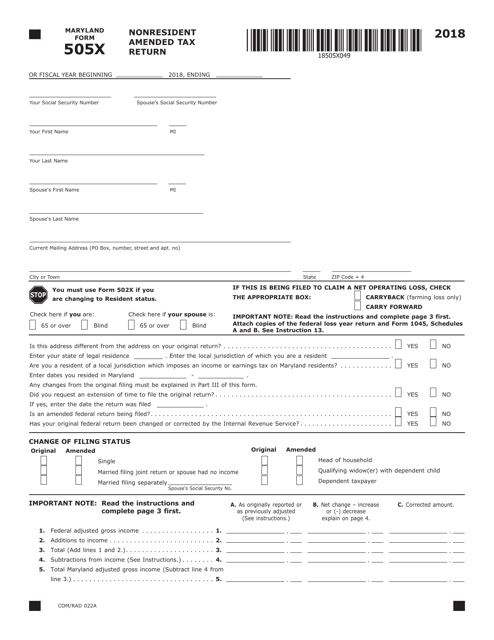

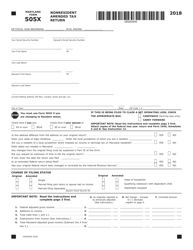

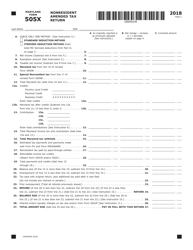

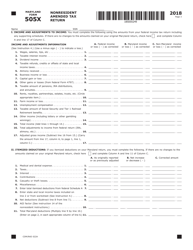

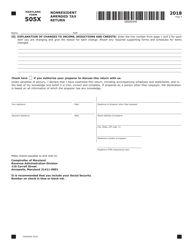

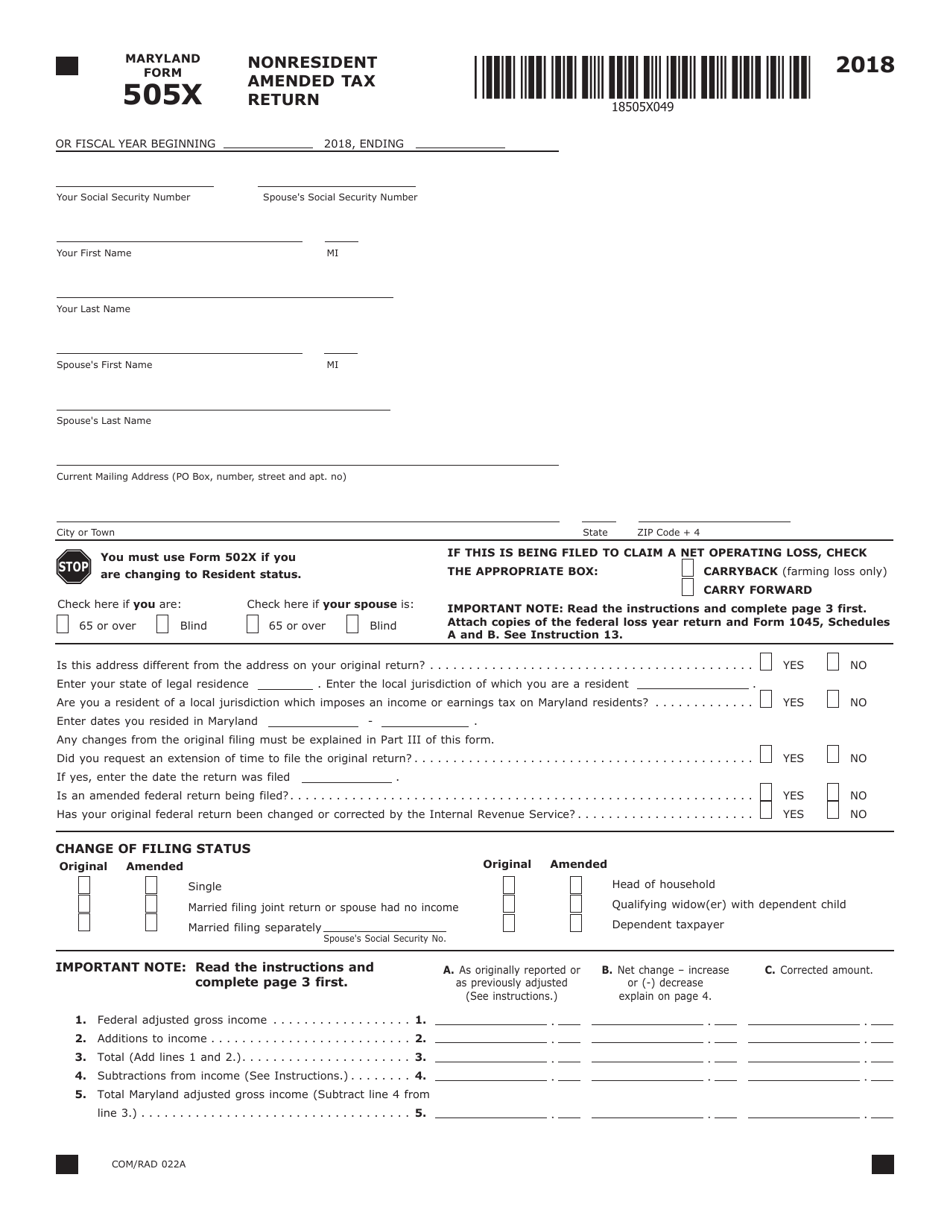

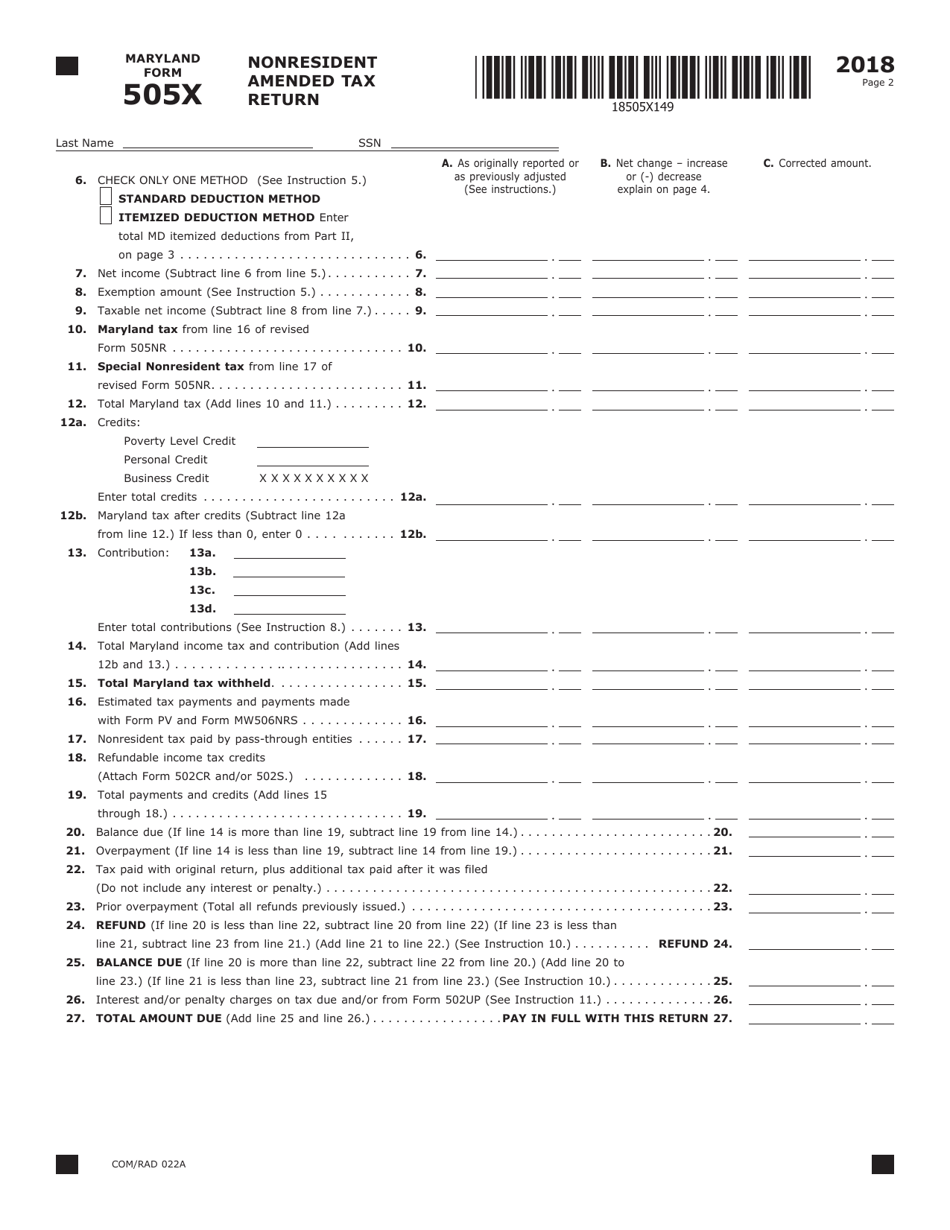

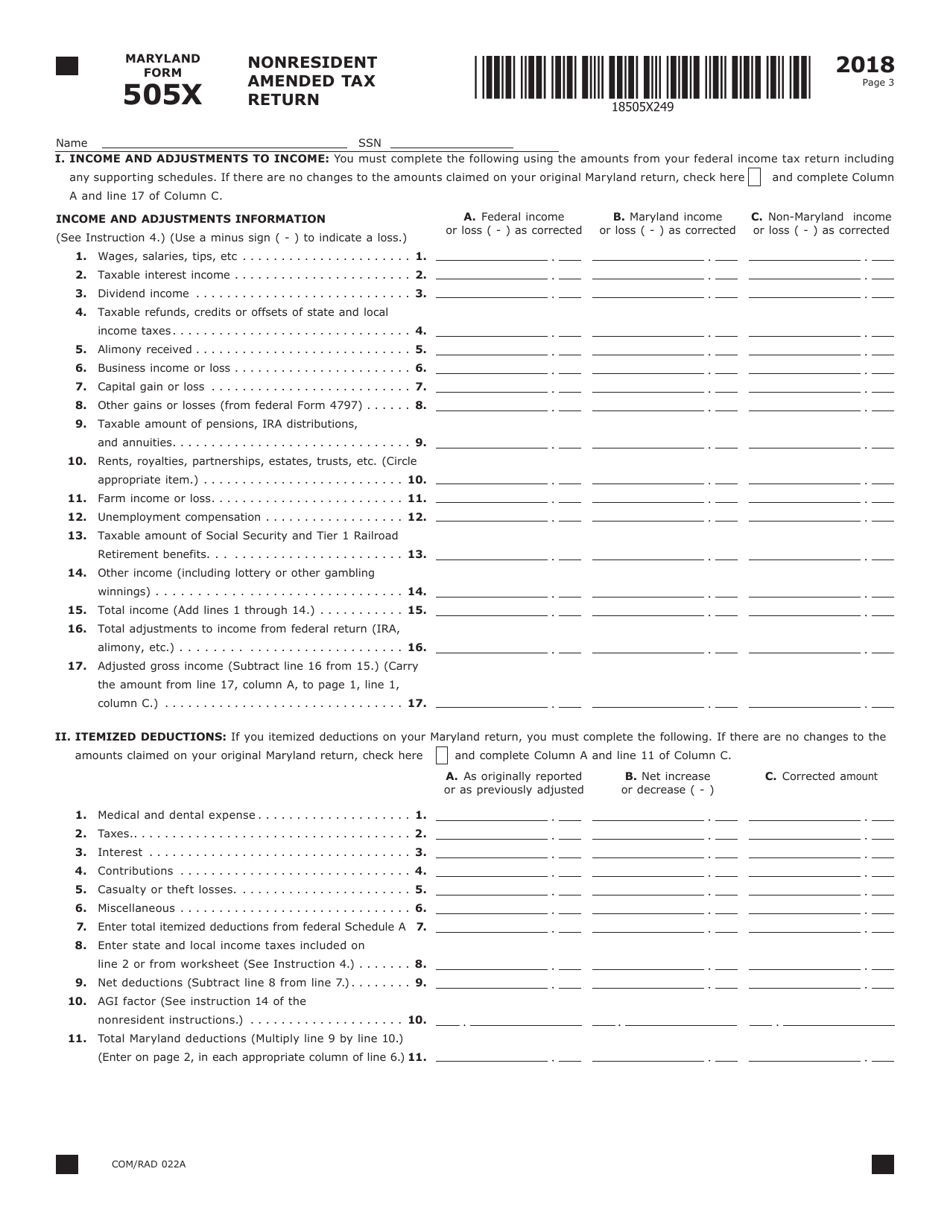

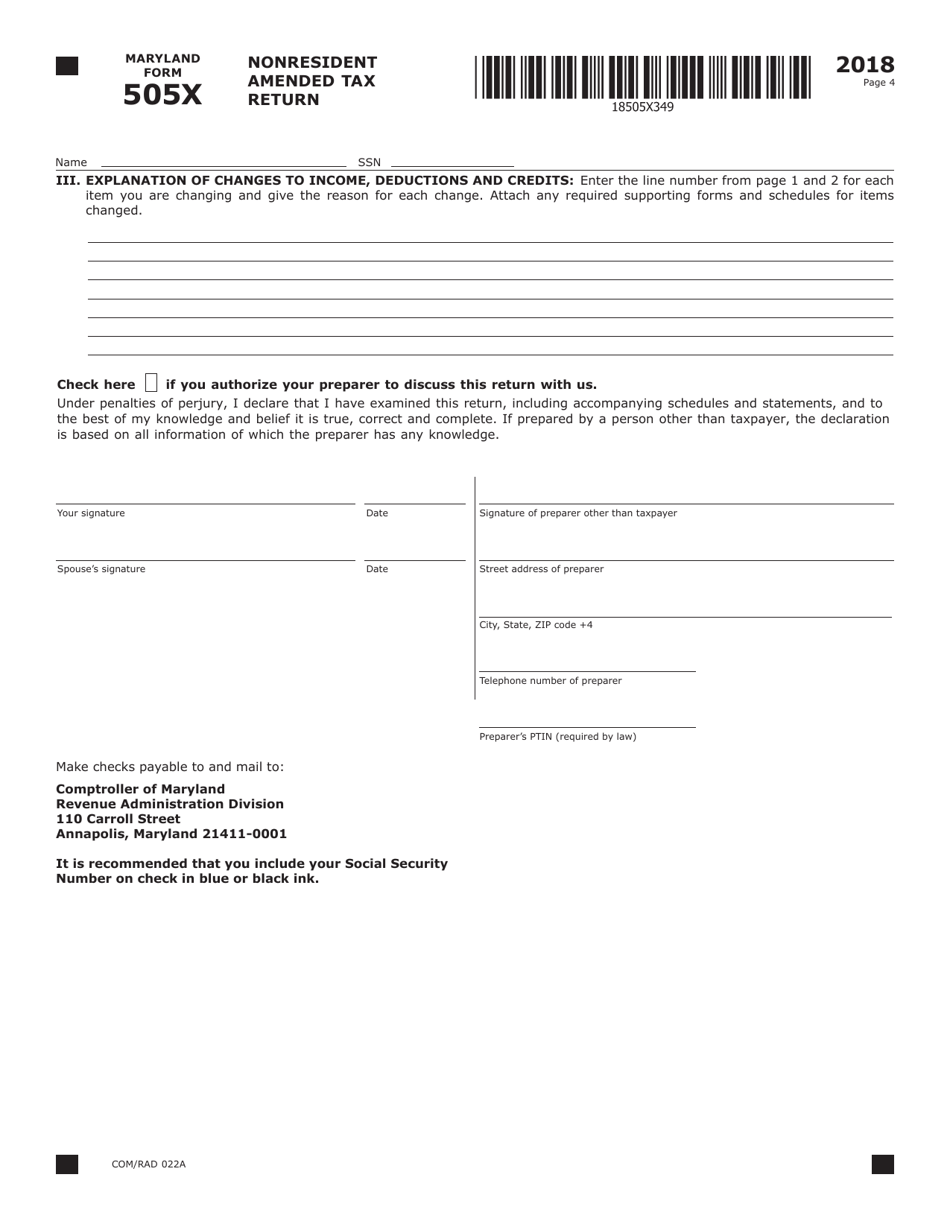

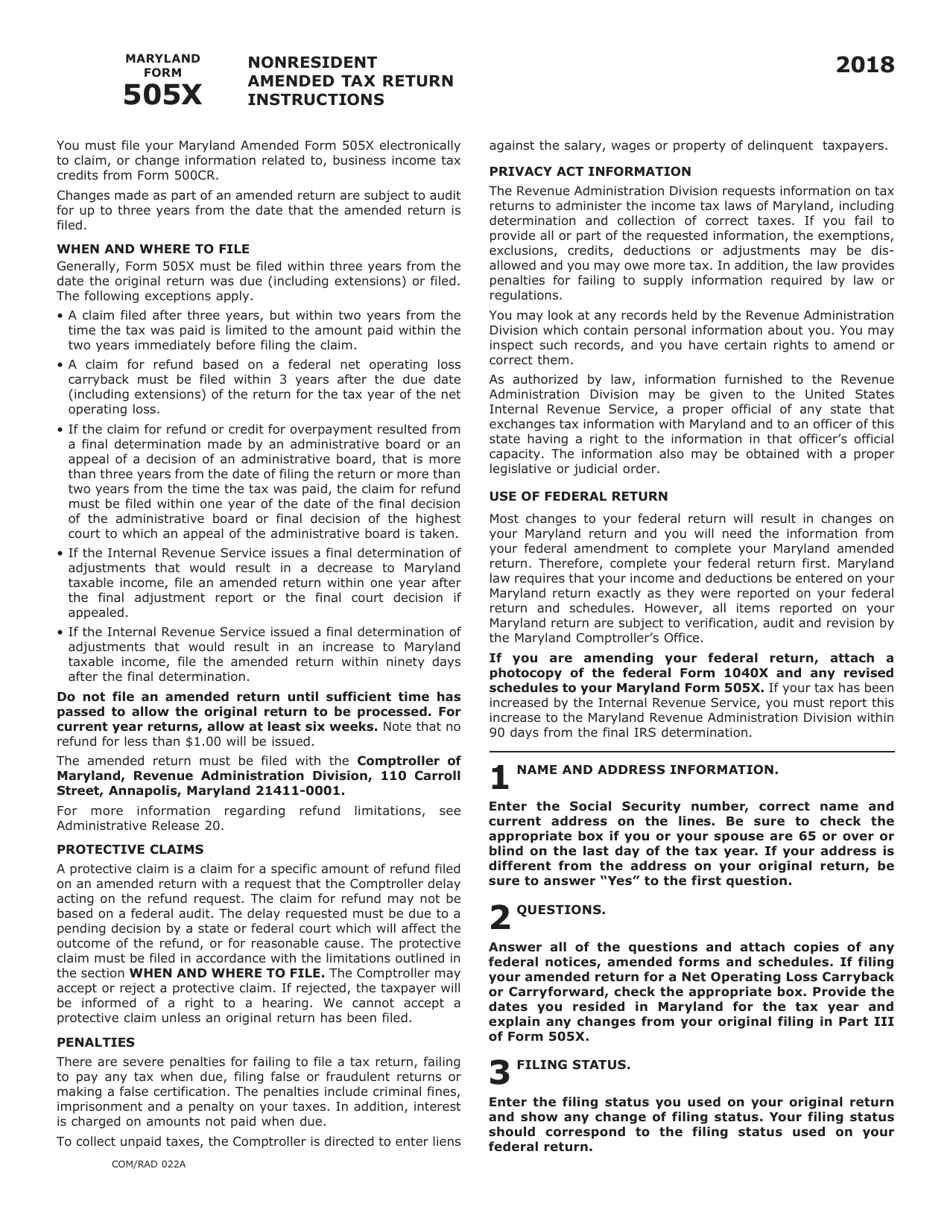

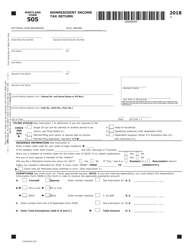

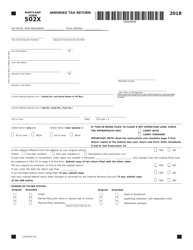

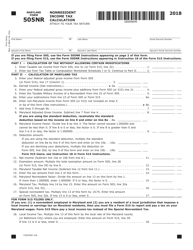

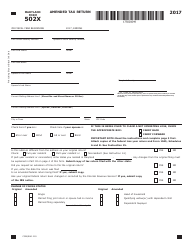

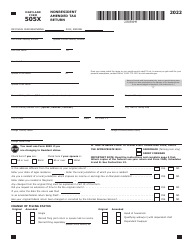

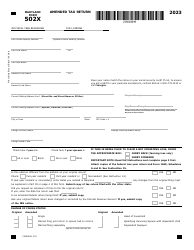

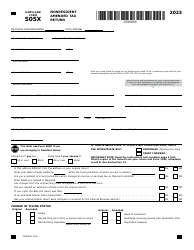

Form COM / RAD022A (Maryland Form 505X) Nonresident Amended Tax Return - Maryland

What Is Form COM/RAD022A (Maryland Form 505X)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD022A?

A: Form COM/RAD022A is the official form used in Maryland for filing a nonresident amended tax return.

Q: What is the purpose of Form COM/RAD022A?

A: The purpose of Form COM/RAD022A is to make changes to a previously filed nonresident tax return in Maryland.

Q: Who should use Form COM/RAD022A?

A: Form COM/RAD022A should be used by nonresidents who need to amend their Maryland tax return.

Q: What information is required on Form COM/RAD022A?

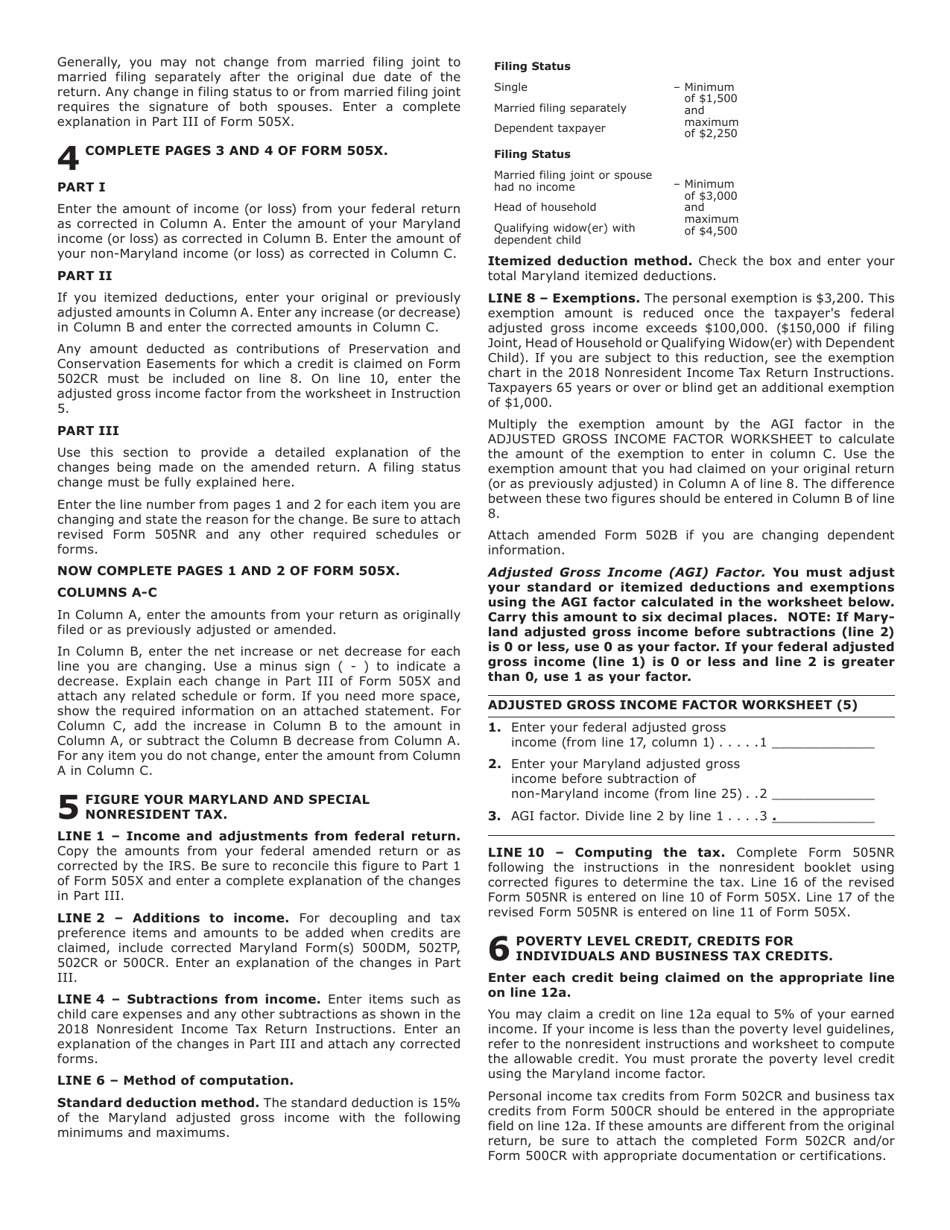

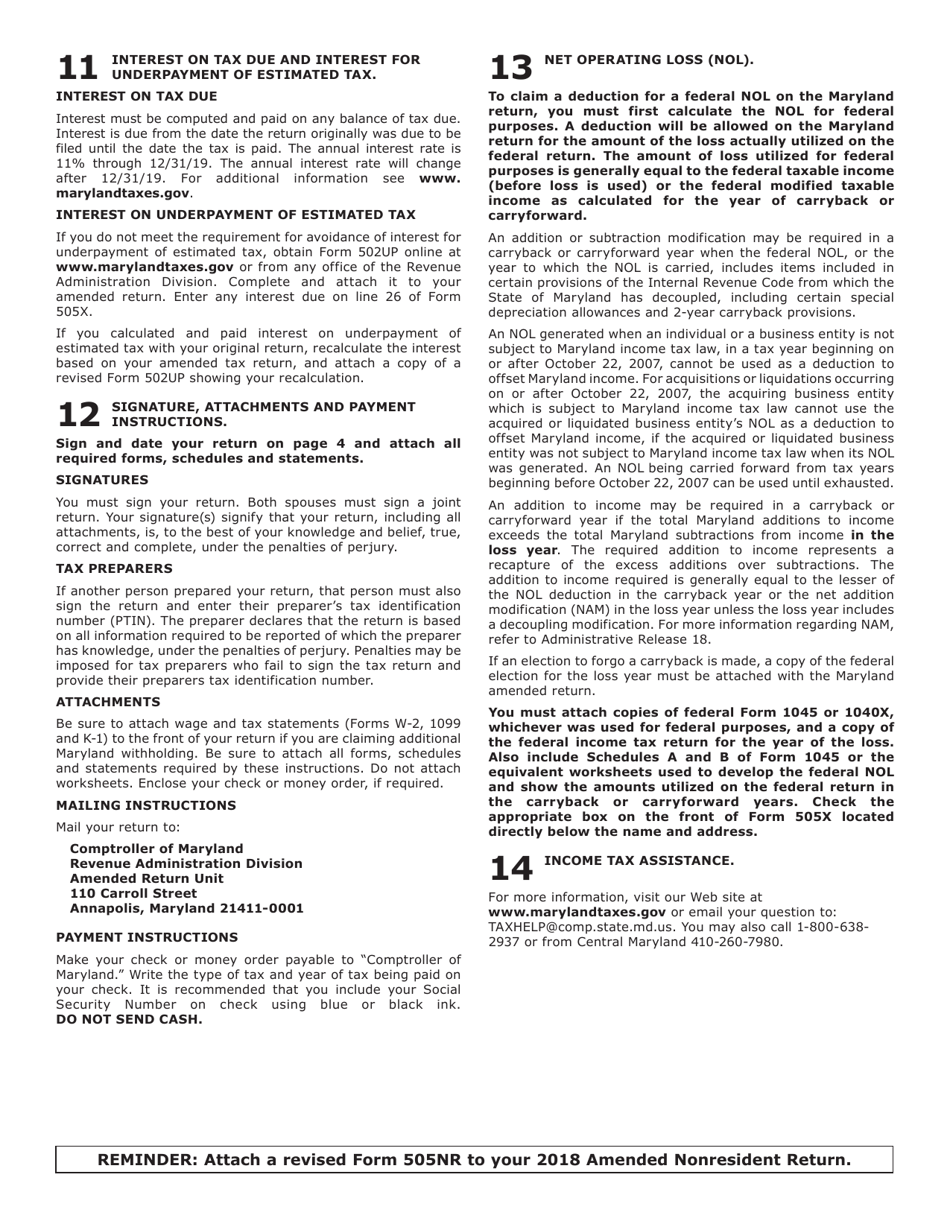

A: Form COM/RAD022A requires you to provide your personal information, details of the original return, and explanations for the changes being made.

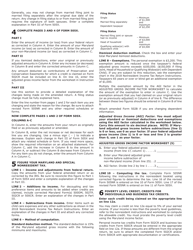

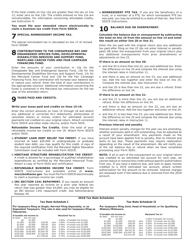

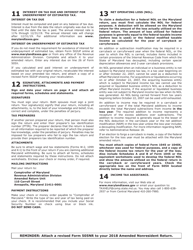

Q: How do I fill out Form COM/RAD022A?

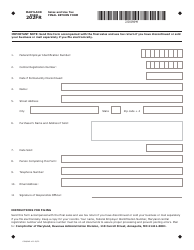

A: To fill out Form COM/RAD022A, you need to follow the instructions provided with the form and accurately enter the required information.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD022A (Maryland Form 505X) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.