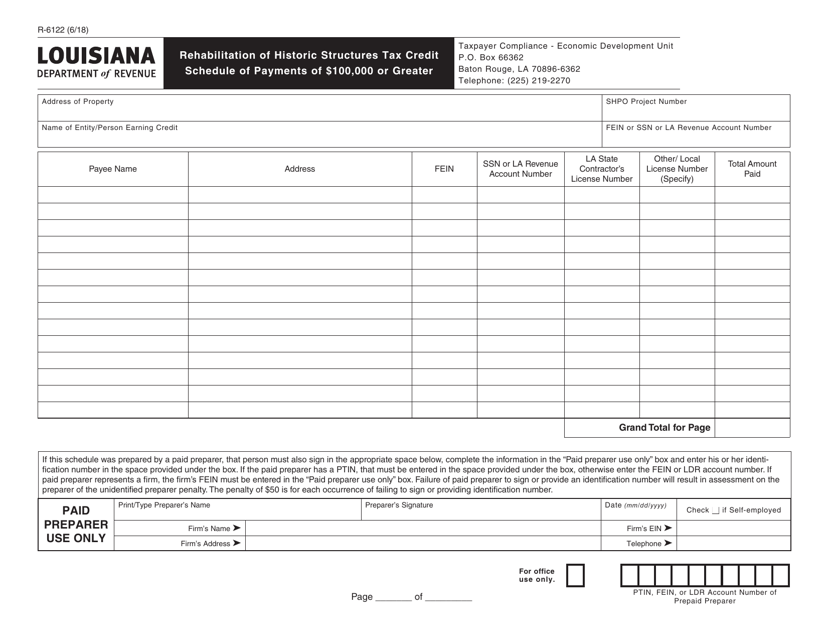

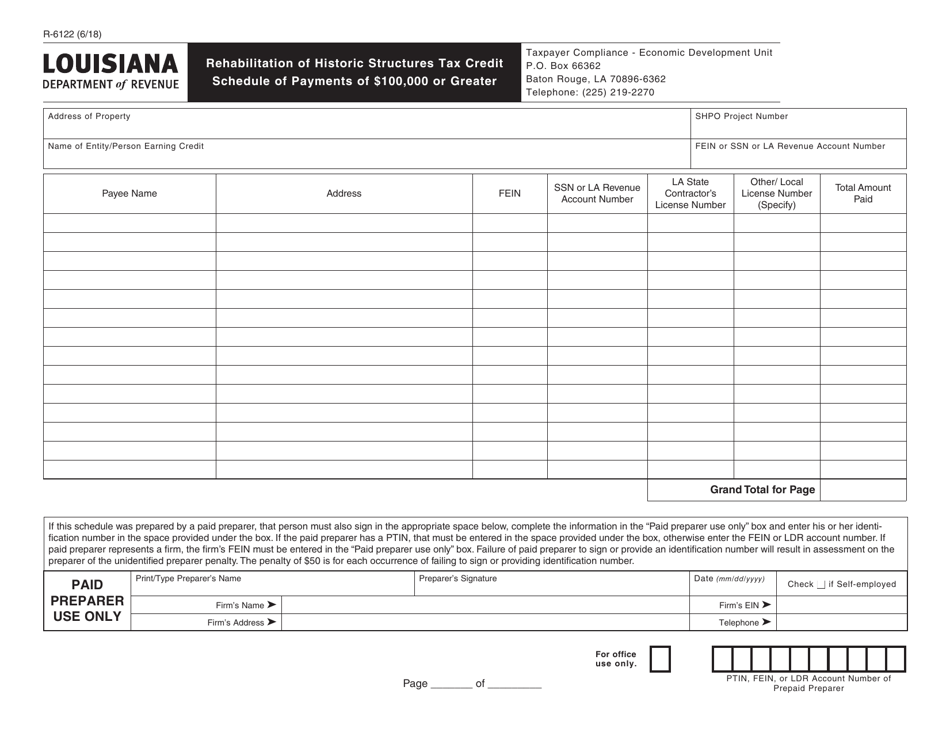

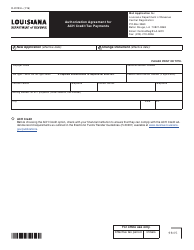

Form R-6122 Rehabilitation of Historic Structures Tax Credit Schedule of Payments of $100,000 or Greater - Louisiana

What Is Form R-6122?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6122?

A: Form R-6122 is a tax credit schedule for the rehabilitation of historic structures in Louisiana.

Q: What is the purpose of Form R-6122?

A: The purpose of Form R-6122 is to report the schedule of payments for rehabilitation projects of $100,000 or greater for historic structures in Louisiana.

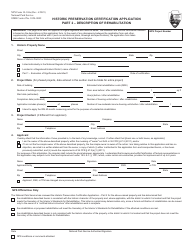

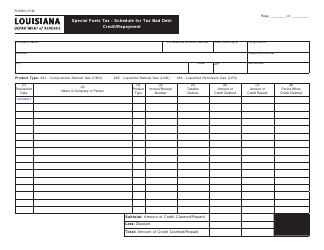

Q: What is the Rehabilitation of Historic Structures Tax Credit?

A: The Rehabilitation of Historic Structures Tax Credit is a tax incentive program in Louisiana that encourages the rehabilitation and preservation of historic buildings.

Q: What is the minimum threshold for reporting on Form R-6122?

A: Form R-6122 is required for rehabilitation projects of $100,000 or greater.

Q: Who can claim the Rehabilitation of Historic Structures Tax Credit?

A: Property owners or developers who undertake qualified rehabilitation projects on historic structures in Louisiana can claim the tax credit.

Q: How much is the tax credit for the rehabilitation of historic structures in Louisiana?

A: The tax credit for the rehabilitation of historic structures in Louisiana is 25% of the eligible rehabilitation expenses.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are limitations and restrictions on the tax credit, including the requirement to meet specific criteria for the rehabilitation project and obtaining approval from the Louisiana Division of Historic Preservation.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6122 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.