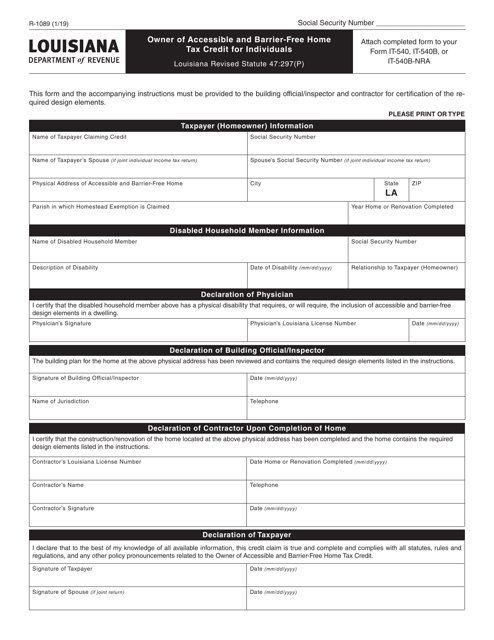

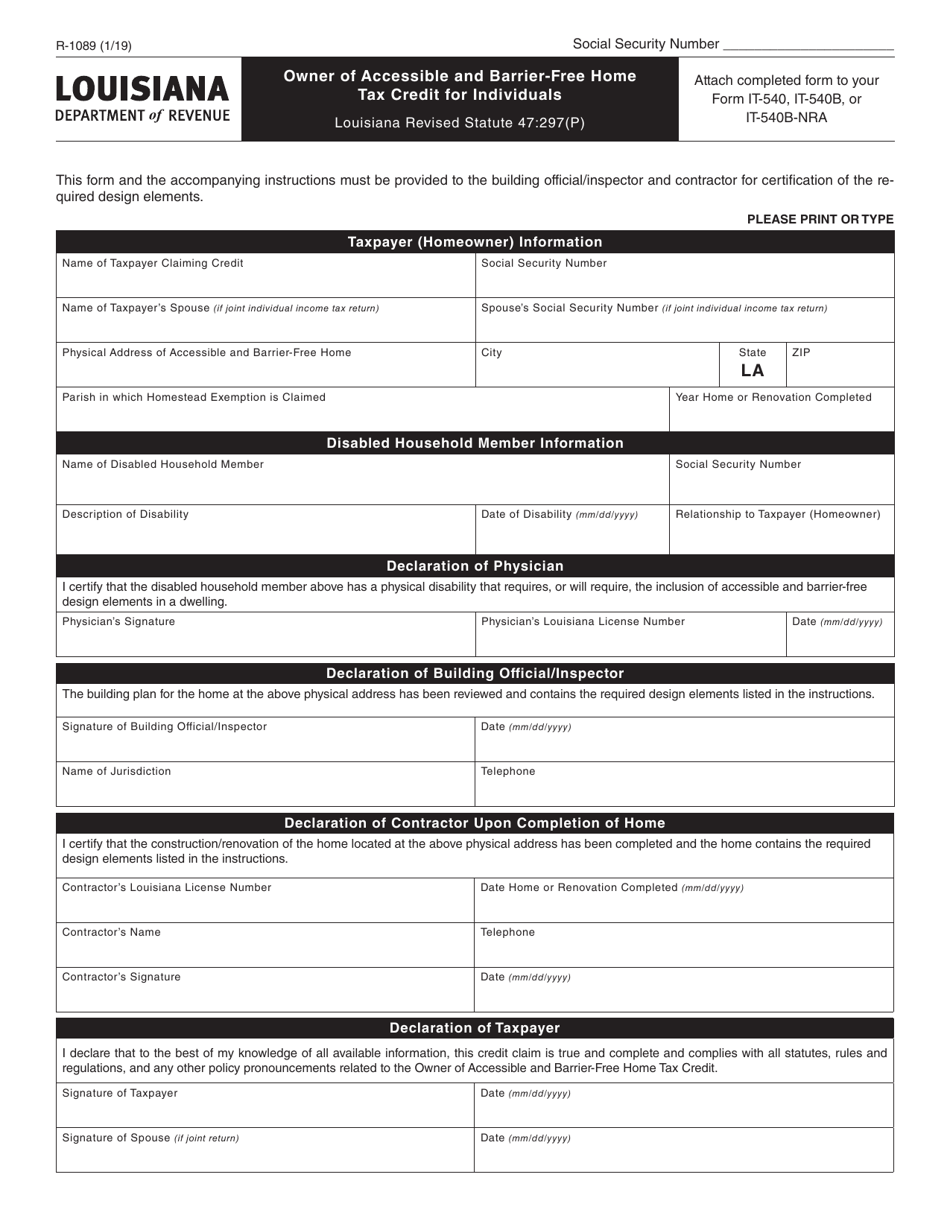

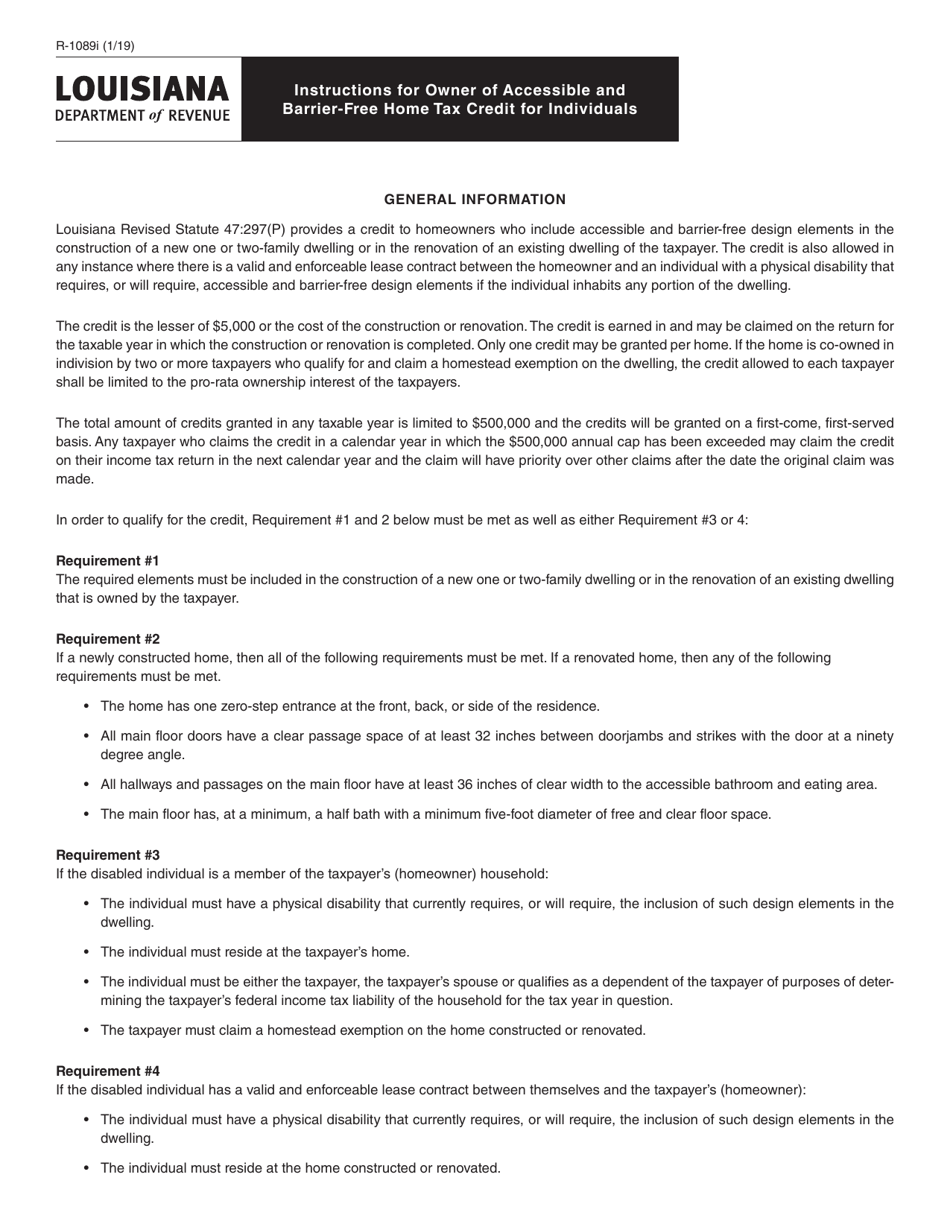

Form R-1089 Owner of Accessible and Barrier-Free Home Tax Credit for Individuals - Louisiana

What Is Form R-1089?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1089?

A: Form R-1089 is a tax form in Louisiana that is used to claim the Owner of Accessible and Barrier-Free Home Tax Credit for Individuals.

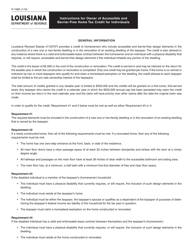

Q: What is the Owner of Accessible and Barrier-Free Home Tax Credit?

A: The Owner of Accessible and Barrier-Free Home Tax Credit is a tax credit available to individuals in Louisiana who own or have made modifications to their home to make it accessible and barrier-free for people with disabilities.

Q: Who is eligible for the tax credit?

A: Individuals who own a home in Louisiana and have made qualifying accessibility modifications to their property may be eligible for the tax credit.

Q: What are qualifying accessibility modifications?

A: Qualifying accessibility modifications include installing ramps, widening doorways, adding grab bars, and other improvements that make the home more accessible for people with disabilities.

Q: How much is the tax credit?

A: The tax credit is equal to 50% of the cost of the qualifying accessibility modifications, up to a maximum credit of $5,000.

Q: Can the tax credit be carried forward?

A: No, the tax credit cannot be carried forward to future years. It can only be used to offset the taxpayer's liability for the current tax year.

Q: How do I claim the tax credit?

A: To claim the tax credit, you must complete and file Form R-1089 with your Louisiana income tax return.

Q: Is there a deadline to claim the tax credit?

A: Yes, the tax credit must be claimed in the same year that the qualifying accessibility modifications are made.

Q: Can the tax credit be claimed by more than one person?

A: No, the tax credit can only be claimed by the individual who owns the home and has made the qualifying accessibility modifications.

Q: Is there a limit to the number of times the tax credit can be claimed?

A: No, there is no limit to the number of times the tax credit can be claimed, as long as each claim is for a different home and qualifying accessibility modifications have been made.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1089 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.