This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-10610

for the current year.

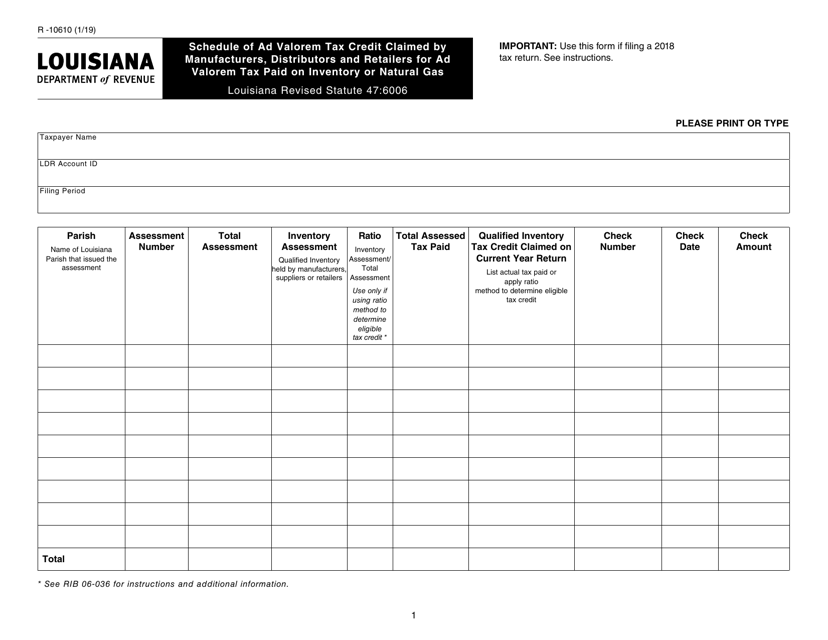

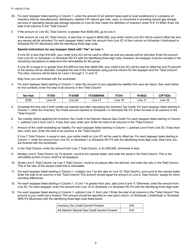

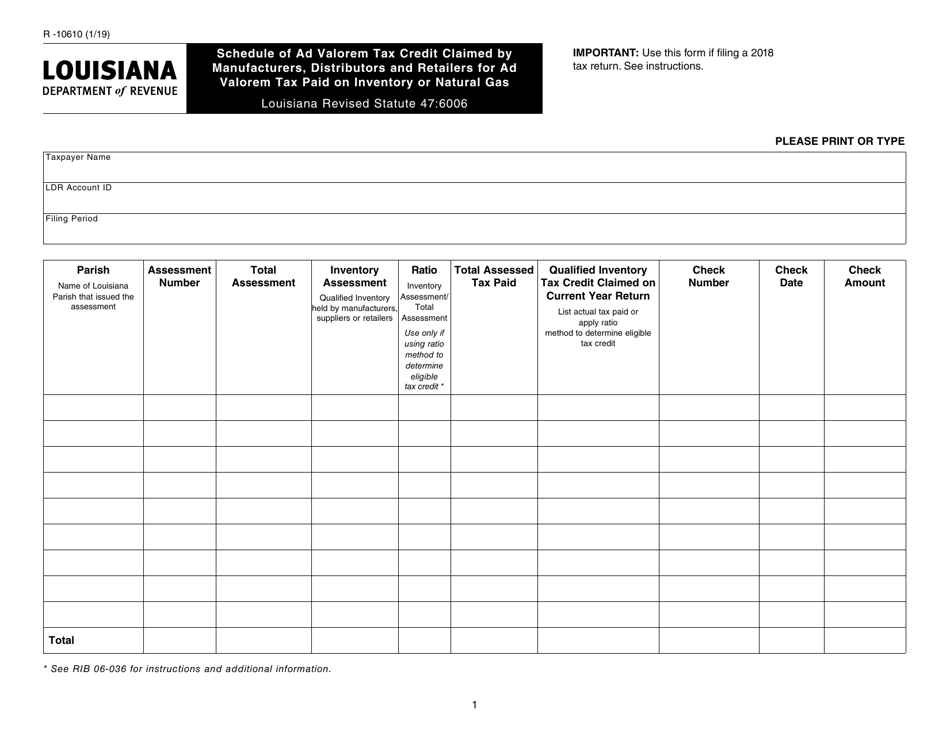

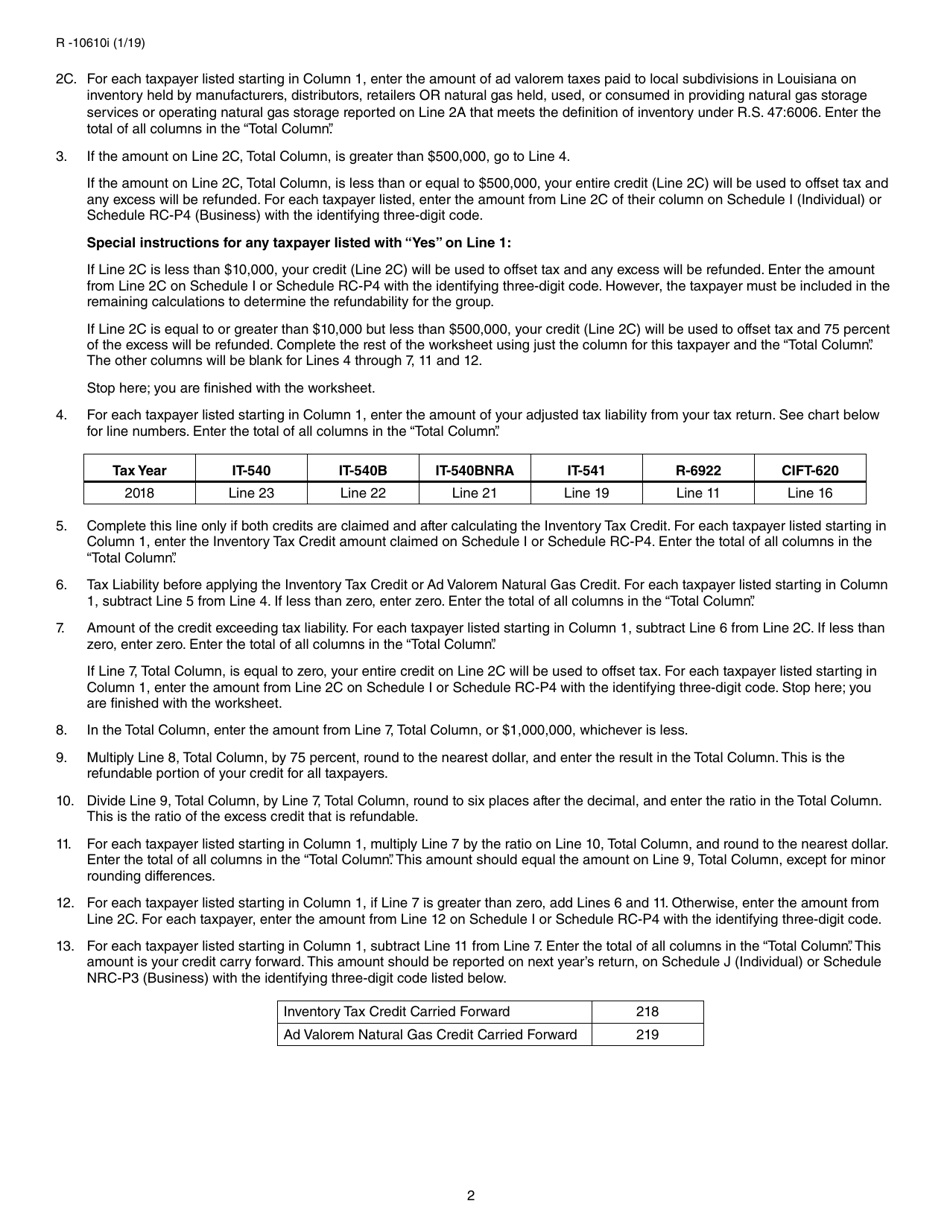

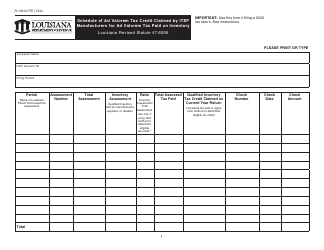

Form R-10610 Schedule of Ad Valorem Tax Credit Claimed by Manufacturers, Distributors and Retailers for Ad Valorem Tax Paid on Inventory or Natural Gas - Louisiana

What Is Form R-10610?

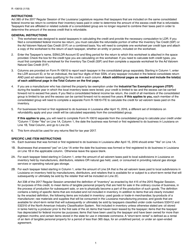

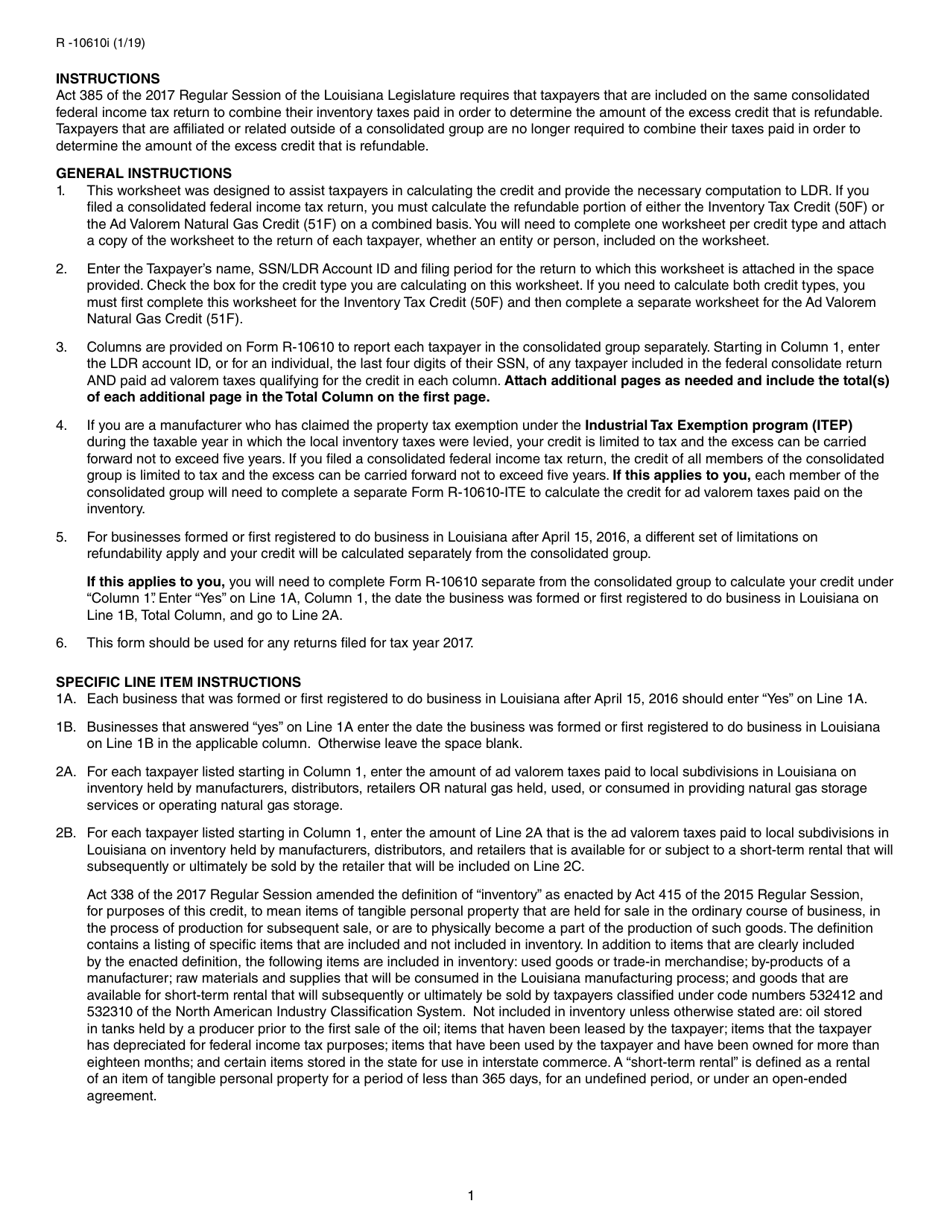

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10610?

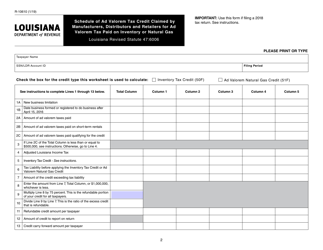

A: Form R-10610 is a schedule used by manufacturers, distributors, and retailers in Louisiana to claim ad valorem tax credit for inventory or natural gas.

Q: Who can use Form R-10610?

A: Manufacturers, distributors, and retailers in Louisiana can use Form R-10610.

Q: What is the purpose of Form R-10610?

A: The purpose of Form R-10610 is to claim ad valorem tax credit for inventory or natural gas paid by manufacturers, distributors, and retailers in Louisiana.

Q: What types of taxes are covered by Form R-10610?

A: Form R-10610 covers ad valorem tax paid on inventory or natural gas.

Q: When should Form R-10610 be filed?

A: Form R-10610 should be filed annually by the due date of the Louisiana Corporation Income and Franchise Tax Return.

Q: Is there a fee to file Form R-10610?

A: No, there is no fee to file Form R-10610.

Q: Are there any penalties for late filing of Form R-10610?

A: Yes, there may be penalties for late filing of Form R-10610, so it is important to file it by the due date.

Q: Who can I contact for more information about Form R-10610?

A: For more information about Form R-10610, you can contact the Louisiana Department of Revenue or consult a tax professional.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10610 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.