This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-10605

for the current year.

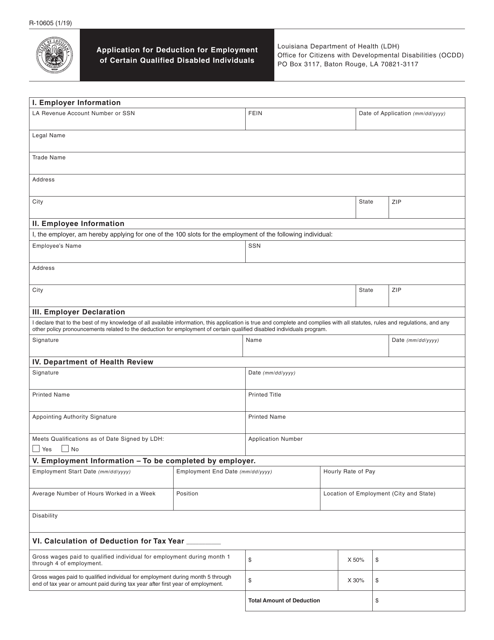

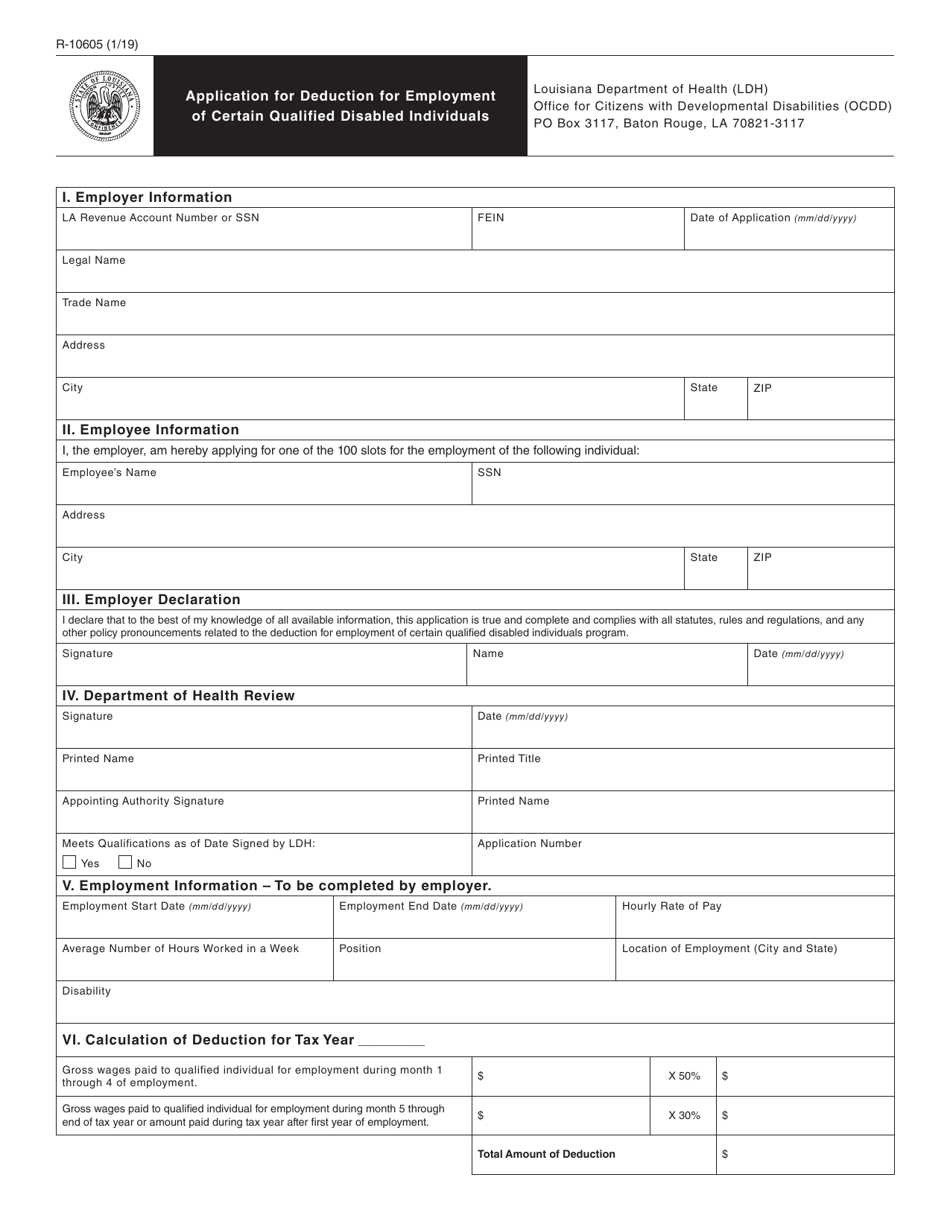

Form R-10605 Application for Deduction for Employment of Certain Qualified Disabled Individuals - Louisiana

What Is Form R-10605?

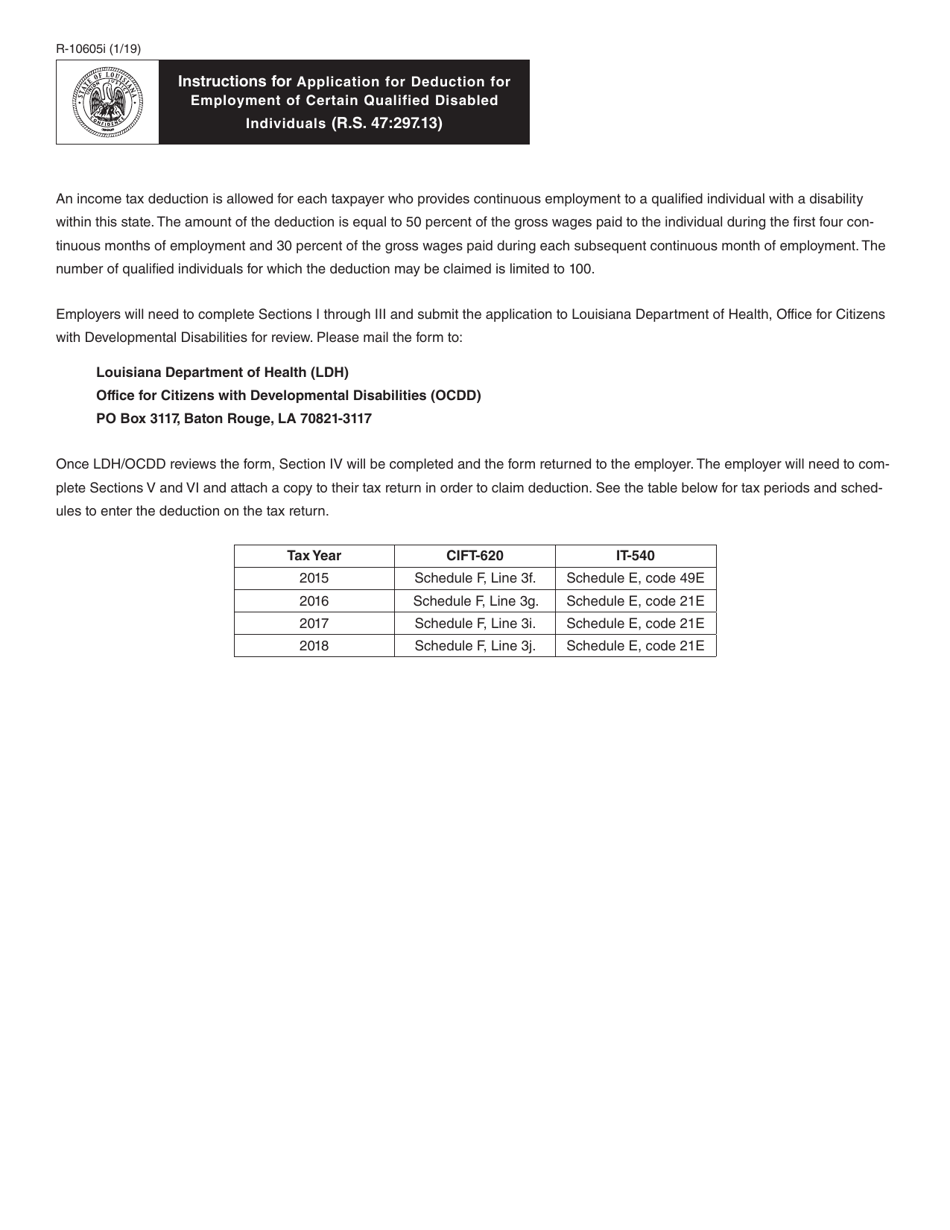

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form R-10605?

A: The Form R-10605 is an application for deduction for the employment of certain qualified disabled individuals in Louisiana.

Q: Who can use the Form R-10605?

A: This form can be used by employers in Louisiana who employ qualified disabled individuals and want to claim a deduction.

Q: What is the purpose of the deduction?

A: The purpose of the deduction is to incentivize employers to hire and retain qualified disabled individuals by providing a tax benefit.

Q: What information is required on the Form R-10605?

A: The form requires information about the employer, the qualified disabled individual, and the percentage of employment.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10605 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.