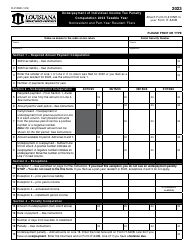

This version of the form is not currently in use and is provided for reference only. Download this version of

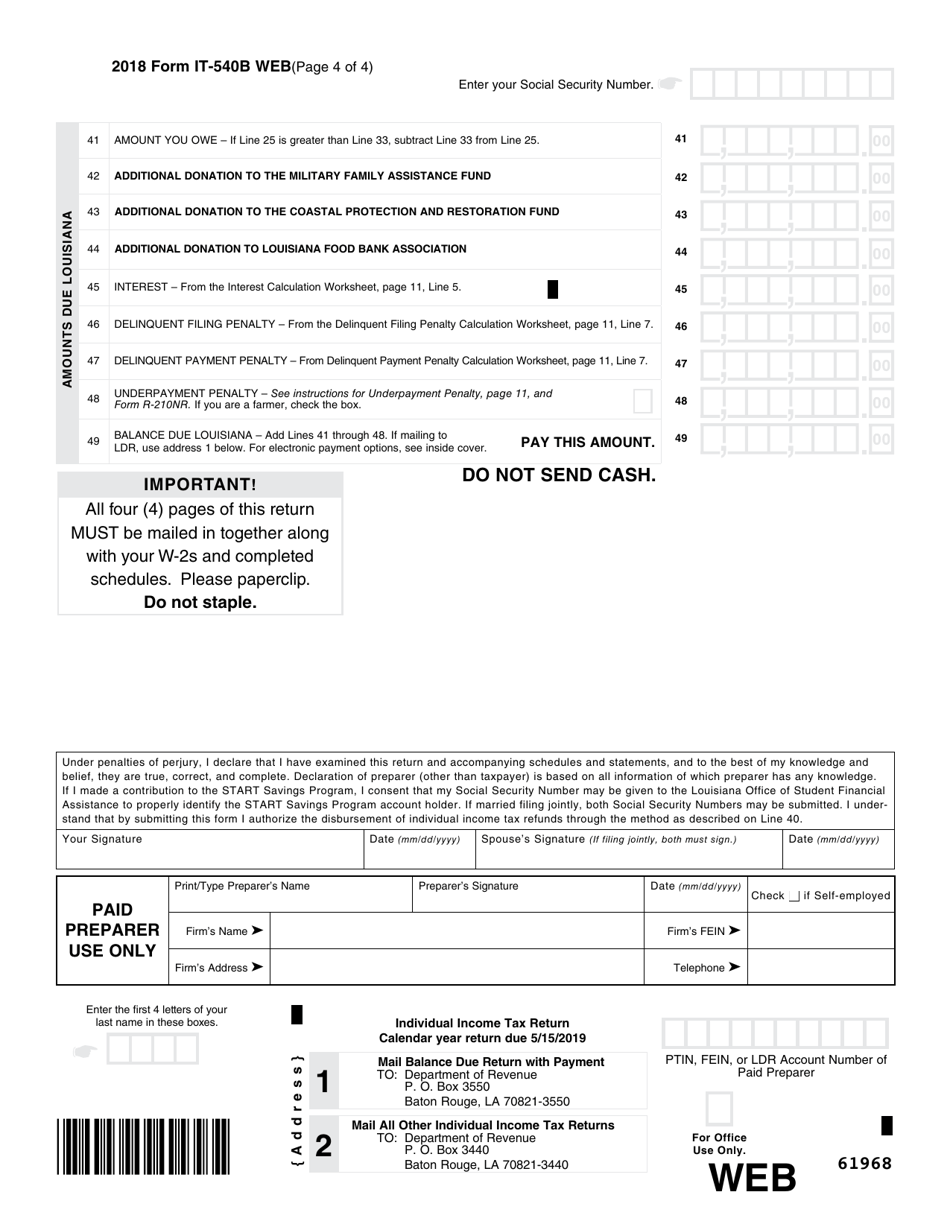

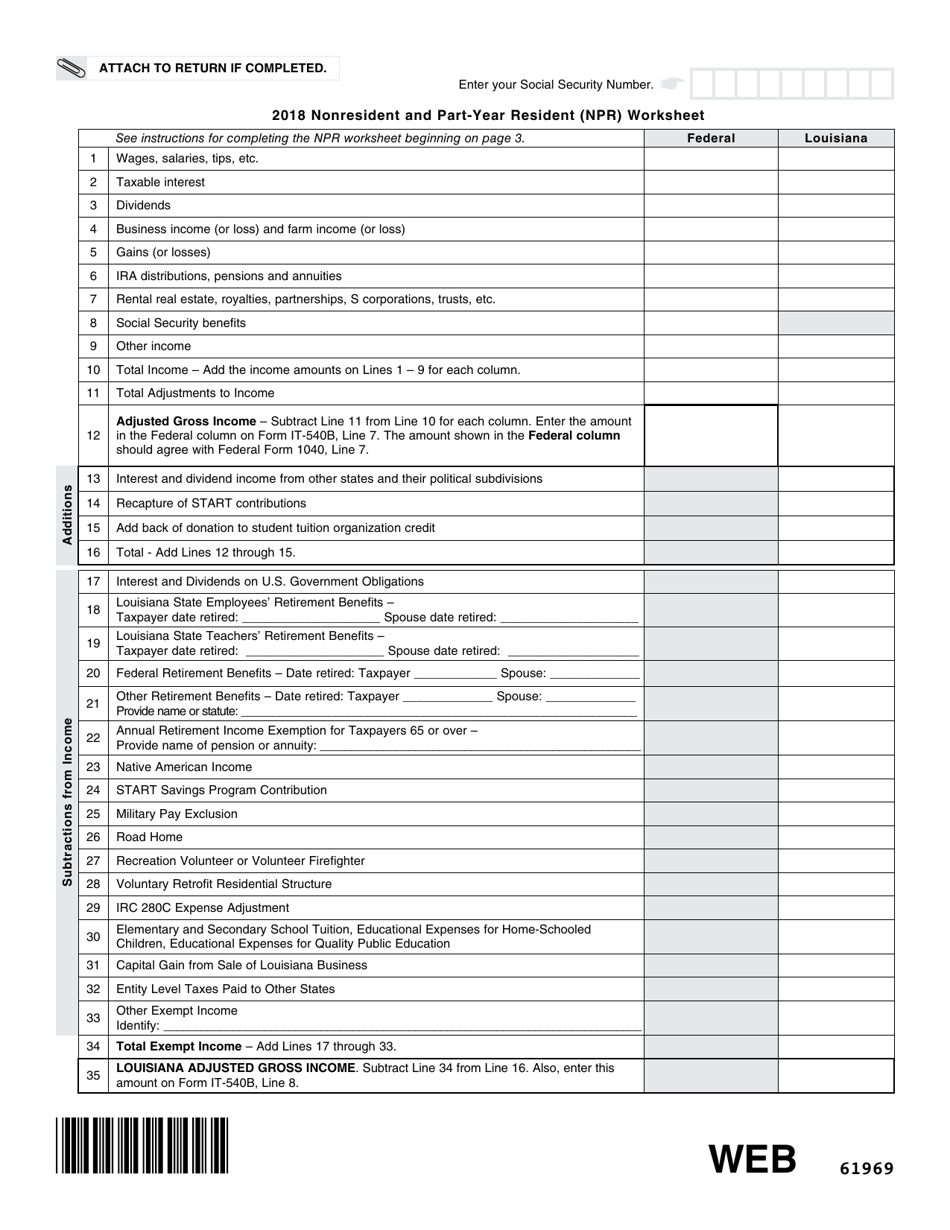

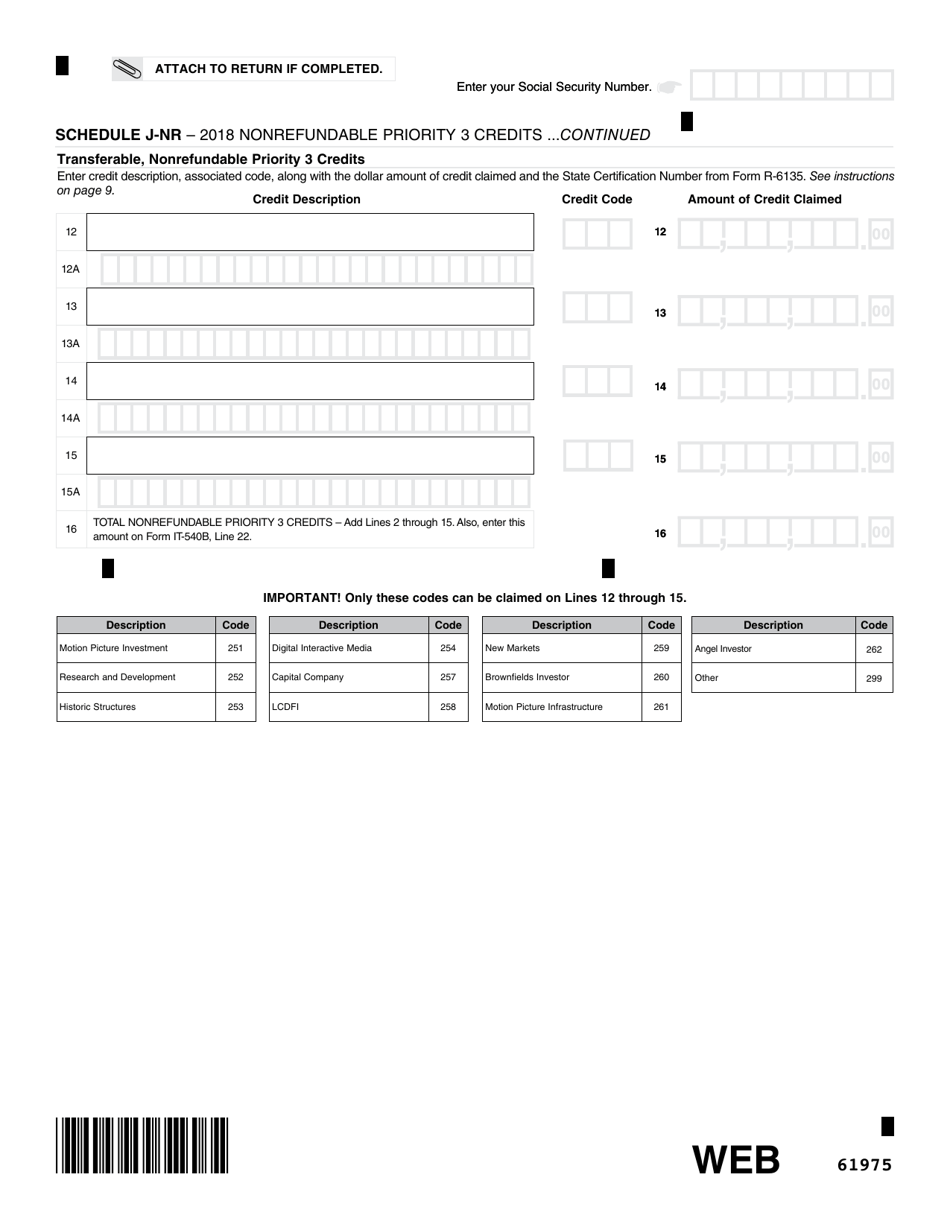

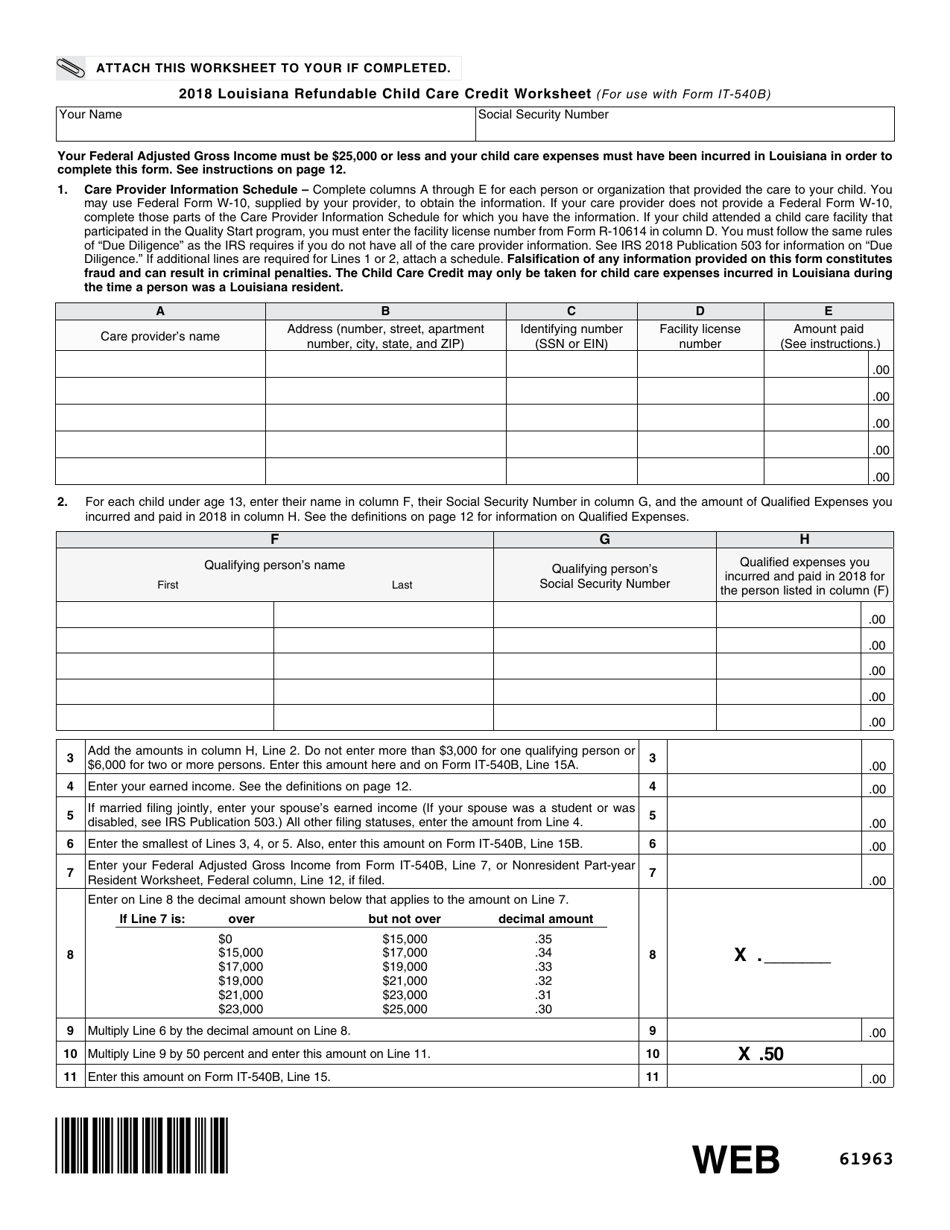

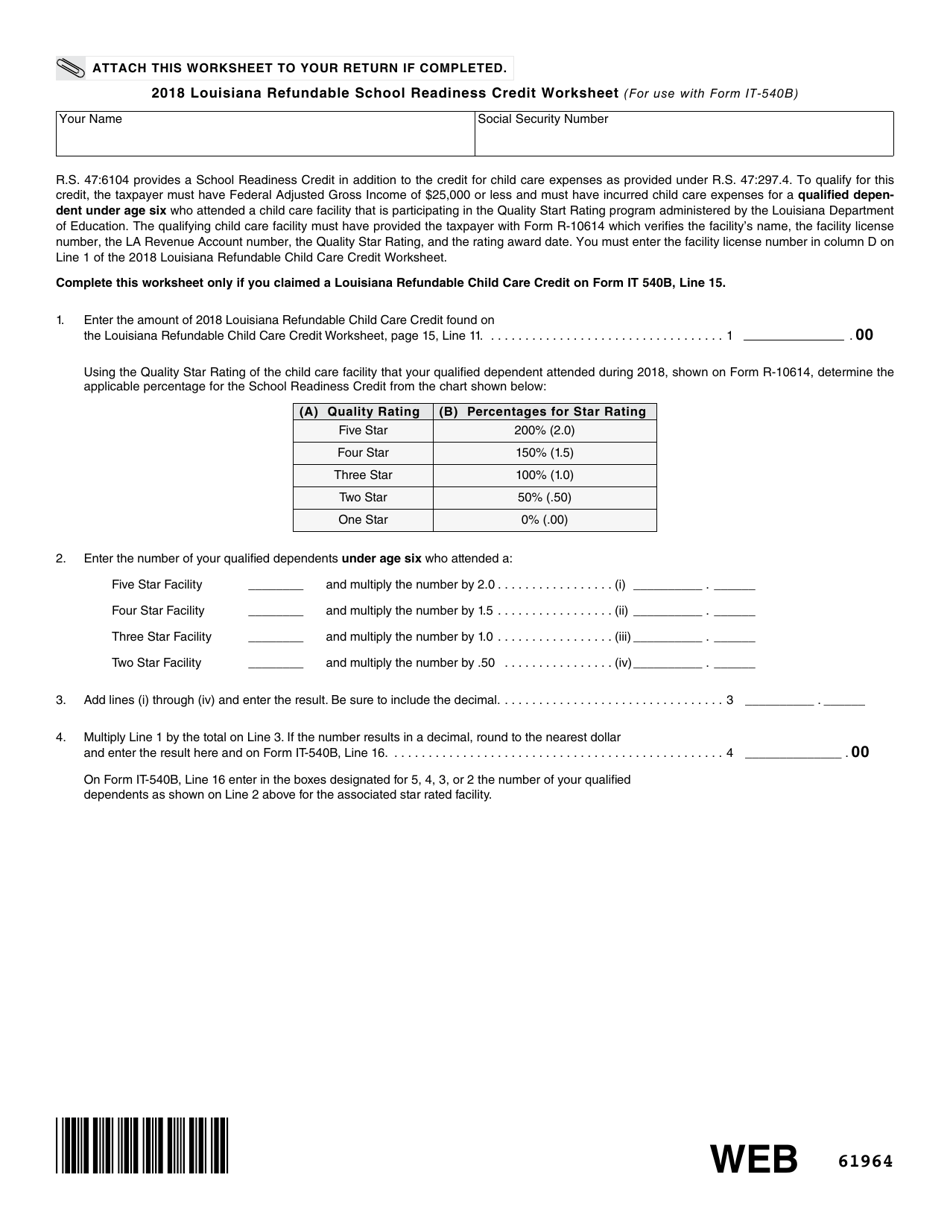

Form IT-540B

for the current year.

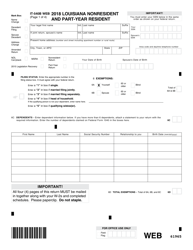

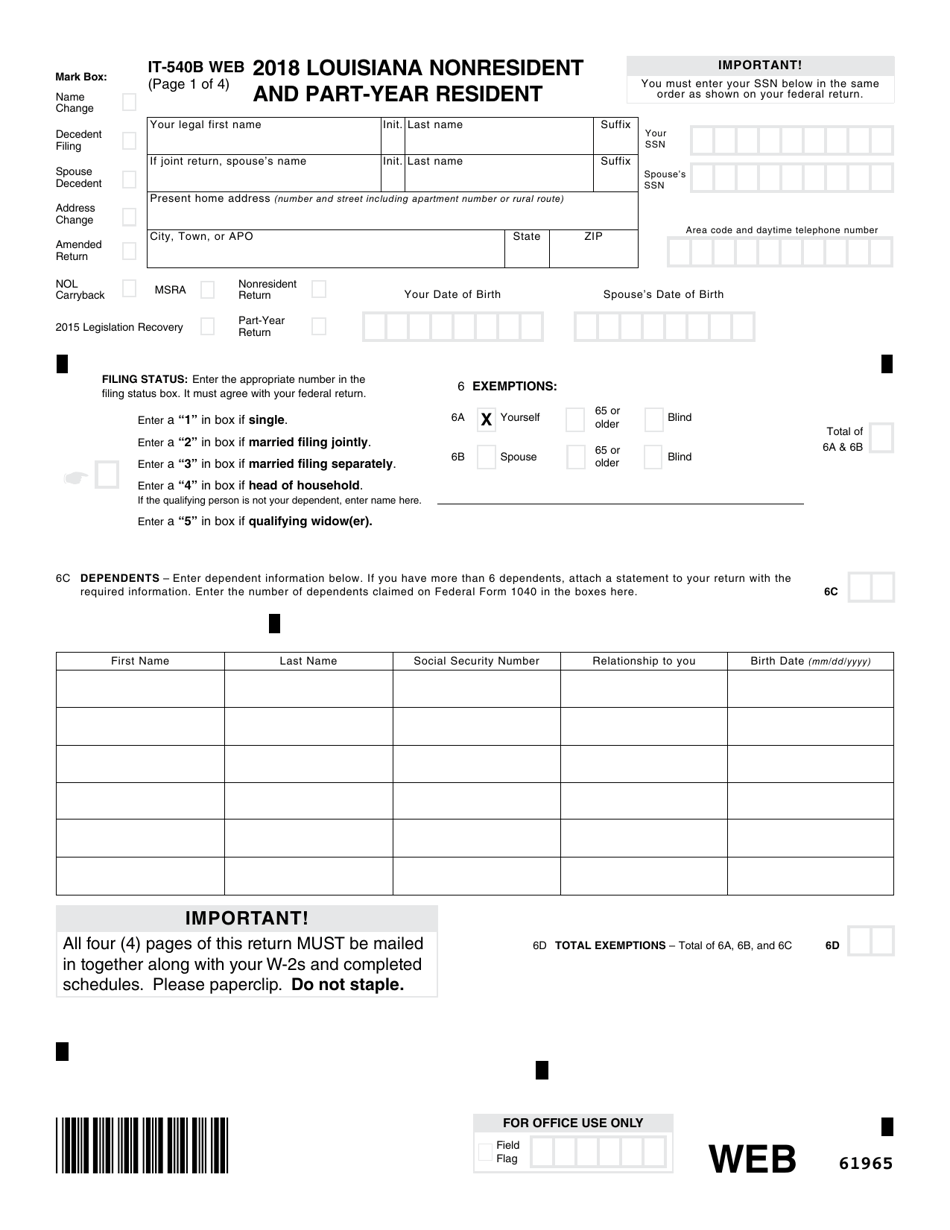

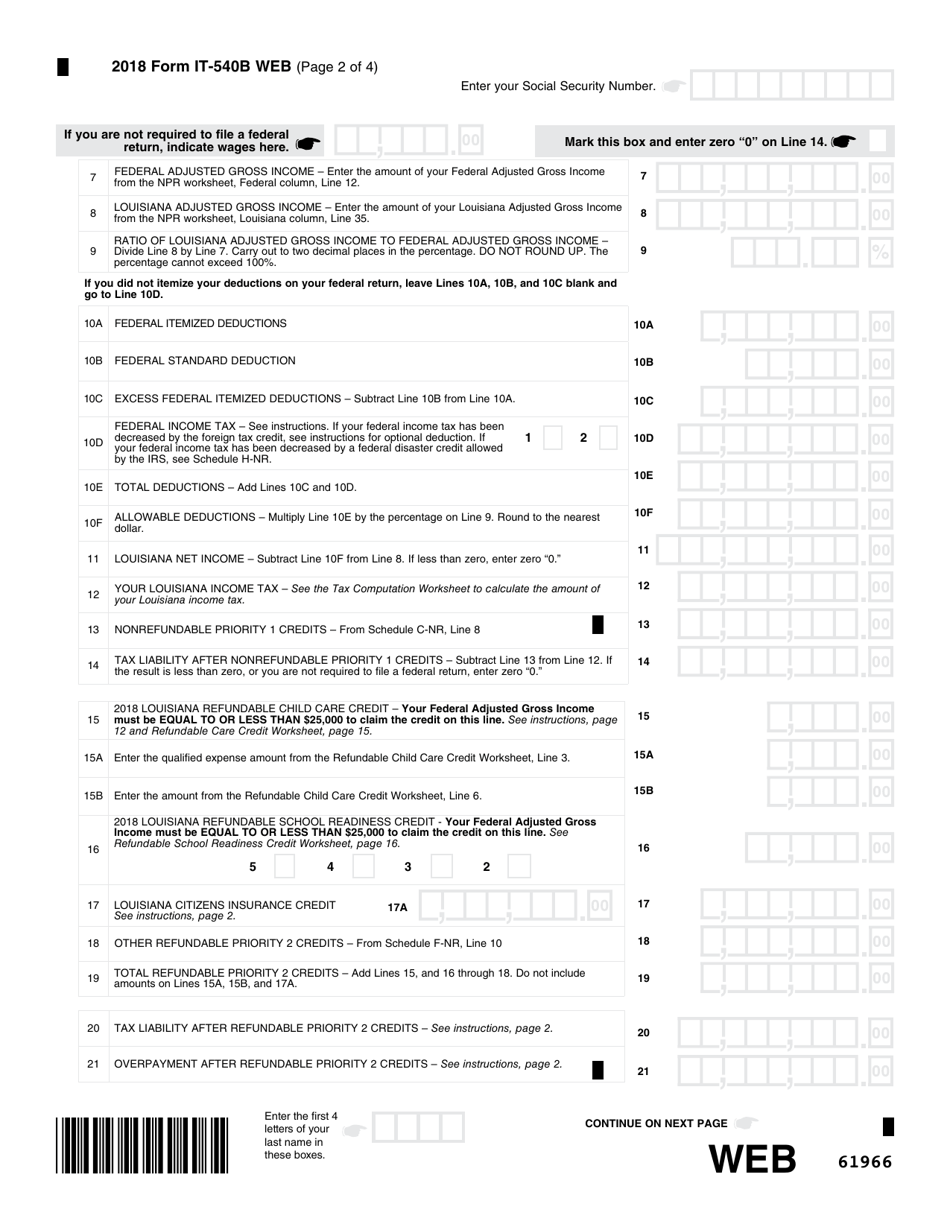

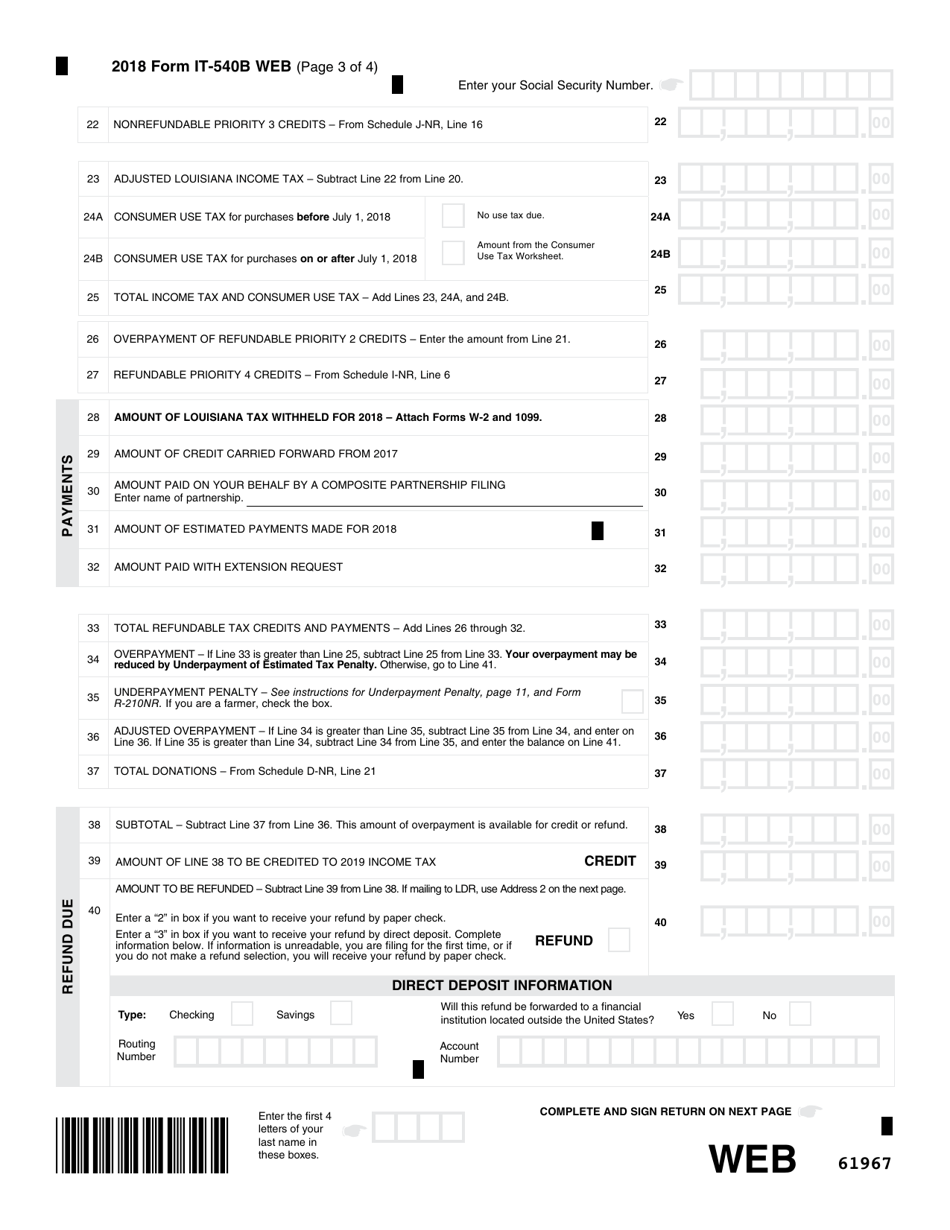

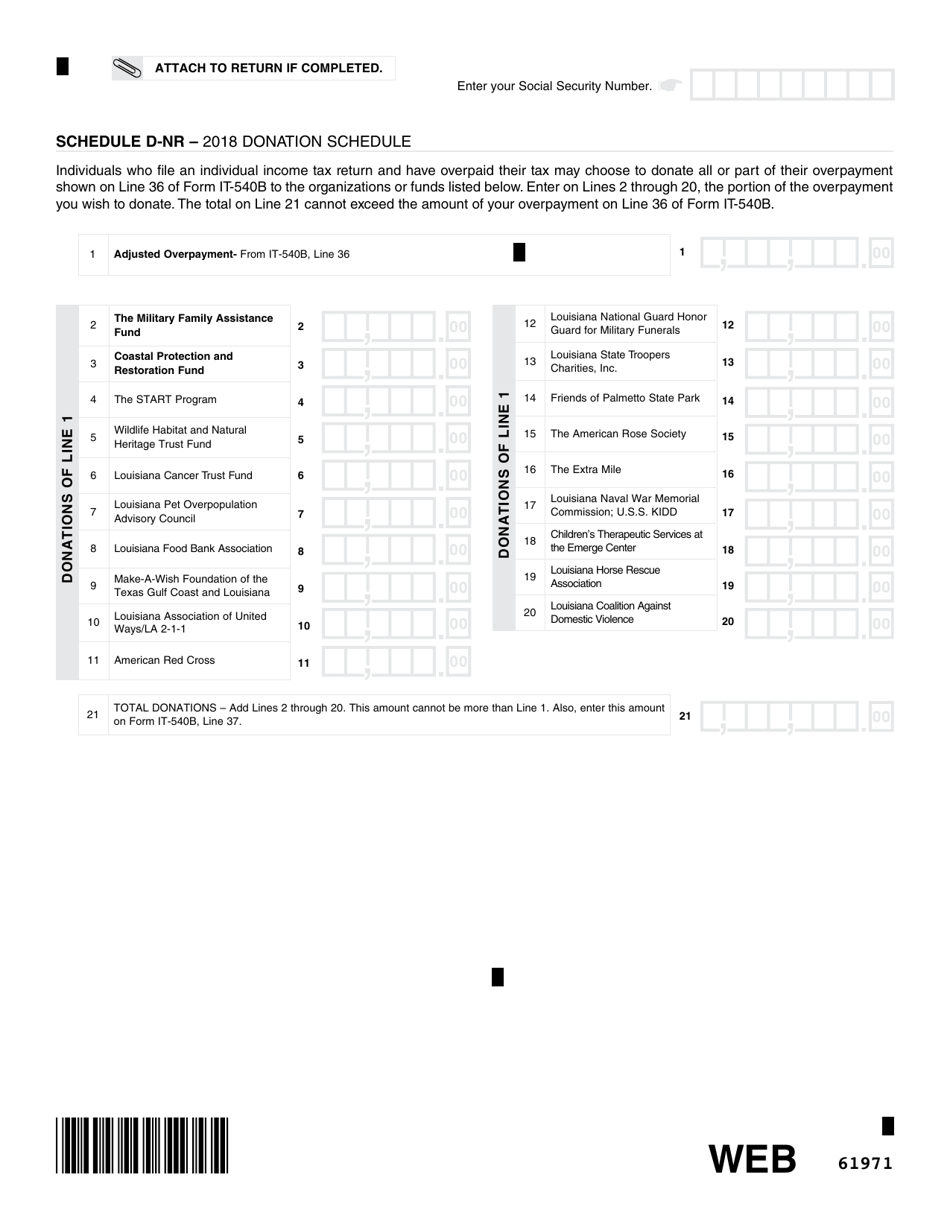

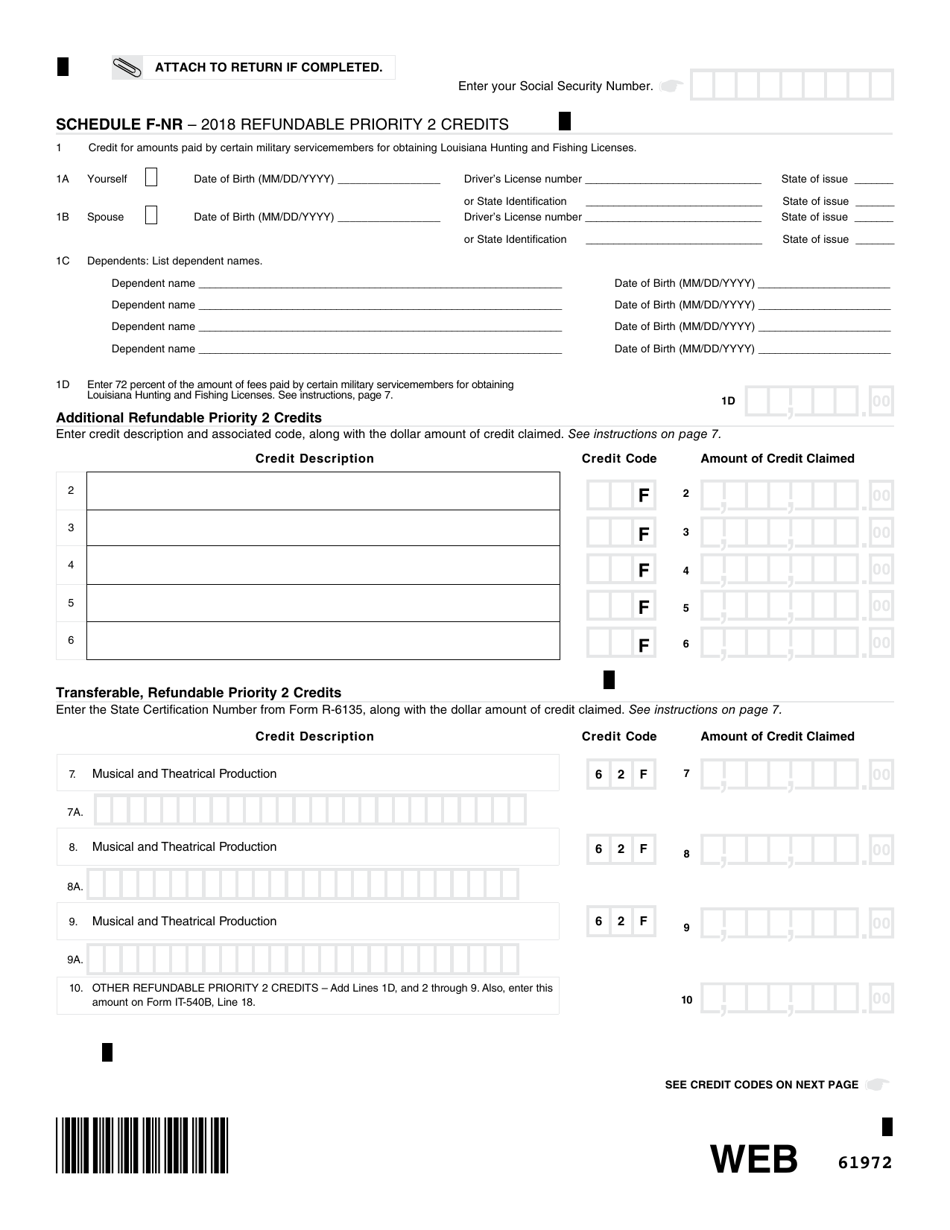

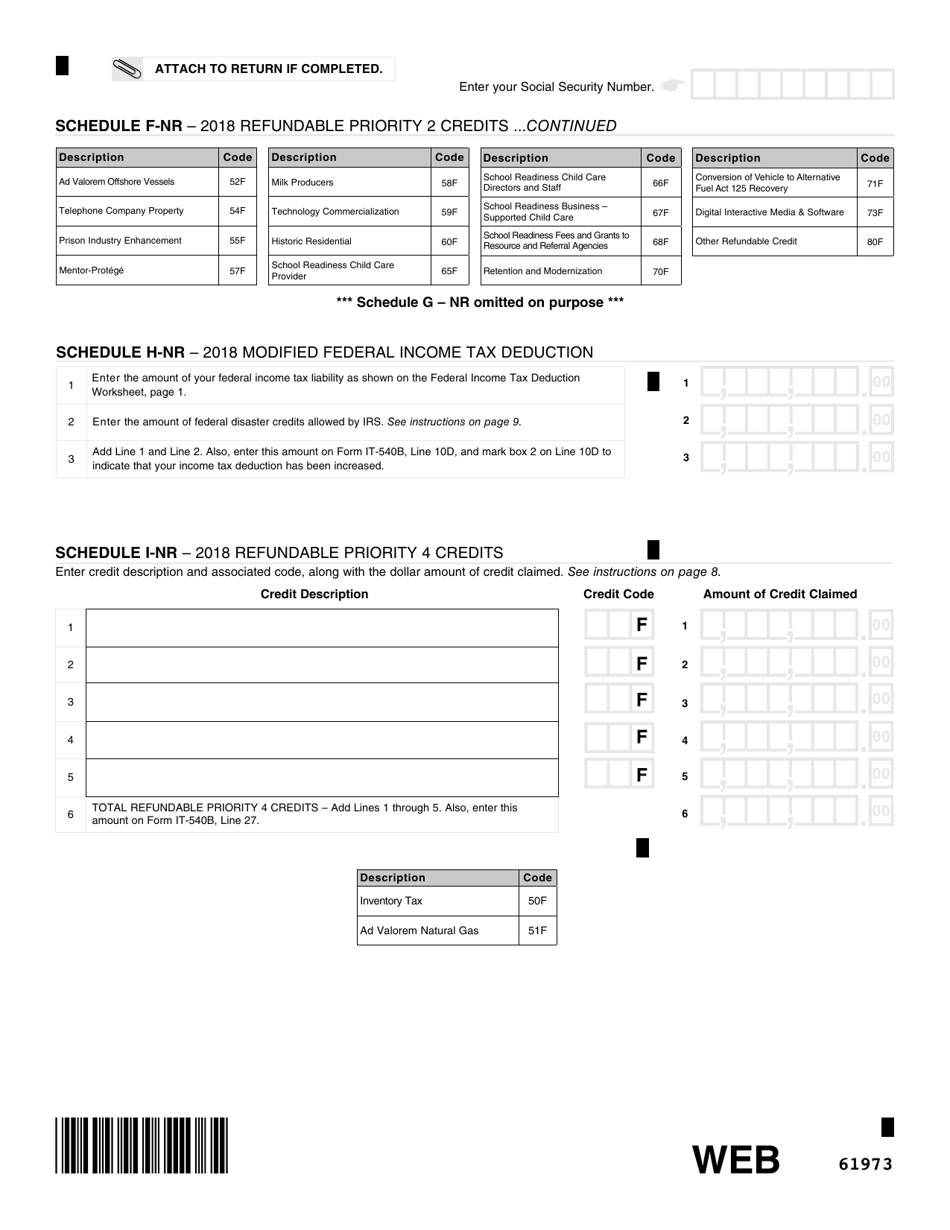

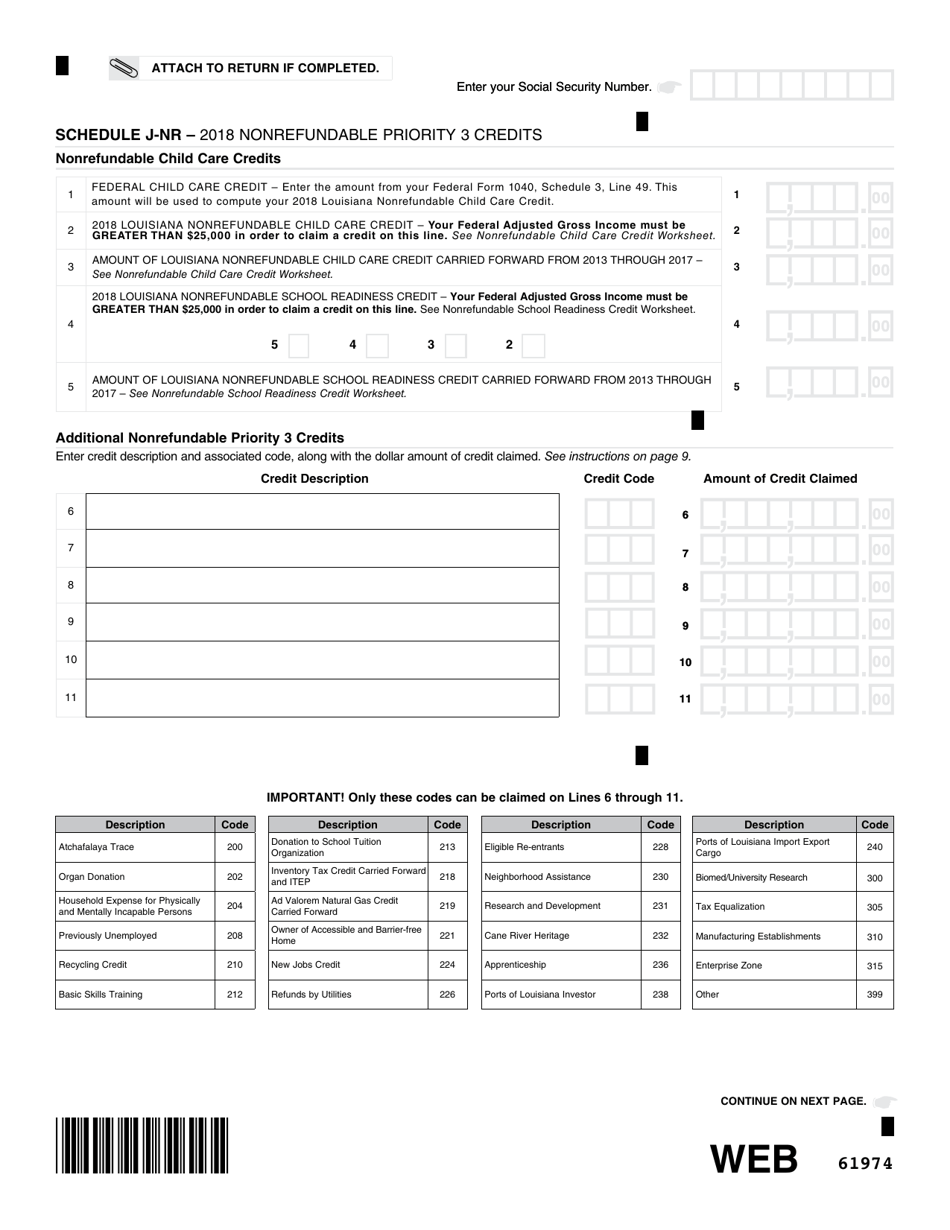

Form IT-540B Louisiana Nonresident and Part-Year Resident Income Tax Return - Louisiana

What Is Form IT-540B?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-540B?

A: Form IT-540B is the Louisiana Nonresident and Part-Year Resident Income Tax Return.

Q: Who needs to file Form IT-540B?

A: Nonresident and part-year residents of Louisiana who have income from Louisiana sources during the tax year need to file Form IT-540B.

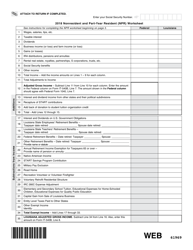

Q: How do I know if I am a nonresident or part-year resident of Louisiana?

A: You are considered a nonresident if you have no Louisiana domicile or if your domicile is not in Louisiana during any portion of the tax year. You are considered a part-year resident if you moved into or out of Louisiana during the tax year.

Q: What income is subject to Louisiana income tax?

A: Louisiana taxes income from all sources, including wages, self-employment income, interest, dividends, rental income, and income from business activities conducted in Louisiana.

Q: When is the deadline to file Form IT-540B?

A: The deadline to file Form IT-540B is the same as the federal income tax deadline, which is usually April 15th. However, if April 15th falls on a weekend or holiday, the deadline is extended to the next business day.

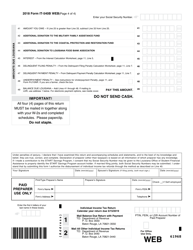

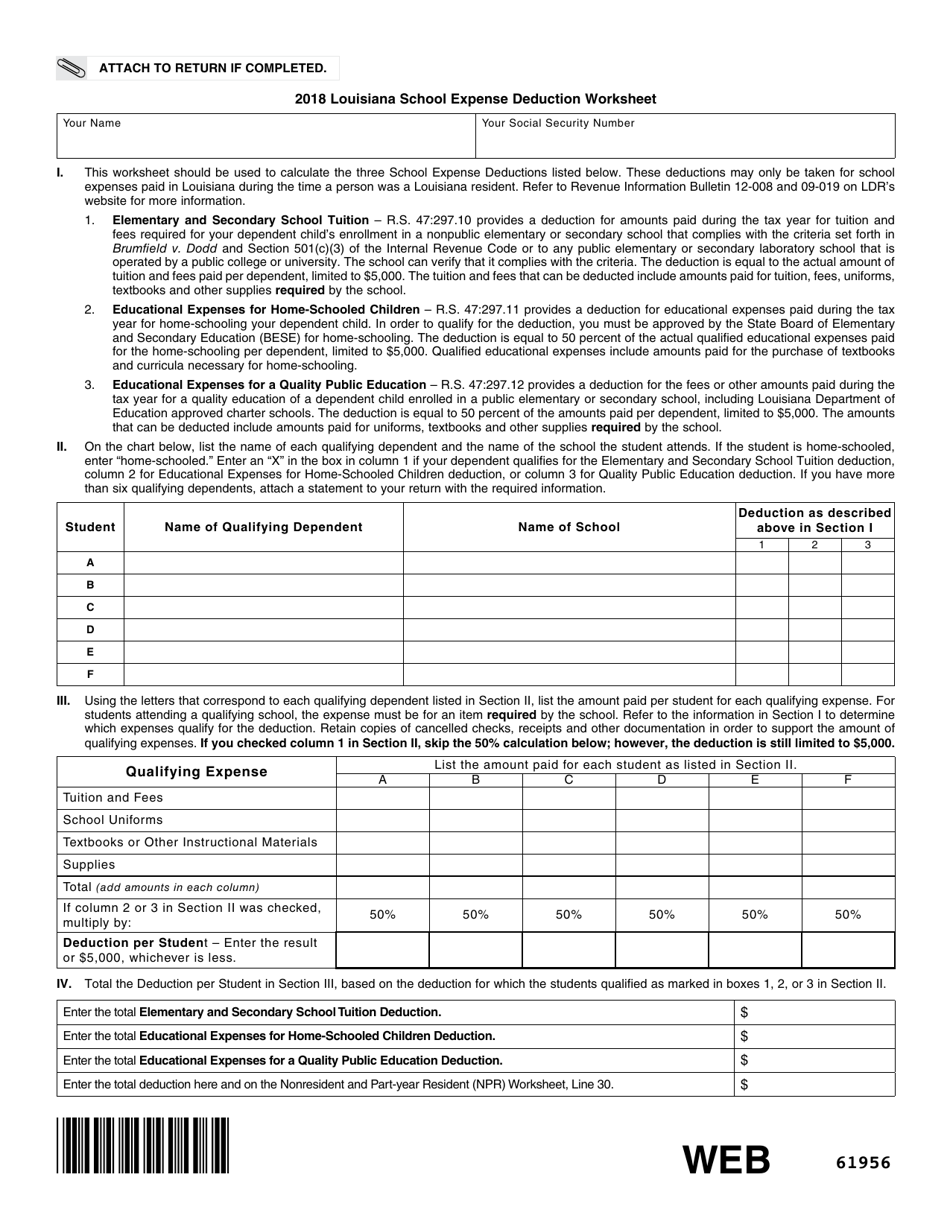

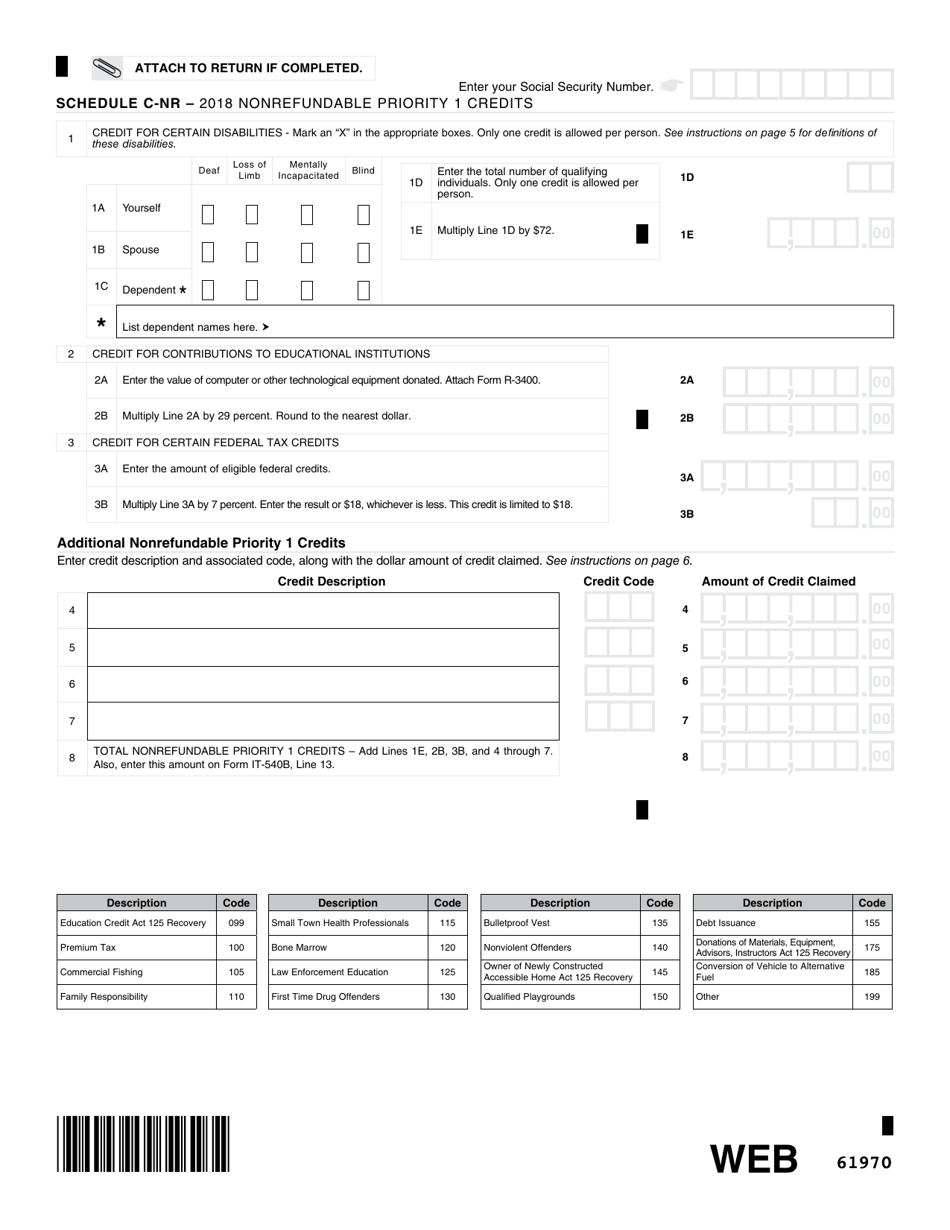

Q: Do I need to attach any supporting documents with Form IT-540B?

A: Yes, you may need to attach copies of your federal return, Form W-2s, and any other forms or schedules that are relevant to your tax situation. Check the instructions for Form IT-540B for specific requirements.

Q: What if I owe taxes but cannot pay the full amount?

A: If you cannot pay the full amount of your tax bill, you should still file your return on time and pay as much as you can. You can also consider setting up a payment plan with the Louisiana Department of Revenue to pay off your balance over time.

Q: What if I need help filling out Form IT-540B?

A: If you need assistance in filling out Form IT-540B, you can contact the Louisiana Department of Revenue or consult with a tax professional for guidance.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540B by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.