This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

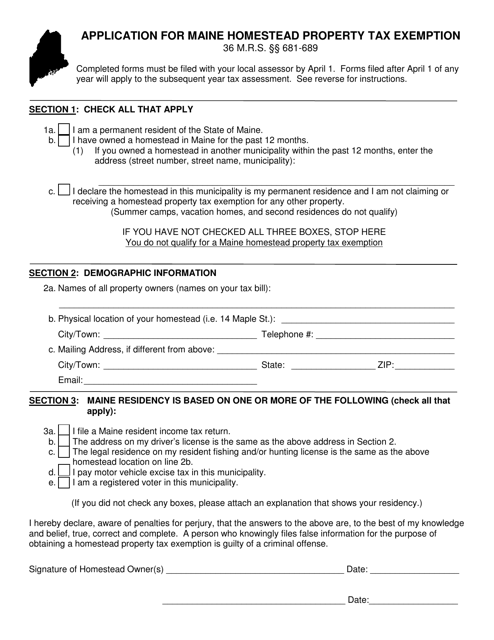

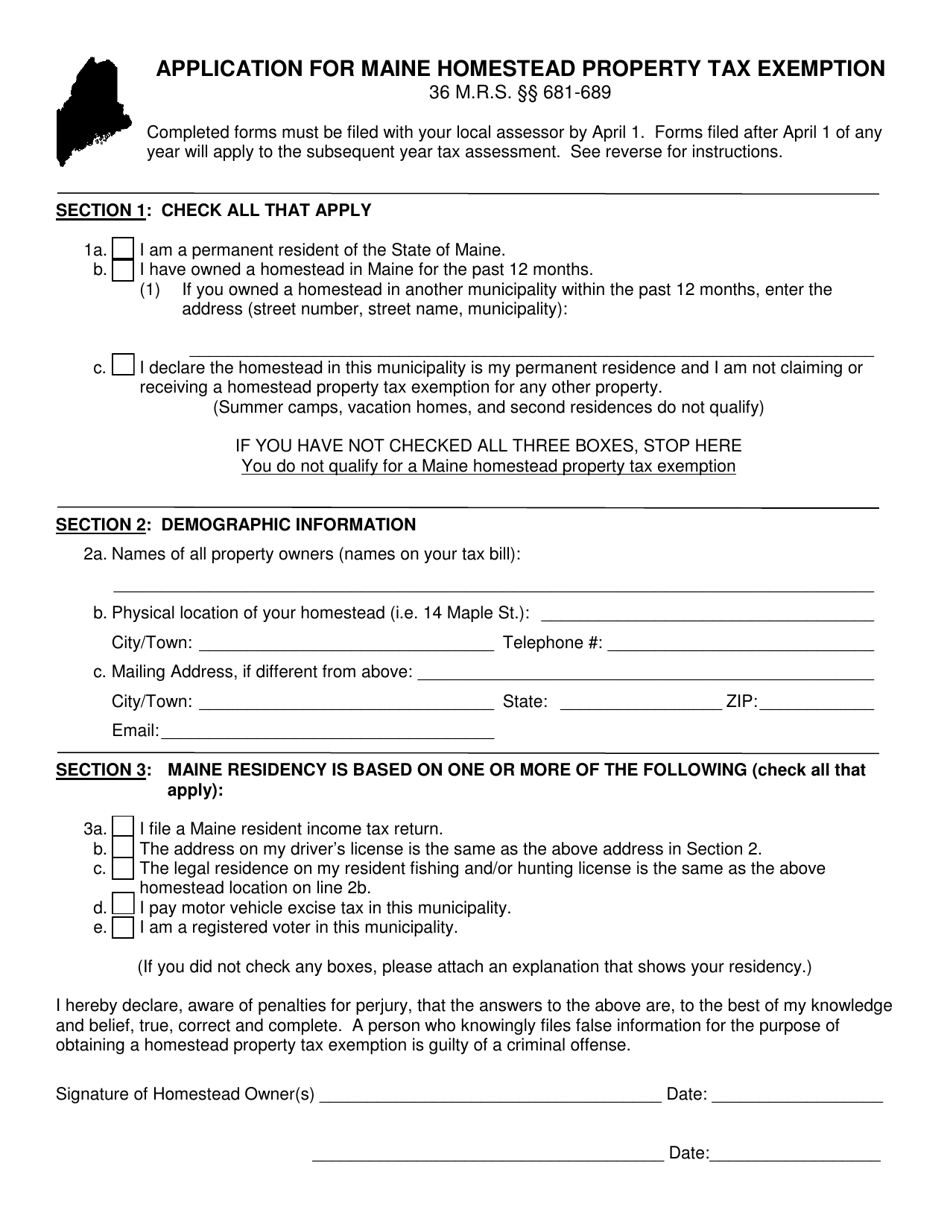

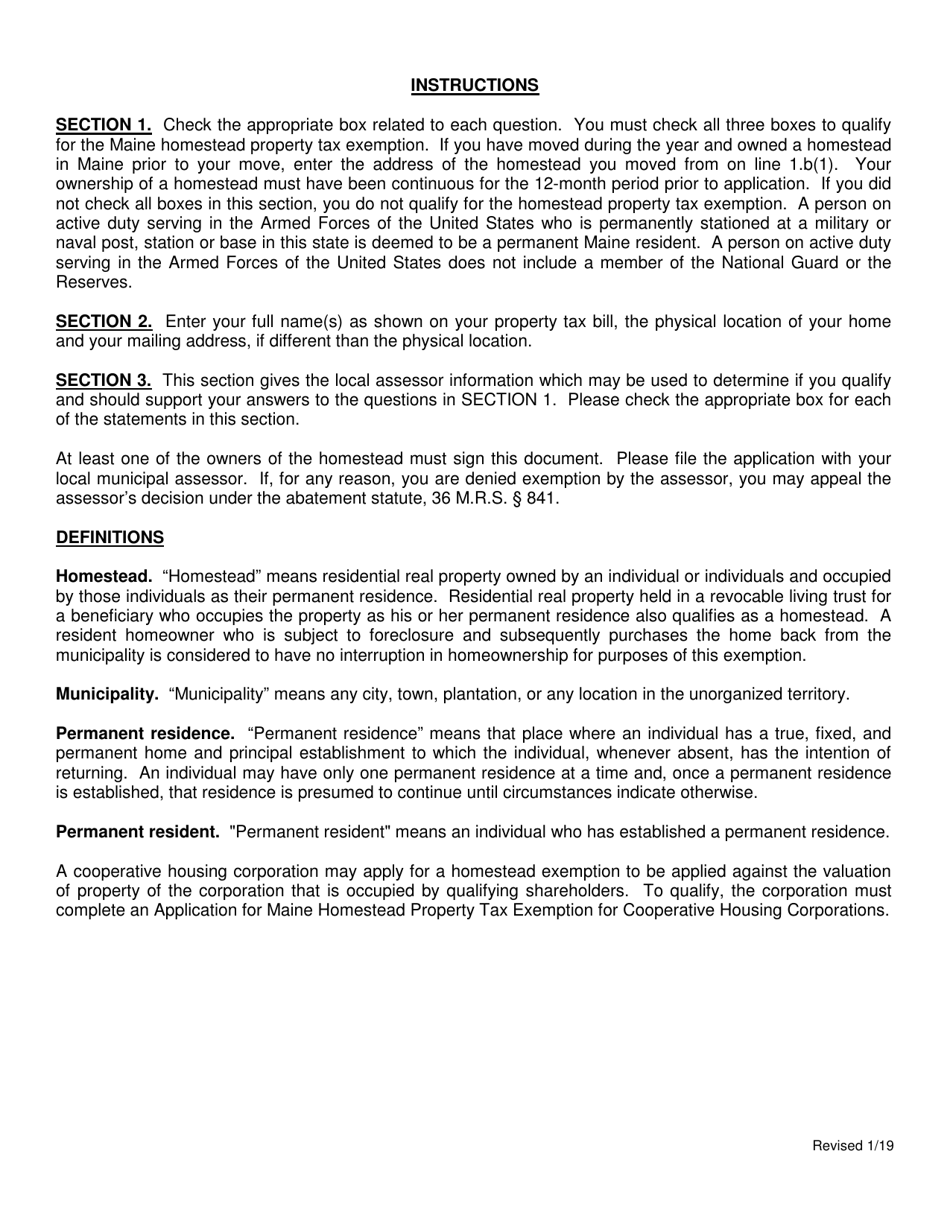

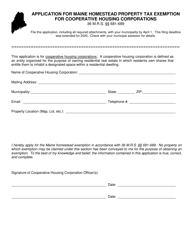

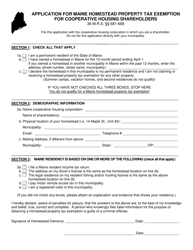

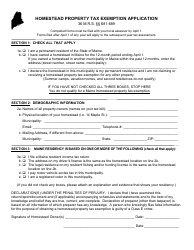

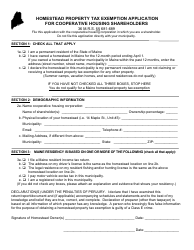

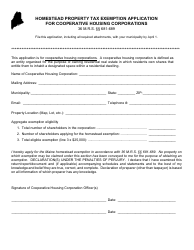

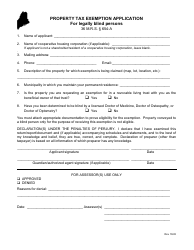

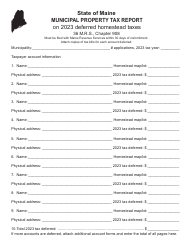

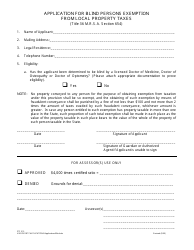

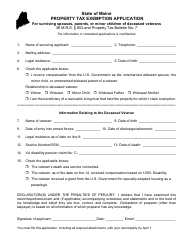

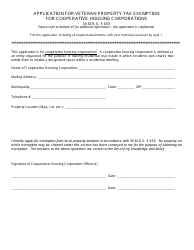

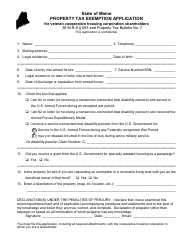

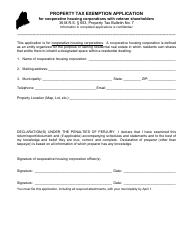

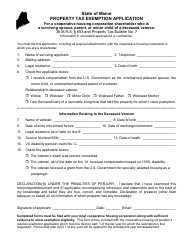

Application for Maine Homestead Property Tax Exemption - Maine

Application for Maine Homestead Property Tax Exemption is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

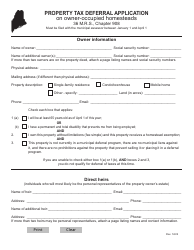

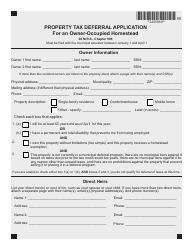

Q: What is the Maine Homestead Property Tax Exemption?

A: The Maine Homestead Property Tax Exemption is a program that provides tax relief to eligible homeowners.

Q: Who is eligible for the Maine Homestead Property Tax Exemption?

A: Homeowners in Maine who have owned and occupied their property as their primary residence for at least 12 months are eligible for the exemption.

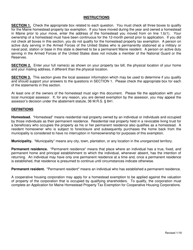

Q: How do I apply for the Maine Homestead Property Tax Exemption?

A: To apply for the exemption, you need to complete and submit the application form to your local tax assessor's office.

Q: What are the benefits of the Maine Homestead Property Tax Exemption?

A: The exemption can reduce the property taxes owed by eligible homeowners, providing them with potential savings.

Q: Is there an income limit for the Maine Homestead Property Tax Exemption?

A: Yes, there is an income limit for the exemption. You must meet certain income requirements to qualify.

Q: Are there any deadlines for applying for the Maine Homestead Property Tax Exemption?

A: Yes, there are specific deadlines for applying. It is important to check with your local tax assessor's office for the exact deadlines.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.