This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-540

for the current year.

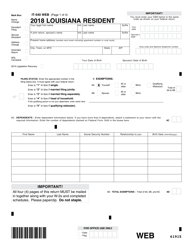

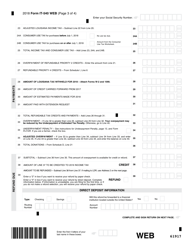

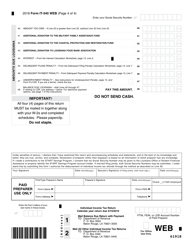

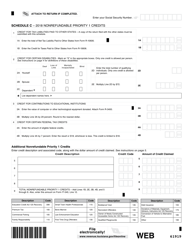

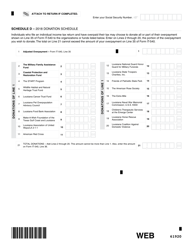

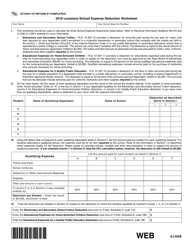

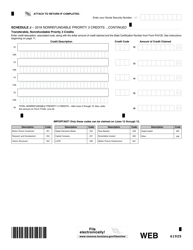

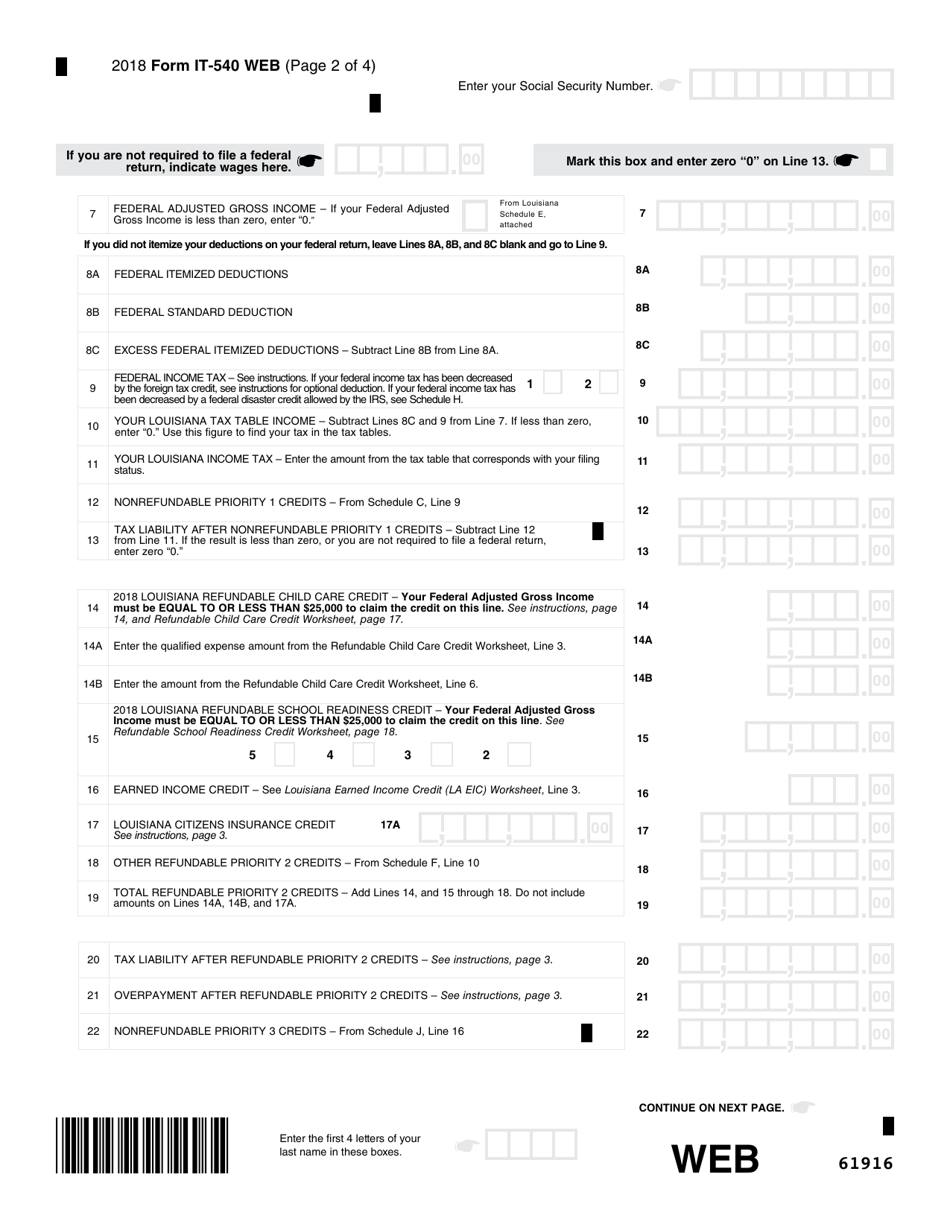

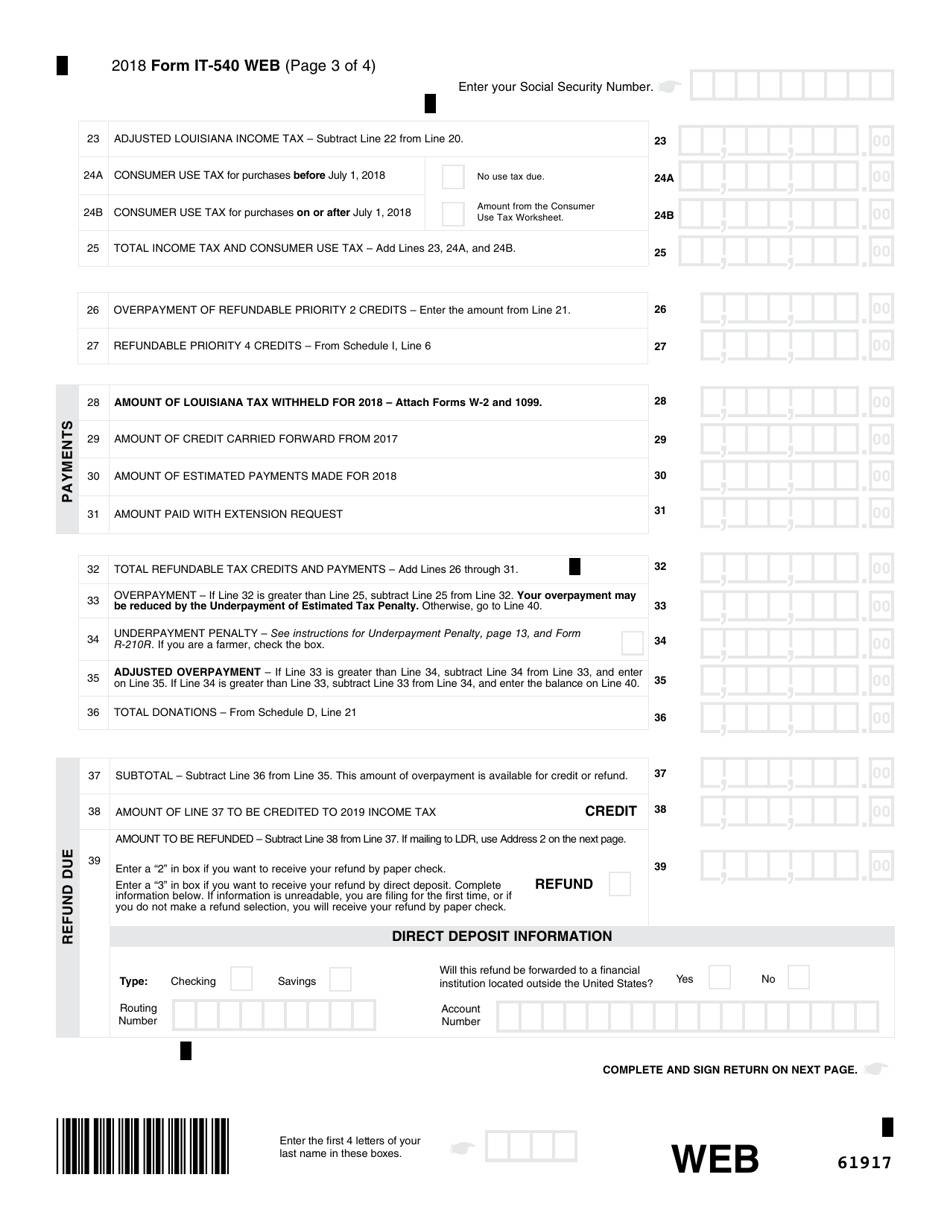

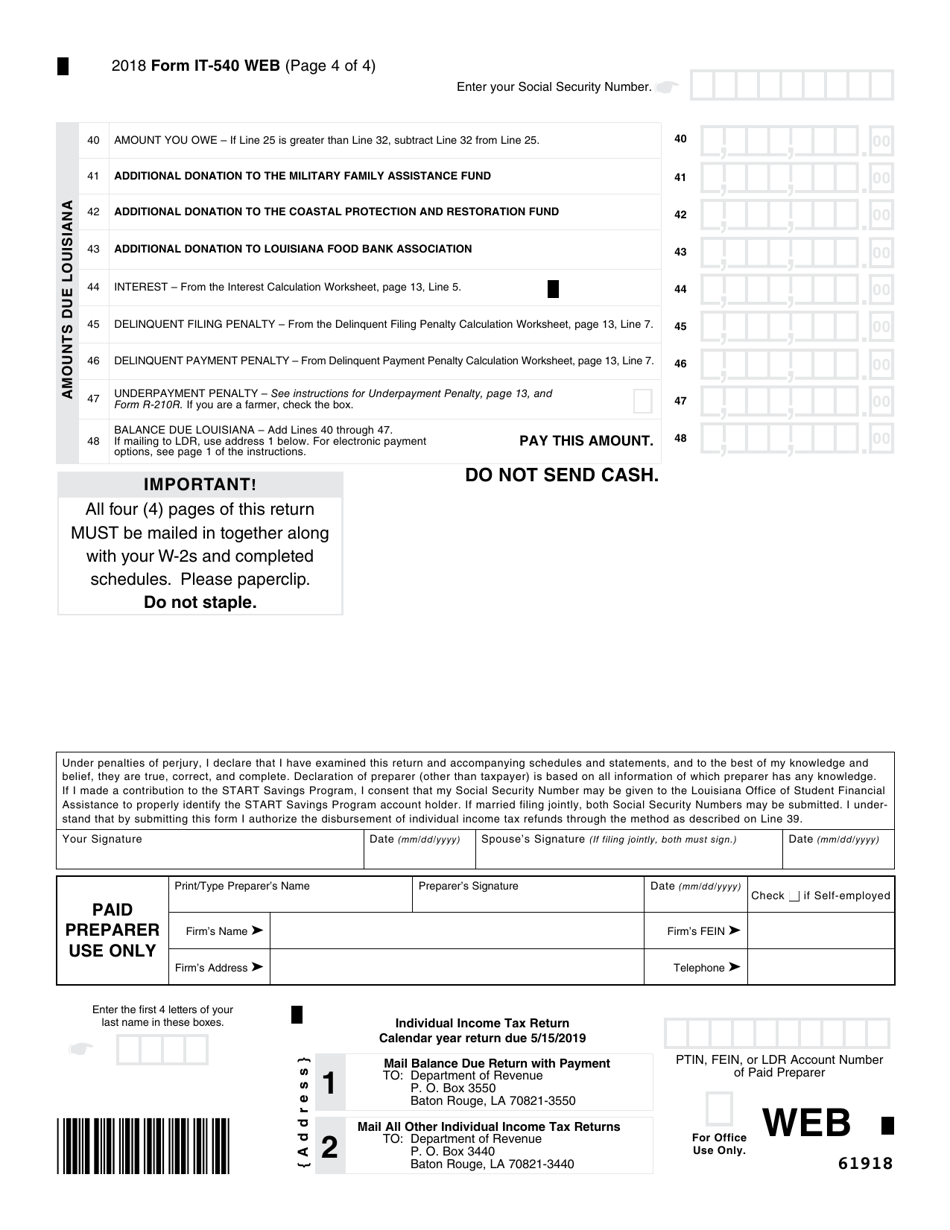

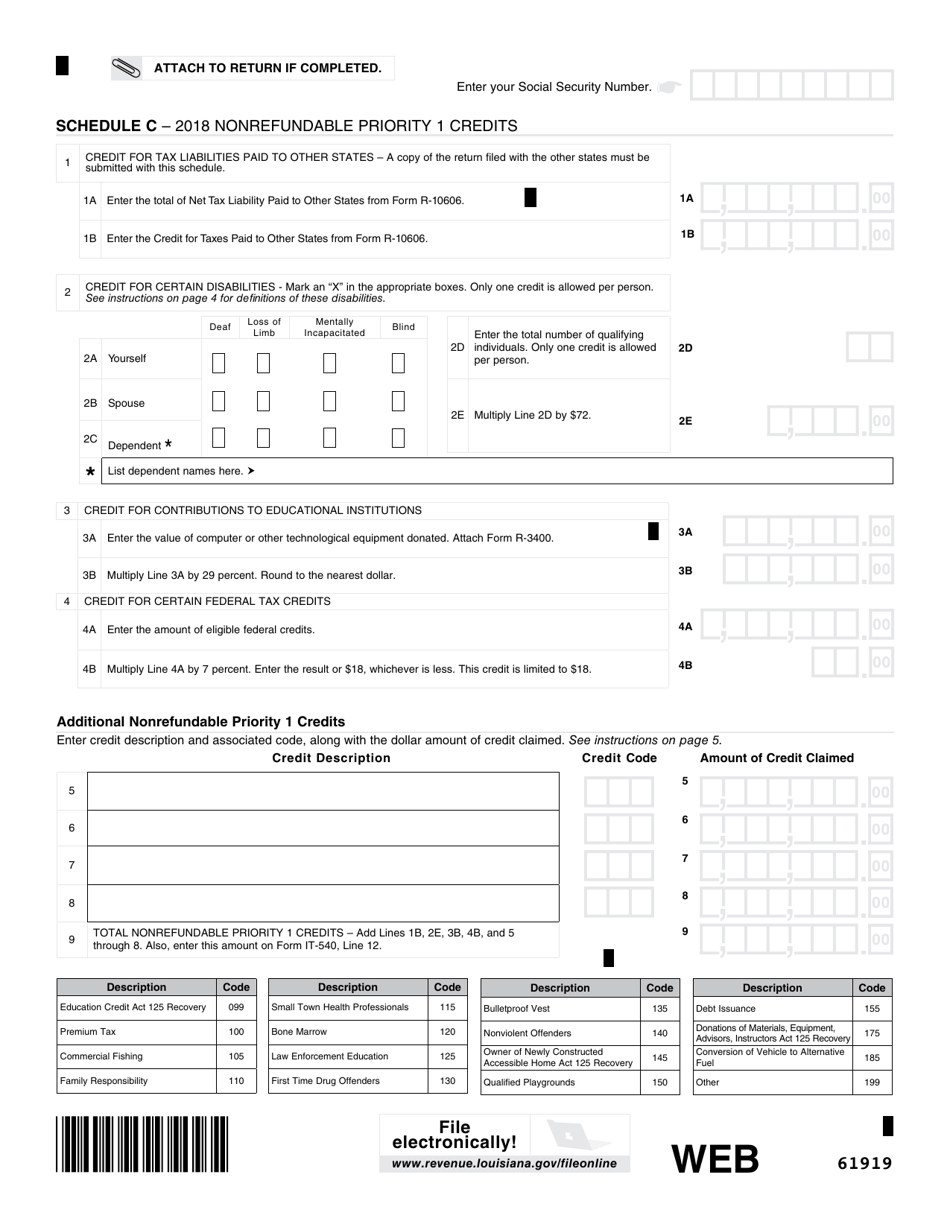

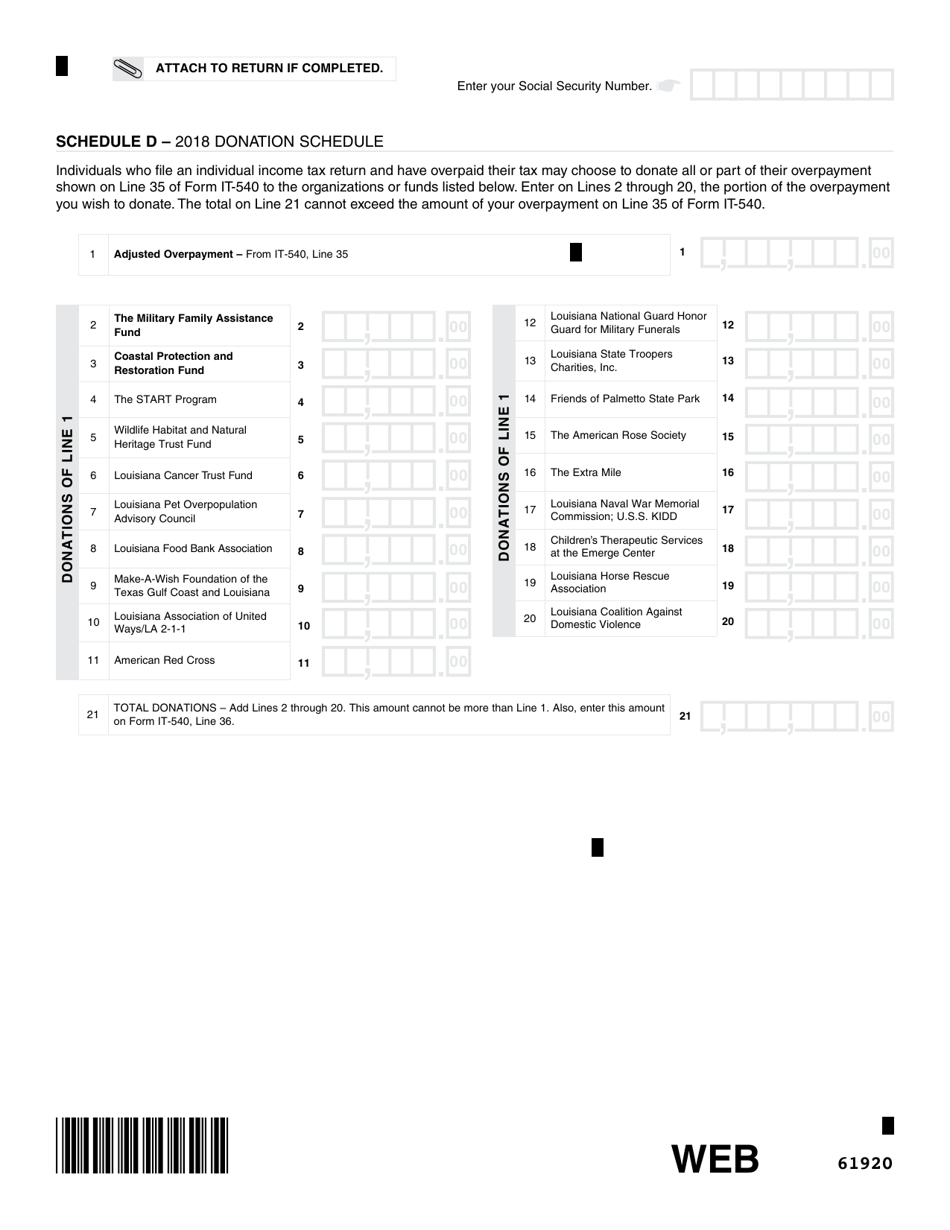

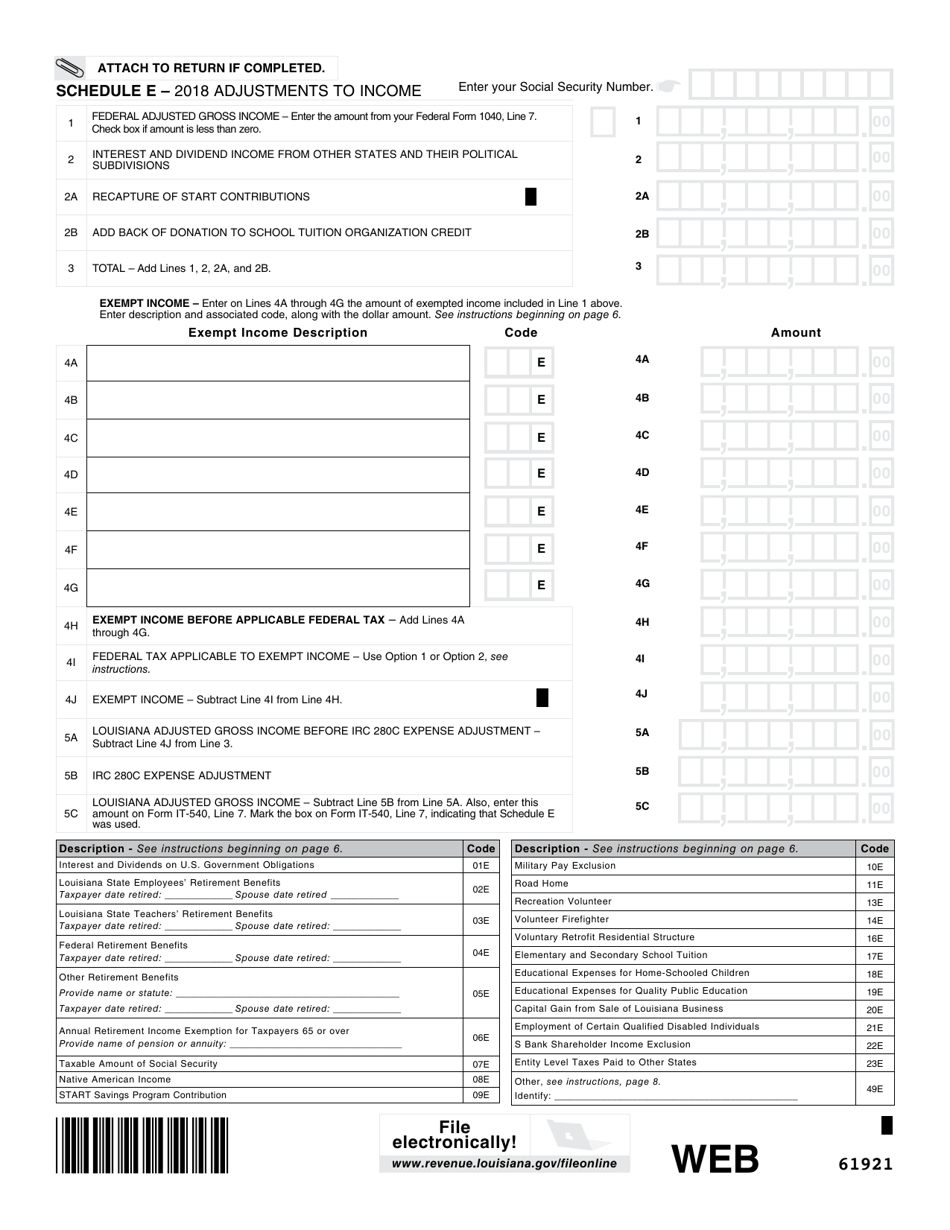

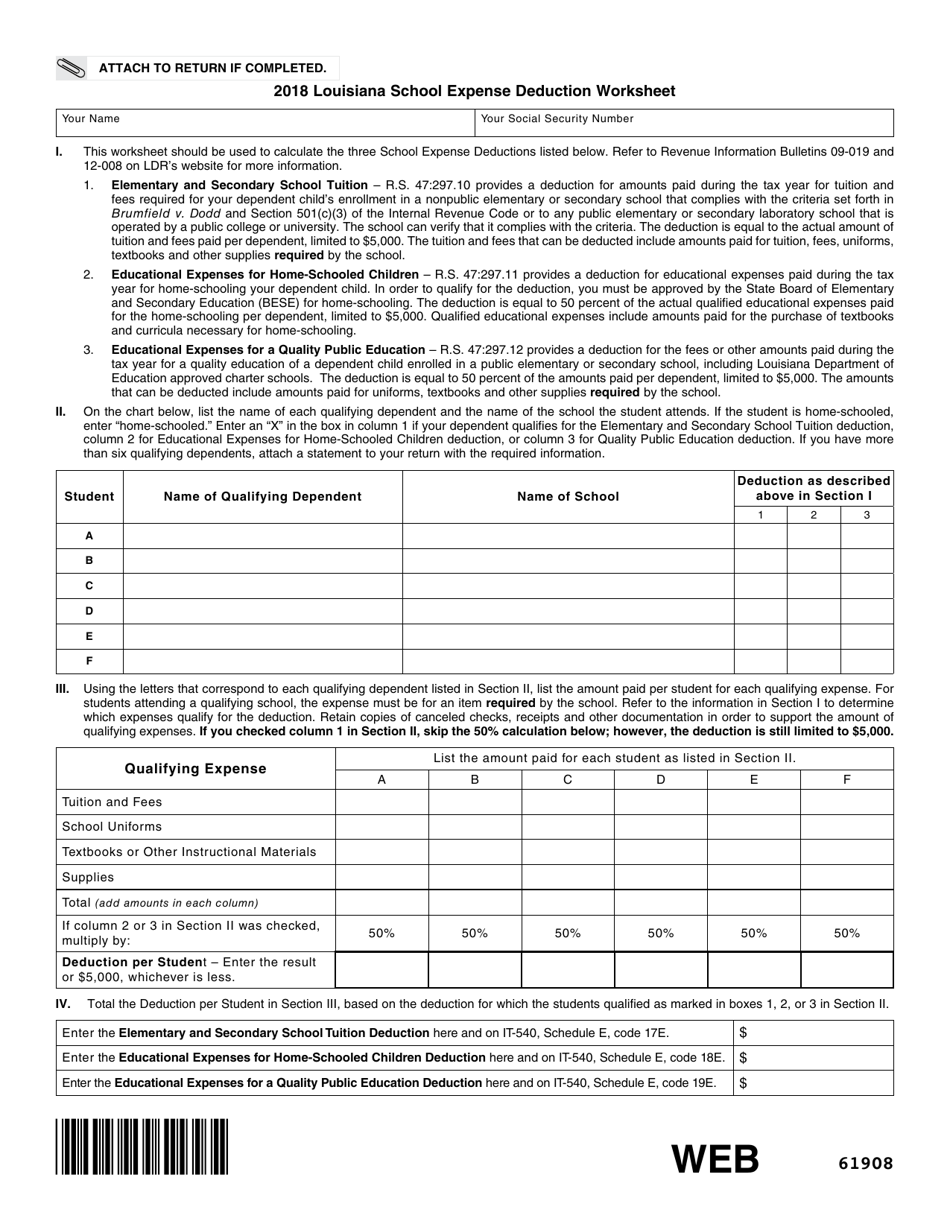

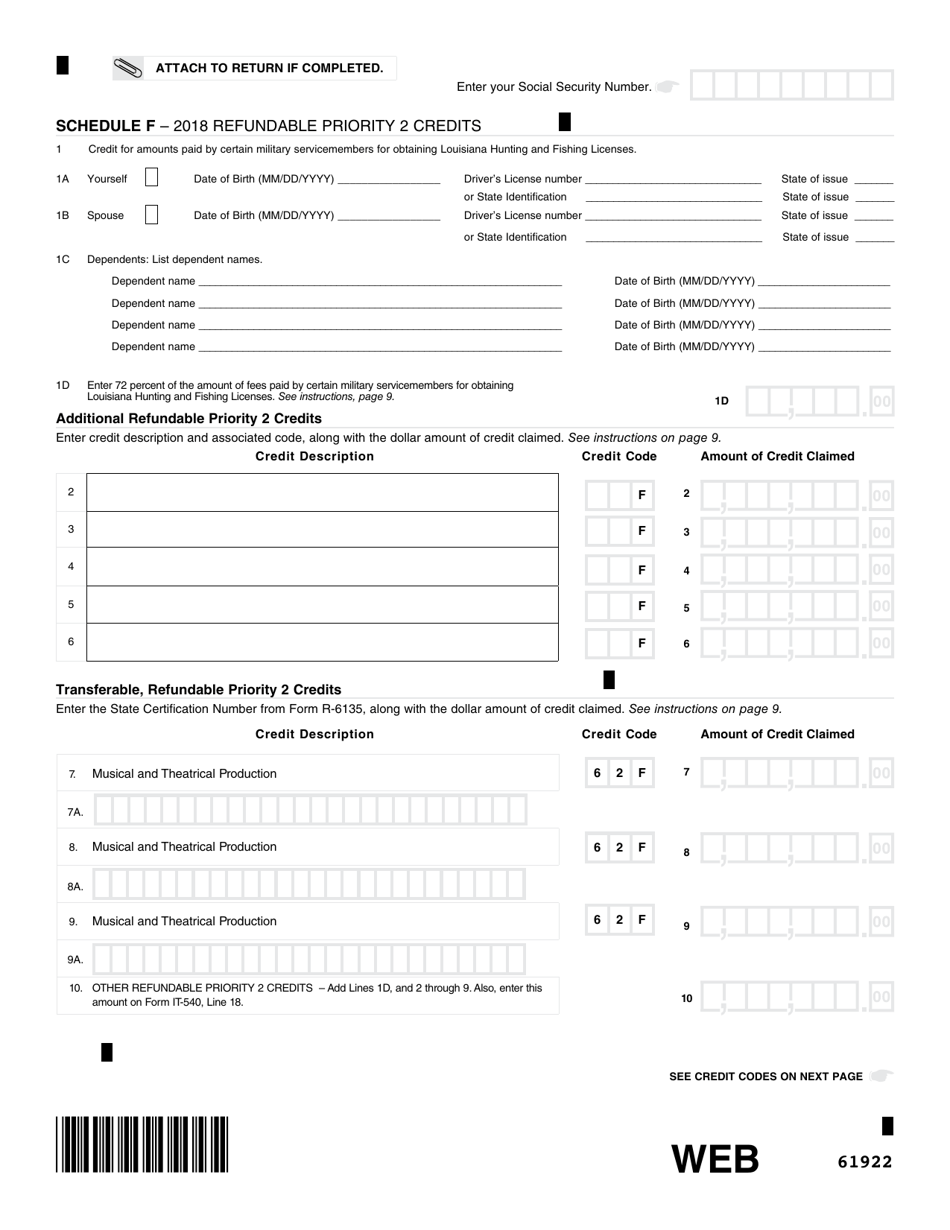

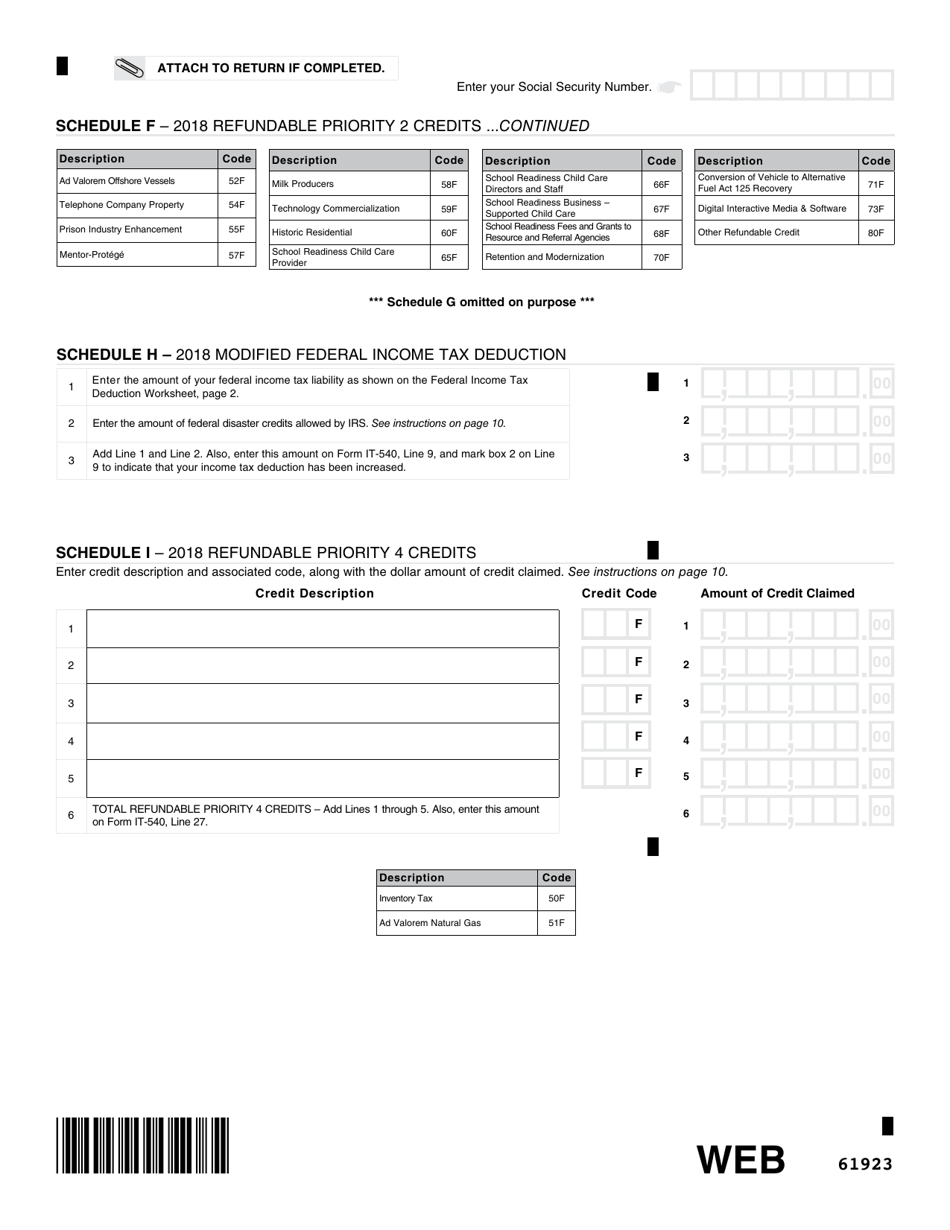

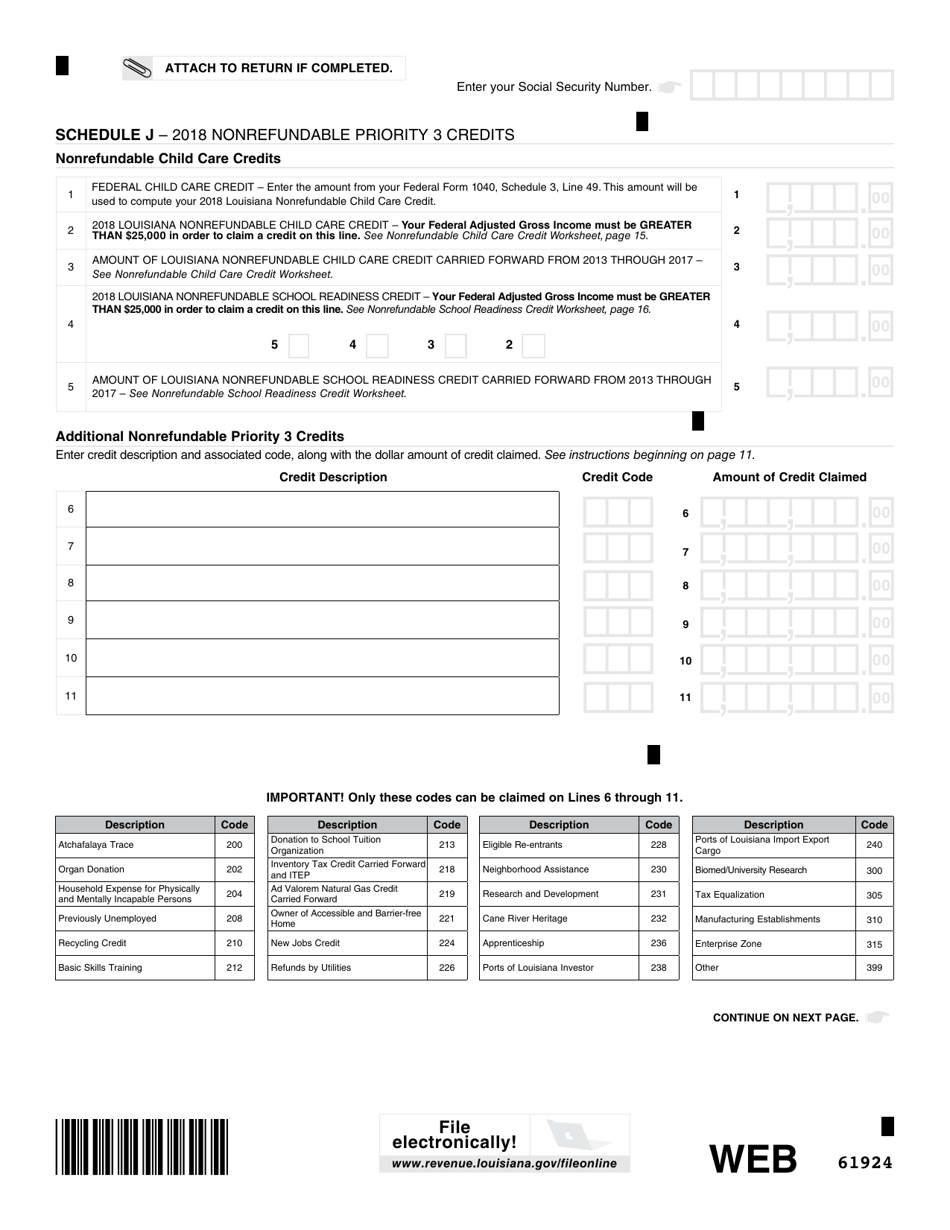

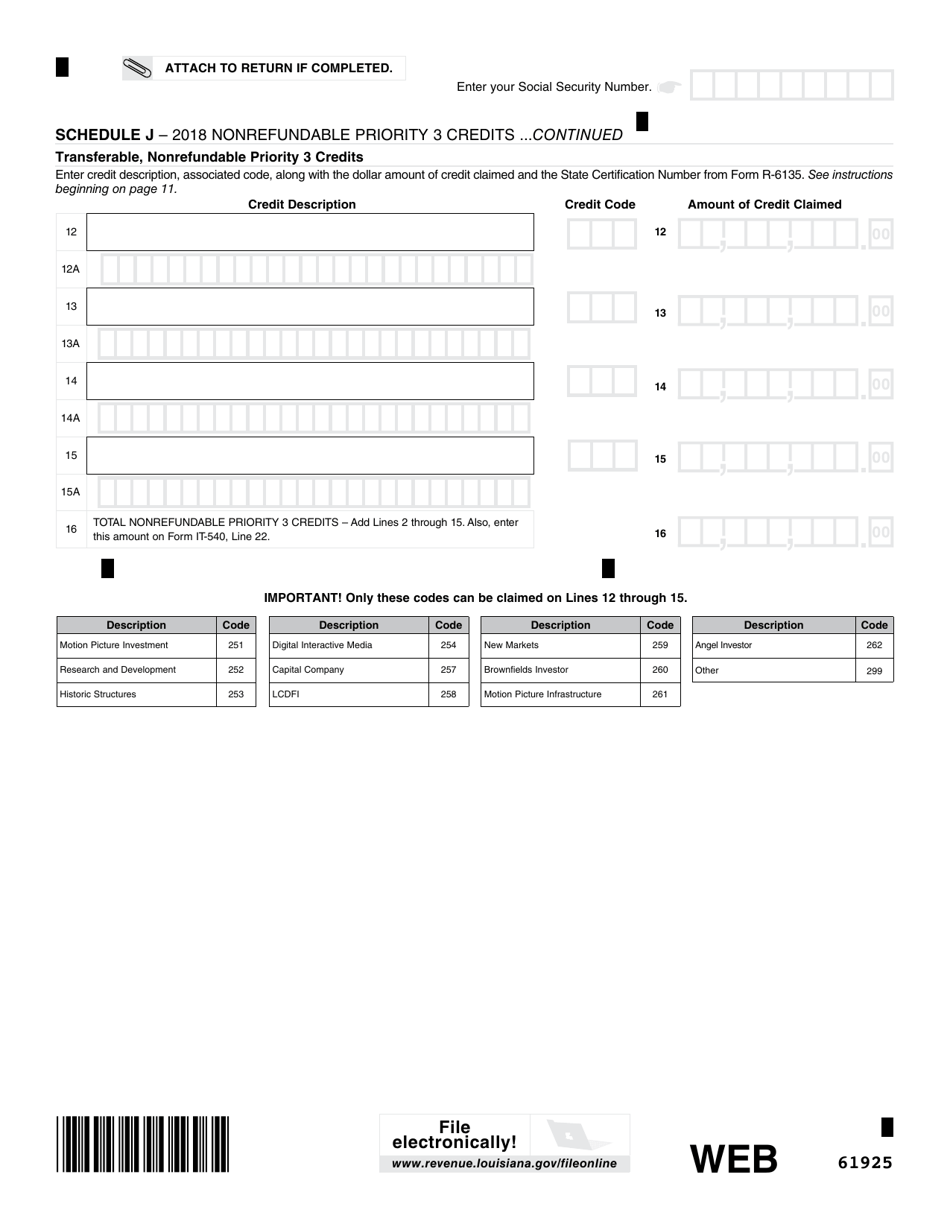

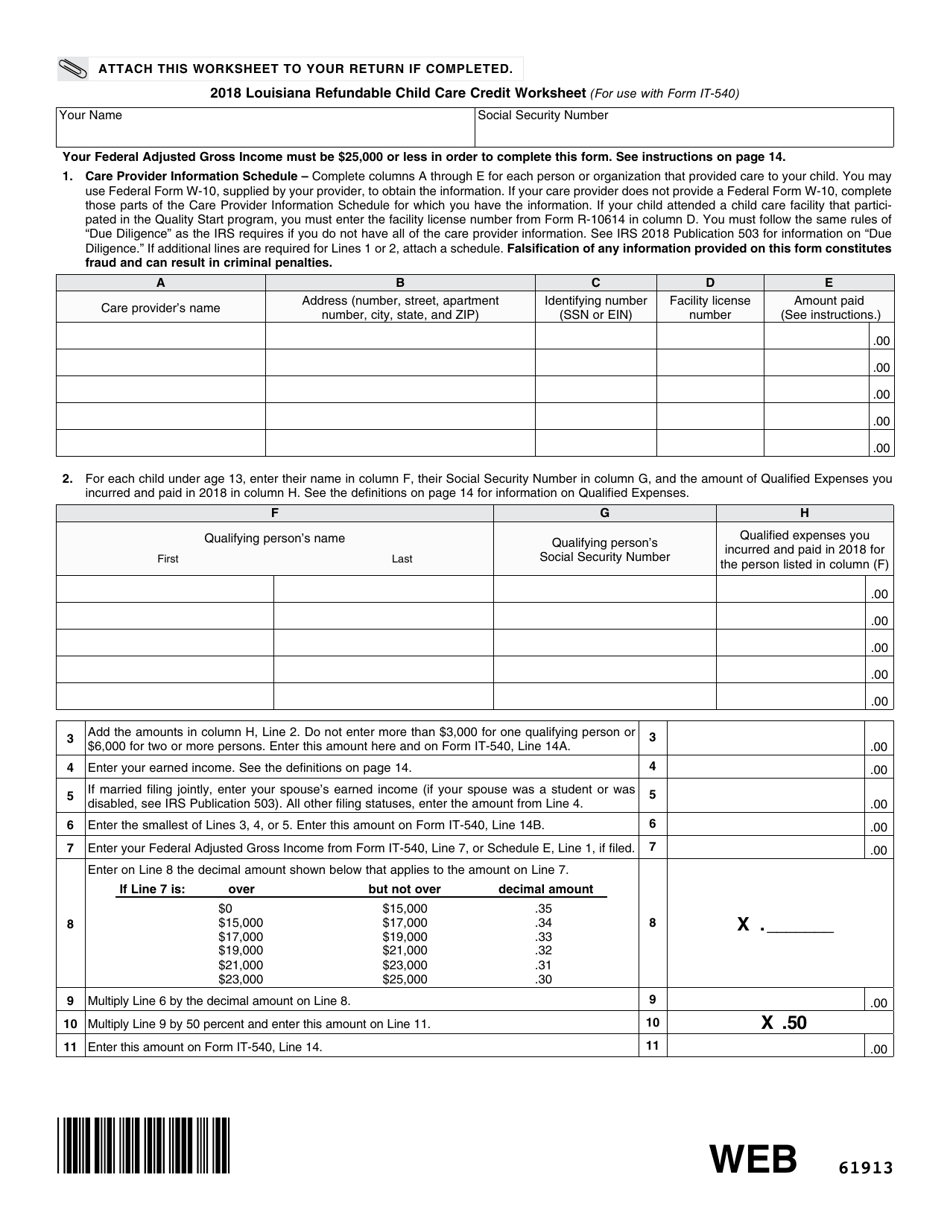

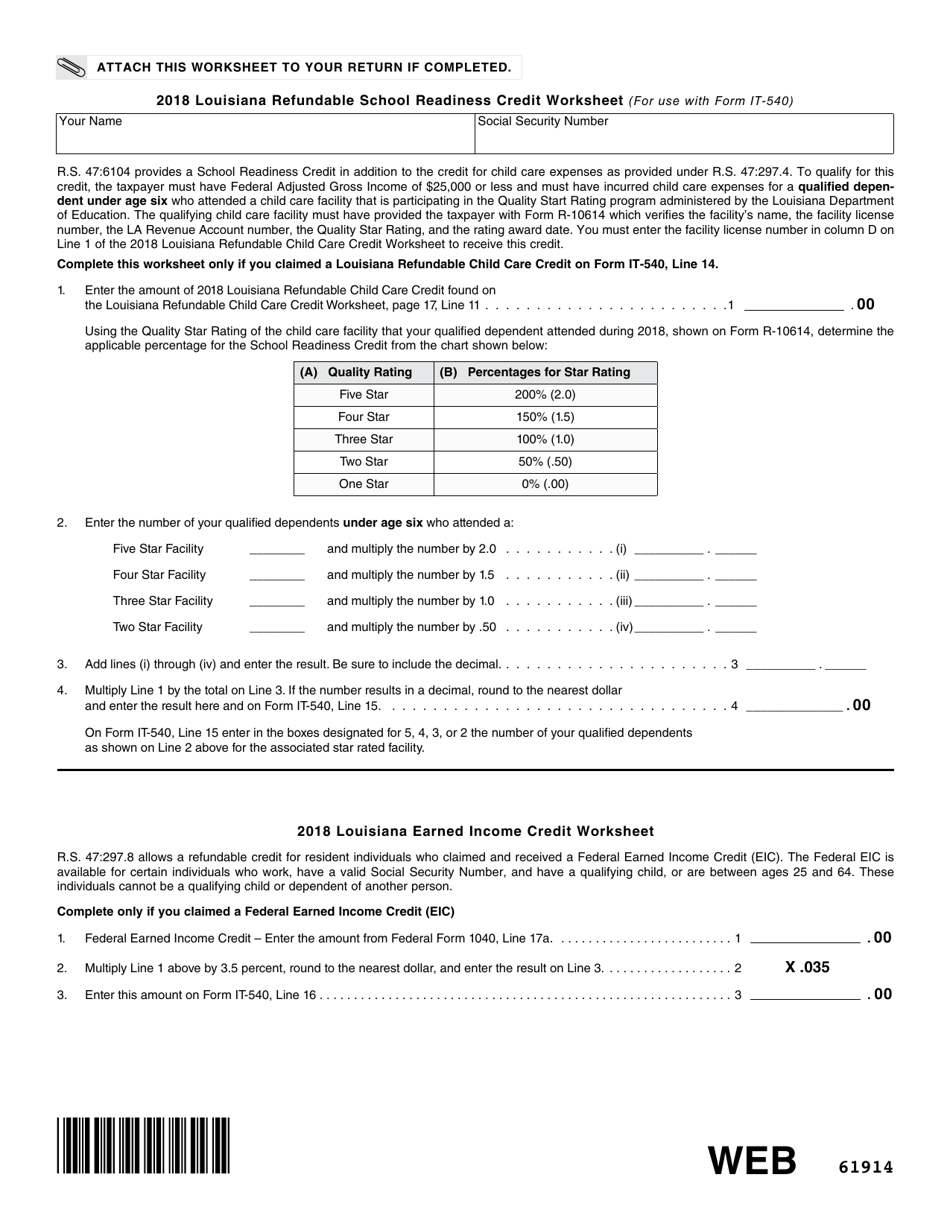

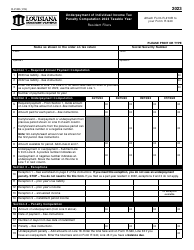

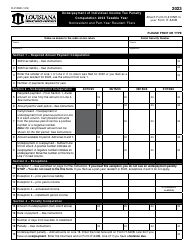

Form IT-540 Louisiana Resident Income Tax Return - Louisiana

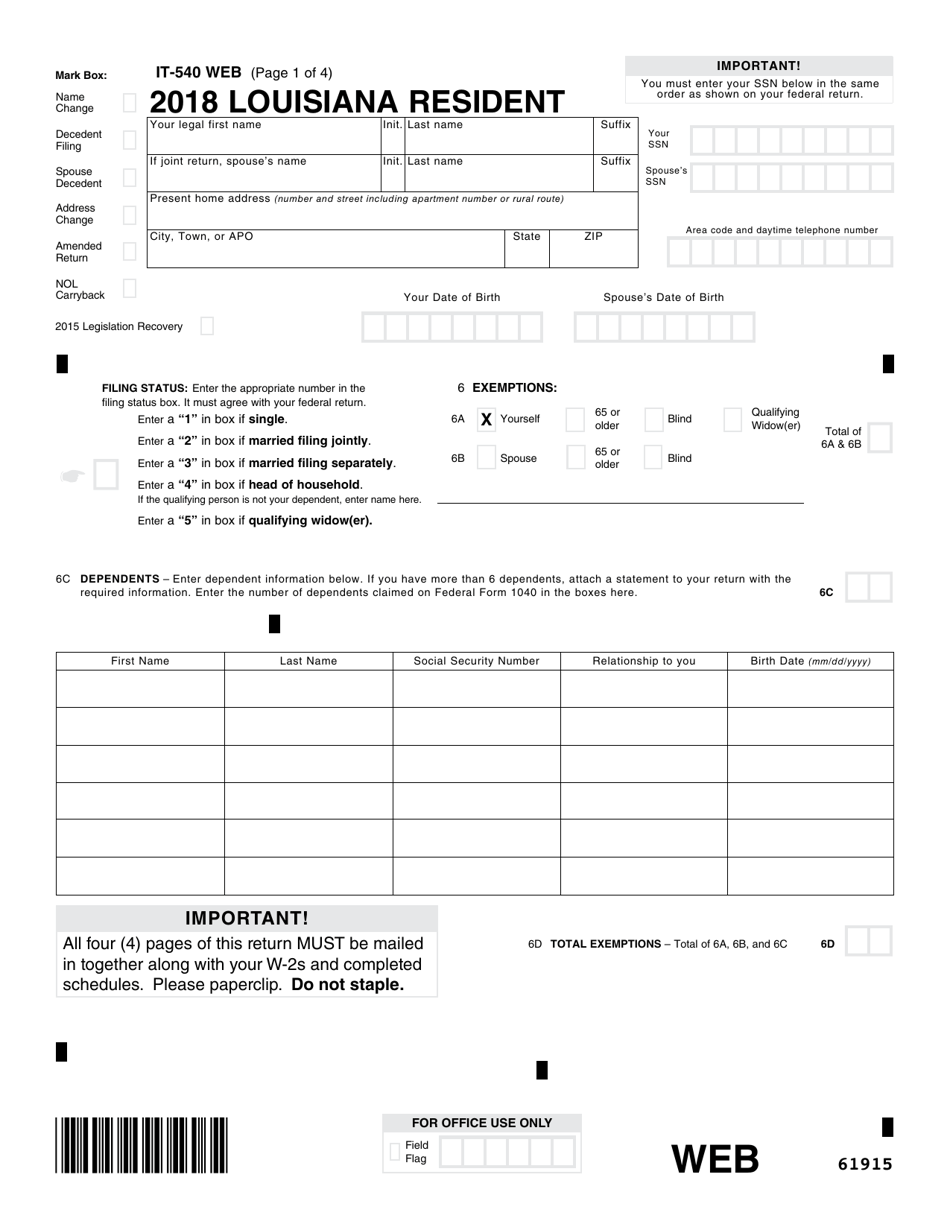

What Is Form IT-540?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-540?

A: Form IT-540 is the Louisiana Resident Income Tax Return.

Q: Who should use Form IT-540?

A: Louisiana residents who need to file their state income tax return should use Form IT-540.

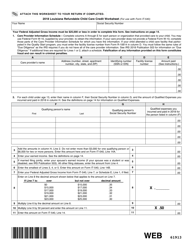

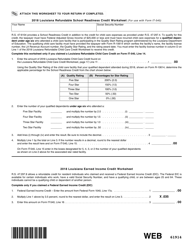

Q: What information is required on Form IT-540?

A: Form IT-540 requires you to provide your personal information, income details, deductions, and credits.

Q: When is the deadline to file Form IT-540?

A: The deadline to file Form IT-540 is generally May 15th, or the next business day if May 15th falls on a weekend or holiday.

Q: Are there any extensions available for filing Form IT-540?

A: Yes, you can request a six-month extension to file your Form IT-540, but you must still pay any taxes owed by the original due date.

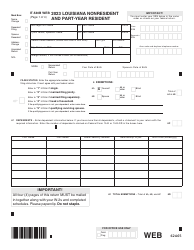

Q: Is there a separate tax form for non-residents or part-year residents?

A: Yes, non-residents and part-year residents should use Form IT-540B instead of Form IT-540.

Q: What should I do if I made a mistake on my filed Form IT-540?

A: If you made a mistake on your filed Form IT-540, you should file an amended return using Form IT-540X to correct the error.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.