This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

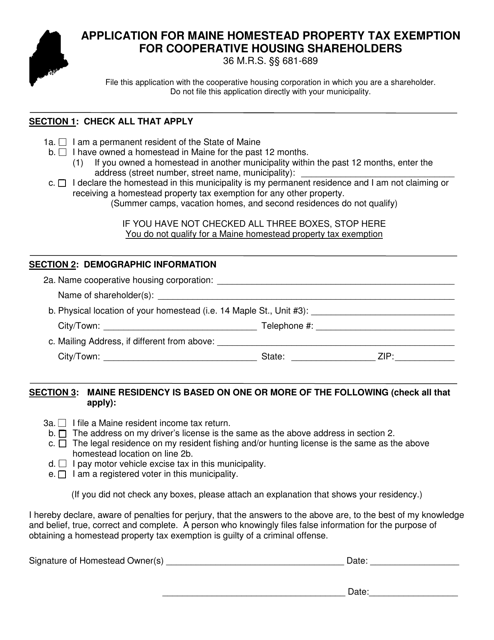

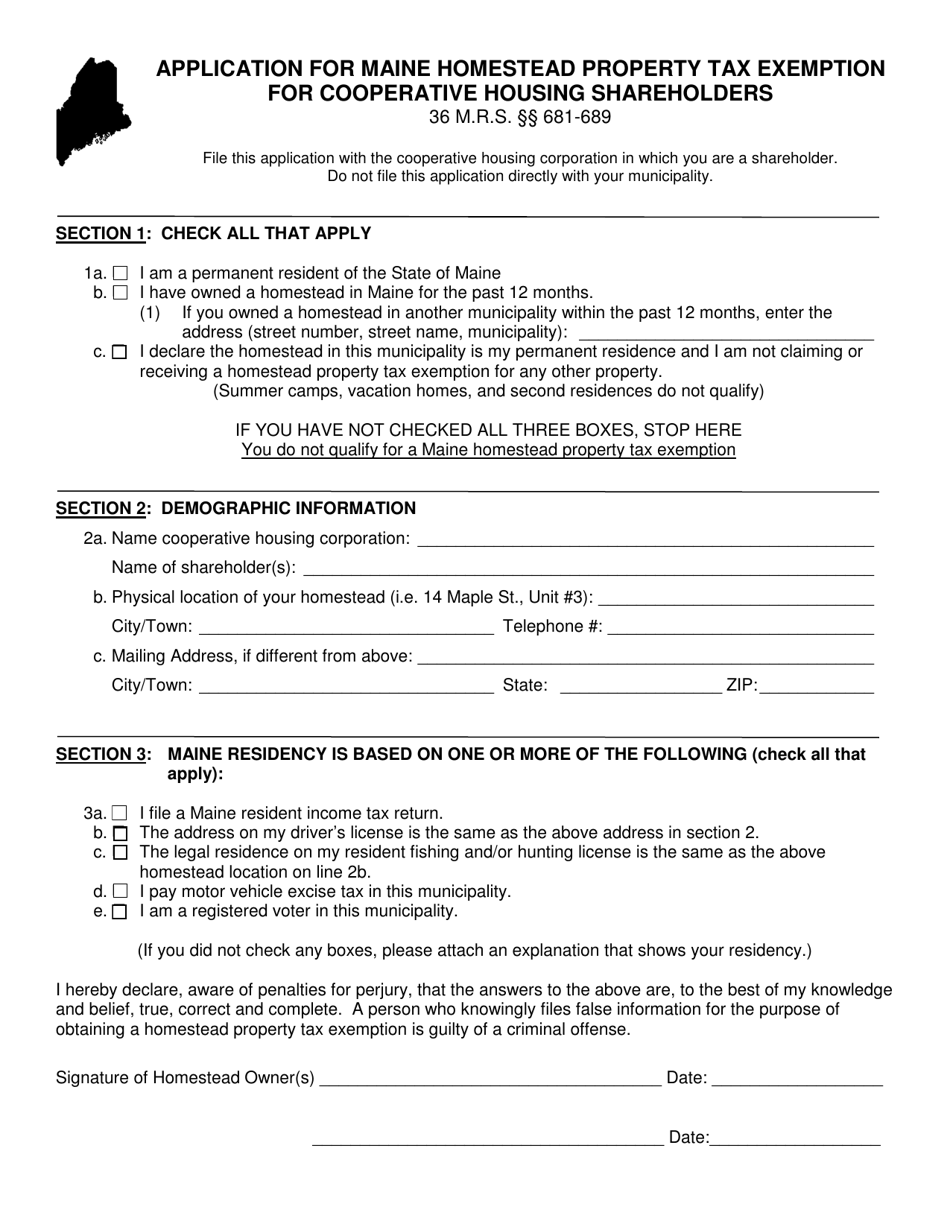

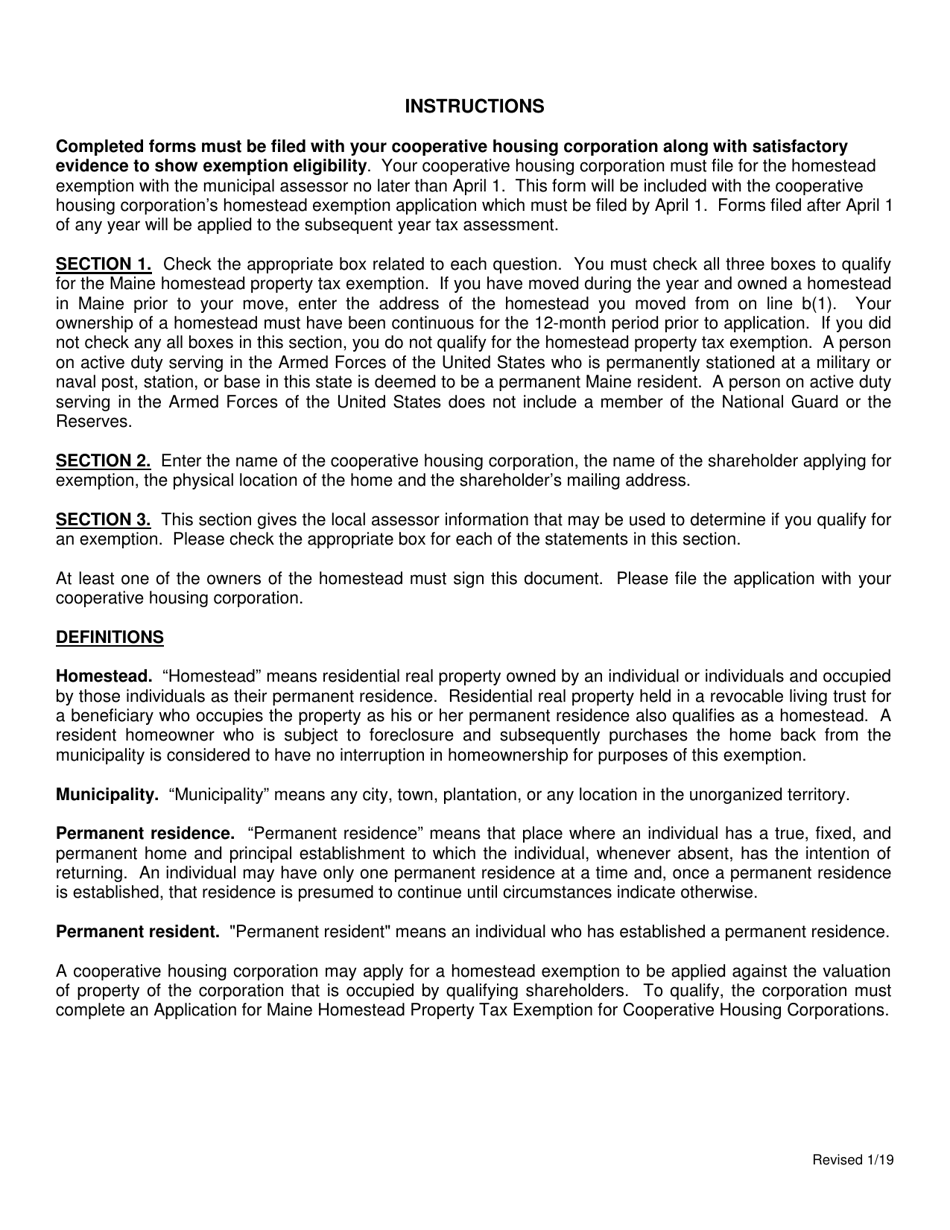

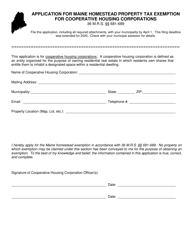

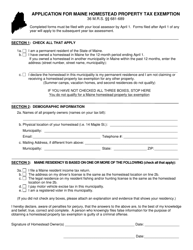

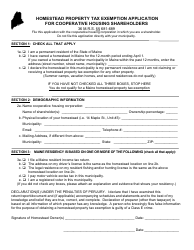

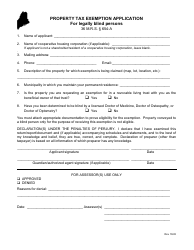

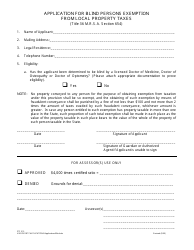

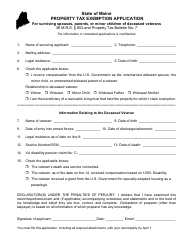

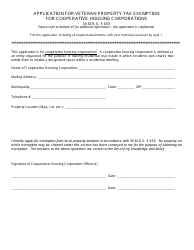

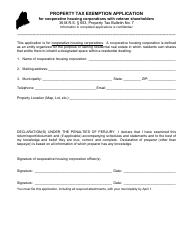

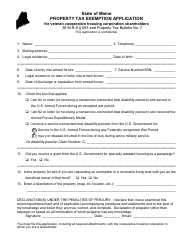

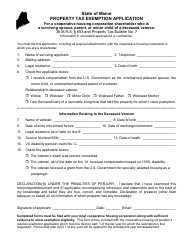

Application for Maine Homestead Property Tax Exemption for Cooperative Housing Shareholders - Maine

Application for Maine Cooperative Housing Shareholders is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Maine Homestead Property Tax Exemption?

A: The Maine Homestead Property Tax Exemption is a program that provides a tax break to eligible homeowners.

Q: Who is eligible for the Maine Homestead Property Tax Exemption?

A: Homeowners who own and occupy their primary residence in Maine may be eligible for the exemption.

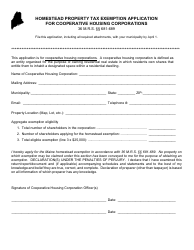

Q: What is cooperative housing?

A: Cooperative housing is a type of housing where shareholders collectively own and have the right to occupy the property.

Q: Who qualifies as a cooperative housing shareholder?

A: Shareholders are individuals who have purchased shares in a cooperative housing corporation and are entitled to occupy a specific unit.

Q: What are the benefits of the Homestead Property Tax Exemption for cooperative housing shareholders?

A: Cooperative housing shareholders who qualify for the exemption may be eligible for property tax savings.

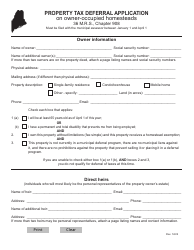

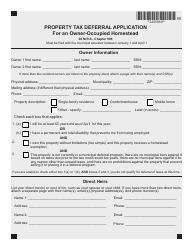

Q: How can I apply for the Maine Homestead Property Tax Exemption for cooperative housing shareholders?

A: To apply for the exemption, you will need to complete an application form and submit it to your local tax assessor's office.

Q: Is there an income limit for the Homestead Property Tax Exemption?

A: Yes, there are income limits that must be met to qualify for the exemption. The income limits vary depending on the municipality.

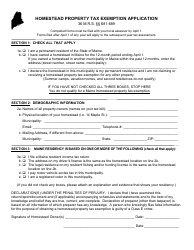

Q: When is the deadline to file the application for the Maine Homestead Property Tax Exemption?

A: The deadline to file the application is April 1st of each year.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.