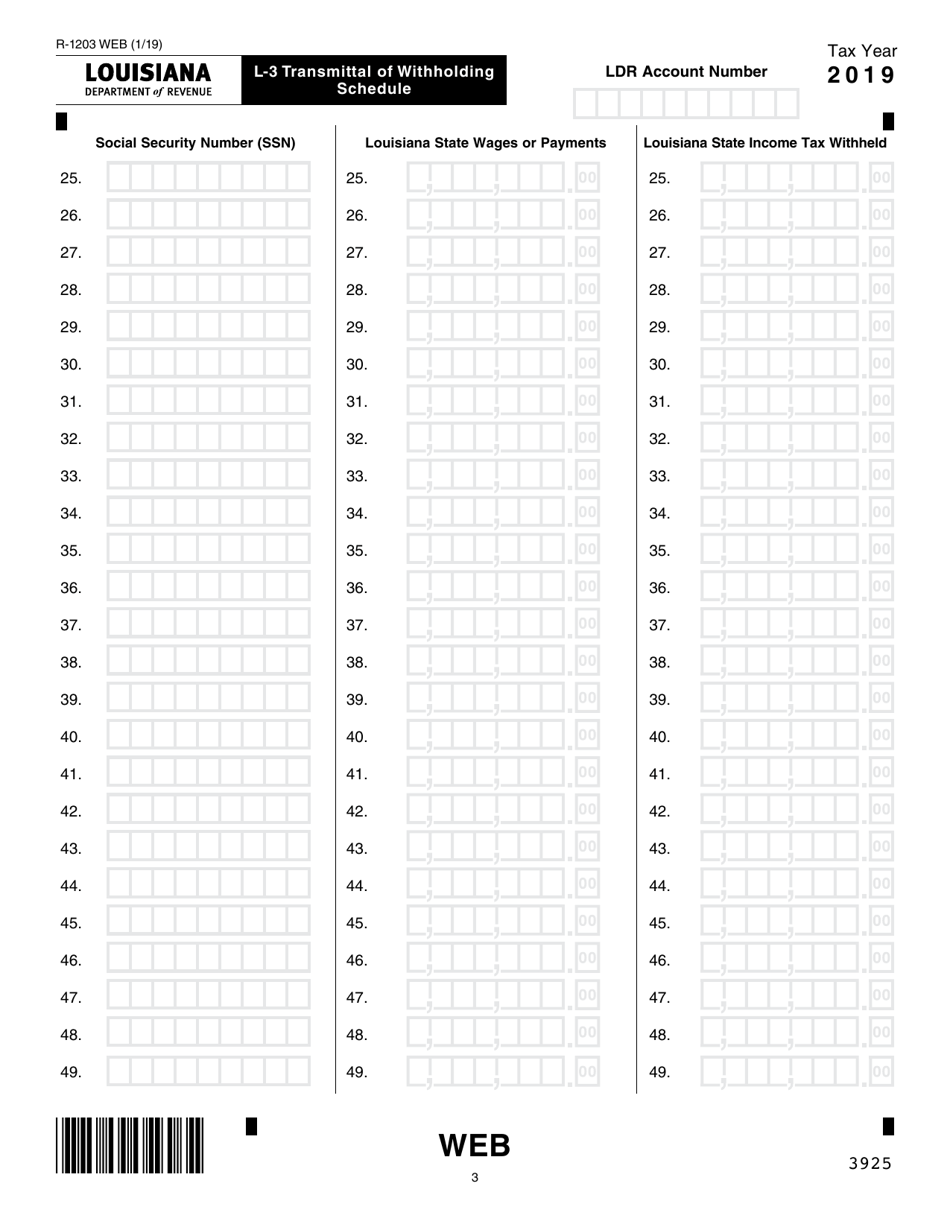

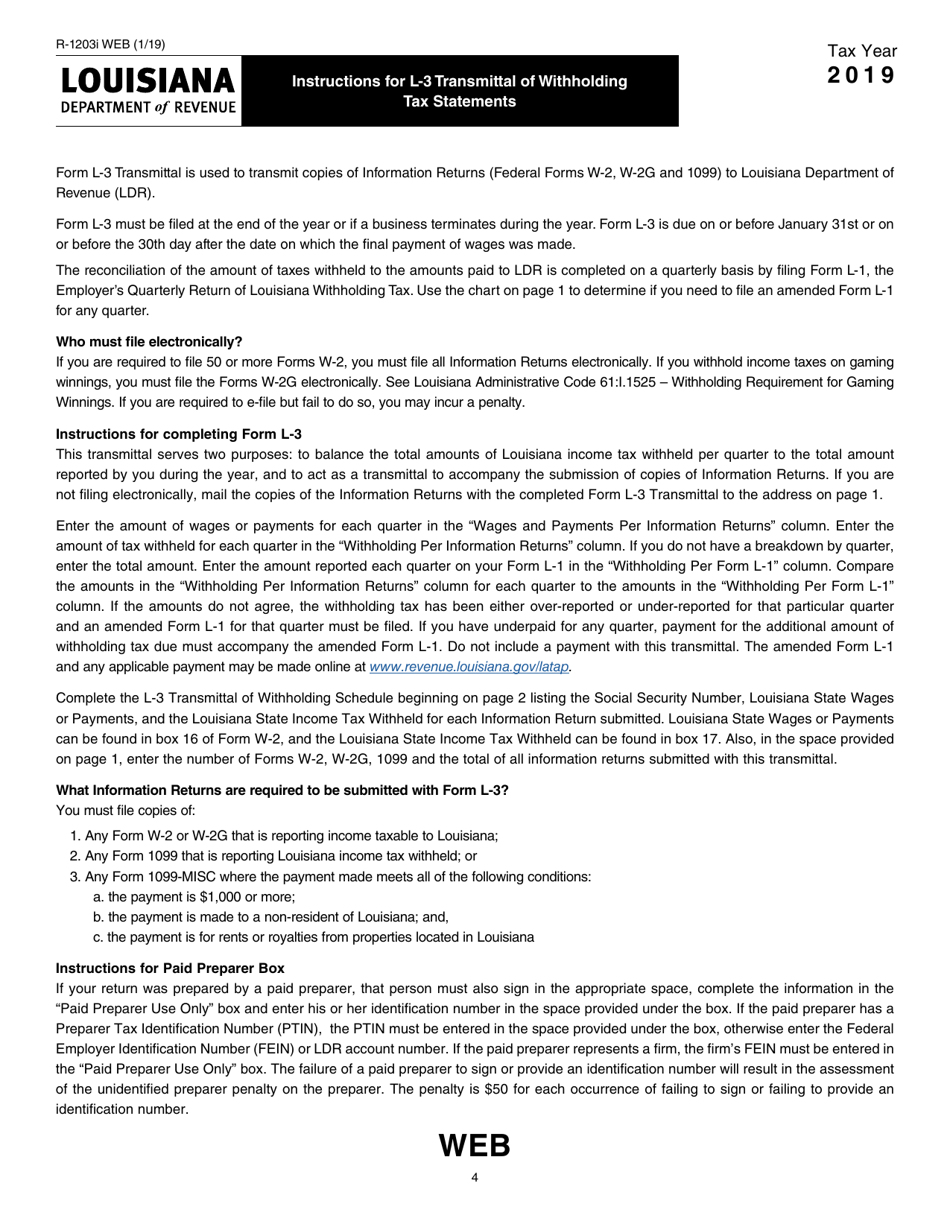

Form L-3 (R-1203 WEB) Transmittal of Withholding Tax Statements - Louisiana

What Is Form L-3 (R-1203 WEB)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-3 (R-1203 WEB)?

A: Form L-3 (R-1203 WEB) is a document used for transmittal of withholding tax statements in Louisiana.

Q: Who needs to file Form L-3 (R-1203 WEB)?

A: Employers who have withheld state income tax from employees in Louisiana need to file Form L-3 (R-1203 WEB).

Q: What is the purpose of Form L-3 (R-1203 WEB)?

A: The purpose of Form L-3 (R-1203 WEB) is to report and remit the withheld state income tax to the Louisiana Department of Revenue.

Q: How often do you need to file Form L-3 (R-1203 WEB)?

A: Form L-3 (R-1203 WEB) should be filed on a quarterly basis.

Q: Is Form L-3 (R-1203 WEB) required to be filed electronically?

A: Yes, Form L-3 (R-1203 WEB) must be filed electronically.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-3 (R-1203 WEB) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.