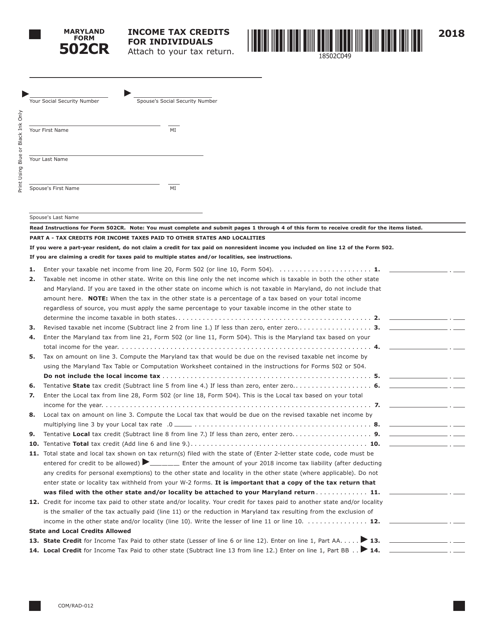

Form COM / RAD-012 (Maryland Form 502CR) Income Tax Credits for Individuals - Maryland

What Is Form COM/RAD-012 (Maryland Form 502CR)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD-012?

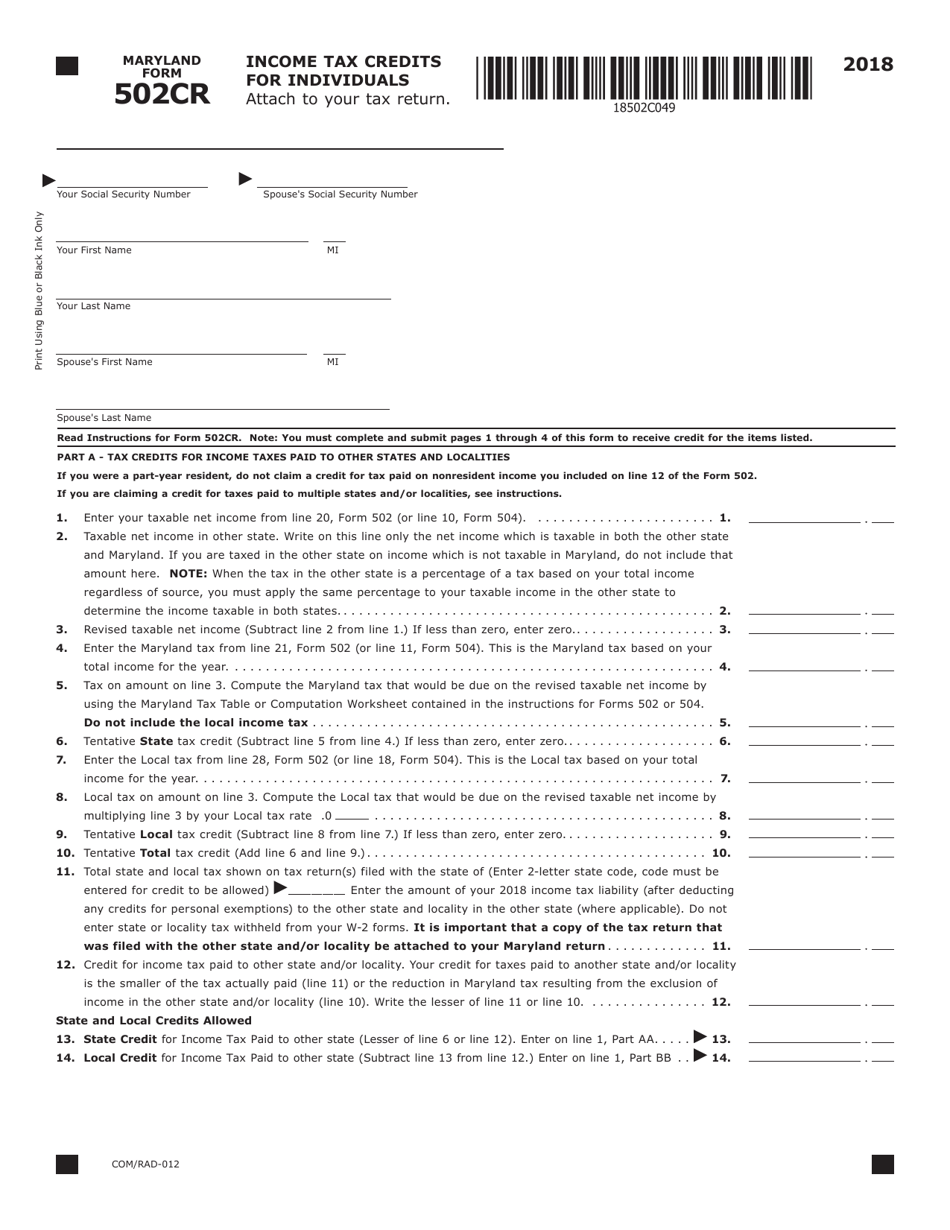

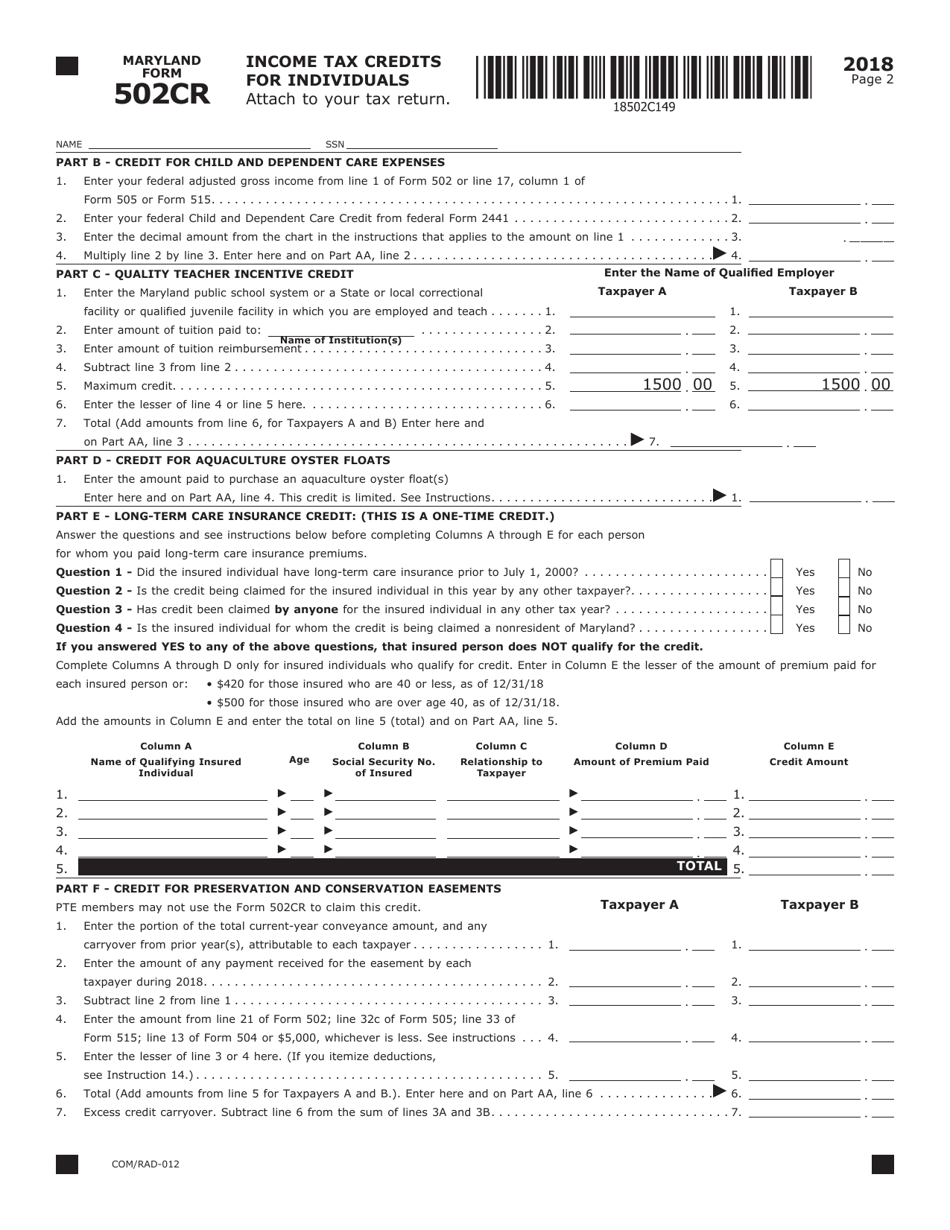

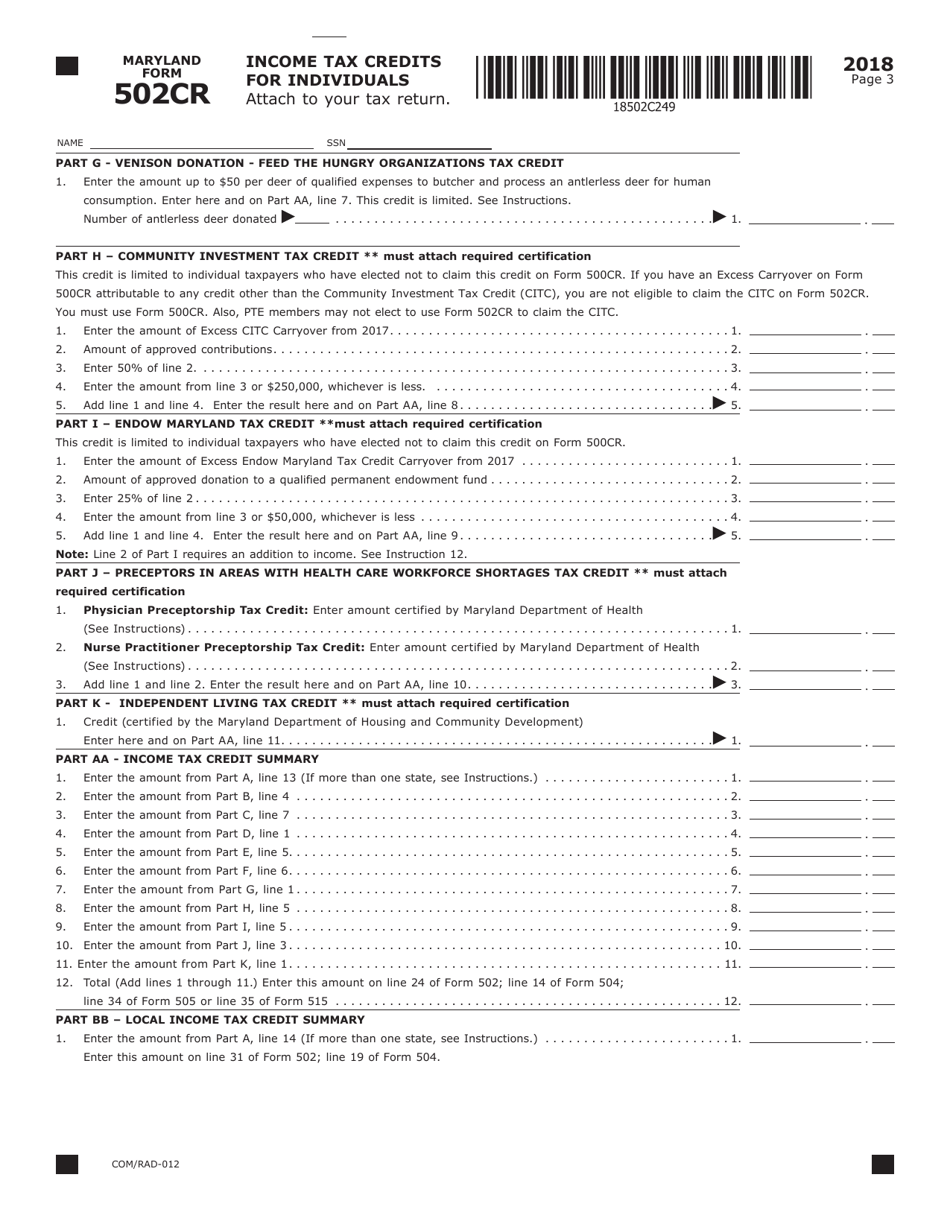

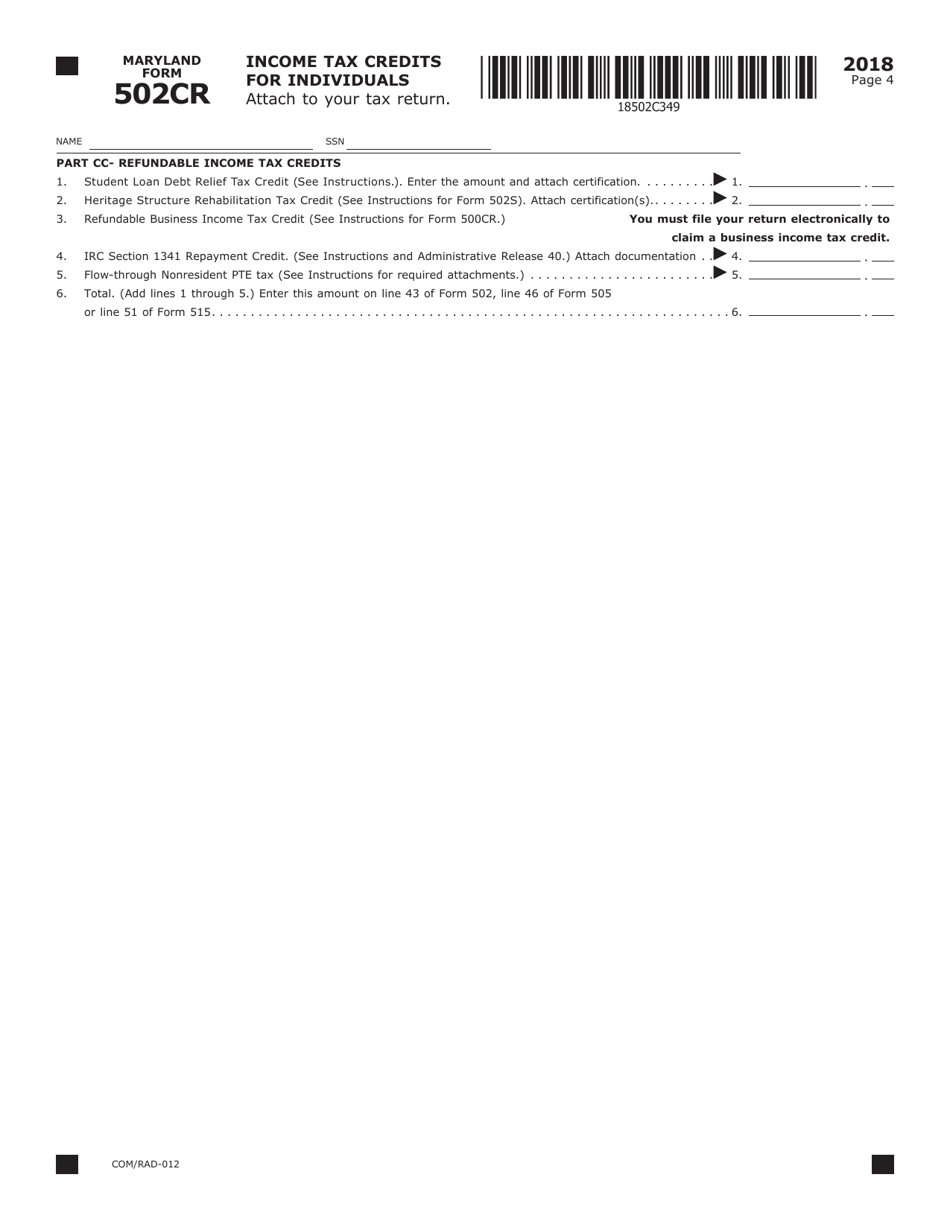

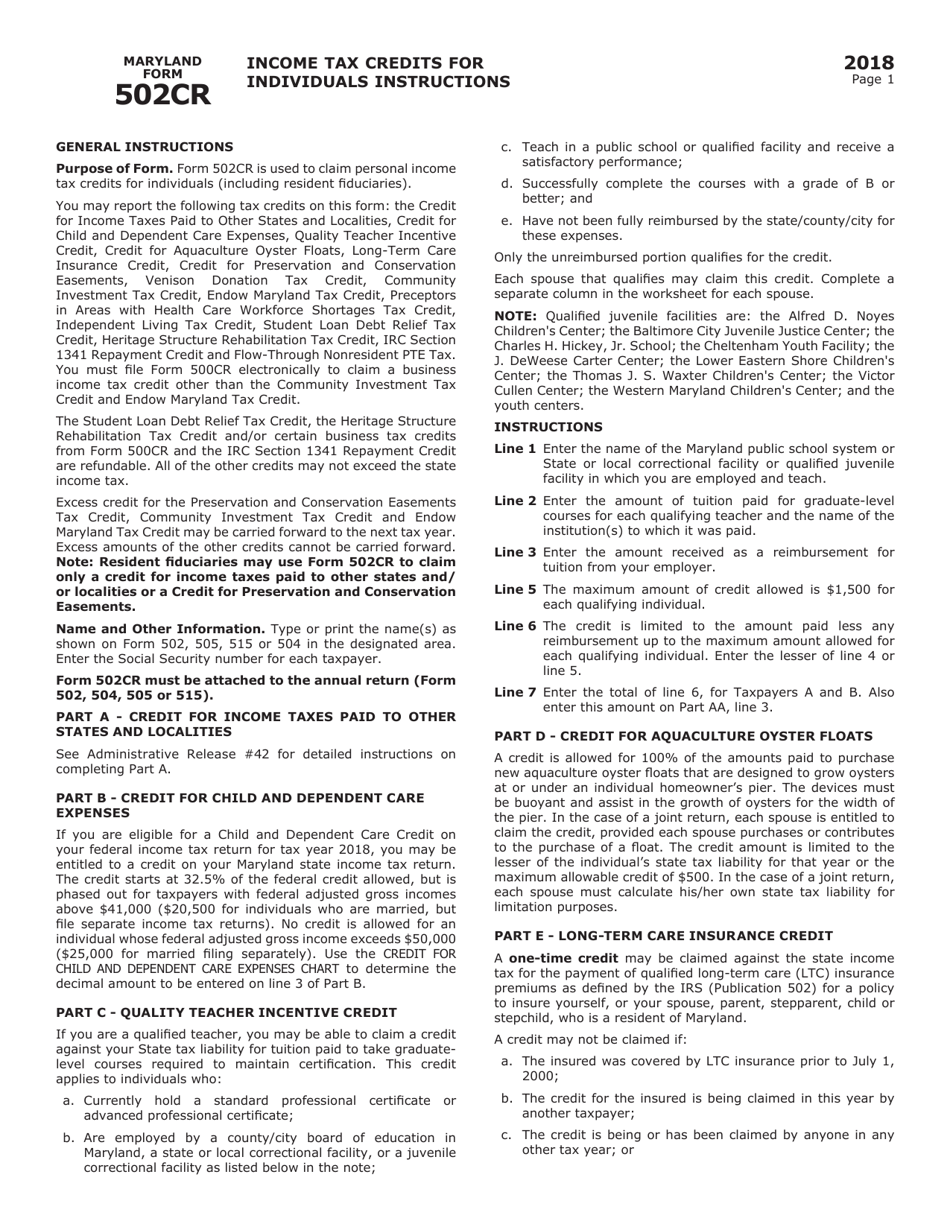

A: Form COM/RAD-012, also known as Maryland Form 502CR, is used to claim income tax credits for individuals in the state of Maryland.

Q: Who can use Form COM/RAD-012?

A: Any individual who is eligible for income tax credits in Maryland can use Form COM/RAD-012.

Q: What are income tax credits?

A: Income tax credits are deductions or reductions in the amount of tax owed. They can help reduce the tax burden on individuals and provide incentives for certain behaviors or circumstances.

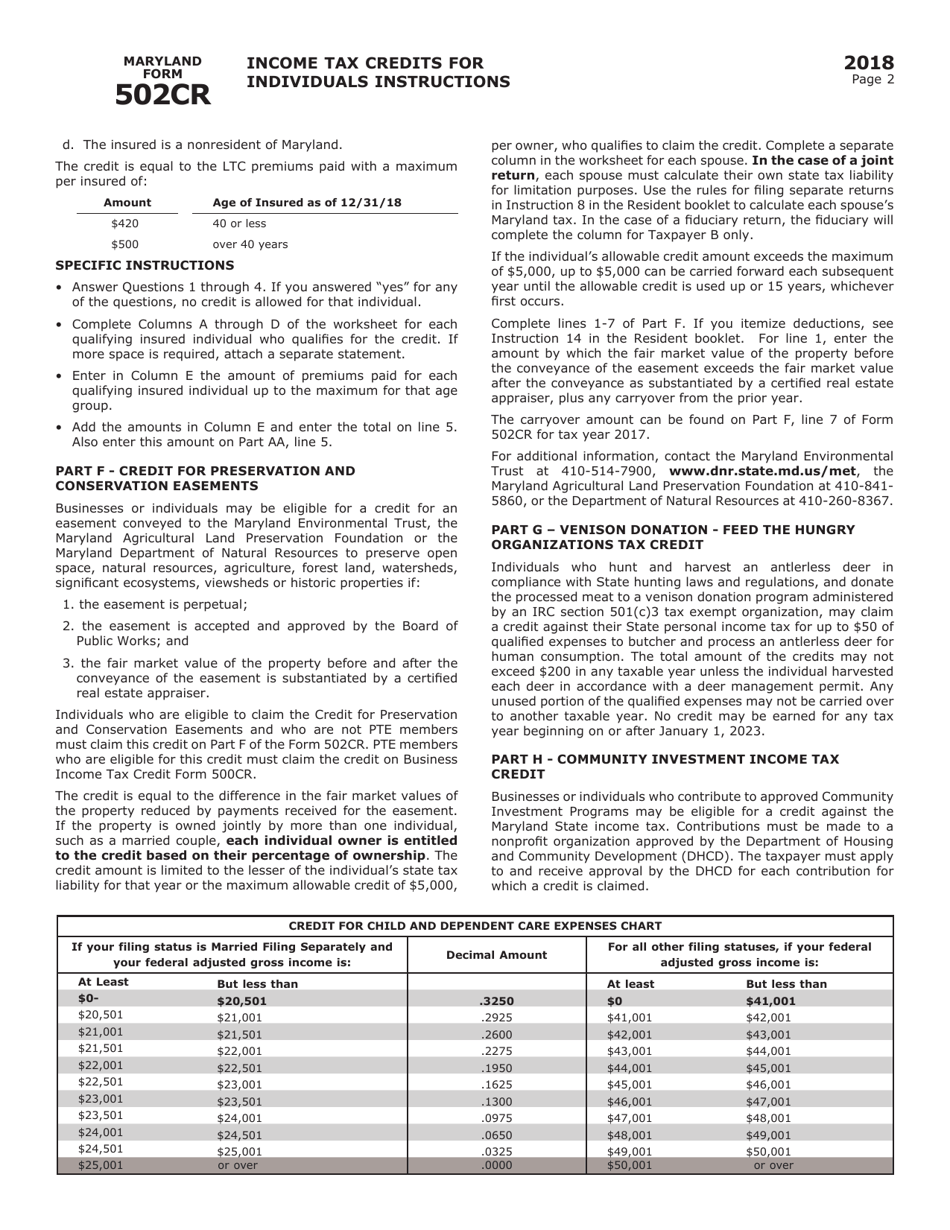

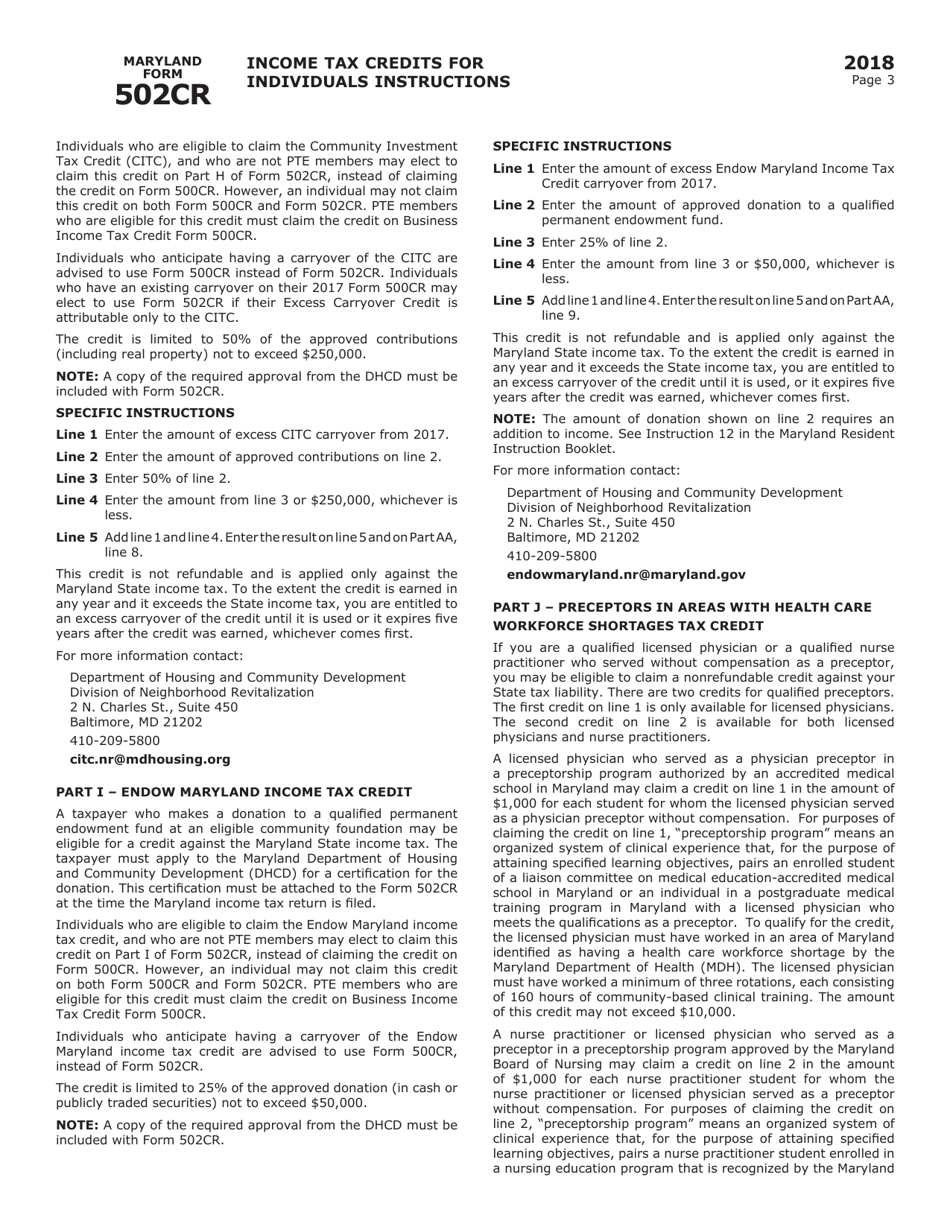

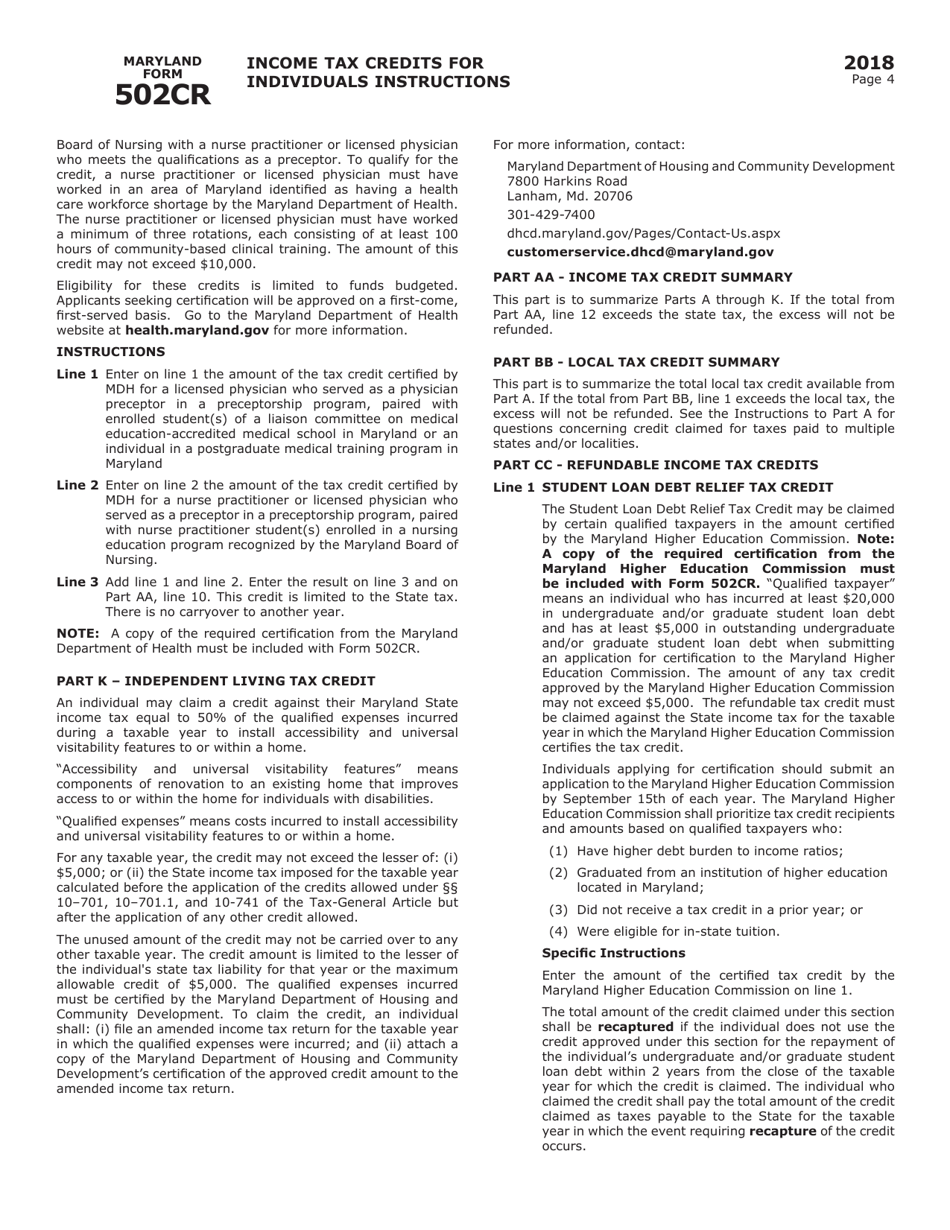

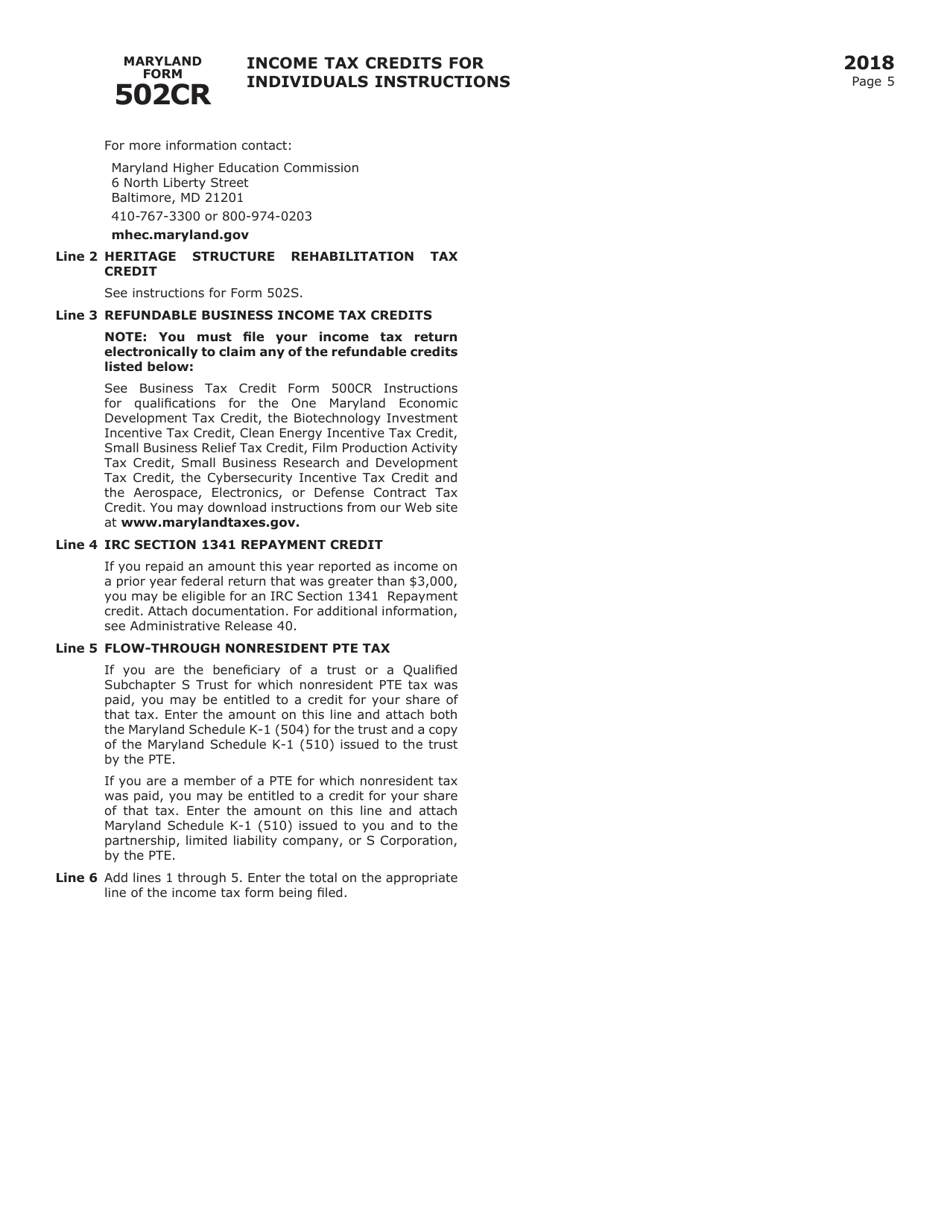

Q: What types of tax credits are available on Form COM/RAD-012?

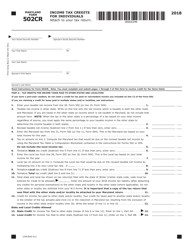

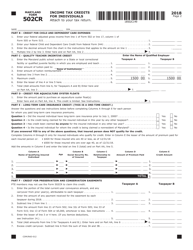

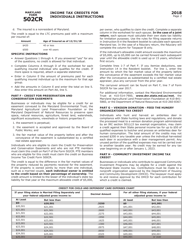

A: Form COM/RAD-012 provides various income tax credits, including but not limited to the Earned Income Credit, Child and Dependent Care Credit, and Credit for Income Taxes Paid to Other States.

Q: How do I fill out Form COM/RAD-012?

A: To fill out Form COM/RAD-012, you will need to follow the instructions provided by the Maryland Department of Revenue. It typically requires entering personal information, income details, and specific information related to the tax credits you are claiming.

Q: When is the deadline to file Form COM/RAD-012?

A: The deadline to file Form COM/RAD-012 in Maryland is usually April 15th, unless it falls on a weekend or holiday, in which case the deadline may be extended.

Q: Can I claim multiple tax credits on Form COM/RAD-012?

A: Yes, you can claim multiple tax credits on Form COM/RAD-012 as long as you meet the eligibility requirements for each credit.

Q: Is there a fee to file Form COM/RAD-012?

A: There is no fee to file Form COM/RAD-012. However, you may need to pay any tax owed based on your income and tax credits claimed.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD-012 (Maryland Form 502CR) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.