This version of the form is not currently in use and is provided for reference only. Download this version of

Form 706ME

for the current year.

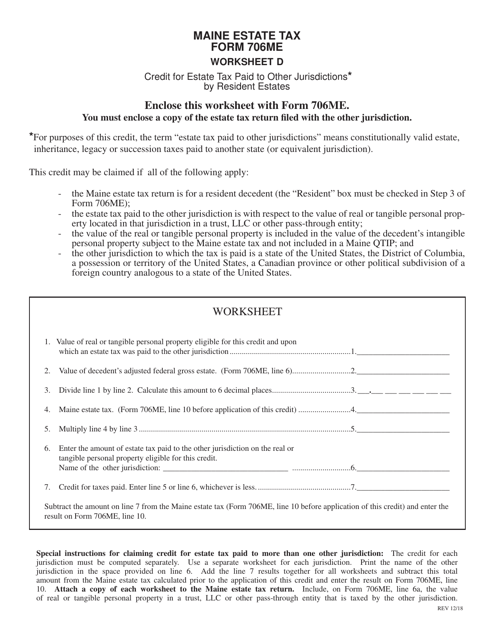

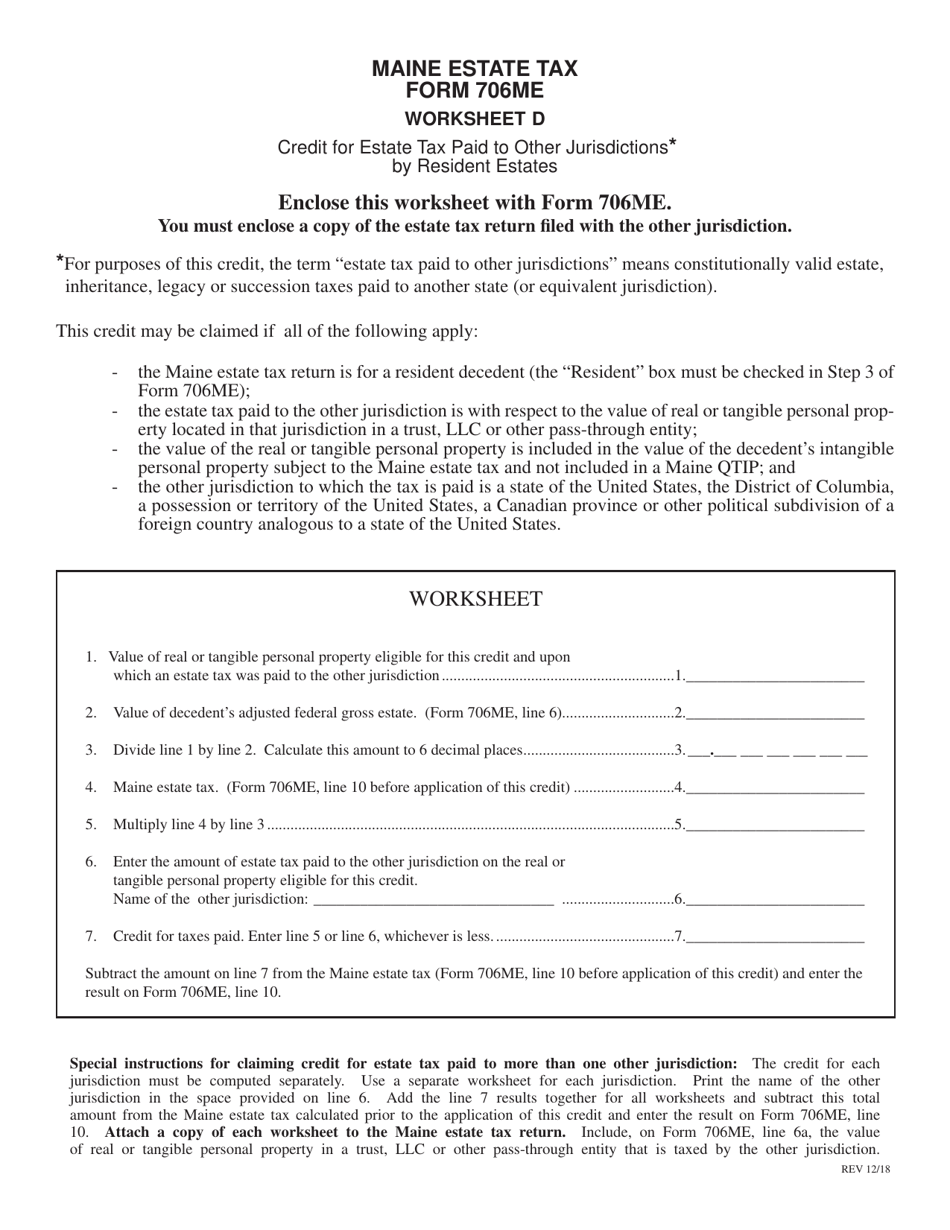

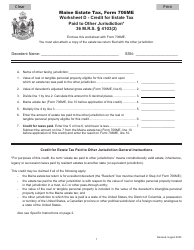

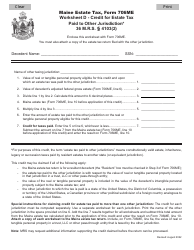

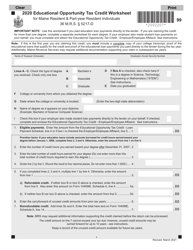

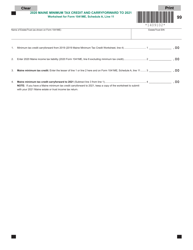

Form 706ME Worksheet D - Credit for Estate Tax Paid to Other Jurisdictions by Resident Estates - Maine

What Is Form 706ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 706ME Worksheet D?

A: Form 706ME Worksheet D is a document used by resident estates in Maine to calculate the credit for estate tax paid to other jurisdictions.

Q: Who needs to use Form 706ME Worksheet D?

A: Resident estates in Maine who have paid estate tax to other jurisdictions need to use Form 706ME Worksheet D.

Q: What is the purpose of Form 706ME Worksheet D?

A: The purpose of Form 706ME Worksheet D is to determine the credit amount that resident estates in Maine can claim for estate tax paid to other jurisdictions.

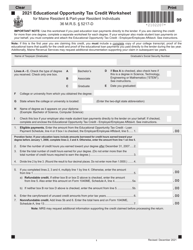

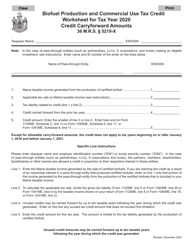

Q: What information is required on Form 706ME Worksheet D?

A: Form 706ME Worksheet D requires information about the estate tax paid to other jurisdictions, including the name of the jurisdiction, the date and amount of payment, and any supporting documents.

Q: Is there a deadline for filing Form 706ME Worksheet D?

A: Yes, Form 706ME Worksheet D must be filed within 9 months from the date of death, or within 15 months if an extension has been granted.

Q: Can I claim a credit for estate tax paid to any jurisdiction?

A: No, you can only claim a credit for estate tax paid to other jurisdictions if there is a reciprocal agreement between Maine and that jurisdiction.

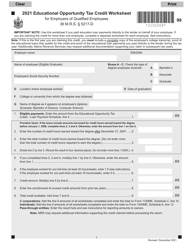

Q: What happens if I overpaid estate tax to another jurisdiction?

A: If you overpaid estate tax to another jurisdiction, you may be eligible for a refund or credit.

Q: How do I calculate the credit for estate tax paid to other jurisdictions?

A: The credit for estate tax paid to other jurisdictions is calculated by multiplying the estate tax paid to the other jurisdiction by a ratio of Maine taxable assets to the total taxable assets.

Q: Do I need to include supporting documents with Form 706ME Worksheet D?

A: Yes, you need to include copies of the estate tax returns filed with other jurisdictions and any supporting documentation that shows the amount of estate tax paid.

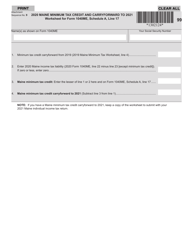

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 706ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.