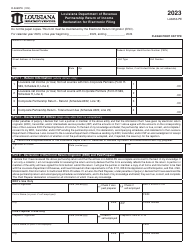

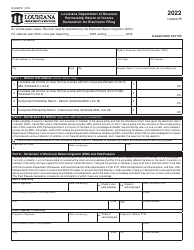

This version of the form is not currently in use and is provided for reference only. Download this version of

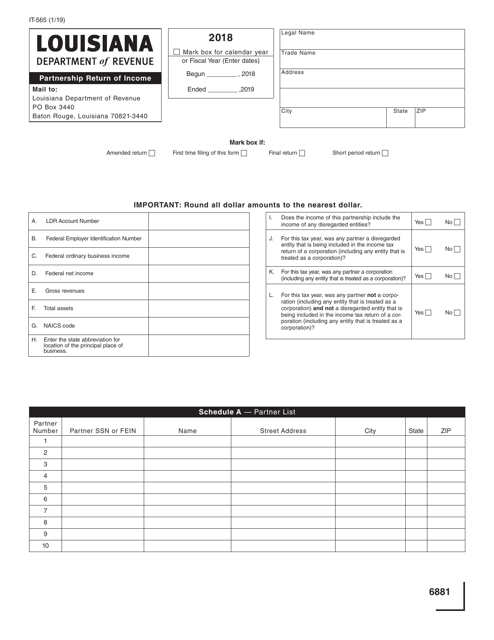

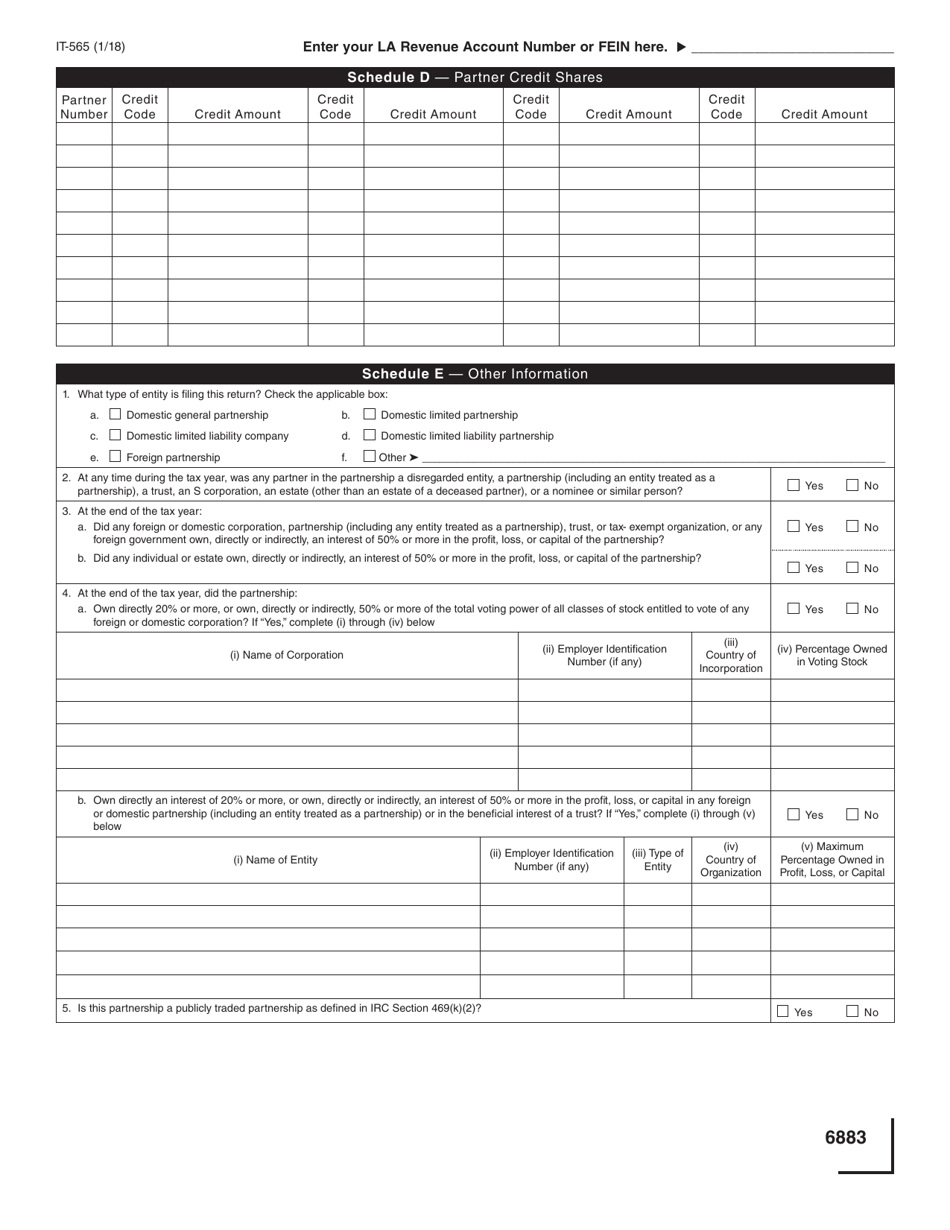

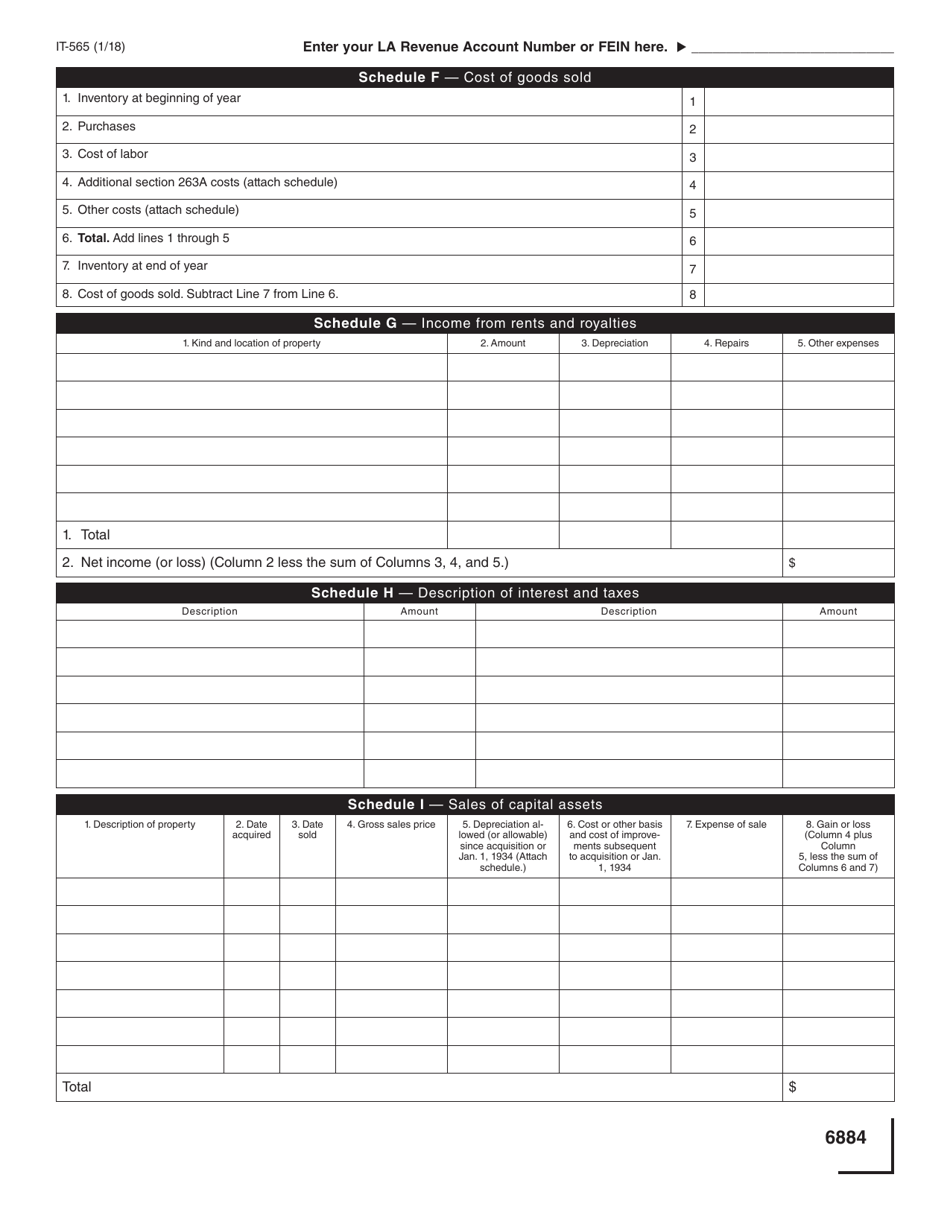

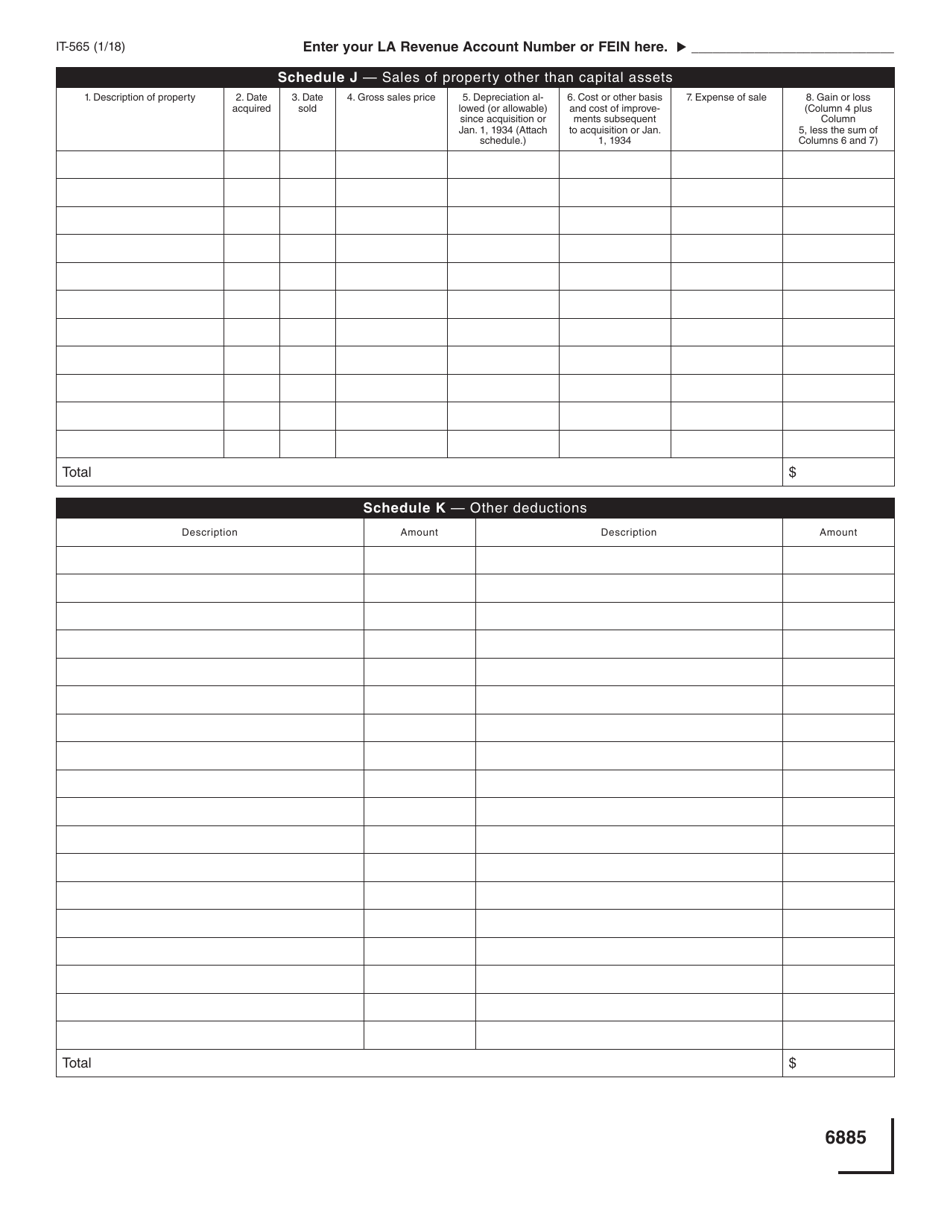

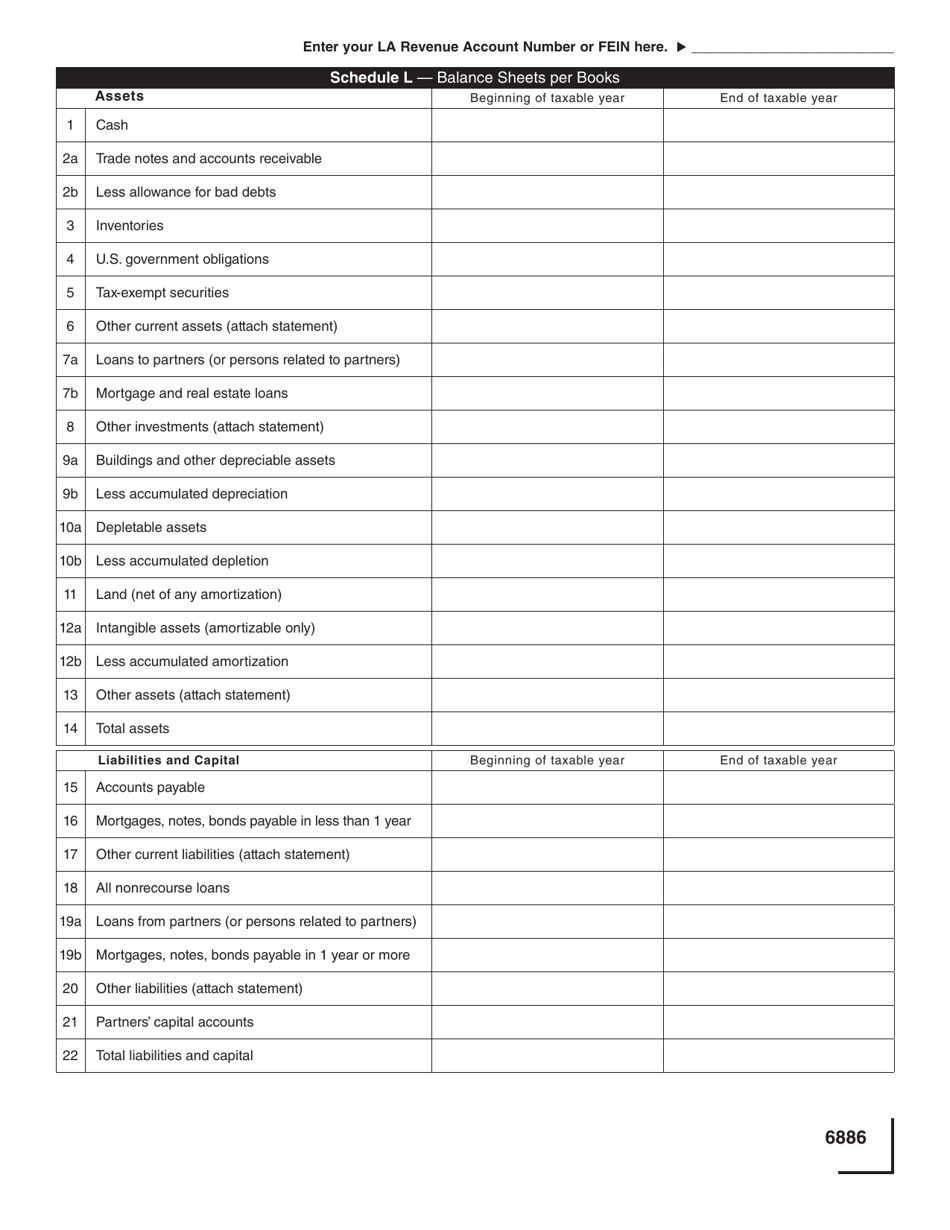

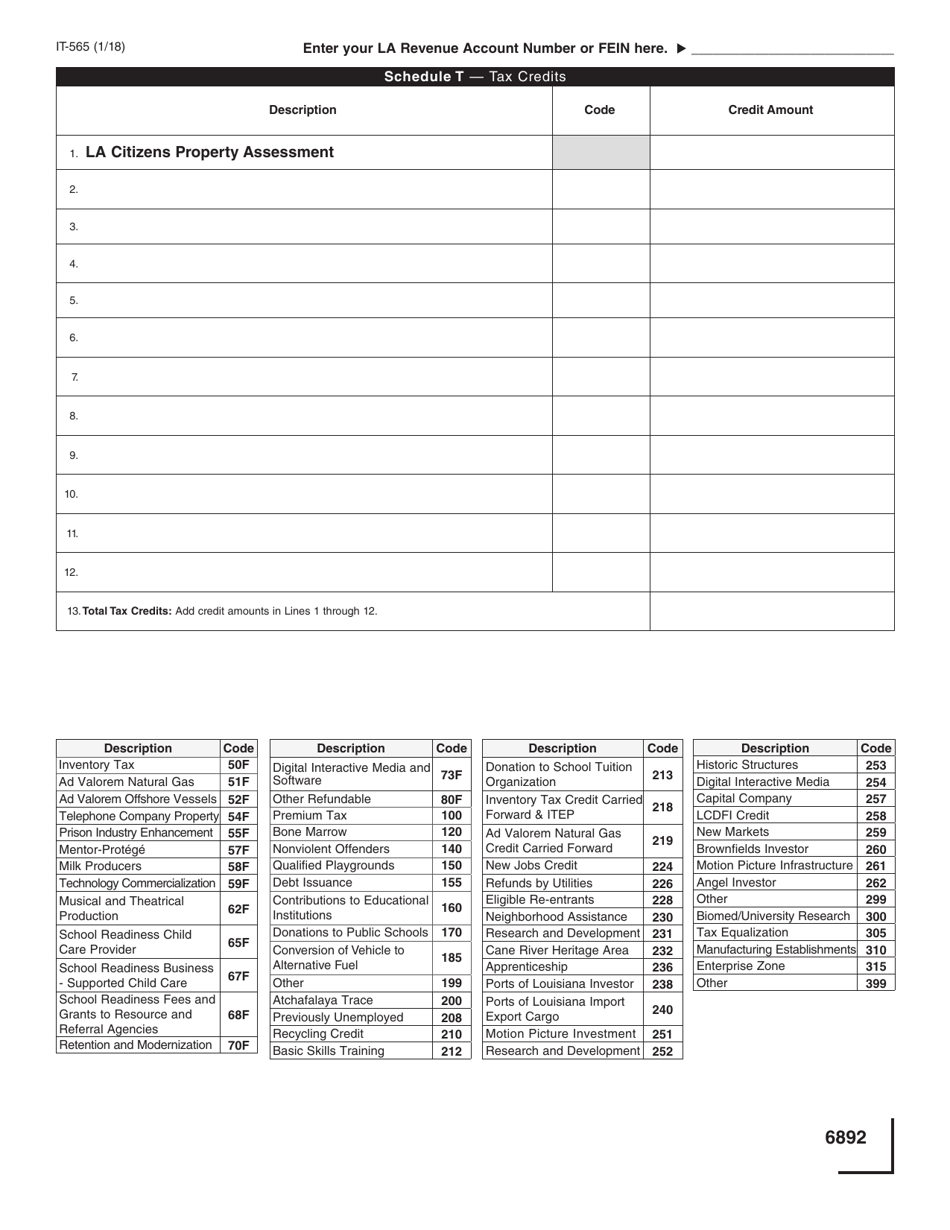

Form IT-565

for the current year.

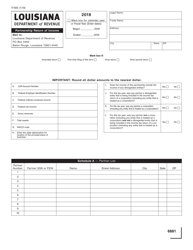

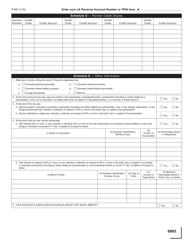

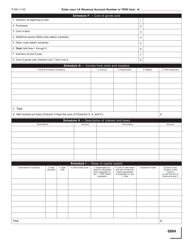

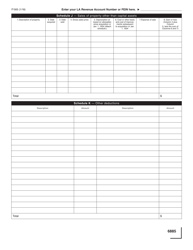

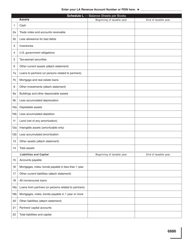

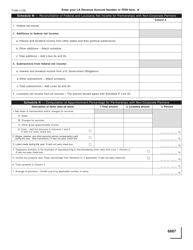

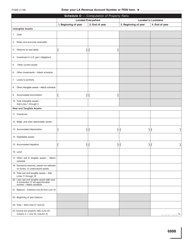

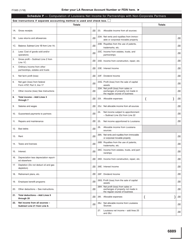

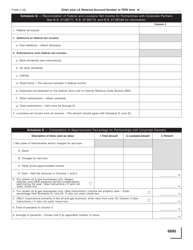

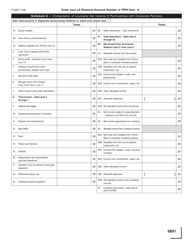

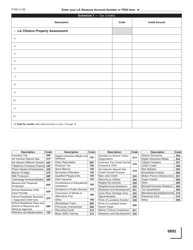

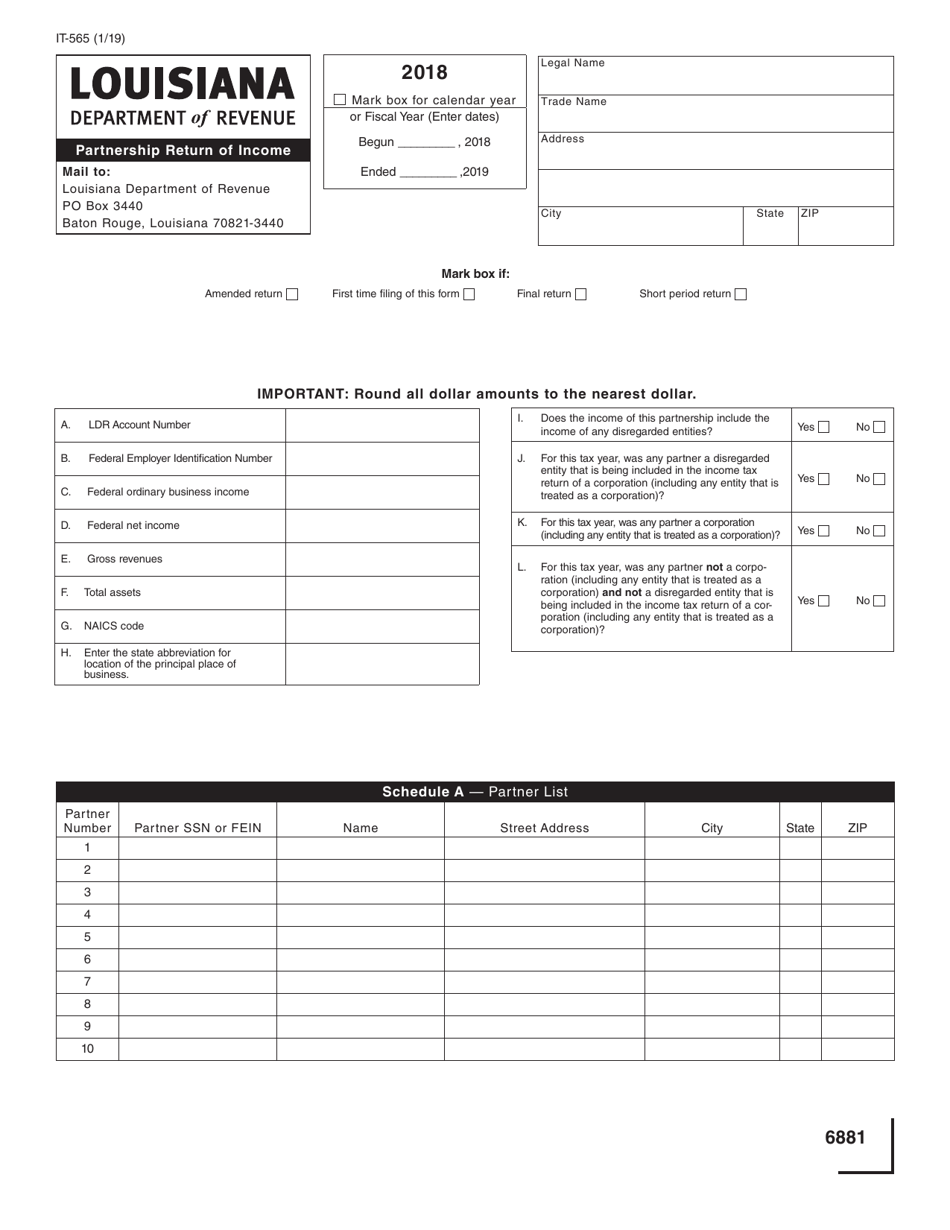

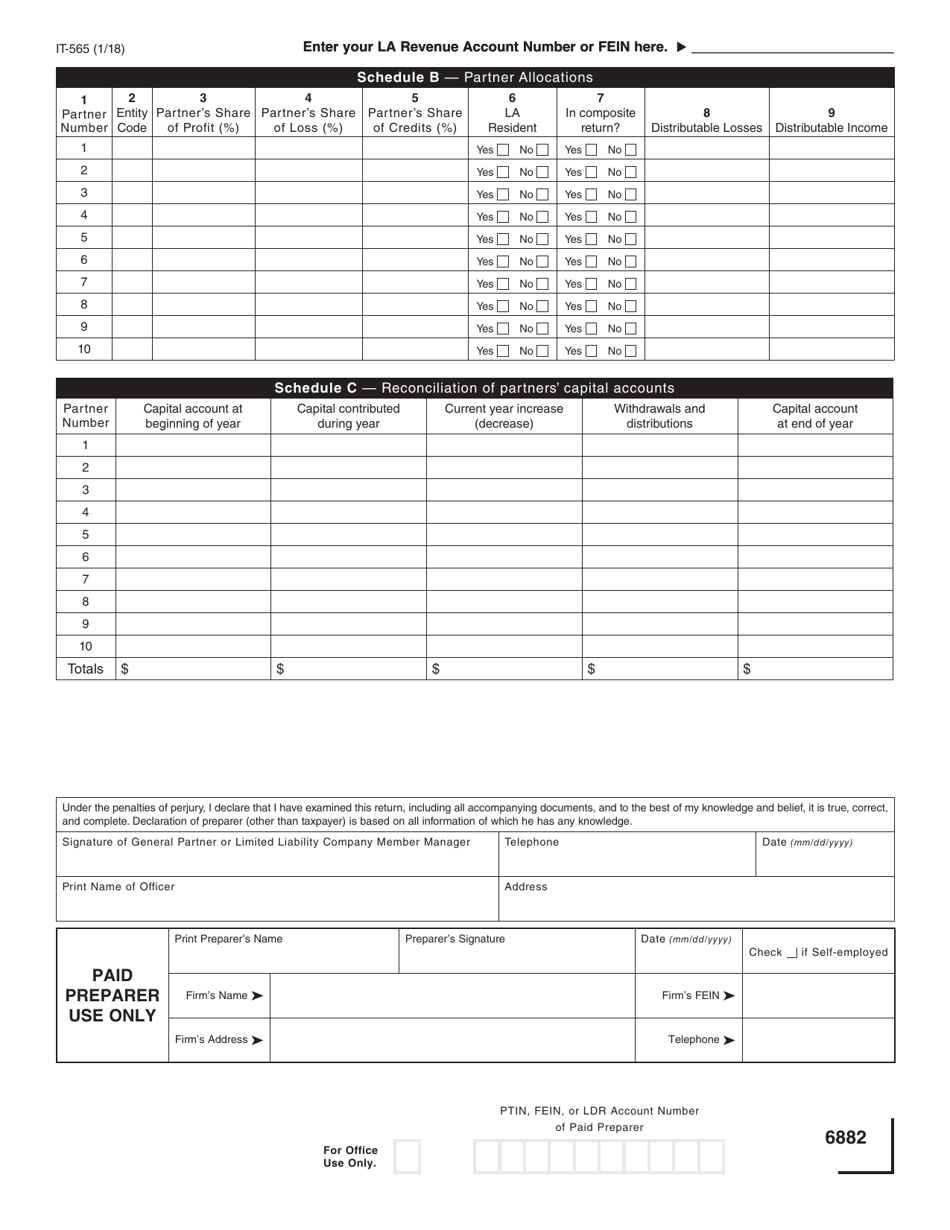

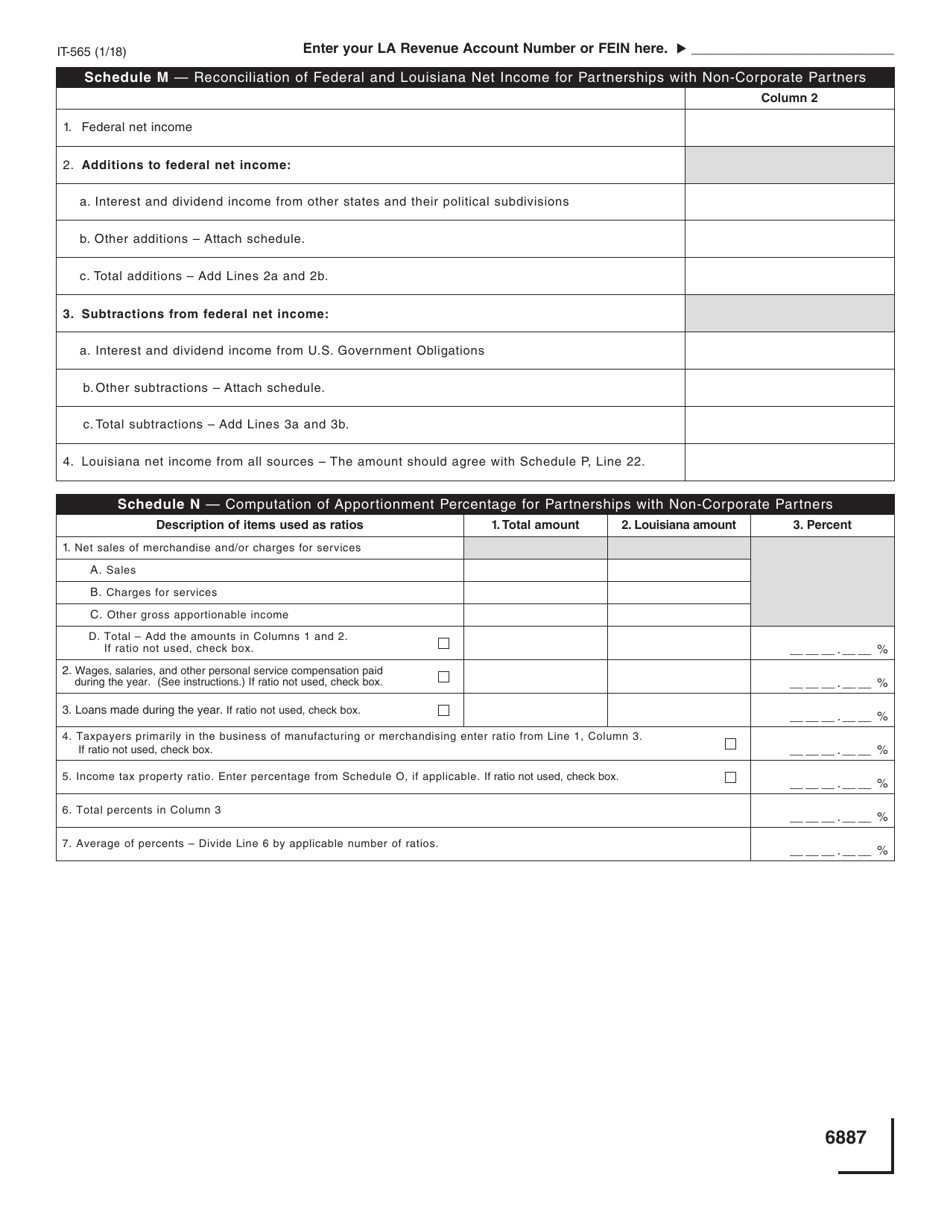

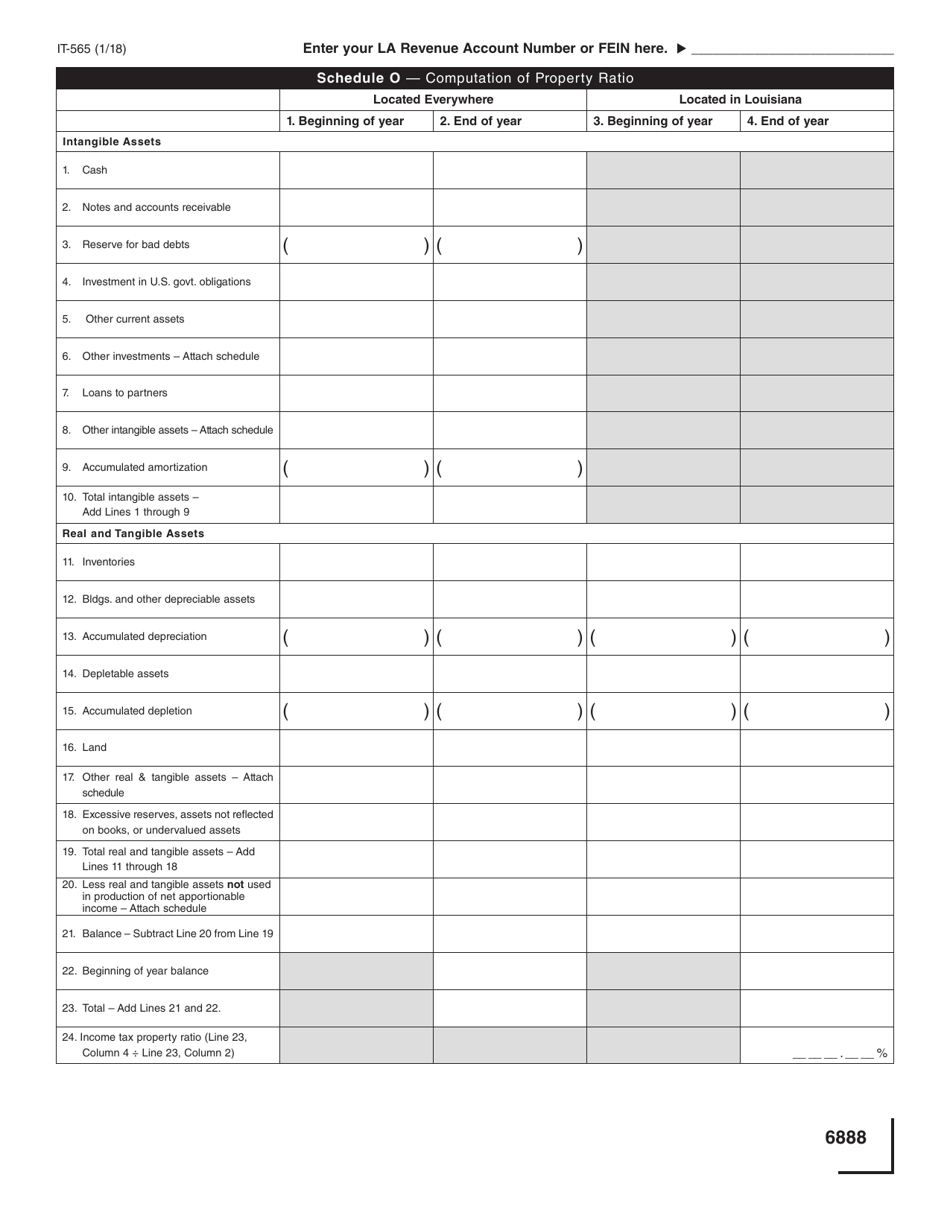

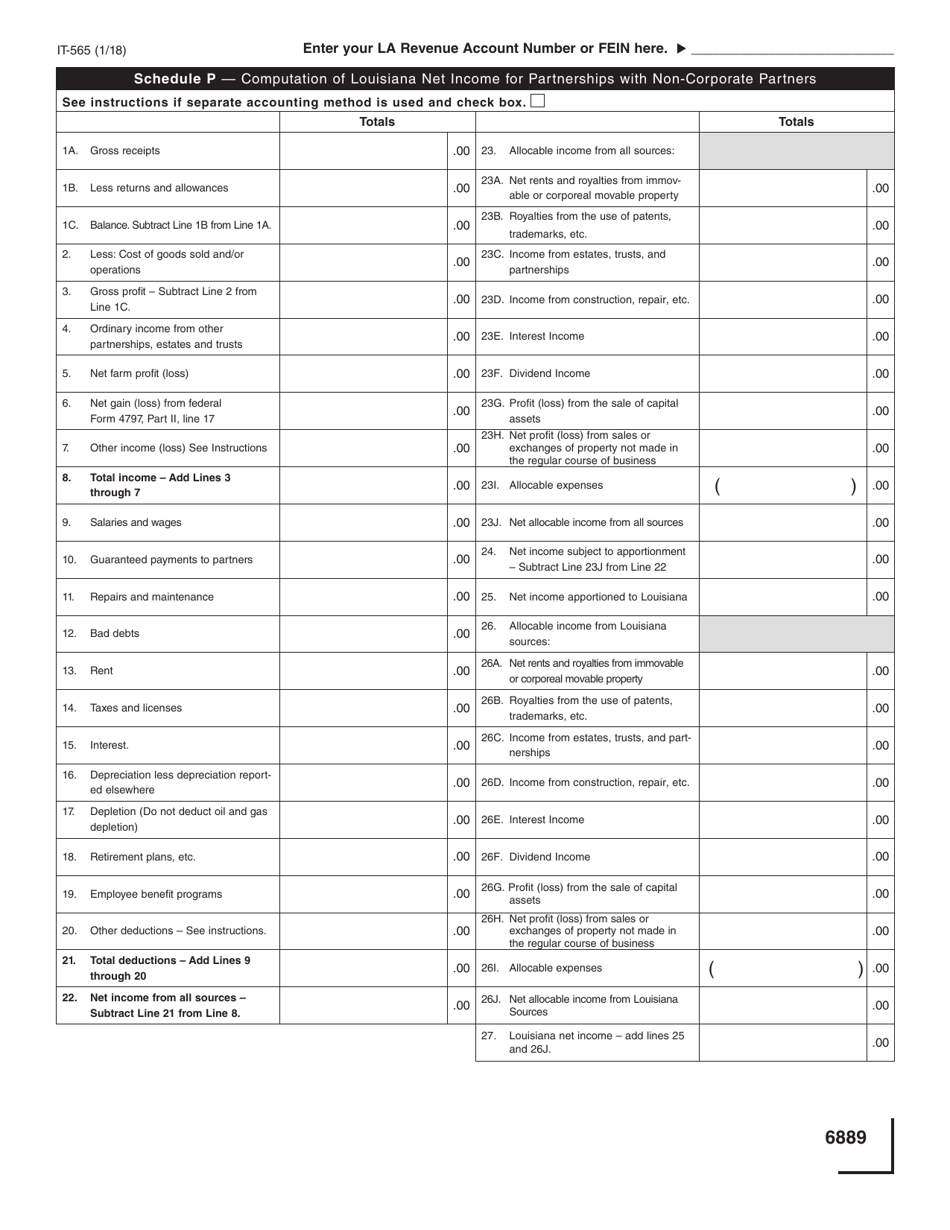

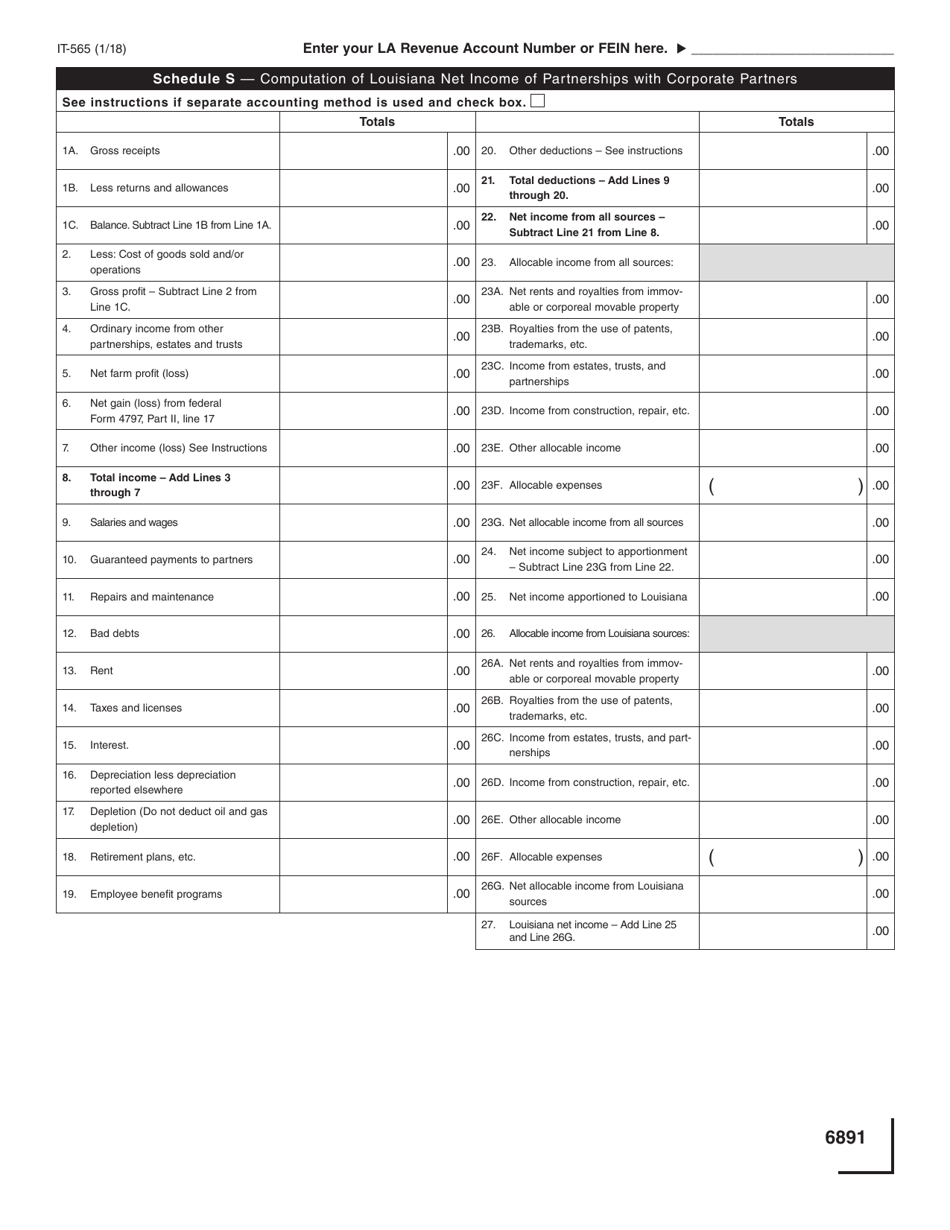

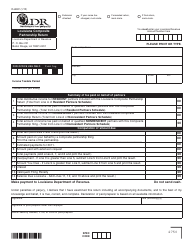

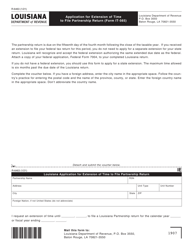

Form IT-565 Partnership Return of Income - Louisiana

What Is Form IT-565?

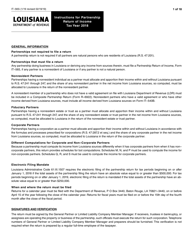

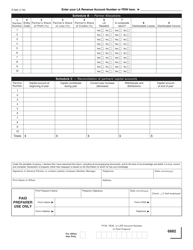

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-565?

A: Form IT-565 is the Partnership Return of Income form used in Louisiana.

Q: Who needs to file Form IT-565?

A: Partnerships in Louisiana need to file Form IT-565.

Q: What is the purpose of Form IT-565?

A: Form IT-565 is used to report partnership income, deductions, credits, and other information to the Louisiana Department of Revenue.

Q: When is the deadline to file Form IT-565?

A: The deadline to file Form IT-565 in Louisiana is the 15th day of the fourth month following the close of the partnership's tax year.

Q: Are there any specific requirements for completing Form IT-565?

A: Yes, there are specific instructions provided by the Louisiana Department of Revenue that need to be followed when completing Form IT-565.

Q: Is there a fee to file Form IT-565?

A: No, there is no fee to file Form IT-565 in Louisiana.

Q: Can Form IT-565 be filed electronically?

A: Yes, Louisiana allows partnerships to file Form IT-565 electronically.

Q: What should I do if I need more time to file Form IT-565?

A: Louisiana allows for an extension of time to file Form IT-565. You can request an extension using Form R-6461, Application for Extension of Time to File.

Q: What are the consequences of not filing Form IT-565?

A: Failure to file Form IT-565 in Louisiana can result in penalties and interest being assessed by the Louisiana Department of Revenue.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-565 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.