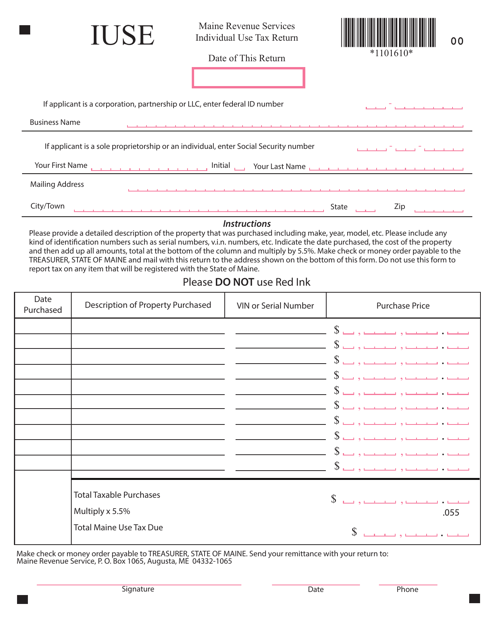

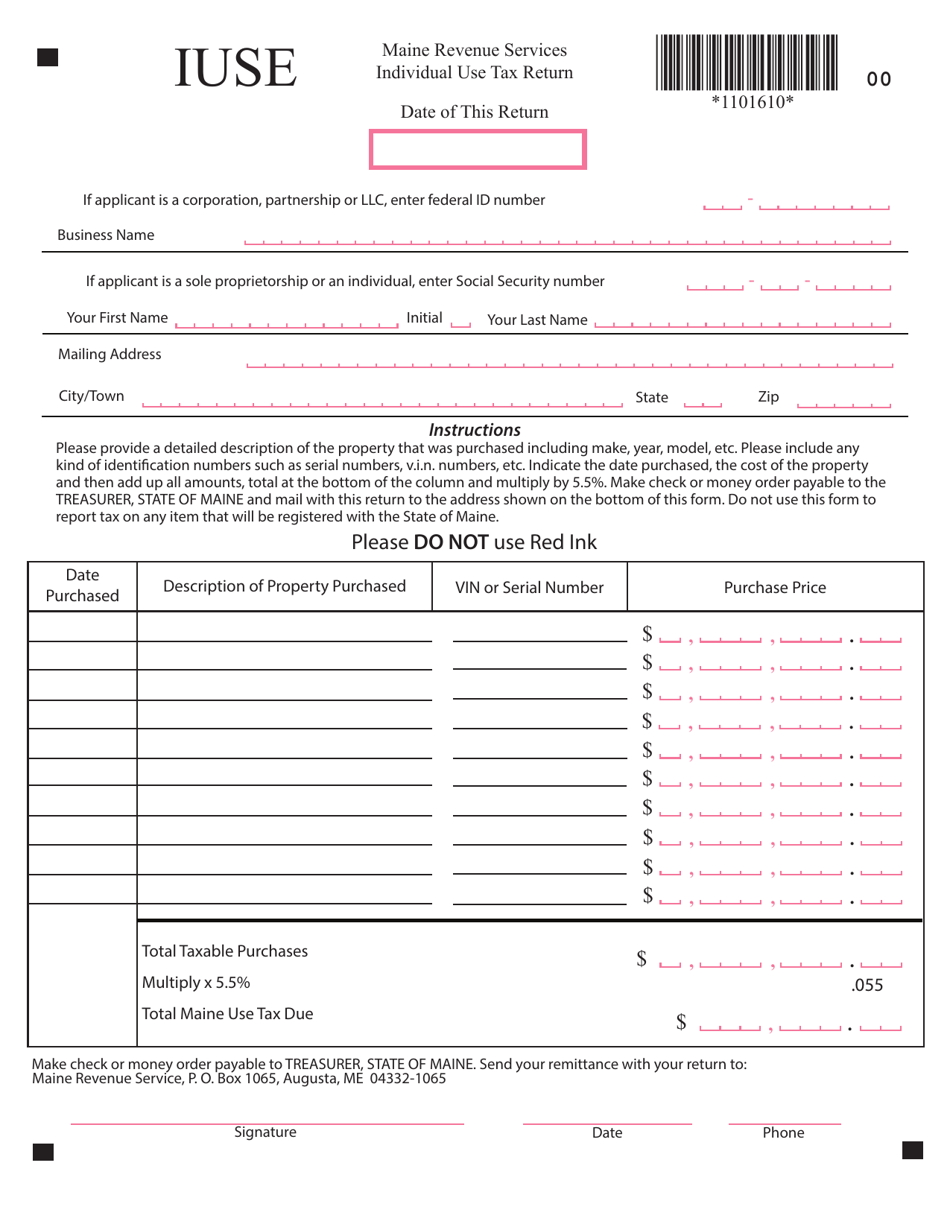

Form IUSE Individual Use Tax Return - Maine

What Is Form IUSE?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IUSE?

A: Form IUSE is the Individual Use Tax Return for residents of Maine.

Q: Who should file Form IUSE?

A: Residents of Maine who made purchases of taxable items for personal use and did not pay sales tax at the time of purchase should file Form IUSE.

Q: What is the purpose of Form IUSE?

A: The purpose of Form IUSE is to report and pay the use tax on taxable items purchased for personal use.

Q: When is the deadline for filing Form IUSE?

A: The deadline for filing Form IUSE is typically the same as the deadline for filing your Maine income tax return, which is April 15th.

Q: What happens if I don't file Form IUSE?

A: If you fail to file Form IUSE and pay the use tax owed, you may be subject to penalties and interest on the unpaid amount.

Q: Are there any exemptions to the use tax?

A: Yes, certain items such as groceries, prescription drugs, and items purchased for resale are exempt from the use tax.

Q: What documentation do I need to file Form IUSE?

A: You will need to provide documentation of your purchases, such as receipts or invoices, to support your use tax calculation.

Q: Can I claim a credit for sales tax paid to another state?

A: Yes, if you paid sales tax to another state on a taxable item, you can claim a credit on your Form IUSE.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IUSE by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.