This version of the form is not currently in use and is provided for reference only. Download this version of

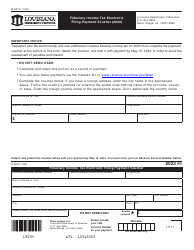

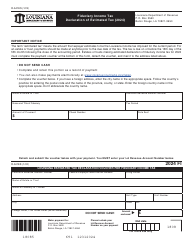

Form IT-541

for the current year.

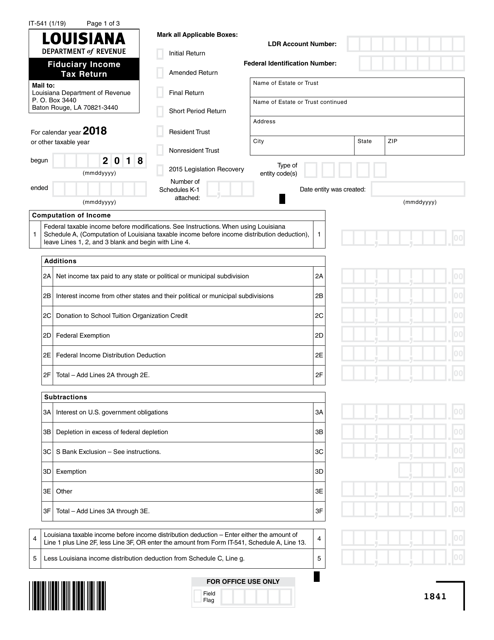

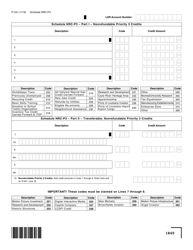

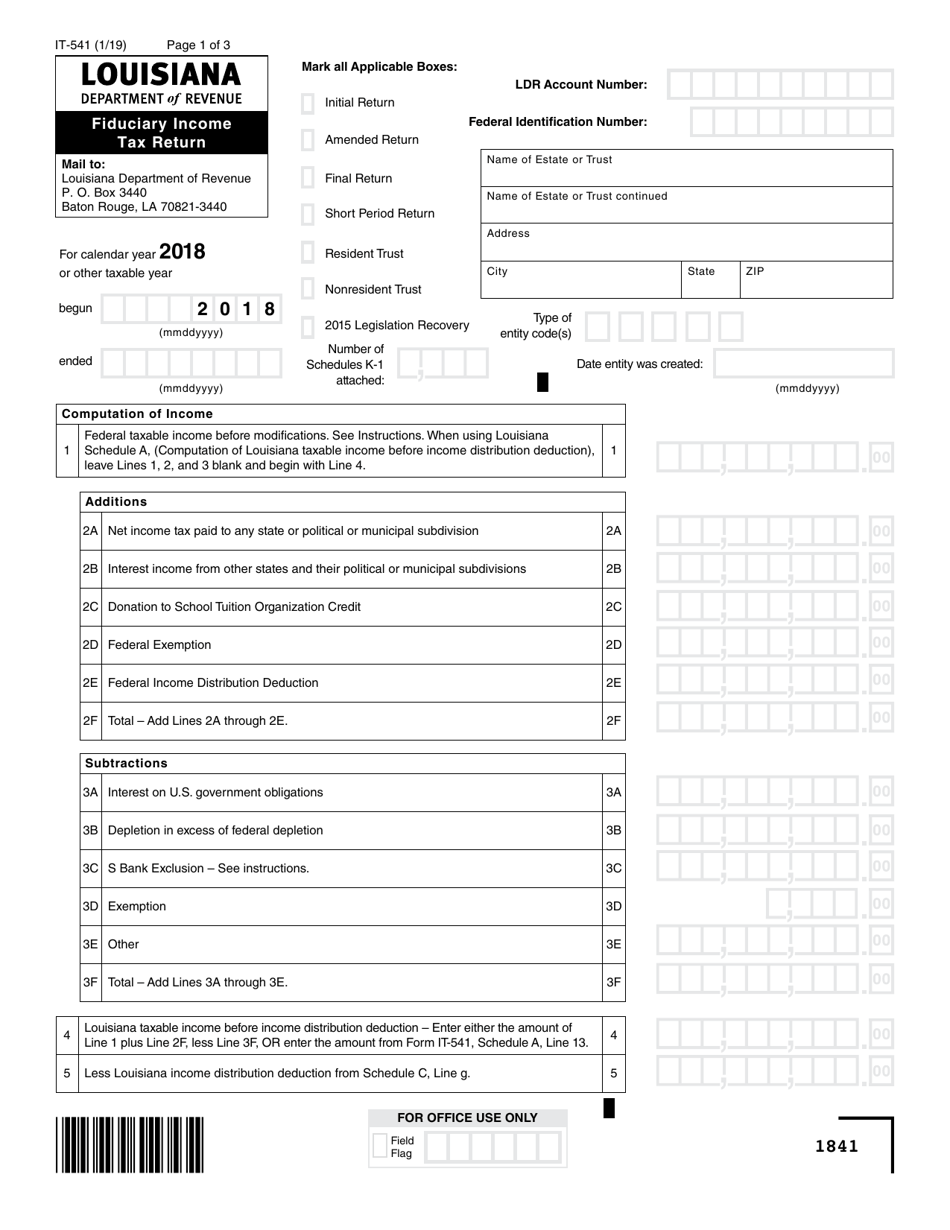

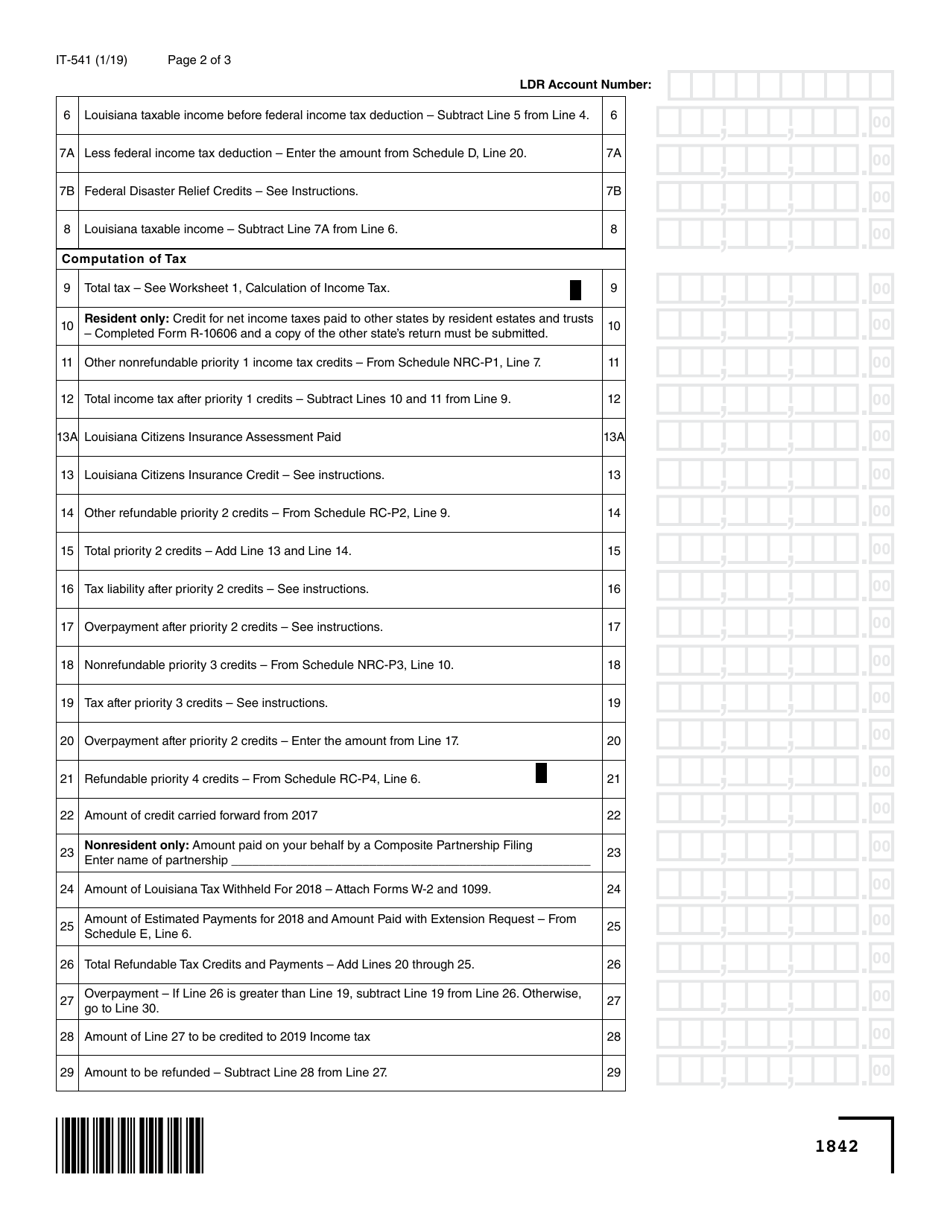

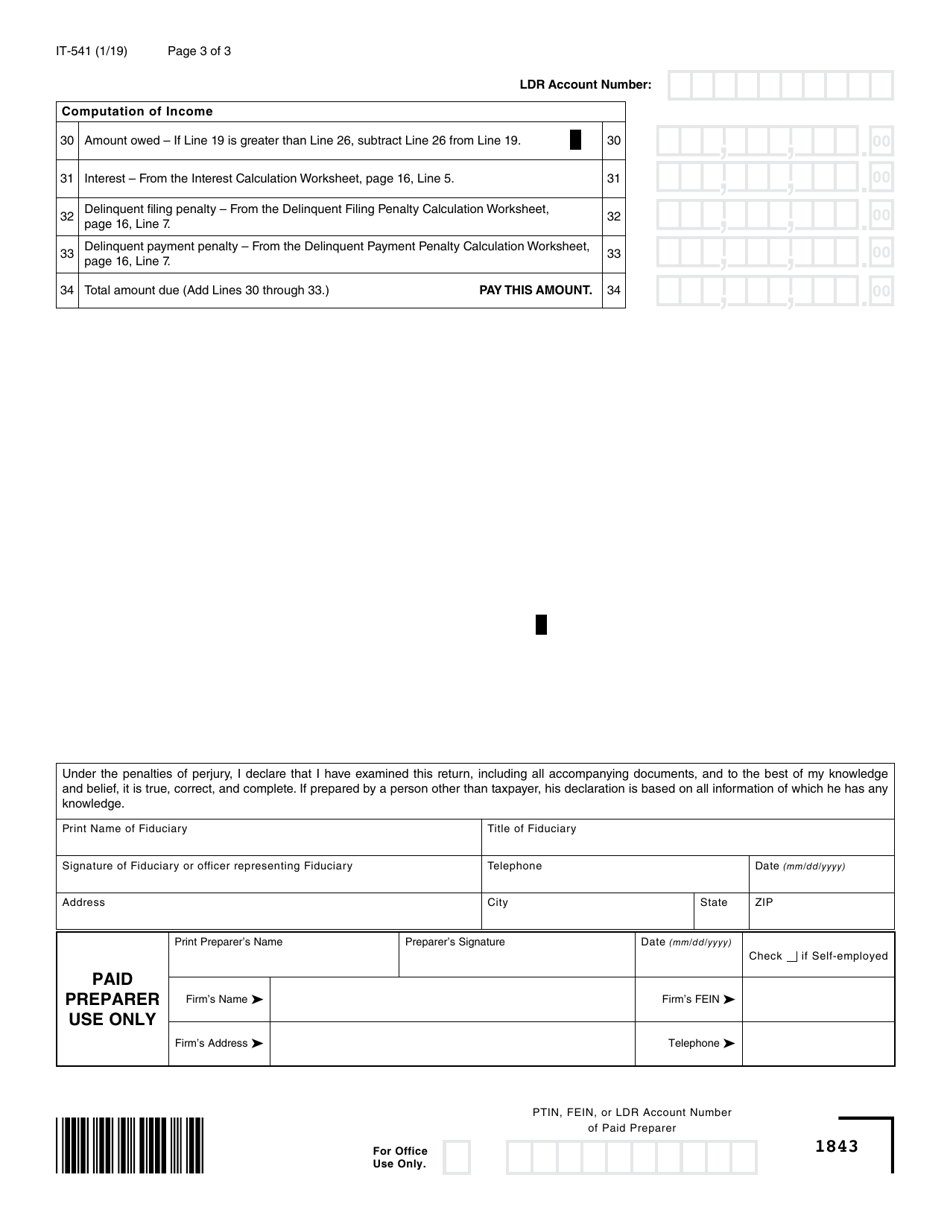

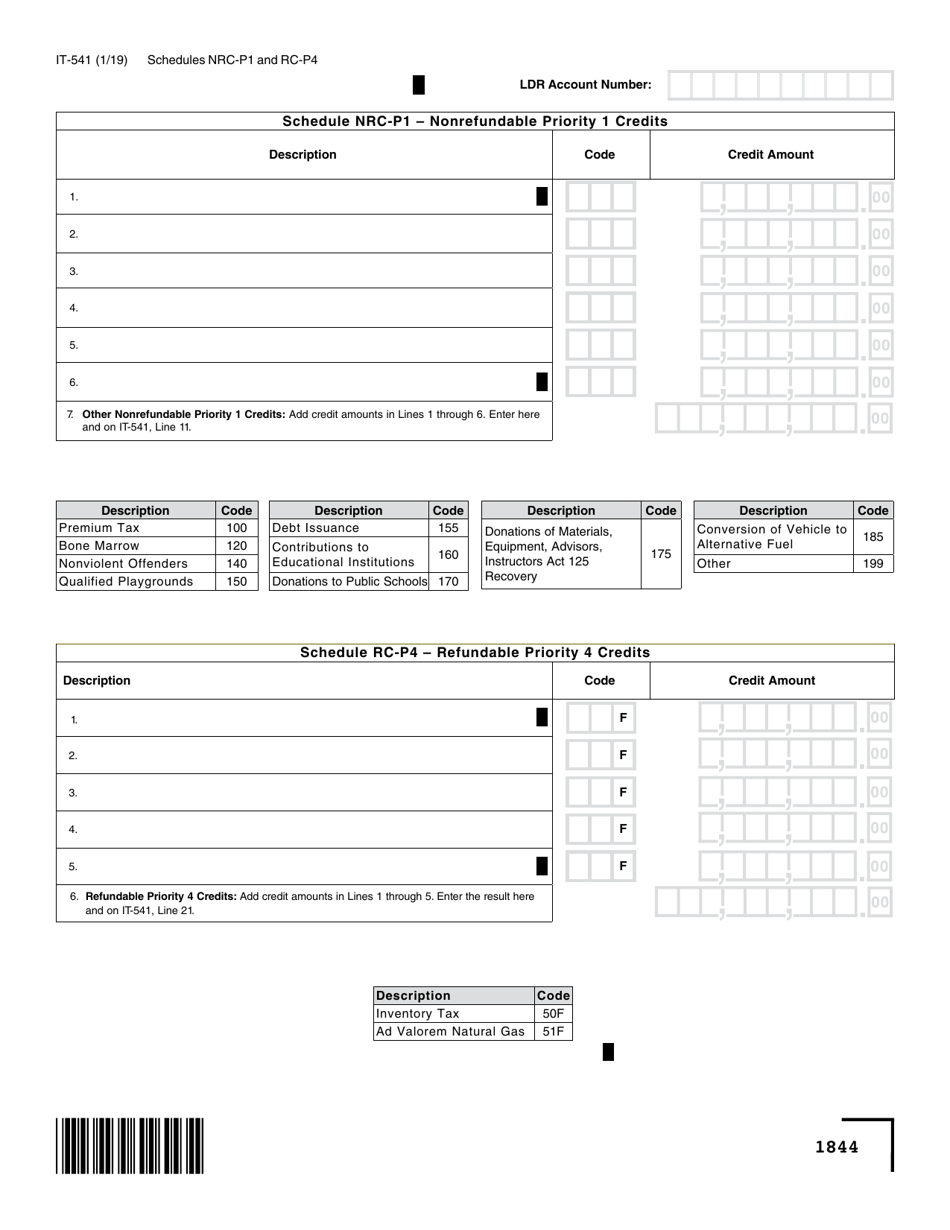

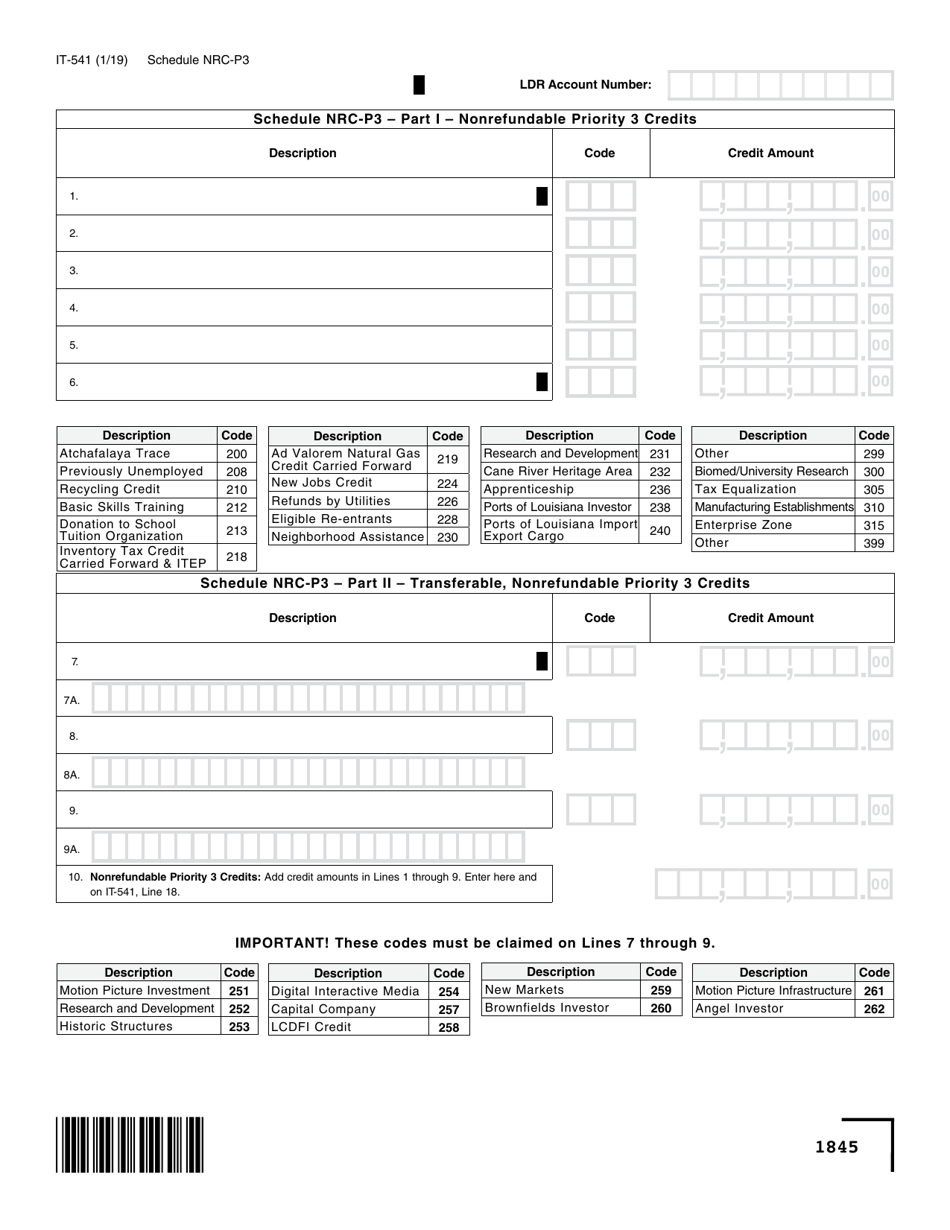

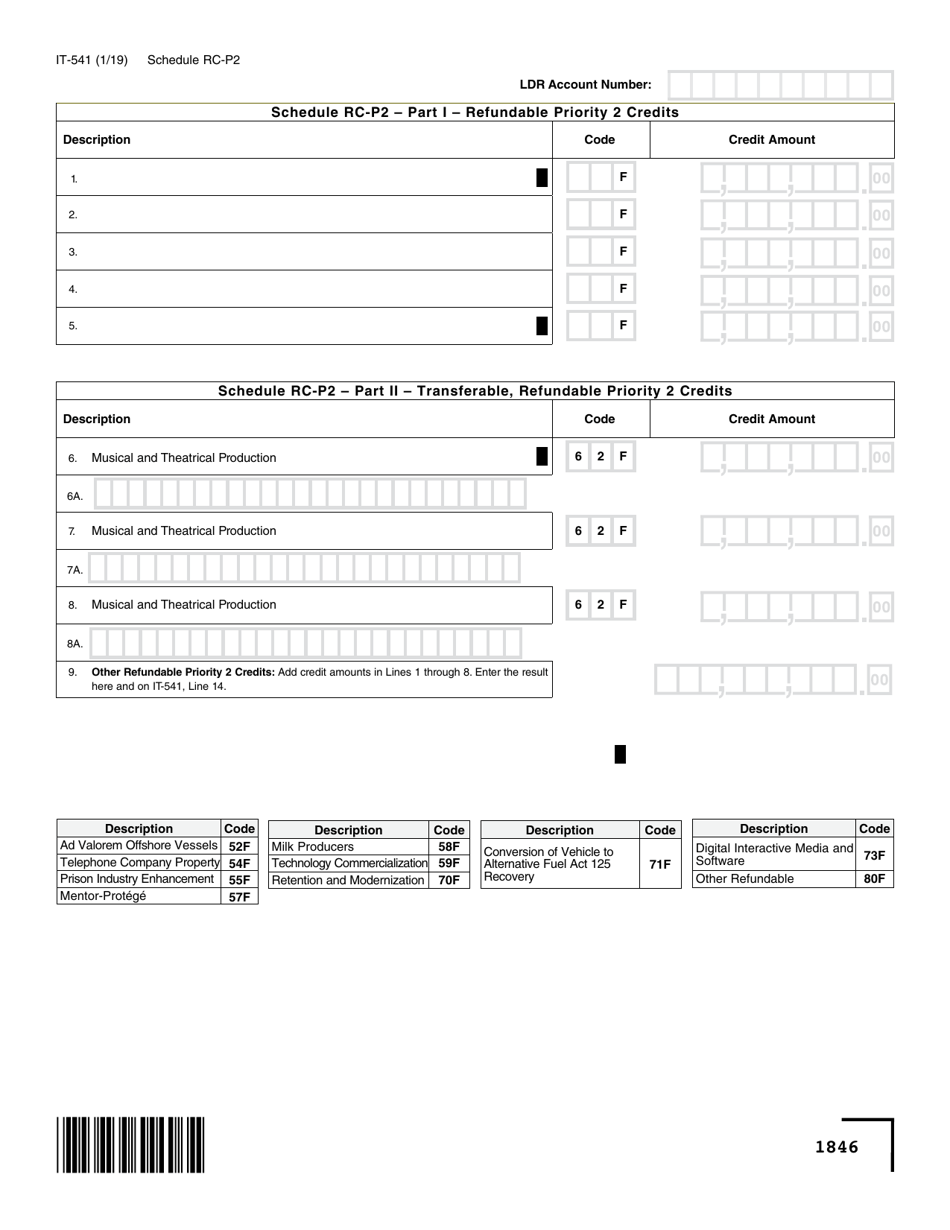

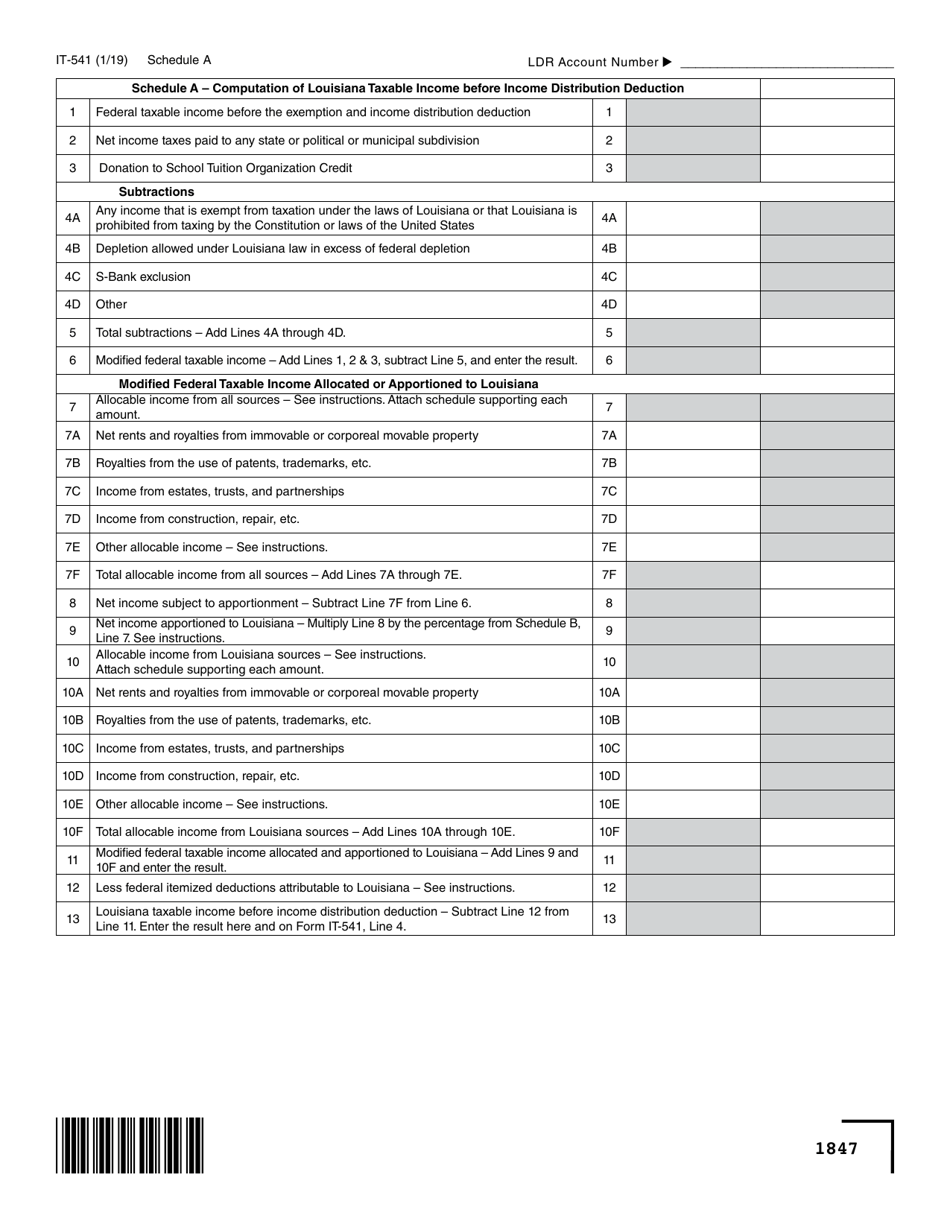

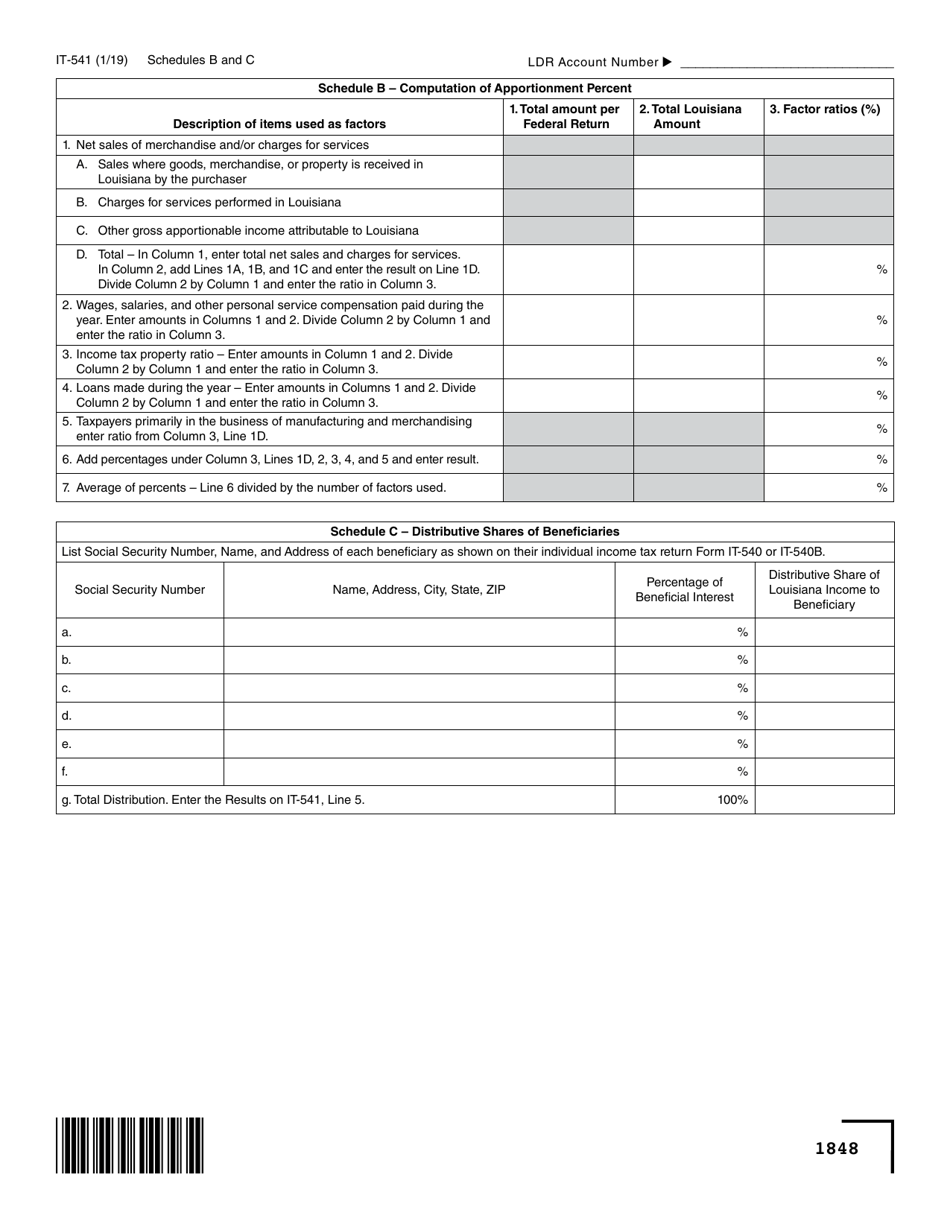

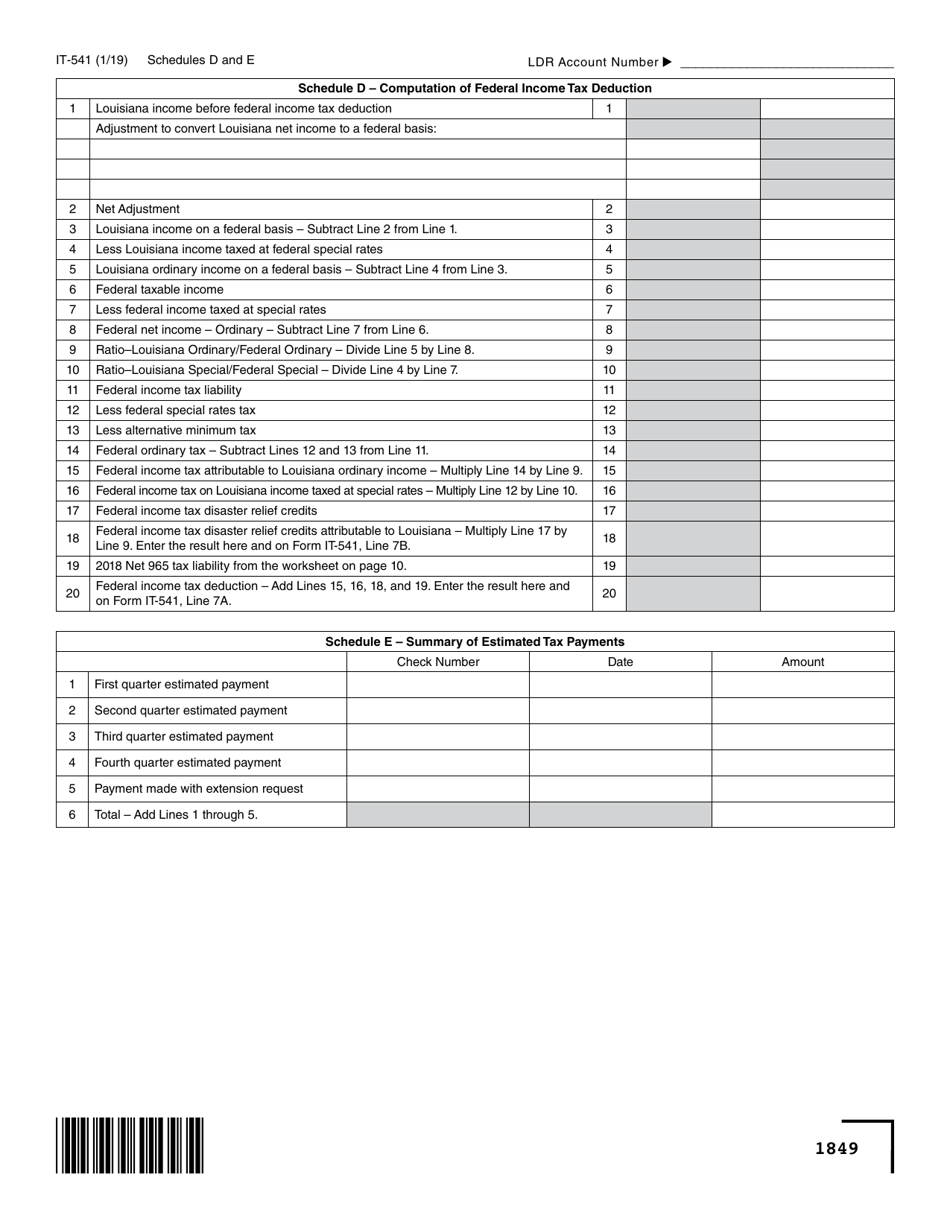

Form IT-541 Fiduciary Income Tax Return - Louisiana

What Is Form IT-541?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

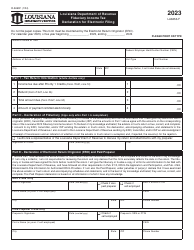

Q: What is Form IT-541?

A: Form IT-541 is the Fiduciary Income Tax Return used in Louisiana.

Q: Who needs to file Form IT-541?

A: Form IT-541 must be filed by estates and trusts that have income from Louisiana sources.

Q: When is Form IT-541 due?

A: Form IT-541 is due on the 15th day of the fourth month following the close of the tax year.

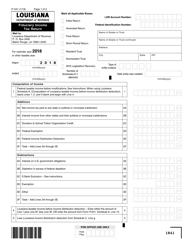

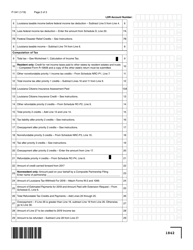

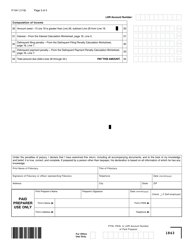

Q: What should be included in Form IT-541?

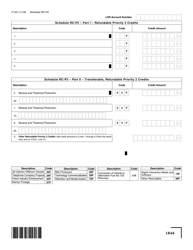

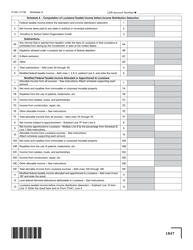

A: Form IT-541 requires you to report the income, deductions, credits, and tax liability of the estate or trust.

Q: Are there any penalties for not filing Form IT-541?

A: Yes, there may be penalties for failing to file or paying the required taxes on time.

Q: Is Form IT-541 the same as the federal tax return?

A: No, Form IT-541 is specific to Louisiana and is different from the federal tax return.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-541 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.