This version of the form is not currently in use and is provided for reference only. Download this version of

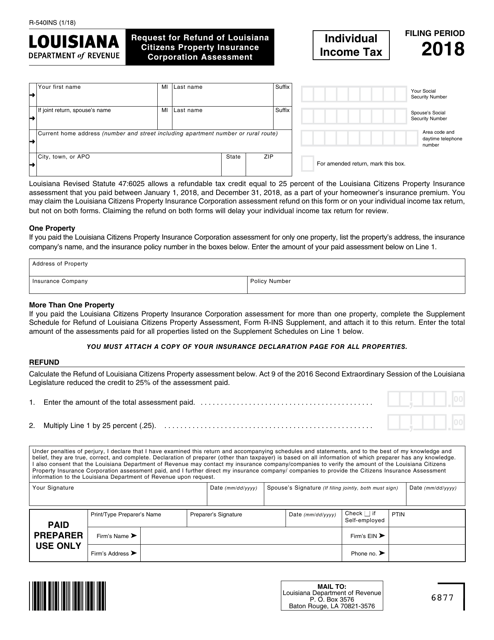

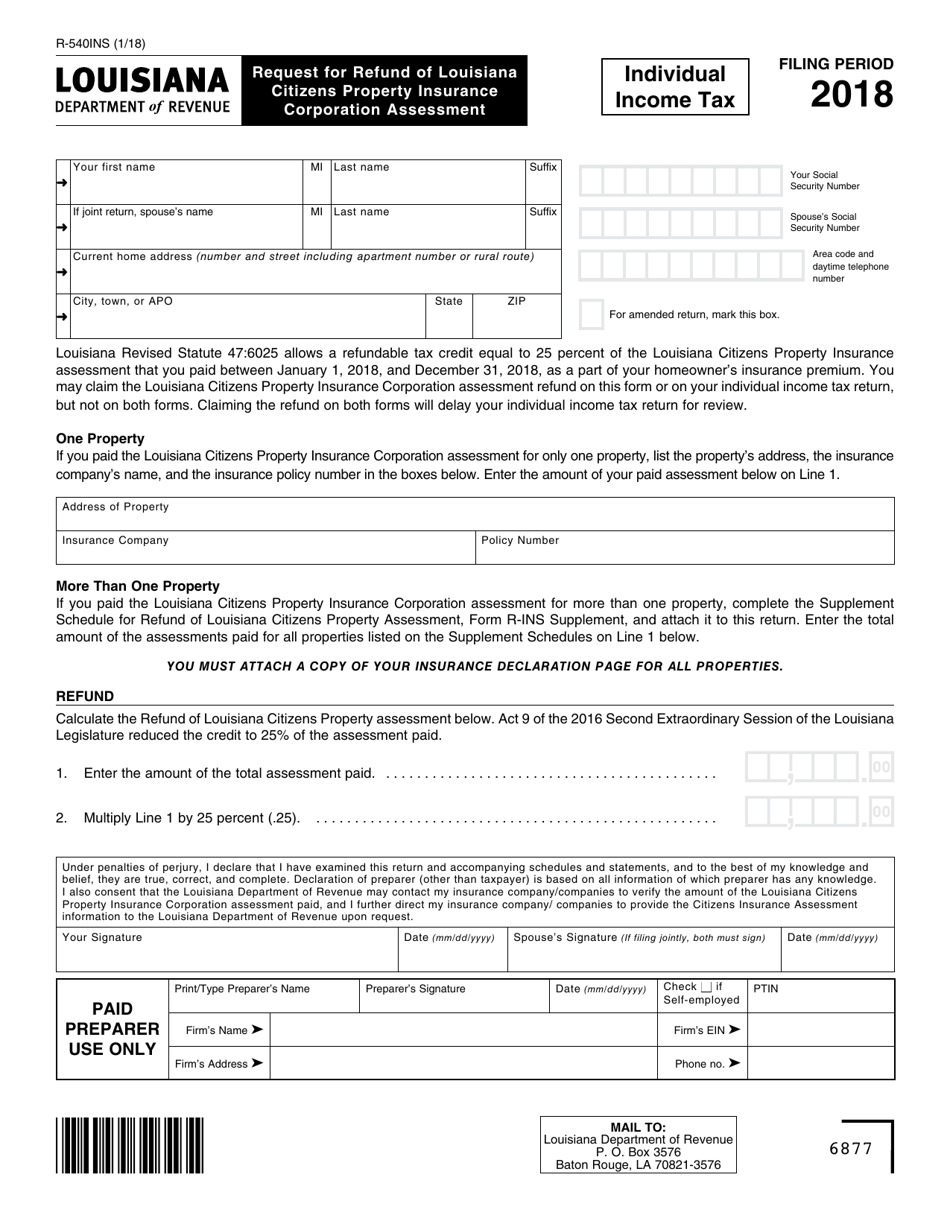

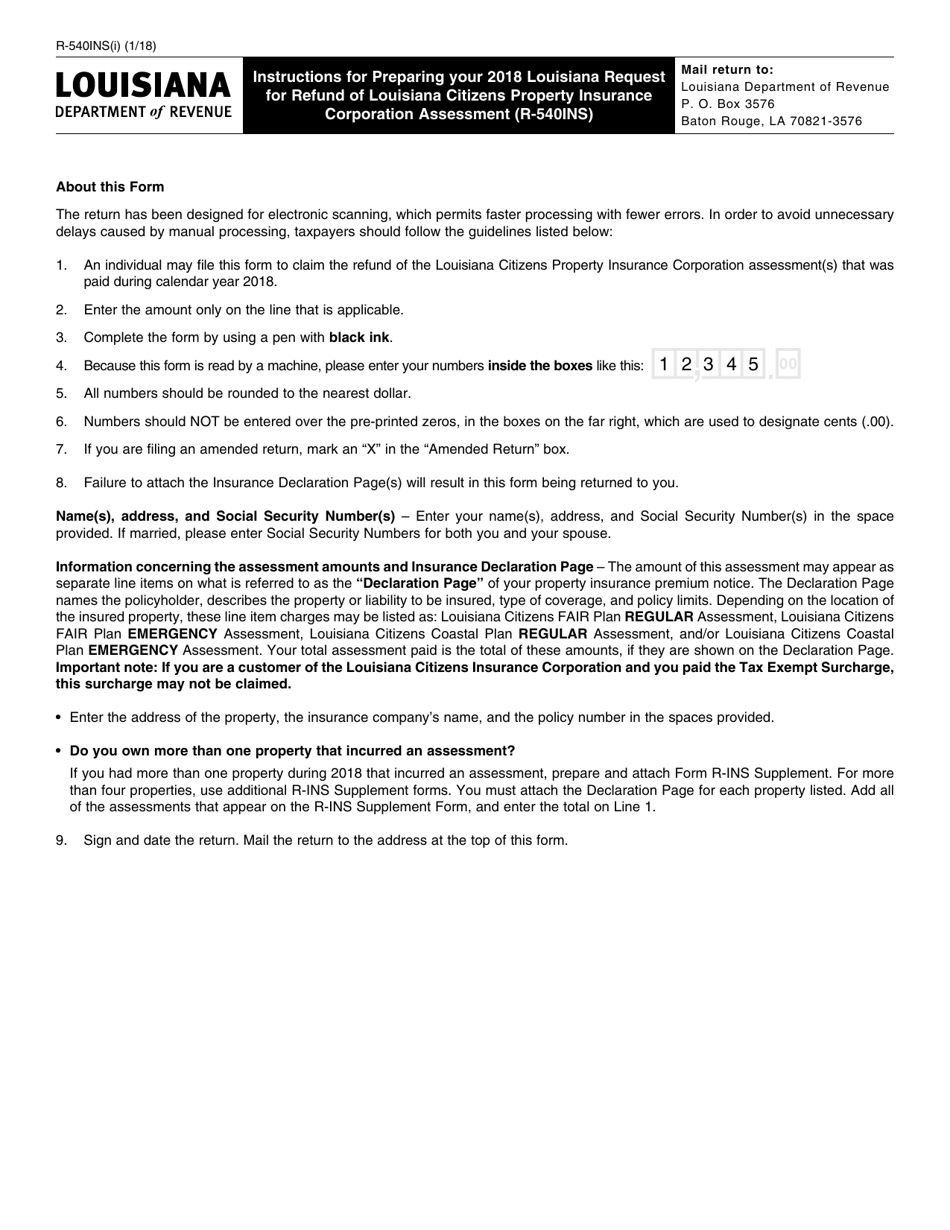

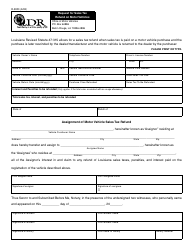

Form R-540INS

for the current year.

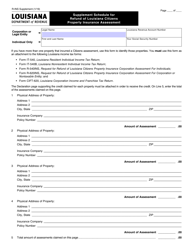

Form R-540INS Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment - Louisiana

What Is Form R-540INS?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-540INS?

A: Form R-540INS is a form used to request a refund of the Louisiana Citizens Property Insurance Corporation assessment.

Q: What is the Louisiana Citizens Property Insurance Corporation assessment?

A: The Louisiana Citizens Property Insurance Corporation assessment is a fee added to insurance policies in Louisiana to help cover the cost of providing property insurance to those who cannot obtain it through the private market.

Q: Who can use Form R-540INS?

A: Any individual or business who has paid the Louisiana Citizens Property Insurance Corporation assessment and believes they are eligible for a refund can use Form R-540INS.

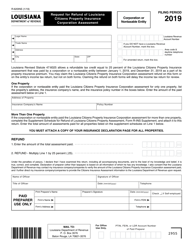

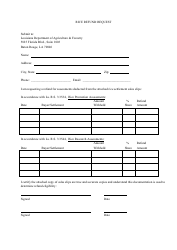

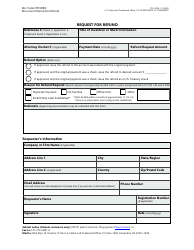

Q: How do I request a refund using Form R-540INS?

A: To request a refund using Form R-540INS, you must complete the form with your personal and insurance policy information, provide documentation of the assessment paid, and submit it to the Louisiana Department of Insurance.

Q: Are there any eligibility requirements for a refund?

A: Yes, there are eligibility requirements for a refund of the Louisiana Citizens Property Insurance Corporation assessment. You must have paid the assessment, had an active insurance policy during the assessment period, and meet certain residency criteria.

Q: Is there a deadline to submit Form R-540INS?

A: Yes, there is a deadline to submit Form R-540INS for a refund of the Louisiana Citizens Property Insurance Corporation assessment. The deadline is typically within one year of the assessment being paid.

Q: How long does it take to process a refund request?

A: The processing time for a refund request using Form R-540INS can vary. It may take several weeks to several months to receive a refund.

Q: What should I do if my refund request is denied?

A: If your refund request is denied, you may have the option to appeal the decision or seek further assistance from the Louisiana Department of Insurance.

Q: Can I request a refund for multiple assessment periods?

A: Yes, you can request a refund for multiple assessment periods using Form R-540INS, as long as you meet the eligibility criteria for each period.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-540INS by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.