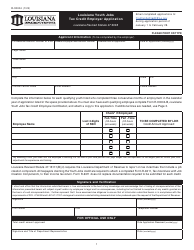

This version of the form is not currently in use and is provided for reference only. Download this version of

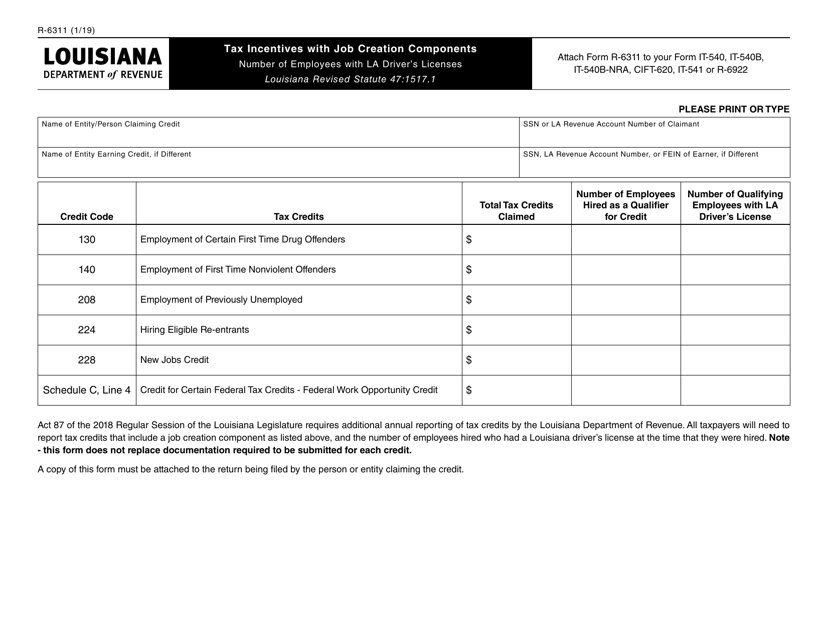

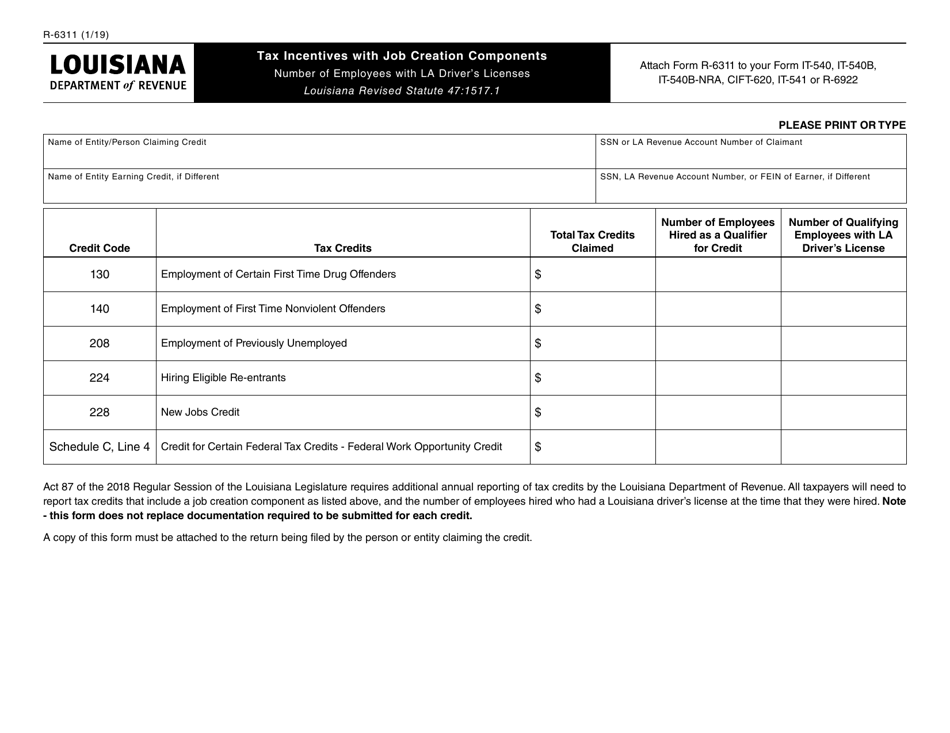

Form R-6311

for the current year.

Form R-6311 Tax Incentives With Job Creation Component - Louisiana

What Is Form R-6311?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

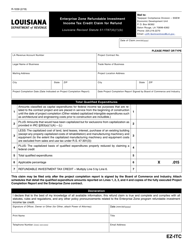

Q: What is Form R-6311?

A: Form R-6311 is a tax incentive form in Louisiana.

Q: What are tax incentives?

A: Tax incentives are benefits provided by the government to encourage certain behaviors or activities.

Q: What is the job creation component of Form R-6311?

A: The job creation component of Form R-6311 refers to the requirement of creating jobs in order to qualify for the tax incentives.

Q: Who is eligible for Form R-6311?

A: Businesses and individuals who are planning to create jobs in Louisiana may be eligible for Form R-6311.

Q: What are the benefits of Form R-6311?

A: The tax incentives provided by Form R-6311 can help businesses and individuals save money on their taxes and encourage job creation.

Q: How do I apply for Form R-6311?

A: To apply for Form R-6311, you need to complete the form and submit it to the appropriate department in Louisiana.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6311 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.