This version of the form is not currently in use and is provided for reference only. Download this version of

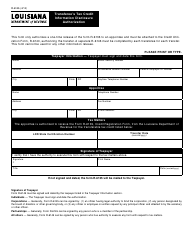

Form R-6111

for the current year.

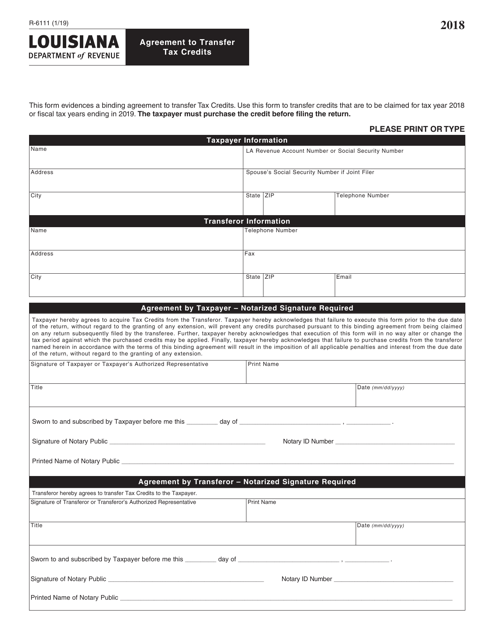

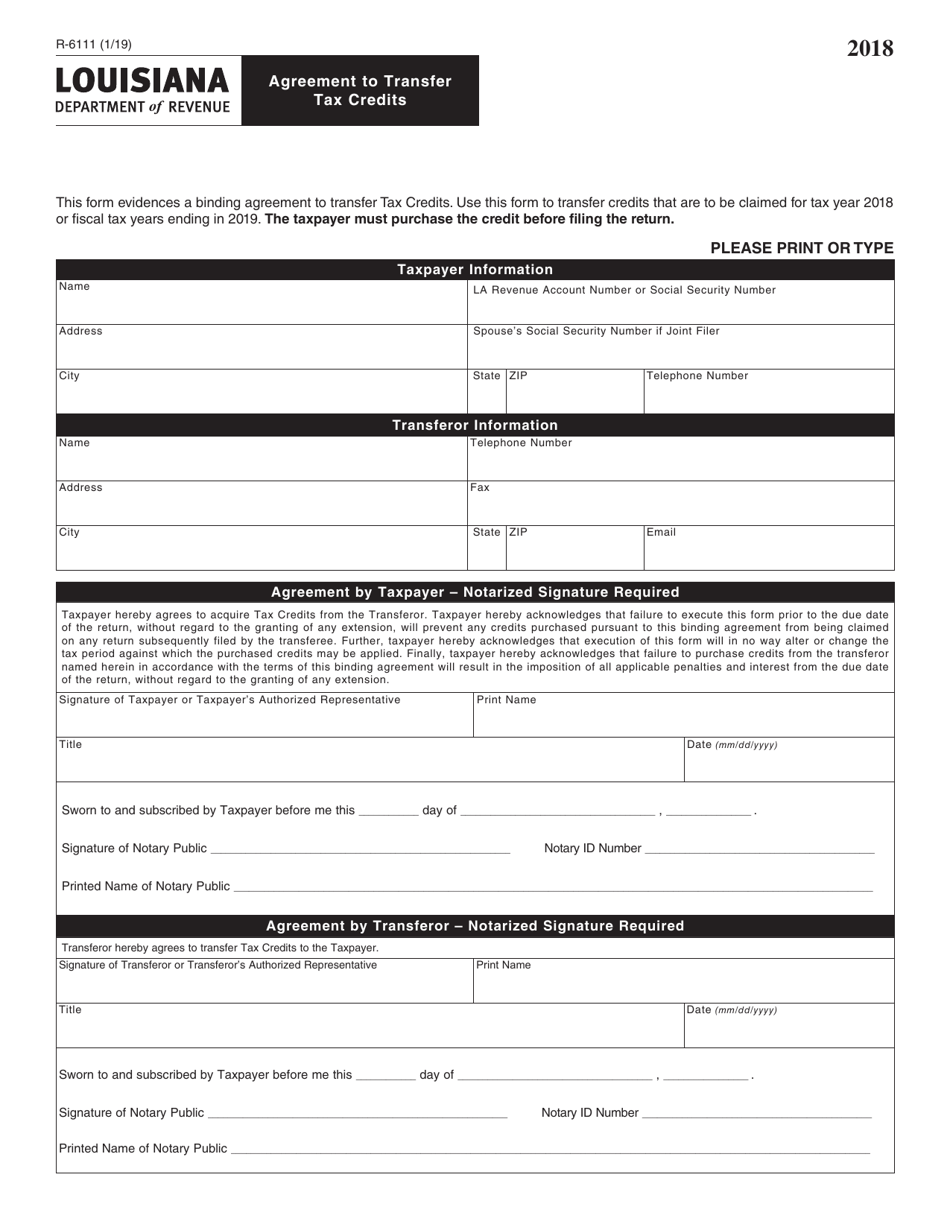

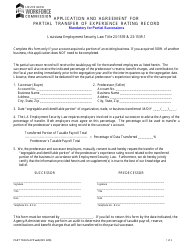

Form R-6111 Agreement to Transfer Tax Credits - Louisiana

What Is Form R-6111?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6111?

A: Form R-6111 is an agreement used to transfer tax credits in Louisiana.

Q: What are tax credits?

A: Tax credits are reductions in the amount of taxes owed.

Q: Who should use Form R-6111?

A: Form R-6111 should be used by individuals or businesses who want to transfer their tax credits to another party.

Q: Why would someone want to transfer tax credits?

A: Someone may want to transfer tax credits if they are unable to utilize them or if they want to sell them to another party.

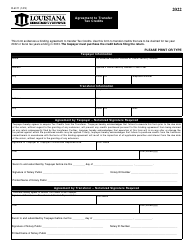

Q: How do I fill out Form R-6111?

A: You must provide your contact information, details about the tax credits being transferred, and information about the party receiving the tax credits.

Q: Are there any fees associated with transferring tax credits using Form R-6111?

A: Yes, there is a fee of $75 per tax credit transfer.

Q: Is there a deadline for submitting Form R-6111?

A: Yes, Form R-6111 must be submitted on or before the original due date of the tax return for which the tax credits were earned.

Q: Can I transfer tax credits to someone outside of Louisiana using Form R-6111?

A: No, Form R-6111 can only be used to transfer tax credits within the state of Louisiana.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6111 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.