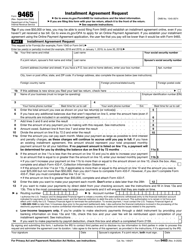

This version of the form is not currently in use and is provided for reference only. Download this version of

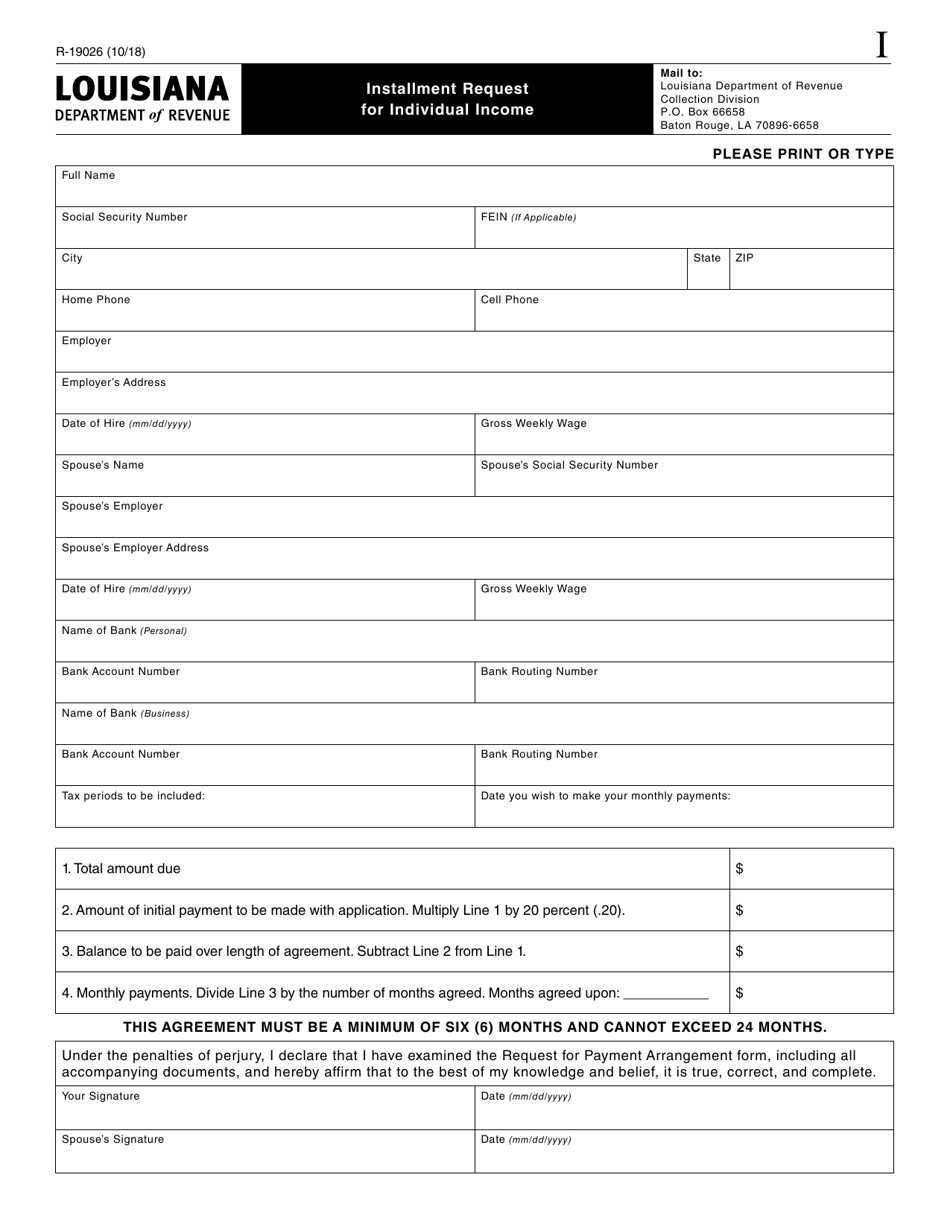

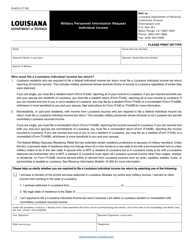

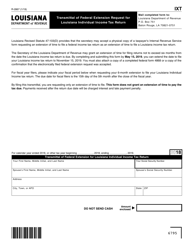

Form R-19026

for the current year.

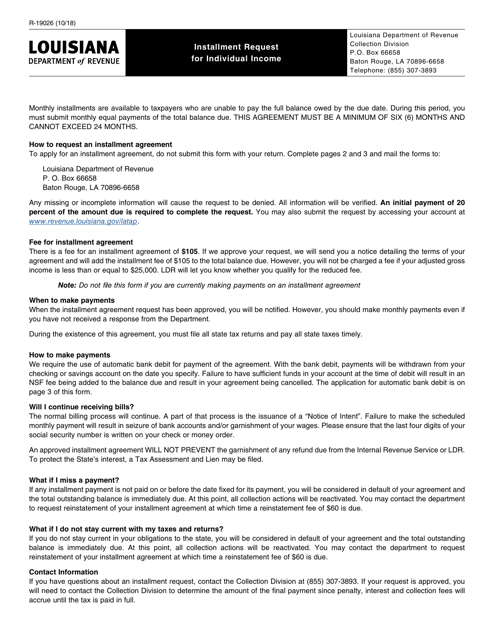

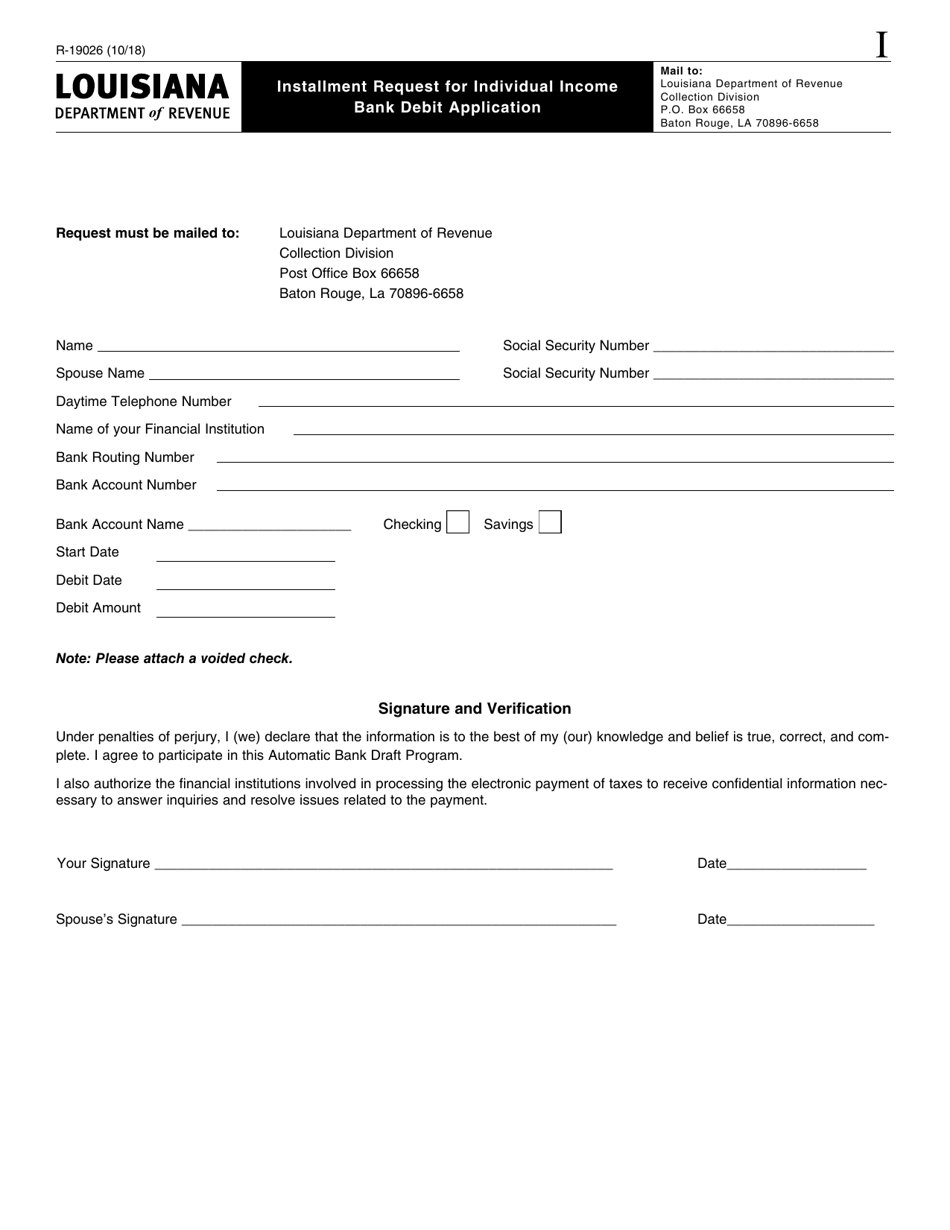

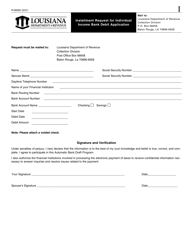

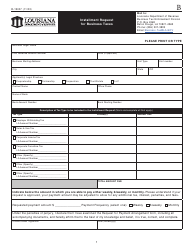

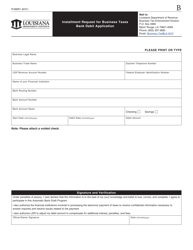

Form R-19026 Installment Request for Individual Income - Louisiana

What Is Form R-19026?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

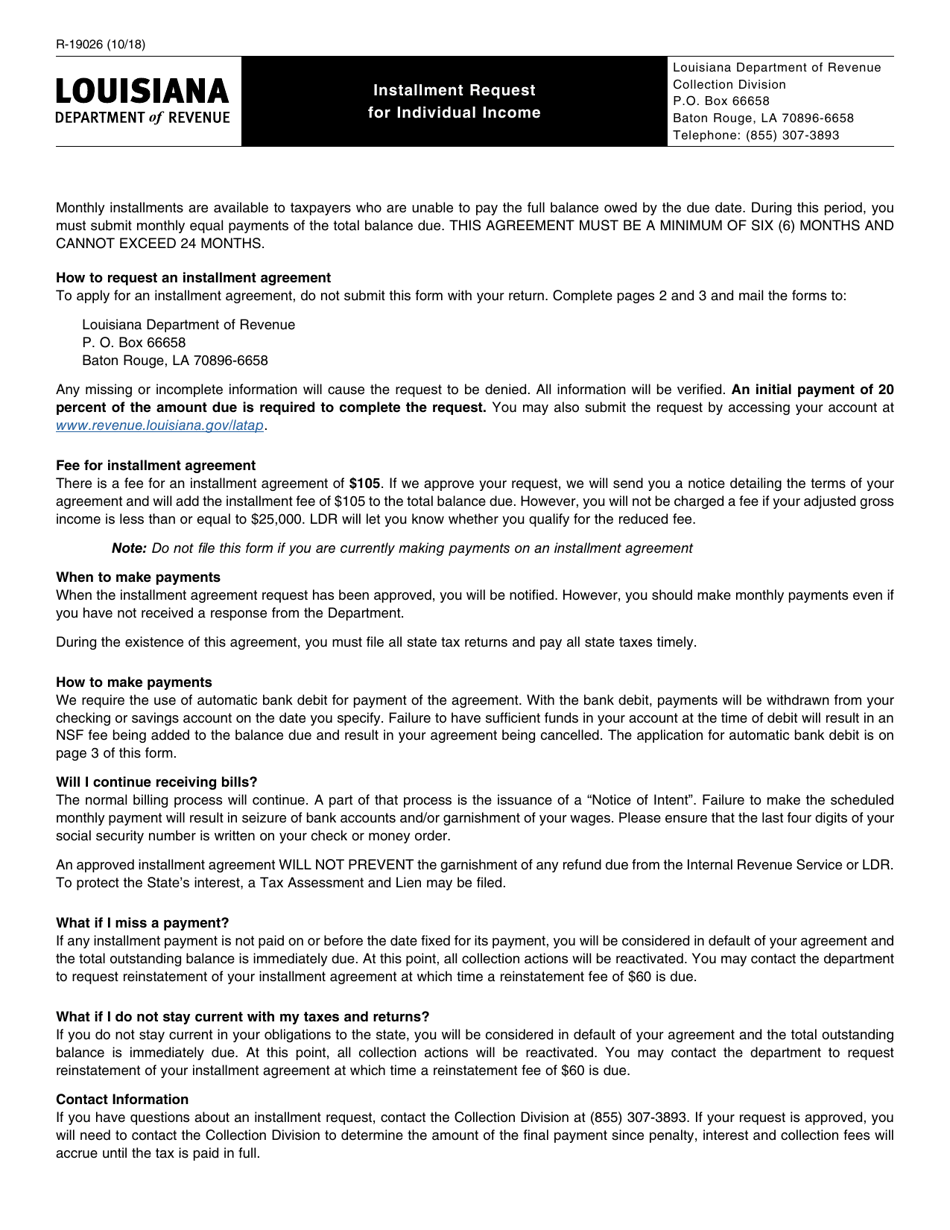

Q: What is Form R-19026?

A: Form R-19026 is the Installment Request forIndividual Income in Louisiana.

Q: Who should use Form R-19026?

A: Individuals in Louisiana who need to request an installment plan for their income taxes should use Form R-19026.

Q: What is the purpose of Form R-19026?

A: The purpose of Form R-19026 is to request a payment plan for individuals who are unable to pay their income taxes in full.

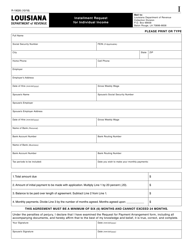

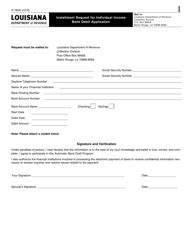

Q: What information do I need to provide on Form R-19026?

A: On Form R-19026, you will need to provide your personal information, tax liability details, and proposed installment payment amounts.

Q: Is there a fee for requesting an installment plan using Form R-19026?

A: Yes, there is a fee for requesting an installment plan using Form R-19026. The fee amount is determined by the total amount of tax due.

Q: What is the deadline for submitting Form R-19026?

A: The deadline for submitting Form R-19026 is the same as the income tax filing deadline in Louisiana.

Q: Can I request an installment plan for previous years' taxes using Form R-19026?

A: No, Form R-19026 is only for requesting an installment plan for current year taxes. If you need to request a payment plan for previous years' taxes, you will need to contact the Louisiana Department of Revenue for further assistance.

Q: Is approval guaranteed for a payment plan requested using Form R-19026?

A: Approval for a payment plan requested using Form R-19026 is not guaranteed. The Louisiana Department of Revenue will review your request and make a decision based on your financial situation.

Q: What should I do if my request for an installment plan using Form R-19026 is denied?

A: If your request for an installment plan using Form R-19026 is denied, you should contact the Louisiana Department of Revenue to discuss alternative payment options.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-19026 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.